Looking for the best of the best dividend stocks? The Canadian Dividend Aristocrats list is the perfect place to start. Some of the companies listed offer great returns, just be careful not to focus on the yield only.

As you start, you can see the list of stocks (Excel export) to learn more about their yield and dividend payout ratios. One important consideration is to compare within sectors and industries to compare apples with apples and oranges with oranges.

To be included in the Canadian Dividend Aristocrats list, a Canadian company must match the following criteria.

- The company’s security is a common stock or income trust listed on the Toronto Stock Exchange and a constituent of the S&P Canada BMI.

- The security has increased ordinary cash dividends every year for five years but can maintain the same dividend for a maximum of two consecutive years within that five-year period.

- The float-adjusted market capitalization of the security, at the time of the review, must be at least C$ 300 million.

- For index additions, the company must have increased dividends in the first year of the prior five years of review for dividend growth. This rule does not apply to current index constituents.

The Dividend Aristocrats list can be a good list to start researching investments but the 5-year of dividend growth requirement is unfortunately not a guarantee for dividend stability.

Considering, a one cent dividend growth also qualifies any company, it’s important you look a little further to narrow down the list but a good start nonetheless.

Note that you can access such dividend data points only with a specialized stock screener, such as Dividend Snapshot Screeners.

Performance of Canadian Dividend Aristocrats

Are you looking to get average returns from the Dividend Aristocrats index or to find a gem in a haystack from the list?

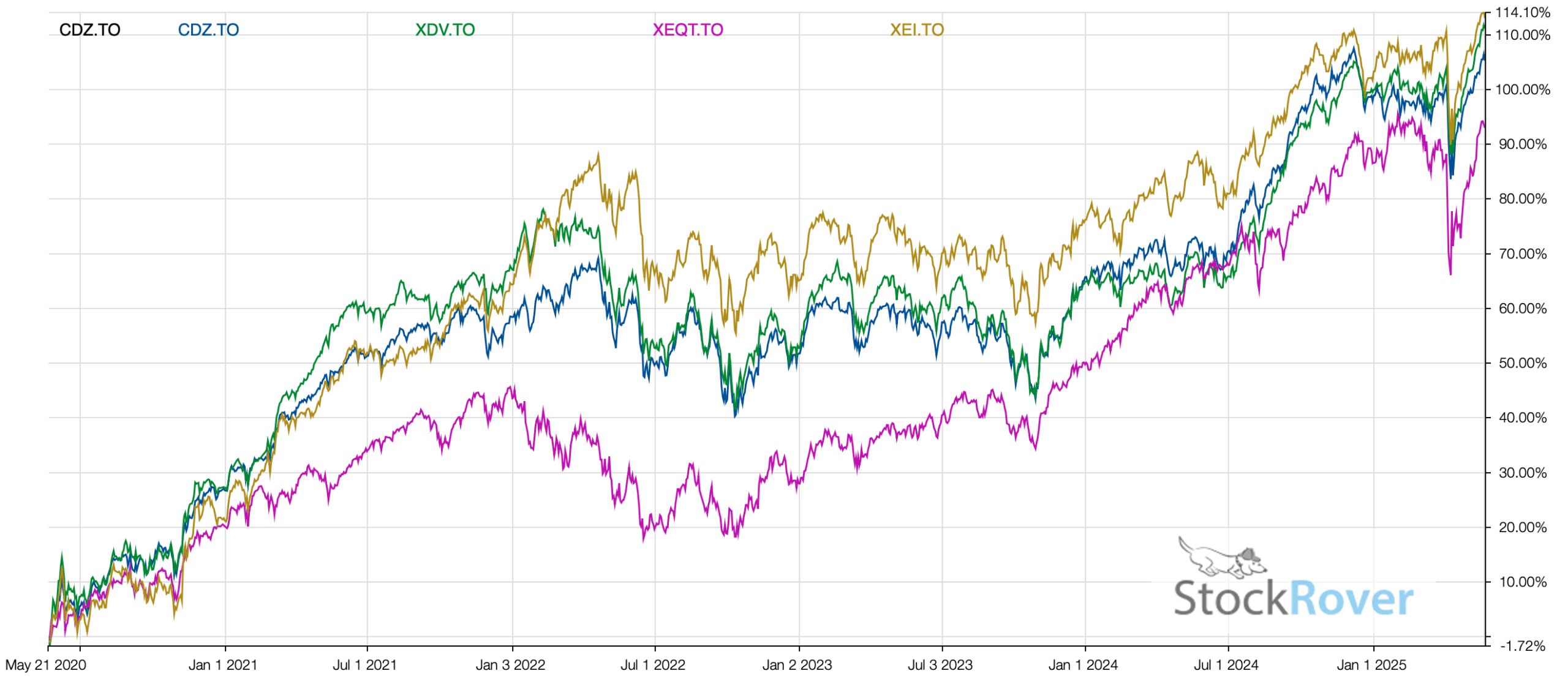

This is where it gets interesting. You can purchase the CDZ dividend ETF tracking the Canadian dividend aristocrats, or you can opt to go with the XDV ETF tracking a broader dividend-payer group.

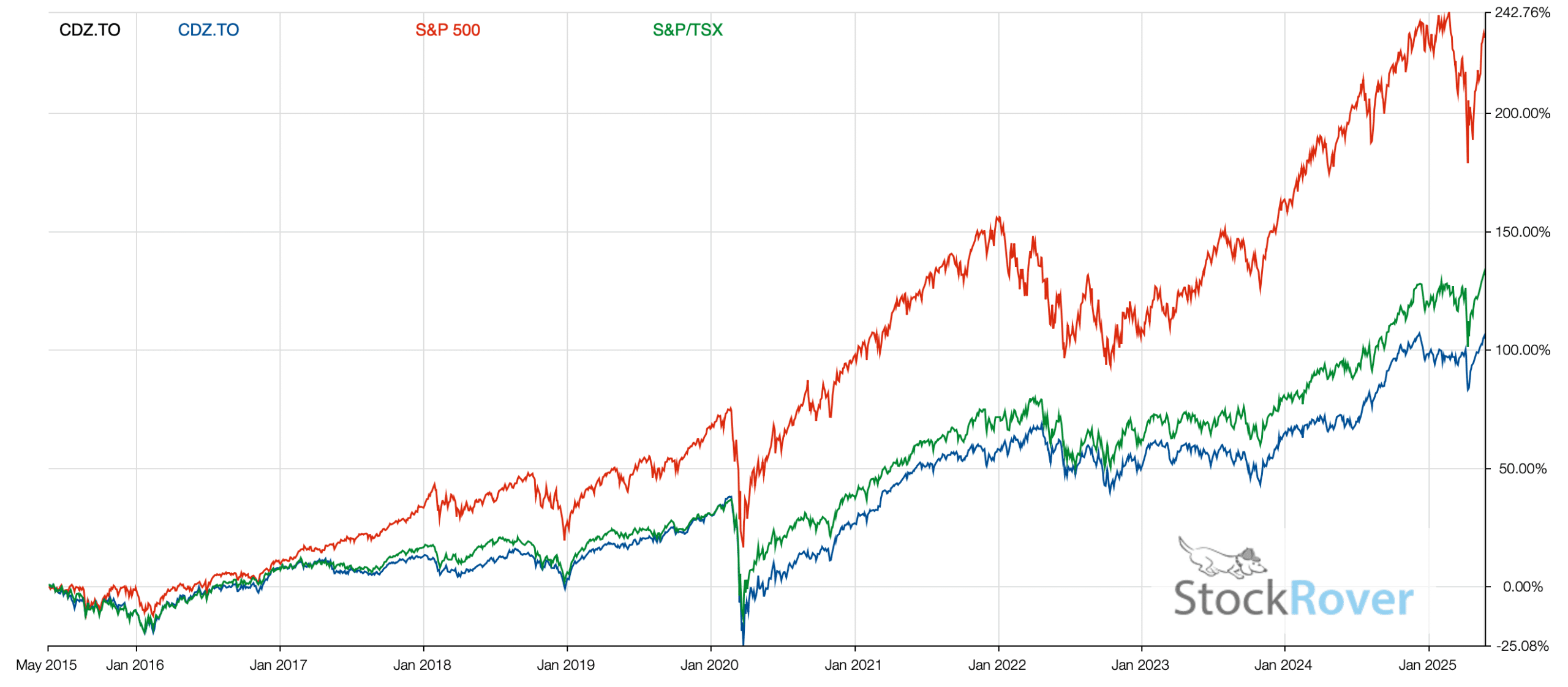

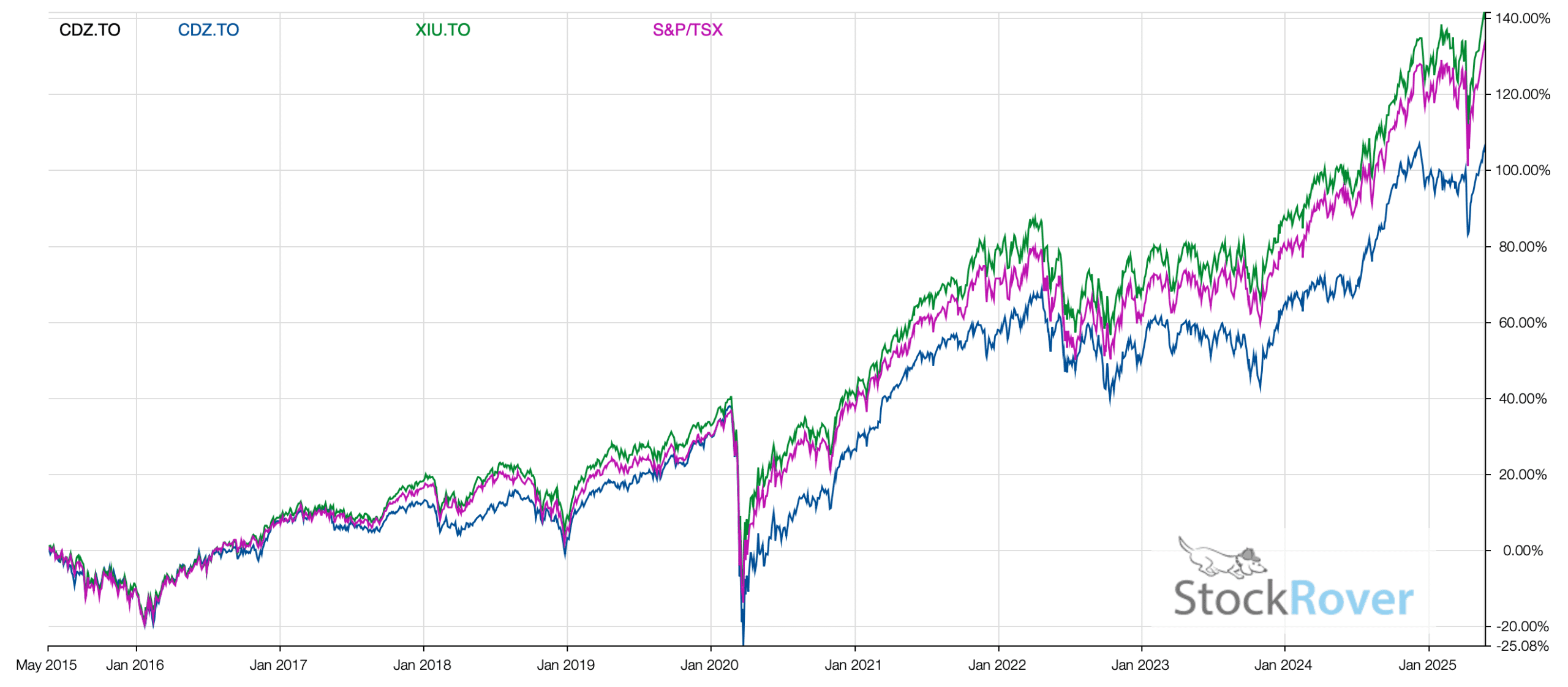

Here is how CDZ does against the indexes and then against some of the popular dividend ETFs.

The distribution yield tends to average around 3%, which is decent, but if it’s income you need, there are better options. In reality, a subset of stocks in the list will fit the best dividend stock profile.

This Aristocrat ETF is more about getting some distribution and appreciation, but the growth over time doesn’t really outperform the XIU ETF (Canadian TSX60 ETF) in the end.

Canadian Dividend Aristocrats

Below are the securities listed in the index as per the rules outlined above. Before you go and agree or not with the index or the rules, indexes are put together to attempt at categorizing certain stocks and investment strategies such as monthly income investing, dividend investing or dividend growth investing. ETFs and mutual funds then use those to put products together to satisfy investor demand.

Have a look at the stock list below, but be sure to check out the Canadian Dividend Achievers, as they need 10+ years of consecutive dividend increases.

TIP: Blend the Aristocrats with a Chowder Score of 10% to narrow down the best.

| TickerKey | Ticker | Company | Sector | Industry | Score | Quote | Market Cap | PE | FPE | EPS | Yield | PayoutRatio | Payments | Dividend | Chowder | GrowthRating | IncomeRating | Tollbooth | Ambassador | Achiever | Aristocrat | King | Country | Graph | SectorID | IndustryID | Grade | MarketCapGroup |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TSE:RY | RY | Royal Bank | Financial Services | Banks - Diversified | 54.00 | 174.84 | 246.58 | 13.92 | 13.92 | 12.56 | 3.52 | 46.36 | 4 | 6.16 | 10.11 | 5 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Mega Cap |

| TSE:TD | TD | TD Bank | Financial Services | Banks - Diversified | 56.41 | 97.39 | 167.75 | 10.10 | 10.10 | 9.64 | 4.31 | 42.41 | 4 | 4.20 | 11.45 | 5 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:ENB | ENB | Enbridge | Energy | Oil & Gas Midstream | 60.39 | 61.53 | 134.14 | 22.79 | 22.79 | 2.70 | 6.13 | 133.16 | 4 | 3.77 | 9.22 | 5 | 7 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 5 | 71 | B | Large Cap |

| TSE:TRI | TRI | Thompson Reuters | Industrials | Consulting Services | 36.57 | 266.18 | 125.36 | 0.00 | 0.00 | 3.26 | 1.11 | 0.00 | 4 | 2.16 | 4.47 | 4 | 3 | Intermediate | NO | YES | YES | NO | Canada | 1 | 9 | 30 | D | Large Cap |

| TSE:BN | BN | Brookfield Corp | Financial Services | Asset Management | 19.12 | 81.04 | 124.30 | 207.28 | 207.28 | 0.39 | 0.54 | 80.20 | 4 | 0.32 | 8.99 | 2 | 1 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 7 | 17 | D | Large Cap |

| TSE:BAM | BAM | Brookfield Asset Management | Financial Services | Asset Management | 49.91 | 74.71 | 120.49 | 38.92 | 38.92 | 1.92 | 2.79 | 72.29 | 4 | 1.52 | 11.24 | 5 | 4 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 17 | C | Large Cap |

| TSE:BMO | BMO | Bank of Montreal | Financial Services | Banks - Diversified | 59.52 | 144.64 | 104.44 | 13.45 | 13.45 | 10.75 | 4.51 | 59.72 | 4 | 6.52 | 11.62 | 5 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:CNQ | CNQ | Canadian Natural Resources | Energy | Oil & Gas E&P | 84.41 | 46.00 | 96.29 | 12.89 | 12.89 | 3.57 | 5.11 | 59.88 | 4 | 2.35 | 21.97 | 9 | 7 | Intermediate | YES | YES | YES | NO | Canada | 1 | 5 | 69 | A+ | Large Cap |

| TSE:BNS | BNS | Scotia Bank | Financial Services | Banks - Diversified | 56.25 | 74.46 | 92.75 | 15.64 | 15.64 | 4.76 | 5.91 | 86.66 | 4 | 4.40 | 9.88 | 5 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:CM | CM | CIBC | Financial Services | Banks - Diversified | 52.24 | 94.69 | 88.46 | 11.91 | 11.91 | 7.95 | 4.10 | 47.73 | 4 | 3.88 | 9.36 | 5 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:CNR | CNR | Canadian National Railway | Industrials | Railroads | 73.05 | 140.05 | 87.88 | 19.61 | 19.61 | 7.14 | 2.53 | 47.83 | 4 | 3.55 | 12.00 | 6 | 5 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 9 | 78 | A | Large Cap |

| TSE:MFC | MFC | Manulife | Financial Services | Insurance - Life | 67.16 | 42.13 | 71.96 | 15.96 | 15.96 | 2.64 | 4.18 | 60.41 | 4 | 1.76 | 14.03 | 6 | 6 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 55 | A | Large Cap |

| TSE:TRP | TRP | TC Energy | Energy | Oil & Gas Midstream | 53.65 | 65.16 | 67.74 | 15.48 | 15.48 | 4.21 | 5.22 | 88.14 | 4 | 3.40 | 7.31 | 2 | 7 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 5 | 71 | B | Large Cap |

| TSE:L | L | Loblaw | Consumer Defensive | Grocery Stores | 49.90 | 222.36 | 66.49 | 30.93 | 30.93 | 7.19 | 1.02 | 27.89 | 4 | 2.26 | 8.38 | 6 | 3 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | C | Large Cap |

| TSE:ATD | ATD | Alimentation Couche-Tard | Consumer Defensive | Grocery Stores | 75.92 | 70.03 | 66.39 | 18.65 | 18.65 | 3.76 | 1.11 | 19.42 | 4 | 0.78 | 24.67 | 9 | 3 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 4 | 47 | A | Large Cap |

| TSE:WCN | WCN | Waste Connections | Industrials | Waste Management | 65.10 | 255.06 | 65.91 | 75.85 | 75.85 | 3.36 | 0.68 | 49.50 | 4 | 1.26 | 12.82 | 8 | 3 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 9 | 110 | A | Large Cap |

| TSE:IMO | IMO | Imperial Oil | Energy | Oil & Gas Integrated | 71.03 | 111.81 | 56.92 | 11.98 | 11.98 | 9.33 | 2.58 | 25.95 | 4 | 2.88 | 19.10 | 8 | 5 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 5 | 70 | A | Large Cap |

| TSE:WPM | WPM | Wheaton Precious Metals Corp | Basic Materials | Gold | 37.02 | 122.66 | 55.67 | 64.47 | 64.47 | 1.90 | 0.69 | 44.13 | 4 | 0.62 | 6.23 | 4 | 3 | Intermediate | NO | NO | YES | NO | Canada | 1 | 1 | 46 | D | Large Cap |

| TSE:IFC | IFC | Intact Financial | Financial Services | Insurance - Property & Casualty | 47.72 | 305.34 | 54.46 | 24.68 | 24.68 | 12.37 | 1.74 | 42.35 | 4 | 5.32 | 11.43 | 5 | 3 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 56 | C | Large Cap |

| TSE:NA | NA | National Bank | Financial Services | Banks - Diversified | 55.19 | 135.40 | 52.99 | 12.91 | 12.91 | 10.49 | 3.49 | 45.58 | 4 | 4.72 | 12.13 | 6 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:DOL | DOL | Dollarama Inc | Consumer Defensive | Discount Stores | 55.92 | 188.06 | 52.11 | 43.03 | 43.03 | 4.37 | 0.23 | 8.40 | 4 | 0.42 | 13.10 | 8 | 2 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 34 | B | Large Cap |

| TSE:SLF | SLF | Sun Life Financial | Financial Services | Insurance - Diversified | 57.31 | 88.05 | 48.36 | 16.04 | 16.04 | 5.49 | 4.00 | 60.41 | 4 | 3.52 | 12.44 | 6 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 54 | B | Large Cap |

| TSE:GWO | GWO | Great West Life | Financial Services | Insurance - Life | 74.06 | 50.54 | 47.04 | 12.30 | 12.30 | 4.11 | 4.83 | 56.65 | 4 | 2.44 | 10.91 | 7 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 55 | A | Large Cap |

| TSE:FNV | FNV | Franco-Nevada Corp | Basic Materials | Gold | 50.12 | 228.17 | 43.96 | 51.09 | 51.09 | 4.47 | 0.87 | 40.93 | 4 | 1.44 | 7.93 | 5 | 3 | Intermediate | NO | YES | YES | NO | Canada | 1 | 1 | 46 | B | Large Cap |

| TSE:NTR | NTR | Nutrien | Basic Materials | Agricultural Inputs | 42.22 | 83.81 | 40.86 | 56.99 | 56.99 | 1.47 | 3.54 | 203.98 | 4 | 2.16 | 6.48 | 4 | 5 | Intermediate | NO | NO | YES | NO | Canada | 1 | 1 | 114 | C | Large Cap |

| TSE:WN | WN | George Weston | Consumer Defensive | Grocery Stores | 49.47 | 267.32 | 34.46 | 30.66 | 30.66 | 8.72 | 1.34 | 38.39 | 4 | 3.58 | 7.93 | 5 | 3 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | C | Large Cap |

| TSE:POW | POW | Power Corporation | Financial Services | Insurance - Life | 61.21 | 52.93 | 33.98 | 12.72 | 12.72 | 4.16 | 4.63 | 55.36 | 4 | 2.45 | 11.48 | 6 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 55 | B | Large Cap |

| TSE:T | T | Telus | Communication Services | Telecommunication Services | 63.85 | 21.98 | 33.28 | 27.82 | 27.82 | 0.79 | 7.58 | 135.21 | 4 | 1.67 | 14.26 | 8 | 1 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 2 | 99 | B | Large Cap |

| TSE:FTS | FTS | Fortis | Utilities | Utilities - Regulated Electric | 69.53 | 64.62 | 32.41 | 19.52 | 19.52 | 3.31 | 3.81 | 48.40 | 4 | 2.46 | 8.98 | 6 | 6 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 106 | A | Large Cap |

| TSE:PPL | PPL | Pembina Pipeline | Energy | Oil & Gas Midstream | 55.29 | 51.53 | 29.93 | 16.79 | 16.79 | 3.07 | 5.51 | 90.20 | 4 | 2.84 | 8.31 | 3 | 7 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 5 | 71 | B | Large Cap |

| TSE:QSR | QSR | Restaurant Brands International | Consumer Cyclical | Restaurants | 51.77 | 90.80 | 29.75 | 22.24 | 22.24 | 4.08 | 3.51 | 110.45 | 4 | 2.32 | 6.11 | 5 | 4 | Consumable - Discretionary | NO | NO | YES | NO | Canada | 1 | 3 | 87 | B | Large Cap |

| TSE:H | H | Hydro One | Utilities | Utilities - Regulated Electric | 57.54 | 48.63 | 29.17 | 23.84 | 23.84 | 2.04 | 2.74 | 61.67 | 4 | 1.33 | 8.10 | 4 | 5 | Tollbooth - Regulated | NO | NO | YES | NO | Canada | 1 | 12 | 106 | B | Large Cap |

| TSE:BCE | BCE | BCE | Communication Services | Telecommunication Services | 44.13 | 29.83 | 27.50 | 71.02 | 71.02 | 0.42 | 5.87 | 620.49 | 4 | 1.75 | 10.33 | 3 | 7 | Tollbooth - Regulated | NO | NO | YES | NO | Canada | 1 | 2 | 99 | C | Large Cap |

| TSE:TOU | TOU | Tourmaline Oil | Energy | Oil & Gas E&P | 64.10 | 67.24 | 25.19 | 19.89 | 19.89 | 3.38 | 2.08 | 99.27 | 4 | 1.40 | 25.55 | 8 | 3 | Intermediate | NO | NO | YES | NO | Canada | 1 | 5 | 69 | B | Large Cap |

| TSE:MRU | MRU | Metro | Consumer Defensive | Grocery Stores | 61.21 | 103.66 | 22.75 | 23.35 | 23.35 | 4.44 | 1.43 | 30.76 | 4 | 1.48 | 11.68 | 7 | 3 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 4 | 47 | B | Large Cap |

| TSE:EMA | EMA | Emera | Utilities | Utilities - Regulated Electric | 65.79 | 60.90 | 18.14 | 20.64 | 20.64 | 2.95 | 4.76 | 65.43 | 4 | 2.90 | 8.53 | 5 | 7 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 106 | A | Large Cap |

| TSE:STN | STN | Stantec | Industrials | Engineering & Construction | 51.39 | 144.58 | 16.49 | 42.78 | 42.78 | 3.38 | 0.62 | 24.77 | 4 | 0.90 | 8.31 | 7 | 3 | Durable | NO | YES | YES | NO | Canada | 1 | 9 | 38 | B | Large Cap |

| TSE:X | X | TMX Group | Financial Services | Financial Data & Stock Exchanges | 36.46 | 56.66 | 15.75 | 34.98 | 34.98 | 1.62 | 1.41 | 47.76 | 4 | 0.80 | 9.01 | 5 | 3 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 7 | 42 | D | Large Cap |

| TSE:MG | MG | Magna International | Consumer Cyclical | Auto Parts | 56.45 | 51.10 | 14.40 | 9.26 | 9.26 | 5.52 | 5.10 | 47.55 | 4 | 1.90 | 15.46 | 4 | 7 | Durable | NO | NO | YES | NO | Canada | 1 | 3 | 19 | B | Large Cap |

| TSE:CCL.B | CCL.B | CCL Industries | Consumer Cyclical | Packaging & Containers | 56.39 | 77.88 | 13.68 | 16.23 | 16.23 | 4.80 | 1.64 | 24.59 | 4 | 1.28 | 12.92 | 6 | 3 | Intermediate | NO | NO | YES | NO | Canada | 1 | 3 | 75 | B | Large Cap |

| TSE:IAG | IAG | Industrial Alliance | Financial Services | Insurance - Diversified | 52.86 | 144.16 | 13.44 | 15.30 | 15.30 | 9.42 | 2.50 | 39.22 | 4 | 3.60 | 14.73 | 6 | 4 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 54 | B | Large Cap |

| TSE:EFN | EFN | Element Fleet Management | Industrials | Rental & Leasing Services | 62.08 | 33.20 | 13.34 | 24.64 | 24.64 | 1.35 | 1.57 | 36.79 | 4 | 0.52 | 23.17 | 8 | 4 | Intermediate | NO | NO | YES | NO | Canada | 1 | 9 | 86 | B | Large Cap |

| TSE:EMP.A | EMP.A | Empire Co | Consumer Defensive | Grocery Stores | 50.64 | 55.51 | 12.86 | 18.82 | 18.82 | 2.95 | 1.59 | 27.43 | 4 | 0.88 | 9.62 | 6 | 3 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | B | Large Cap |

| TSE:ALA | ALA | AltaGas | Utilities | Utilities - Regulated Gas | 54.66 | 38.47 | 11.50 | 20.46 | 20.46 | 1.88 | 3.28 | 65.06 | 4 | 1.26 | 3.28 | 4 | 5 | Tollbooth - Regulated | NO | NO | YES | NO | Canada | 1 | 12 | 107 | B | Large Cap |

| TSE:SAP | SAP | Saputo | Consumer Defensive | Packaged Foods | 49.77 | 26.89 | 11.18 | 0.00 | 0.00 | -0.41 | 2.83 | 0.00 | 4 | 0.76 | 4.67 | 5 | 5 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 74 | C | Large Cap |

| TSE:FSV | FSV | FirstService Corp | Real Estate | Real Estate Services | 36.41 | 237.40 | 10.79 | 59.81 | 59.81 | 3.97 | 0.58 | 34.83 | 4 | 1.00 | 1.50 | 3 | 1 | Intermediate | NO | NO | YES | NO | Canada | 1 | 10 | 79 | D | Large Cap |

| TSE:CU | CU | Canadian Utilities | Utilities | Utilities - Diversified | 54.58 | 37.65 | 10.23 | 25.79 | 25.79 | 1.46 | 4.86 | 118.57 | 4 | 1.83 | 5.86 | 4 | 7 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 104 | B | Large Cap |

| TSE:TFII | TFII | TFI International | Industrials | Trucking | 67.07 | 121.02 | 10.16 | 19.34 | 19.34 | 6.26 | 2.04 | 36.14 | 4 | 1.80 | 10.65 | 7 | 4 | Intermediate | NO | NO | YES | NO | Canada | 1 | 9 | 102 | A | Large Cap |

| TSE:CTC.A | CTC.A | Canadian Tire Corporation | Consumer Cyclical | Specialty Retail | 54.19 | 183.49 | 10.11 | 12.07 | 12.07 | 15.20 | 3.87 | 42.68 | 4 | 7.10 | 14.89 | 6 | 6 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 3 | 95 | B | Large Cap |

| TSE:OTEX | OTEX | Open Text Corporation | Technology | Software - Application | 75.44 | 38.26 | 9.91 | 11.27 | 11.27 | 3.39 | 3.77 | 42.51 | 4 | 1.05 | 17.91 | 7 | 6 | Subscription | NO | NO | YES | NO | Canada | 1 | 11 | 90 | A | Mid Cap |

| TSE:TIH | TIH | Toromont Industries | Industrials | Industrial Distribution | 72.54 | 118.56 | 9.63 | 19.63 | 19.63 | 6.04 | 1.75 | 31.65 | 4 | 2.08 | 13.94 | 8 | 4 | Intermediate | YES | YES | YES | NO | Canada | 1 | 9 | 52 | A | Mid Cap |

| TSE:QBR.B | QBR.B | Quebecor | Communication Services | Telecommunication Services | 52.80 | 40.88 | 9.41 | 12.43 | 12.43 | 3.29 | 3.42 | 39.46 | 4 | 1.40 | 9.15 | 5 | 6 | Tollbooth - Regulated | NO | NO | YES | NO | Canada | 1 | 2 | 99 | B | Mid Cap |

| TSE:CPX | CPX | Capital Power Corporation | Utilities | Utilities - Independent Power Producers | 74.93 | 56.37 | 8.72 | 12.17 | 12.17 | 4.63 | 4.63 | 46.05 | 4 | 2.61 | 10.75 | 7 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 12 | 105 | A | Mid Cap |

| TSE:WFG | WFG | West Fraser Timber | Basic Materials | Lumber & Wood Production | 39.99 | 100.46 | 7.97 | 0.00 | 0.00 | -0.18 | 1.75 | 3,288.20 | 4 | 1.28 | 16.84 | 4 | 2 | Intermediate | NO | NO | YES | NO | Canada | 1 | 1 | 62 | D | Mid Cap |

| TSE:SOBO | SOBO | South Bow Corp | Energy | Oil & Gas Midstream | 44.35 | 35.88 | 7.47 | 26.26 | 26.26 | 1.37 | 7.65 | 52.27 | 4 | 2.00 | 7.65 | 2 | 9 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 5 | 71 | C | Mid Cap |

| TSE:FTT | FTT | Finning Intl | Industrials | Industrial Distribution | 58.41 | 55.22 | 7.43 | 15.60 | 15.60 | 3.54 | 2.19 | 30.89 | 4 | 1.21 | 6.80 | 6 | 5 | Intermediate | NO | YES | YES | NO | Canada | 1 | 9 | 52 | B | Mid Cap |

| TSE:CAR.UN | CAR.UN | Canadian Apartment Properties REIT | Real Estate | REIT - Residential | 34.63 | 43.73 | 6.94 | 61.97 | 61.97 | 0.71 | 3.55 | 202.15 | 12 | 1.55 | 4.95 | 2 | 4 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 10 | 83 | D | Mid Cap |

| TSE:PKI | PKI | Parkland Corporation | Energy | Oil & Gas Refining & Marketing | 55.96 | 38.60 | 6.73 | 34.77 | 34.77 | 1.11 | 3.73 | 124.49 | 4 | 1.44 | 6.59 | 6 | 5 | Intermediate | NO | YES | YES | NO | Canada | 1 | 5 | 72 | B | Mid Cap |

| TSE:ACO.X | ACO.X | Atco | Utilities | Utilities - Diversified | 57.60 | 51.13 | 5.75 | 13.46 | 13.46 | 3.80 | 3.95 | 51.99 | 4 | 2.02 | 6.94 | 4 | 6 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 104 | B | Mid Cap |

| TSE:BYD | BYD | Boyd Group Services | Consumer Cyclical | Personal Services | 34.18 | 209.39 | 4.50 | 248.47 | 248.47 | 0.84 | 0.29 | 70.47 | 4 | 0.61 | 2.37 | 5 | 1 | Consumable - Discretionary | NO | YES | YES | NO | Canada | 1 | 3 | 117 | D | Mid Cap |

| TSE:TA | TA | TransAlta | Utilities | Utilities - Independent Power Producers | 21.99 | 15.12 | 4.48 | 0.00 | 0.00 | 0.00 | 1.72 | 233.96 | 4 | 0.26 | 1.72 | 2 | 3 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 12 | 105 | D | Mid Cap |

| TSE:GRT.UN | GRT.UN | Granite REIT | Real Estate | REIT - Industrial | 62.19 | 69.00 | 4.20 | 13.78 | 13.78 | 5.01 | 4.93 | 66.16 | 12 | 3.40 | 8.15 | 6 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 10 | 81 | B | Mid Cap |

| TSE:SJ | SJ | Stella-Jones | Basic Materials | Lumber & Wood Production | 70.83 | 75.21 | 4.18 | 12.62 | 12.62 | 5.96 | 1.65 | 18.81 | 4 | 1.24 | 16.52 | 7 | 4 | Intermediate | YES | YES | YES | NO | Canada | 1 | 1 | 62 | A | Mid Cap |

| TSE:GEI | GEI | Gibson Energy | Energy | Oil & Gas Midstream | 54.93 | 24.08 | 3.94 | 24.57 | 24.57 | 0.98 | 7.14 | 165.10 | 4 | 1.72 | 10.32 | 6 | 8 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 5 | 71 | B | Mid Cap |

| TSE:CRT.UN | CRT.UN | CT REIT | Real Estate | REIT - Retail | 58.57 | 15.87 | 3.76 | 10.54 | 10.54 | 1.51 | 5.97 | 45.20 | 12 | 0.95 | 9.42 | 5 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 10 | 84 | B | Mid Cap |

| TSE:EQB | EQB | Equitable Group | Financial Services | Mortgage Finance | 61.53 | 93.72 | 3.59 | 9.60 | 9.60 | 9.76 | 2.26 | 20.23 | 4 | 2.12 | 20.59 | 6 | 4 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 67 | B | Mid Cap |

| TSE:PBH | PBH | Premium Brands | Consumer Defensive | Packaged Foods | 71.42 | 78.90 | 3.54 | 29.77 | 29.77 | 2.65 | 4.31 | 128.86 | 4 | 3.40 | 14.43 | 8 | 5 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 74 | A | Mid Cap |

| TSE:MFI | MFI | Maple Leaf Foods | Consumer Defensive | Packaged Foods | 48.88 | 28.28 | 3.50 | 37.21 | 37.21 | 0.76 | 3.39 | 96.98 | 4 | 0.96 | 10.31 | 6 | 4 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 74 | C | Mid Cap |

| TSE:EIF | EIF | Exchange Income Fund | Industrials | Airlines | 52.18 | 58.25 | 2.99 | 23.58 | 23.58 | 2.47 | 4.53 | 103.51 | 12 | 2.64 | 7.99 | 5 | 7 | Consumable - Discretionary | NO | NO | YES | NO | Canada | 1 | 9 | 14 | B | Mid Cap |

| TSE:CCA | CCA | Cogeco Cable | Communication Services | Telecommunication Services | 78.67 | 68.48 | 2.88 | 8.84 | 8.84 | 7.75 | 5.39 | 45.45 | 4 | 3.69 | 15.28 | 8 | 8 | Tollbooth - Regulated | YES | YES | YES | NO | Canada | 1 | 2 | 99 | A | Mid Cap |

| TSE:GSY | GSY | goeasy | Financial Services | Credit Services | 63.78 | 163.48 | 2.63 | 10.76 | 10.76 | 15.20 | 3.57 | 28.91 | 4 | 5.84 | 24.60 | 7 | 6 | Intermediate | YES | YES | YES | NO | Canada | 1 | 7 | 32 | B | Mid Cap |

| TSE:FN | FN | First National Financial | Financial Services | Mortgage Finance | 52.82 | 40.56 | 2.43 | 13.96 | 13.96 | 2.91 | 6.16 | 102.10 | 12 | 2.50 | 8.90 | 4 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 67 | B | Mid Cap |

| TSE:AP.UN | AP.UN | Allied Properties REIT | Real Estate | REIT - Office | 35.03 | 16.93 | 2.37 | 0.00 | 0.00 | -3.09 | 10.63 | 0.00 | 12 | 1.80 | 12.55 | 3 | 9 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 10 | 82 | D | Mid Cap |

| TSE:KMP.UN | KMP.UN | Killam Apartment REIT | Real Estate | REIT - Residential | 40.64 | 19.52 | 2.34 | 3.63 | 3.63 | 5.37 | 3.69 | 9.54 | 12 | 0.72 | 4.49 | 2 | 4 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 10 | 83 | C | Mid Cap |

| TSE:NWC | NWC | The North West Company | Consumer Defensive | Grocery Stores | 60.72 | 48.62 | 2.32 | 17.18 | 17.18 | 2.83 | 3.29 | 55.28 | 4 | 1.60 | 6.79 | 5 | 5 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | B | Mid Cap |

| TSE:IIP.UN | IIP.UN | InterRent REIT | Real Estate | REIT - Residential | 38.58 | 13.60 | 1.90 | 0.00 | 0.00 | -1.17 | 2.92 | 0.00 | 12 | 0.40 | 8.04 | 6 | 3 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 10 | 83 | D | Small Cap |

| TSE:BDGI | BDGI | Badger Daylighting | Industrials | Engineering & Construction | 56.67 | 45.50 | 1.54 | 22.81 | 22.81 | 2.00 | 1.65 | 36.48 | 4 | 0.75 | 6.48 | 6 | 4 | Durable | NO | NO | YES | NO | Canada | 1 | 9 | 38 | B | Small Cap |

| TSE:JWEL | JWEL | Jamieson Wellness | Consumer Defensive | Packaged Foods | 61.02 | 35.53 | 1.48 | 29.12 | 29.12 | 1.22 | 2.36 | 64.31 | 4 | 0.84 | 15.67 | 7 | 3 | Consumable - Discretionary | NO | NO | YES | NO | Canada | 1 | 4 | 74 | B | Small Cap |

| TSE:SVI | SVI | StorageVault Canada | Real Estate | Real Estate Services | 41.52 | 4.01 | 1.47 | 0.00 | 0.00 | -0.09 | 0.29 | 0.00 | 4 | 0.01 | 2.08 | 5 | 2 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 10 | 79 | C | Small Cap |

| TSE:CJT | CJT | Cargojet | Industrials | Integrated Freight & Logistics | 59.45 | 93.23 | 1.45 | 12.38 | 12.38 | 7.53 | 1.50 | 17.27 | 4 | 1.40 | 8.77 | 6 | 4 | Consumable - Discretionary | NO | NO | YES | NO | Canada | 1 | 9 | 58 | B | Small Cap |

| TSE:SIS | SIS | Savaria Corporation | Industrials | Specialty Industrial Machinery | 65.03 | 18.92 | 1.35 | 27.42 | 27.42 | 0.69 | 2.85 | 75.57 | 12 | 0.54 | 5.50 | 6 | 5 | Durable | YES | YES | YES | NO | Canada | 1 | 9 | 94 | A | Small Cap |

| TSE:ENGH | ENGH | Enghouse Systems | Technology | Software - Application | 71.46 | 22.81 | 1.26 | 16.06 | 16.06 | 1.42 | 5.26 | 73.21 | 4 | 1.20 | 19.68 | 7 | 7 | Intermediate | YES | YES | YES | NO | Canada | 1 | 11 | 90 | A | Small Cap |

| TSE:ALS | ALS | Altius Minerals | Basic Materials | Other Industrial Metals & Mining | 58.21 | 26.82 | 1.24 | 12.47 | 12.47 | 2.15 | 1.34 | 14.77 | 4 | 0.36 | 14.34 | 5 | 3 | Intermediate | NO | NO | YES | NO | Canada | 1 | 1 | 73 | B | Small Cap |

| TSE:ARE | ARE | Aecon Group | Industrials | Engineering & Construction | 35.34 | 19.78 | 1.24 | 0.00 | 0.00 | -1.53 | 3.84 | 0.00 | 4 | 0.76 | 6.62 | 3 | 6 | Durable | NO | NO | YES | NO | Canada | 1 | 9 | 38 | D | Small Cap |

| TSE:NOA | NOA | North American | Energy | Oil & Gas Equipment & Services | 59.73 | 24.13 | 0.71 | 18.14 | 18.14 | 1.33 | 1.99 | 28.27 | 4 | 0.48 | 20.03 | 7 | 4 | Intermediate | NO | NO | YES | NO | Canada | 1 | 5 | 115 | B | Small Cap |

| TSE:ADEN | ADEN | ADENTRA | Industrials | Industrial Distribution | 74.07 | 27.36 | 0.68 | 12.25 | 12.25 | 2.23 | 2.19 | 25.06 | 4 | 0.60 | 14.04 | 8 | 5 | Intermediate | YES | YES | YES | NO | Canada | 1 | 9 | 52 | A | Small Cap |

| TSE:FSZ | FSZ | Fiera Capital Corp | Financial Services | Asset Management | 39.44 | 6.07 | 0.66 | 19.58 | 19.58 | 0.31 | 7.12 | 233.03 | 4 | 0.43 | 7.61 | 1 | 8 | Intermediate | NO | NO | YES | NO | Canada | 1 | 7 | 17 | D | Small Cap |

| TSE:CGO | CGO | Cogeco | Communication Services | Telecommunication Services | 81.89 | 64.29 | 0.61 | 7.17 | 7.17 | 8.97 | 5.74 | 38.79 | 4 | 3.69 | 20.04 | 8 | 8 | Tollbooth - Regulated | YES | YES | YES | NO | Canada | 1 | 2 | 99 | A+ | Small Cap |

| TSE:MI.UN | MI.UN | Minto Apartment REIT | Real Estate | REIT - Residential | 49.82 | 14.54 | 0.56 | 5.86 | 5.86 | 2.48 | 3.57 | 34.17 | 12 | 0.52 | 7.02 | 5 | 4 | Tollbooth - Unregulated | NO | NO | YES | NO | Canada | 1 | 10 | 83 | C | Small Cap |

- February 2025: ALA, EFN, GEI, HPS.A, SOBO, SVI, TA Added. Removal of ABX, AEM, CAS, CF, PAAS

- October 2024: Removal of CP, CSH.UN, SRU.UN, and TCL.A.

- January 2024: No changes.

- July 2023: No changes.

- April 2023: H, NTR, TOU, WCN and MI.UN added. AQN, KEY, ONEX, GR.UN, TCS and INE removed.

- January 2023: BN added. SMU.UN removed.

- November 2022: No changes.

- August 2022: SRU.UN added.

- April 2022: 9 Additions (ABX, ALS, CF, HDI, JWEL, TCS, WFG, KMP.UN, SGR.UN), 1 removal (BLX)

- January 2022: No changes.

- November 2021: No changes.

- September 2021: 1 removal (CHP.UN)

- March 2021: 9 additions (AEM, BAD, CJT, CP, ECN, FN, QSR, WPM, X) and 2 removal (OR, RNW).

- January 2021: No changes.

- November 2020: No changes.

- September 2020: LB and MTY were removed.

- June 2020: Removal of AD, SU, SES, IPL, and RCH

- April 2020: No removal with the addition of CGO, FSZ, GWO, MFI, POW, and QBR.B.

- January 2020: No addition or removal.

- July 2019: SJR.B and GEI were removed. GS was also removed as it was acquired and 10 more companies were added.

- January 2019: ALA was removed after the dividend reduction and ENF was removed as it was acquired by ENB.

- September 2018: A couple of stocks were removed and one was acquired. CJR.B and CIX were removed and PJC.A was acquired by MRU.

- May 2018: No changes.

- February 2018: The following stocks are added; BEI.UN, EQB, TIH, PBH, RNW, PKI, SES, ONEX, and OTEX while the following 9 stocks were removed; FCR, RCI.B, WJA, SCL, IGM, PSI, CMG, NVU.UN, RUS, and ESI.

- January 2018: Agrium is removed as the companies merged with Potash to form Nutrien.

- September 2017: HCG and AIM were removed since they reduced their dividends.

- May 2017: 1 company was removed. Nevsun Resources (TSE:NSU) was removed from the list.

- February 2017: 14 companies were added while 1 was removed. Newcomers are: ALA, AP.UN, ARE, BAM.A, BEI.UN, BMO, CAR.UN, FCR, ITP, L, NWC, PPL, STN, and WN. BDT was the company removed from the aristocrat index in the last update.

Canadian Dividend Achievers

Going a step further, looking at the Dividend Achievers requires 10 years of dividend increase.

| TickerKey | Ticker | Company | Sector | Industry | Score | Quote | Market Cap | PE | FPE | EPS | Yield | PayoutRatio | Payments | Dividend | Chowder | GrowthRating | IncomeRating | Tollbooth | Ambassador | Achiever | Aristocrat | King | Country | Graph | SectorID | IndustryID | Grade | MarketCapGroup |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TSE:RY | RY | Royal Bank | Financial Services | Banks - Diversified | 54.00 | 174.84 | 246.58 | 13.92 | 13.92 | 12.56 | 3.52 | 46.36 | 4 | 6.16 | 10.11 | 5 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Mega Cap |

| TSE:TD | TD | TD Bank | Financial Services | Banks - Diversified | 56.41 | 97.39 | 167.75 | 10.10 | 10.10 | 9.64 | 4.31 | 42.41 | 4 | 4.20 | 11.45 | 5 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:ENB | ENB | Enbridge | Energy | Oil & Gas Midstream | 60.39 | 61.53 | 134.14 | 22.79 | 22.79 | 2.70 | 6.13 | 133.16 | 4 | 3.77 | 9.22 | 5 | 7 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 5 | 71 | B | Large Cap |

| TSE:TRI | TRI | Thompson Reuters | Industrials | Consulting Services | 36.57 | 266.18 | 125.36 | 0.00 | 0.00 | 3.26 | 1.11 | 0.00 | 4 | 2.16 | 4.47 | 4 | 3 | Intermediate | NO | YES | YES | NO | Canada | 1 | 9 | 30 | D | Large Cap |

| TSE:BAM | BAM | Brookfield Asset Management | Financial Services | Asset Management | 49.91 | 74.71 | 120.49 | 38.92 | 38.92 | 1.92 | 2.79 | 72.29 | 4 | 1.52 | 11.24 | 5 | 4 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 17 | C | Large Cap |

| TSE:BMO | BMO | Bank of Montreal | Financial Services | Banks - Diversified | 59.52 | 144.64 | 104.44 | 13.45 | 13.45 | 10.75 | 4.51 | 59.72 | 4 | 6.52 | 11.62 | 5 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:CNQ | CNQ | Canadian Natural Resources | Energy | Oil & Gas E&P | 84.41 | 46.00 | 96.29 | 12.89 | 12.89 | 3.57 | 5.11 | 59.88 | 4 | 2.35 | 21.97 | 9 | 7 | Intermediate | YES | YES | YES | NO | Canada | 1 | 5 | 69 | A+ | Large Cap |

| TSE:BNS | BNS | Scotia Bank | Financial Services | Banks - Diversified | 56.25 | 74.46 | 92.75 | 15.64 | 15.64 | 4.76 | 5.91 | 86.66 | 4 | 4.40 | 9.88 | 5 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:CM | CM | CIBC | Financial Services | Banks - Diversified | 52.24 | 94.69 | 88.46 | 11.91 | 11.91 | 7.95 | 4.10 | 47.73 | 4 | 3.88 | 9.36 | 5 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:CNR | CNR | Canadian National Railway | Industrials | Railroads | 73.05 | 140.05 | 87.88 | 19.61 | 19.61 | 7.14 | 2.53 | 47.83 | 4 | 3.55 | 12.00 | 6 | 5 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 9 | 78 | A | Large Cap |

| TSE:MFC | MFC | Manulife | Financial Services | Insurance - Life | 67.16 | 42.13 | 71.96 | 15.96 | 15.96 | 2.64 | 4.18 | 60.41 | 4 | 1.76 | 14.03 | 6 | 6 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 55 | A | Large Cap |

| TSE:L | L | Loblaw | Consumer Defensive | Grocery Stores | 49.90 | 222.36 | 66.49 | 30.93 | 30.93 | 7.19 | 1.02 | 27.89 | 4 | 2.26 | 8.38 | 6 | 3 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | C | Large Cap |

| TSE:ATD | ATD | Alimentation Couche-Tard | Consumer Defensive | Grocery Stores | 75.92 | 70.03 | 66.39 | 18.65 | 18.65 | 3.76 | 1.11 | 19.42 | 4 | 0.78 | 24.67 | 9 | 3 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 4 | 47 | A | Large Cap |

| TSE:WCN | WCN | Waste Connections | Industrials | Waste Management | 65.10 | 255.06 | 65.91 | 75.85 | 75.85 | 3.36 | 0.68 | 49.50 | 4 | 1.26 | 12.82 | 8 | 3 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 9 | 110 | A | Large Cap |

| TSE:IMO | IMO | Imperial Oil | Energy | Oil & Gas Integrated | 71.03 | 111.81 | 56.92 | 11.98 | 11.98 | 9.33 | 2.58 | 25.95 | 4 | 2.88 | 19.10 | 8 | 5 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 5 | 70 | A | Large Cap |

| TSE:IFC | IFC | Intact Financial | Financial Services | Insurance - Property & Casualty | 47.72 | 305.34 | 54.46 | 24.68 | 24.68 | 12.37 | 1.74 | 42.35 | 4 | 5.32 | 11.43 | 5 | 3 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 56 | C | Large Cap |

| TSE:NA | NA | National Bank | Financial Services | Banks - Diversified | 55.19 | 135.40 | 52.99 | 12.91 | 12.91 | 10.49 | 3.49 | 45.58 | 4 | 4.72 | 12.13 | 6 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 21 | B | Large Cap |

| TSE:DOL | DOL | Dollarama Inc | Consumer Defensive | Discount Stores | 55.92 | 188.06 | 52.11 | 43.03 | 43.03 | 4.37 | 0.23 | 8.40 | 4 | 0.42 | 13.10 | 8 | 2 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 34 | B | Large Cap |

| TSE:SLF | SLF | Sun Life Financial | Financial Services | Insurance - Diversified | 57.31 | 88.05 | 48.36 | 16.04 | 16.04 | 5.49 | 4.00 | 60.41 | 4 | 3.52 | 12.44 | 6 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 54 | B | Large Cap |

| TSE:GWO | GWO | Great West Life | Financial Services | Insurance - Life | 74.06 | 50.54 | 47.04 | 12.30 | 12.30 | 4.11 | 4.83 | 56.65 | 4 | 2.44 | 10.91 | 7 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 55 | A | Large Cap |

| TSE:FNV | FNV | Franco-Nevada Corp | Basic Materials | Gold | 50.12 | 228.17 | 43.96 | 51.09 | 51.09 | 4.47 | 0.87 | 40.93 | 4 | 1.44 | 7.93 | 5 | 3 | Intermediate | NO | YES | YES | NO | Canada | 1 | 1 | 46 | B | Large Cap |

| TSE:WN | WN | George Weston | Consumer Defensive | Grocery Stores | 49.47 | 267.32 | 34.46 | 30.66 | 30.66 | 8.72 | 1.34 | 38.39 | 4 | 3.58 | 7.93 | 5 | 3 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | C | Large Cap |

| TSE:POW | POW | Power Corporation | Financial Services | Insurance - Life | 61.21 | 52.93 | 33.98 | 12.72 | 12.72 | 4.16 | 4.63 | 55.36 | 4 | 2.45 | 11.48 | 6 | 6 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 55 | B | Large Cap |

| TSE:T | T | Telus | Communication Services | Telecommunication Services | 63.85 | 21.98 | 33.28 | 27.82 | 27.82 | 0.79 | 7.58 | 135.21 | 4 | 1.67 | 14.26 | 8 | 1 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 2 | 99 | B | Large Cap |

| TSE:FTS | FTS | Fortis | Utilities | Utilities - Regulated Electric | 69.53 | 64.62 | 32.41 | 19.52 | 19.52 | 3.31 | 3.81 | 48.40 | 4 | 2.46 | 8.98 | 6 | 6 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 106 | A | Large Cap |

| TSE:RBA | RBA | Ritchie Bros Auctioneers | Industrials | Specialty Business Services | 59.34 | 143.52 | 26.58 | 50.81 | 50.81 | 2.82 | 1.11 | 58.23 | 4 | 1.16 | 9.38 | 7 | 3 | Intermediate | NO | YES | NO | NO | Canada | 1 | 9 | 92 | B | Large Cap |

| TSE:MRU | MRU | Metro | Consumer Defensive | Grocery Stores | 61.21 | 103.66 | 22.75 | 23.35 | 23.35 | 4.44 | 1.43 | 30.76 | 4 | 1.48 | 11.68 | 7 | 3 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 4 | 47 | B | Large Cap |

| TSE:EMA | EMA | Emera | Utilities | Utilities - Regulated Electric | 65.79 | 60.90 | 18.14 | 20.64 | 20.64 | 2.95 | 4.76 | 65.43 | 4 | 2.90 | 8.53 | 5 | 7 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 106 | A | Large Cap |

| TSE:STN | STN | Stantec | Industrials | Engineering & Construction | 51.39 | 144.58 | 16.49 | 42.78 | 42.78 | 3.38 | 0.62 | 24.77 | 4 | 0.90 | 8.31 | 7 | 3 | Durable | NO | YES | YES | NO | Canada | 1 | 9 | 38 | B | Large Cap |

| TSE:IAG | IAG | Industrial Alliance | Financial Services | Insurance - Diversified | 52.86 | 144.16 | 13.44 | 15.30 | 15.30 | 9.42 | 2.50 | 39.22 | 4 | 3.60 | 14.73 | 6 | 4 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 54 | B | Large Cap |

| TSE:EMP.A | EMP.A | Empire Co | Consumer Defensive | Grocery Stores | 50.64 | 55.51 | 12.86 | 18.82 | 18.82 | 2.95 | 1.59 | 27.43 | 4 | 0.88 | 9.62 | 6 | 3 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | B | Large Cap |

| TSE:SAP | SAP | Saputo | Consumer Defensive | Packaged Foods | 49.77 | 26.89 | 11.18 | 0.00 | 0.00 | -0.41 | 2.83 | 0.00 | 4 | 0.76 | 4.67 | 5 | 5 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 74 | C | Large Cap |

| TSE:CU | CU | Canadian Utilities | Utilities | Utilities - Diversified | 54.58 | 37.65 | 10.23 | 25.79 | 25.79 | 1.46 | 4.86 | 118.57 | 4 | 1.83 | 5.86 | 4 | 7 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 104 | B | Large Cap |

| TSE:CTC.A | CTC.A | Canadian Tire Corporation | Consumer Cyclical | Specialty Retail | 54.19 | 183.49 | 10.11 | 12.07 | 12.07 | 15.20 | 3.87 | 42.68 | 4 | 7.10 | 14.89 | 6 | 6 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 3 | 95 | B | Large Cap |

| TSE:TIH | TIH | Toromont Industries | Industrials | Industrial Distribution | 72.54 | 118.56 | 9.63 | 19.63 | 19.63 | 6.04 | 1.75 | 31.65 | 4 | 2.08 | 13.94 | 8 | 4 | Intermediate | YES | YES | YES | NO | Canada | 1 | 9 | 52 | A | Mid Cap |

| TSE:CPX | CPX | Capital Power Corporation | Utilities | Utilities - Independent Power Producers | 74.93 | 56.37 | 8.72 | 12.17 | 12.17 | 4.63 | 4.63 | 46.05 | 4 | 2.61 | 10.75 | 7 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 12 | 105 | A | Mid Cap |

| TSE:FTT | FTT | Finning Intl | Industrials | Industrial Distribution | 58.41 | 55.22 | 7.43 | 15.60 | 15.60 | 3.54 | 2.19 | 30.89 | 4 | 1.21 | 6.80 | 6 | 5 | Intermediate | NO | YES | YES | NO | Canada | 1 | 9 | 52 | B | Mid Cap |

| TSE:PKI | PKI | Parkland Corporation | Energy | Oil & Gas Refining & Marketing | 55.96 | 38.60 | 6.73 | 34.77 | 34.77 | 1.11 | 3.73 | 124.49 | 4 | 1.44 | 6.59 | 6 | 5 | Intermediate | NO | YES | YES | NO | Canada | 1 | 5 | 72 | B | Mid Cap |

| TSE:ACO.X | ACO.X | Atco | Utilities | Utilities - Diversified | 57.60 | 51.13 | 5.75 | 13.46 | 13.46 | 3.80 | 3.95 | 51.99 | 4 | 2.02 | 6.94 | 4 | 6 | Tollbooth - Regulated | NO | YES | YES | NO | Canada | 1 | 12 | 104 | B | Mid Cap |

| TSE:BYD | BYD | Boyd Group Services | Consumer Cyclical | Personal Services | 34.18 | 209.39 | 4.50 | 248.47 | 248.47 | 0.84 | 0.29 | 70.47 | 4 | 0.61 | 2.37 | 5 | 1 | Consumable - Discretionary | NO | YES | YES | NO | Canada | 1 | 3 | 117 | D | Mid Cap |

| TSE:GRT.UN | GRT.UN | Granite REIT | Real Estate | REIT - Industrial | 62.19 | 69.00 | 4.20 | 13.78 | 13.78 | 5.01 | 4.93 | 66.16 | 12 | 3.40 | 8.15 | 6 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 10 | 81 | B | Mid Cap |

| TSE:SJ | SJ | Stella-Jones | Basic Materials | Lumber & Wood Production | 70.83 | 75.21 | 4.18 | 12.62 | 12.62 | 5.96 | 1.65 | 18.81 | 4 | 1.24 | 16.52 | 7 | 4 | Intermediate | YES | YES | YES | NO | Canada | 1 | 1 | 62 | A | Mid Cap |

| TSE:CRT.UN | CRT.UN | CT REIT | Real Estate | REIT - Retail | 58.57 | 15.87 | 3.76 | 10.54 | 10.54 | 1.51 | 5.97 | 45.20 | 12 | 0.95 | 9.42 | 5 | 5 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 10 | 84 | B | Mid Cap |

| TSE:EQB | EQB | Equitable Group | Financial Services | Mortgage Finance | 61.53 | 93.72 | 3.59 | 9.60 | 9.60 | 9.76 | 2.26 | 20.23 | 4 | 2.12 | 20.59 | 6 | 4 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 67 | B | Mid Cap |

| TSE:PBH | PBH | Premium Brands | Consumer Defensive | Packaged Foods | 71.42 | 78.90 | 3.54 | 29.77 | 29.77 | 2.65 | 4.31 | 128.86 | 4 | 3.40 | 14.43 | 8 | 5 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 74 | A | Mid Cap |

| TSE:MFI | MFI | Maple Leaf Foods | Consumer Defensive | Packaged Foods | 48.88 | 28.28 | 3.50 | 37.21 | 37.21 | 0.76 | 3.39 | 96.98 | 4 | 0.96 | 10.31 | 6 | 4 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 74 | C | Mid Cap |

| TSE:CCA | CCA | Cogeco Cable | Communication Services | Telecommunication Services | 78.67 | 68.48 | 2.88 | 8.84 | 8.84 | 7.75 | 5.39 | 45.45 | 4 | 3.69 | 15.28 | 8 | 8 | Tollbooth - Regulated | YES | YES | YES | NO | Canada | 1 | 2 | 99 | A | Mid Cap |

| TSE:GSY | GSY | goeasy | Financial Services | Credit Services | 63.78 | 163.48 | 2.63 | 10.76 | 10.76 | 15.20 | 3.57 | 28.91 | 4 | 5.84 | 24.60 | 7 | 6 | Intermediate | YES | YES | YES | NO | Canada | 1 | 7 | 32 | B | Mid Cap |

| TSE:FN | FN | First National Financial | Financial Services | Mortgage Finance | 52.82 | 40.56 | 2.43 | 13.96 | 13.96 | 2.91 | 6.16 | 102.10 | 12 | 2.50 | 8.90 | 4 | 7 | Tollbooth - Unregulated | NO | YES | YES | NO | Canada | 1 | 7 | 67 | B | Mid Cap |

| TSE:NWC | NWC | The North West Company | Consumer Defensive | Grocery Stores | 60.72 | 48.62 | 2.32 | 17.18 | 17.18 | 2.83 | 3.29 | 55.28 | 4 | 1.60 | 6.79 | 5 | 5 | Consumable - Necessities | NO | YES | YES | NO | Canada | 1 | 4 | 47 | B | Mid Cap |

| TSE:SIS | SIS | Savaria Corporation | Industrials | Specialty Industrial Machinery | 65.03 | 18.92 | 1.35 | 27.42 | 27.42 | 0.69 | 2.85 | 75.57 | 12 | 0.54 | 5.50 | 6 | 5 | Durable | YES | YES | YES | NO | Canada | 1 | 9 | 94 | A | Small Cap |

| TSE:ENGH | ENGH | Enghouse Systems | Technology | Software - Application | 71.46 | 22.81 | 1.26 | 16.06 | 16.06 | 1.42 | 5.26 | 73.21 | 4 | 1.20 | 19.68 | 7 | 7 | Intermediate | YES | YES | YES | NO | Canada | 1 | 11 | 90 | A | Small Cap |

| TSE:GCG.A | GCG.A | Guardian Capital Group | Financial Services | Asset Management | 64.26 | 40.58 | 1.00 | 13.99 | 13.99 | 2.90 | 3.84 | 50.45 | 4 | 1.56 | 23.55 | 7 | 6 | Consumable - Discretionary | YES | YES | NO | NO | Canada | 1 | 7 | 17 | B | Small Cap |

| TSE:ADEN | ADEN | ADENTRA | Industrials | Industrial Distribution | 74.07 | 27.36 | 0.68 | 12.25 | 12.25 | 2.23 | 2.19 | 25.06 | 4 | 0.60 | 14.04 | 8 | 5 | Intermediate | YES | YES | YES | NO | Canada | 1 | 9 | 52 | A | Small Cap |

| TSE:CGO | CGO | Cogeco | Communication Services | Telecommunication Services | 81.89 | 64.29 | 0.61 | 7.17 | 7.17 | 8.97 | 5.74 | 38.79 | 4 | 3.69 | 20.04 | 8 | 8 | Tollbooth - Regulated | YES | YES | YES | NO | Canada | 1 | 2 | 99 | A+ | Small Cap |

Canadian Dividend Ambassadors

This is a custom filter with Dividend Snapshot and you get to see the list of stocks with 10 years of dividend growth and with a 10% dividend growth.

Are you suprised to see very few financial stocks in the list?

| TickerKey | Ticker | Company | Sector | Industry | Score | Quote | Market Cap | PE | FPE | EPS | Yield | PayoutRatio | Payments | Dividend | Chowder | GrowthRating | IncomeRating | Tollbooth | Ambassador | Achiever | Aristocrat | King | Country | Graph | SectorID | IndustryID | Grade | MarketCapGroup |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TSE:ENB | ENB | Enbridge | Energy | Oil & Gas Midstream | 60.39 | 61.53 | 134.14 | 22.79 | 22.79 | 2.70 | 6.13 | 133.16 | 4 | 3.77 | 9.22 | 5 | 7 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 5 | 71 | B | Large Cap |

| TSE:CNQ | CNQ | Canadian Natural Resources | Energy | Oil & Gas E&P | 84.41 | 46.00 | 96.29 | 12.89 | 12.89 | 3.57 | 5.11 | 59.88 | 4 | 2.35 | 21.97 | 9 | 7 | Intermediate | YES | YES | YES | NO | Canada | 1 | 5 | 69 | A+ | Large Cap |

| TSE:CNR | CNR | Canadian National Railway | Industrials | Railroads | 73.05 | 140.05 | 87.88 | 19.61 | 19.61 | 7.14 | 2.53 | 47.83 | 4 | 3.55 | 12.00 | 6 | 5 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 9 | 78 | A | Large Cap |

| TSE:MFC | MFC | Manulife | Financial Services | Insurance - Life | 67.16 | 42.13 | 71.96 | 15.96 | 15.96 | 2.64 | 4.18 | 60.41 | 4 | 1.76 | 14.03 | 6 | 6 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 55 | A | Large Cap |

| TSE:ATD | ATD | Alimentation Couche-Tard | Consumer Defensive | Grocery Stores | 75.92 | 70.03 | 66.39 | 18.65 | 18.65 | 3.76 | 1.11 | 19.42 | 4 | 0.78 | 24.67 | 9 | 3 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 4 | 47 | A | Large Cap |

| TSE:WCN | WCN | Waste Connections | Industrials | Waste Management | 65.10 | 255.06 | 65.91 | 75.85 | 75.85 | 3.36 | 0.68 | 49.50 | 4 | 1.26 | 12.82 | 8 | 3 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 9 | 110 | A | Large Cap |

| TSE:IMO | IMO | Imperial Oil | Energy | Oil & Gas Integrated | 71.03 | 111.81 | 56.92 | 11.98 | 11.98 | 9.33 | 2.58 | 25.95 | 4 | 2.88 | 19.10 | 8 | 5 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 5 | 70 | A | Large Cap |

| TSE:DOL | DOL | Dollarama Inc | Consumer Defensive | Discount Stores | 55.92 | 188.06 | 52.11 | 43.03 | 43.03 | 4.37 | 0.23 | 8.40 | 4 | 0.42 | 13.10 | 8 | 2 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 34 | B | Large Cap |

| TSE:MRU | MRU | Metro | Consumer Defensive | Grocery Stores | 61.21 | 103.66 | 22.75 | 23.35 | 23.35 | 4.44 | 1.43 | 30.76 | 4 | 1.48 | 11.68 | 7 | 3 | Consumable - Necessities | YES | YES | YES | NO | Canada | 1 | 4 | 47 | B | Large Cap |

| TSE:IAG | IAG | Industrial Alliance | Financial Services | Insurance - Diversified | 52.86 | 144.16 | 13.44 | 15.30 | 15.30 | 9.42 | 2.50 | 39.22 | 4 | 3.60 | 14.73 | 6 | 4 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 54 | B | Large Cap |

| TSE:CTC.A | CTC.A | Canadian Tire Corporation | Consumer Cyclical | Specialty Retail | 54.19 | 183.49 | 10.11 | 12.07 | 12.07 | 15.20 | 3.87 | 42.68 | 4 | 7.10 | 14.89 | 6 | 6 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 3 | 95 | B | Large Cap |

| TSE:TIH | TIH | Toromont Industries | Industrials | Industrial Distribution | 72.54 | 118.56 | 9.63 | 19.63 | 19.63 | 6.04 | 1.75 | 31.65 | 4 | 2.08 | 13.94 | 8 | 4 | Intermediate | YES | YES | YES | NO | Canada | 1 | 9 | 52 | A | Mid Cap |

| TSE:SJ | SJ | Stella-Jones | Basic Materials | Lumber & Wood Production | 70.83 | 75.21 | 4.18 | 12.62 | 12.62 | 5.96 | 1.65 | 18.81 | 4 | 1.24 | 16.52 | 7 | 4 | Intermediate | YES | YES | YES | NO | Canada | 1 | 1 | 62 | A | Mid Cap |

| TSE:EQB | EQB | Equitable Group | Financial Services | Mortgage Finance | 61.53 | 93.72 | 3.59 | 9.60 | 9.60 | 9.76 | 2.26 | 20.23 | 4 | 2.12 | 20.59 | 6 | 4 | Tollbooth - Unregulated | YES | YES | YES | NO | Canada | 1 | 7 | 67 | B | Mid Cap |

| TSE:PBH | PBH | Premium Brands | Consumer Defensive | Packaged Foods | 71.42 | 78.90 | 3.54 | 29.77 | 29.77 | 2.65 | 4.31 | 128.86 | 4 | 3.40 | 14.43 | 8 | 5 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 74 | A | Mid Cap |

| TSE:MFI | MFI | Maple Leaf Foods | Consumer Defensive | Packaged Foods | 48.88 | 28.28 | 3.50 | 37.21 | 37.21 | 0.76 | 3.39 | 96.98 | 4 | 0.96 | 10.31 | 6 | 4 | Consumable - Discretionary | YES | YES | YES | NO | Canada | 1 | 4 | 74 | C | Mid Cap |

| TSE:CCA | CCA | Cogeco Cable | Communication Services | Telecommunication Services | 78.67 | 68.48 | 2.88 | 8.84 | 8.84 | 7.75 | 5.39 | 45.45 | 4 | 3.69 | 15.28 | 8 | 8 | Tollbooth - Regulated | YES | YES | YES | NO | Canada | 1 | 2 | 99 | A | Mid Cap |

| TSE:GSY | GSY | goeasy | Financial Services | Credit Services | 63.78 | 163.48 | 2.63 | 10.76 | 10.76 | 15.20 | 3.57 | 28.91 | 4 | 5.84 | 24.60 | 7 | 6 | Intermediate | YES | YES | YES | NO | Canada | 1 | 7 | 32 | B | Mid Cap |

| TSE:SIS | SIS | Savaria Corporation | Industrials | Specialty Industrial Machinery | 65.03 | 18.92 | 1.35 | 27.42 | 27.42 | 0.69 | 2.85 | 75.57 | 12 | 0.54 | 5.50 | 6 | 5 | Durable | YES | YES | YES | NO | Canada | 1 | 9 | 94 | A | Small Cap |

| TSE:ENGH | ENGH | Enghouse Systems | Technology | Software - Application | 71.46 | 22.81 | 1.26 | 16.06 | 16.06 | 1.42 | 5.26 | 73.21 | 4 | 1.20 | 19.68 | 7 | 7 | Intermediate | YES | YES | YES | NO | Canada | 1 | 11 | 90 | A | Small Cap |

| TSE:GCG.A | GCG.A | Guardian Capital Group | Financial Services | Asset Management | 64.26 | 40.58 | 1.00 | 13.99 | 13.99 | 2.90 | 3.84 | 50.45 | 4 | 1.56 | 23.55 | 7 | 6 | Consumable - Discretionary | YES | YES | NO | NO | Canada | 1 | 7 | 17 | B | Small Cap |

| TSE:ADEN | ADEN | ADENTRA | Industrials | Industrial Distribution | 74.07 | 27.36 | 0.68 | 12.25 | 12.25 | 2.23 | 2.19 | 25.06 | 4 | 0.60 | 14.04 | 8 | 5 | Intermediate | YES | YES | YES | NO | Canada | 1 | 9 | 52 | A | Small Cap |

| TSE:CGO | CGO | Cogeco | Communication Services | Telecommunication Services | 81.89 | 64.29 | 0.61 | 7.17 | 7.17 | 8.97 | 5.74 | 38.79 | 4 | 3.69 | 20.04 | 8 | 8 | Tollbooth - Regulated | YES | YES | YES | NO | Canada | 1 | 2 | 99 | A+ | Small Cap |

What About a Longer Dividend Streak?

The longer the streak, the longer new stocks can get in and technology moves fast these days.

The US Dividend Aristocrats and the Dividend Kings have 25 and 50 years of dividend increases but that doesn’t really mean much for growth. It just means they are capable of growing the dividend by 1 cent for an extremely long time.

50 years is as long as a portfolio lifetime.