Investing in dividend stocks has brought peace to my finances and it has provided me with an investing strategy to grow my portfolio and earn an income from it. Yes! You can get your cake and eat it! You can grow your portfolio with a 10% annual growth rate of return (ROR) and earn dividend income at the same time.

Unfortunately, you can’t just buy any dividend stocks to reach those results. You need to put a plan in place, starting with the basics. Master the basics and you will be on your way to build a strong dividend portfolio. Take time to get a headstart by learning from others and their mistakes.

Read on for the 3 simple steps to start dividend investing. Skip the mistakes and start with a good strategy.

- What is a dividend stock?

- Why invest in dividend stocks?

- A successful investment strategy

- 3 Steps – How to start investing in dividend stocks

What is a Dividend Stock?

A dividend stock, in simple words, is a stock that pays a dividend on a regular schedule. The schedule can be annual, semi-annual, quarterly or monthly. A dividend represents cash returned to investors which technically reduces the value of the company by the amount of dividend paid. In practice, with the stock price trading up and down during the day, it rarely settles that way.

The dividend yield is calculated by dividing the total annual dividend by the stock price. Typically, each sector will tend to have a dividend yield pattern that you should be familiar with.

Often times, when mentioning dividend stocks, it also includes stocks that pay a non-qualifying dividend such as a distribution. Income trusts, or MLPs, will usually pay non-qualifying dividends in the form of distribution which can also include a return of capital.

It’s important to understand the difference between dividends and a distribution as it has tax implication and often time, the stock and dividend growth will differ between the two types of stocks.

Why invest in Dividend Stocks?

If you build the right portfolio you can set up a wealth building machine! It doesn’t happen overnight but you can build a portfolio that can provide a 10% annual rate of return and pay you dividend along the way. When you choose to leverage the dividend re-investing program (DRIP), you put compound growth on autopilot and if you have dividend growth stocks such as the Dividend Growth Stocks (or Ambassadors), you have an accelerated growth.

Here are some reasons why investors seek dividend stocks.

- Seek regular income – often times, income seekings focus on REITs or high-yield stocks. There is very little growth but you can earn more from your portfolio today.

- Getting paid while markets fluctuate – dividend stock prices fluctuate just like any other stocks on the markets but dividends paid from strong dividend stocks can be consistent and even grow if you pick dividend growth stocks.

- Manage volatility through blue-chip dividend stocks – blue-chip stocks can provide less volatility and troubled times and are considered safe dividend investments.

- Higher returns from dividend growth stocks – dividend growth stocks can provide higher growth since they should only be able to grow their dividends if the company grow its bottom line. See the dividend triangle.

- Beat the markets – if you select the right dividend growth stocks, you can beat the markets.

- Avoid depleting your portfolio from withdrawals and retire with dividend income – worried about outliving your money? Dividend investing can help you avoid withdrawing and live from your portfolio dividend.

- Predictable income today and tomorrow – dividend income from dependable companies is predictable. The S&P Dividend Aristocrats have paid grown their dividends for 25 years.

- All of the above

In the end, investing in solid dividend growth stocks can be less stressful. In bear markets, you still get paid to wait. With DRIP, you get to buy more stocks and average your cost over time. No market timing involved.

You can see my dividend income history as proof that dividend investing works and is totally worth the effort needed to find a strong dividend growth company.

Dividend Growth Investing – A Successful Investment Strategy

Before we review the details of the winning strategy, let’s discuss some approaches that are less effective.

- Don’t focus on dividend yield, that’s not the most important metric. It’s mostly telling you how much you get paid today based on the stock price. If all you want is income, it will be important but remember that you will be sacrificing total return growth over time. More on that later.

- Forget about yield on cost, that’s just a feel-good metric. It’s a number that should go up over time but that’s not really telling you much. You get to know how much income your invested capital is providing you but you cannot use that to select a future investment as you will need to use the current dividend yield.

CONSISTENT DIVIDEND GROWTH is what has been working. I did start with high yield stock and it was nice to see the dividend income but my total portfolio growth was not where it should have been. What can I say? I was a newbie dividend investor and I wanted to generate retirement income from my portfolio and that’s what I was doing – only generating income and not growing my portfolio. In my strive to become a better investor, I stumbled upon the 10% dividend growth, the chowder rule, and the total return value of a portfolio. Let me show you why those 3 concepts matter.

10% Dividend Growth

This concept comes from a BNN interview with Thomas Cameron where he mentioned that his stock picks must past the 10/10 rule. The rule is essentially a really strong filter to select companies with the ability to grow their earnings consistently and at a certain rate by paying a dividend with a minimum growth rate. There are 2 criteria to the filter:

- 10 years of consecutive dividend growth

- 10% annual growth rate

Here is why this filter is better than using ANY US DIVIDEND ARISTOCRATS! Yes, even if an aristocrat must have increased their dividends for 25 years, the increase could simply be 1 cent.

The 10/10 rule expects a 10% CAGR (compound annual growth rate) dividend growth to pass the test. To achieve consistent dividend growth with a 10% CAGR growth, a company must be able to grow the earnings, otherwise, the payout ratio will get out of hands.

If the dividend payout ratio becomes an issue, investors will start assuming the dividend is at risk. Investors will sell, the price will go down, the dividend yield will go up and either the dividend is reduced or there is earnings growth.

The Chowder Rule

The Chowder Rule is a quick metric to help you quickly assess your potential total return. The formula is simple, you take the 10 years CAGR dividend growth and add the current dividend yield.

Chowder Score = Dividend Yield + Dividend Growth

It’s a quick and simple formula to assess growth and you just need to decide what value is important to you. What this method does is include any stocks with a lower dividend yield as a low dividend yield stock may have a spectacular dividend growth setting you up for a good total return on your investment. My filter for the Chowder Score is 12% but that’s really up to you to decide what your cut off is.

Total Return

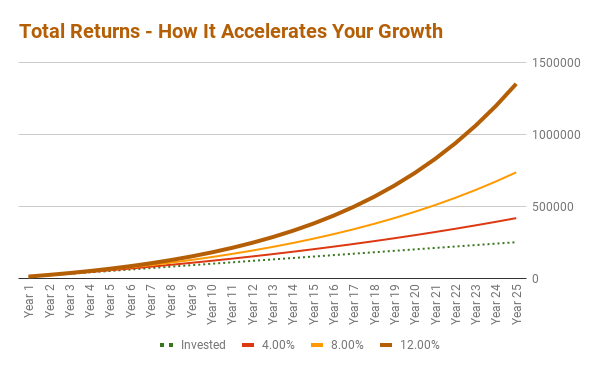

I ignored this in the first few years and focused on income even though I was very early in my accumulation years. I left money on the table. It’s the difference between a 4% return on your portfolio and a 12% return. You should separate your income strategy in retirement versus your accumulation strategy during your working years.

Once I made the switch and included the filters above, I started adding stocks like Visa NYSE:V, Costco NASDAQ:COST, or Saputo TSE:SAP into my portfolio and the results have been great.

In retirement, I have two options, keep riding the growth or switch to a higher dividend yield stock at some point. I am undecided at this point but using my RESP account to assess the withdrawal strategy with a cash bucket.

How To Start Investing in Dividend Stocks

Step 1 – Choose your investment platform

If you have small amounts to invest, Computershare might be the best platform to start investing in dividend stocks at ZERO cost but it’s not as flexible as a discount broker. It’s a good automated platform for a regular small addition to a holding.

If you have some money to open an account for a $9.95 cost per trade, you should go with a discount broker. The cheapest discount brokers are Questrade and CIBC’s Investor’s Edge. Think of your account size and review the maintenance fees for small accounts.

Review your needs and use the discount broker for dividend investors table to compare them and assess which platform will work for you. It’s easy to transfer in and out of Questrade, Qtrade or Virtual Brokers, but the bank platforms are much easier if you bank with them. Nevertheless, it’s really easy to switch discount broker when you have a decent size portfolio as all the fees will be covered in case you are not happy with your first choice.

Step 2 – Screening Dividend Stocks

The easiest is to start from a pre-existing list such as the Canadian Dividend Aristocrats or US Dividend Aristocrats but you can expend to the Dividend Achiever list or restrict the list to the Dividend Ambassadors.

What I actually like to do is include all of the stocks that

- Pay a dividend for at least 10 years – it’s enough to have gone through an economic cycle and it includes newcomers. It’s also the perfect time period to understand management’s intent.

- Dividend growth of 10% for the last 10 years – in general, the growth between 3, 5 and 10 years will be consistent but sometimes there is an outlier growth that triggers the 10% CAGR growth and you want to make sure there are no outliers.

- Filter against the Chowder Score – that’s not a standard metric. You will need to compute it in a spreadsheet. The 10-year dividend growth is also not always accessible.

- Dividend yield can be a deciding factor when you are down to a few options or any other criteria you feel are pertinent to your strategy.

Filtering stocks should leave you with a handful of options before the final decision.

I use the Dividend Snapshot data to filter my list of stocks. It provides a comprehensive list of data points to filter against. While dividend investors have dividend stocks in common, there is a myriad of ways to select a dividend stock. This is a journey you have to venture on by yourself to figure out what data points are important in your decision process.

There are many website and services, free or paid, that can help with filtering stocks. Unfortunately, the free resources are usually very limited. Consider the cost of any services as a portfolio fee which should still be cheaper than paying someone to give you advice.

Step 3 – Choosing the Dividend Stock to Buy

What if every month a different stock matches your criteria, there is a point where you need to stop adding new stocks to your portfolio. The reason is that you should focus on reaching a certain number of shares to DRIP at least one share. That’s when you put compound growth on autopilot.

Markets will fluctuate, that’s a fact and a reality you will face and not all stocks bounced back at the same rate. The last decision you need to make is to understand which stock fit best in your portfolio. As mentioned earlier, are you either in the accumulating or retirement phase of your life. Each of those phases may have a different strategy that will guide you make the final decision for which stock to buy.

I am very peculiar to my sector exposure and track the ratios against my targets meticulously. I made clear decisions to not have bonds, consumer cyclical or basic materials. I usually try to close the gap of a sector when I make a purchase.

The shortlist from step 2 and your strategy from step 3 should provide you with a clear decision and the best of all is that no emotions were involved.

Dividend investing is worth it, it’s safe, and will bring you peace of mind.