Many stocks, ETFs, and mutual funds trade in Canada, and it can be overwhelming to decide what to buy. At some point, you reach the state of research paralysis and take no action. Researching the best Canadian stocks for your portfolio doesn’t have to be hard.

You usually start from a list such as the Canadian Dividend Aristocrats or, better yet, the Canadian Dividend Achievers. Those lists narrow down the stocks to look into, but that’s where the complexity starts, as there are many, many, many ways to create stock lists. You will see below the various ways you can build a list. What’s important is to know what you are looking for.

A word of caution. Don’t start screening with yield. If that’s what you are doing, you already decided to leave a lot of money on the table. Even if you are retired, unless you have a pile of cash that it doesn’t matter, but that’s not the situation of most investors.

Focusing on Mid to Large Market Cap Stocks

Let me show you what the best 5 stocks by market capitalization are based on the following market capitalization grouping. You can read more details on what market cap means to risk in a more detailed post, but the size of company matters greatly.

Stability and moat are critical here. Innovative solutions can be profitable but they often can be copied. As such, smaller companies with growth are interesting but not without higher risks.

| wdt_ID | Market Cap Tier | Value Range |

|---|---|---|

| 1 | Mega Cap | > $200B |

| 2 | Large Cap | $10B - $200B |

| 3 | Mid Cap | $2B - $10B |

| 4 | Small Cap | $300M - $2B |

| 5 | Micro Cap | $50M - $300M |

| 7 | Nano Cap | < $50M |

- Mega Cap: These companies dominate their industry and often have very little competition. Their challenges are often around becoming too much of a monopoly and regulators stepping in.

- Large Cap: These companies are very mature and usually have a moat. There is competition but it is limited to a small number of companies.

- Mid Cap: These companies have grown and are focused on dominating their business. At this level, you get a higher level of safety compared to the smaller companies.

- Small Cap: These companies are in the growth business life cycle and have potential to grow more or be acquired. There are still risks and your money could go sideways at times but you could have higher returns.

- Micro Cap: These companie have usually struggle to grow at the expected pace. Still in the start-up phase to some extent working to get in the growth phase. There is potential but it's also risky.

- Nano Cap: These companies fall into the penny stocks category. These companies have the highest risk with the potential for some high reward.

For the remaining selection of stocks, the focus will be on mid to large-market cap stocks. There aren’t any mega market cap stocks in Canada, by the way.

Methodology for the Best Stocks in Canada

The approach here is to stabilize the business with good total return. This is not about building a retirement dividend income but total returns, including compounded dividends. In retirement, you can switch your millions invested into income-producing stocks.

The retirement portfolio is another option for a long-lasting dividend income portfolio. For example, the model portfolio is built exclusively with large-cap stocks. My portfolio has just around 20 stocks, all large-cap stocks.

The goal of showing the best five stocks by market cap is to help understand what exists in each grouping, as each group comes with an investment risk. It will help show how to balance your risk vs return strategy.

One caveat to the selection process is that I will exclude oil and gas stocks and mining stocks. Unfortunately, these companies are too impacted by commodity prices to have enough stability.

Below is a table that will show you at a high level the composition of the dividend stocks on the TSX.

| wdt_ID | Market Cap | Stocks | Dividend Stocks | Ratio |

|---|---|---|---|---|

| 2 | Mega Cap | 0 | 0 | 0.00 |

| 3 | Large Cap | 71 | 66 | 92.30 |

| 4 | Mid Cap | 152 | 111 | 73.02 |

| 5 | Small Cap | 252 | 146 | 57.93 |

| 7 | Micro Cap | 223 | 65 | 29.14 |

| 8 | Nano Cap | 143 | 18 | 12.59 |

The ratio of dividend-paying stocks to non-dividend-paying stocks is an important part of the risk factor, as the ability to pay a dividend consistently implies revenue stability.

The ability to grow the dividend annually shows not only the ability to have consistent and stable revenue but also a growing revenue. Getting dividend income in the retirement years, it’s important to have dividend growth; otherwise, you lose to inflation.

Did you see the pattern in the number of stocks paying a dividend? The larger the company, the more it tends to pay a dividend.

Note that you need access to specialized dividend data to screen dividend stocks. You should consider a screener such as Dividend Snapshot Screeners.

Best 5 Canadian Mega Cap Stocks

There are no mega-cap stocks in Canada. While I hold many of them in my portfolio, they are all U.S. mega-cap stocks.

They are also my best-performing stocks. If you aren’t ready to deal with the currency exchange, buy the best S&P 500 ETF.

Another option is the NASDAQ 100 with XQQ, but know that 90% of the NASDAQ 100 is included in the S&P500. The NASDAQ 100 is more volatile, and your blood pressure may be impacted ;)

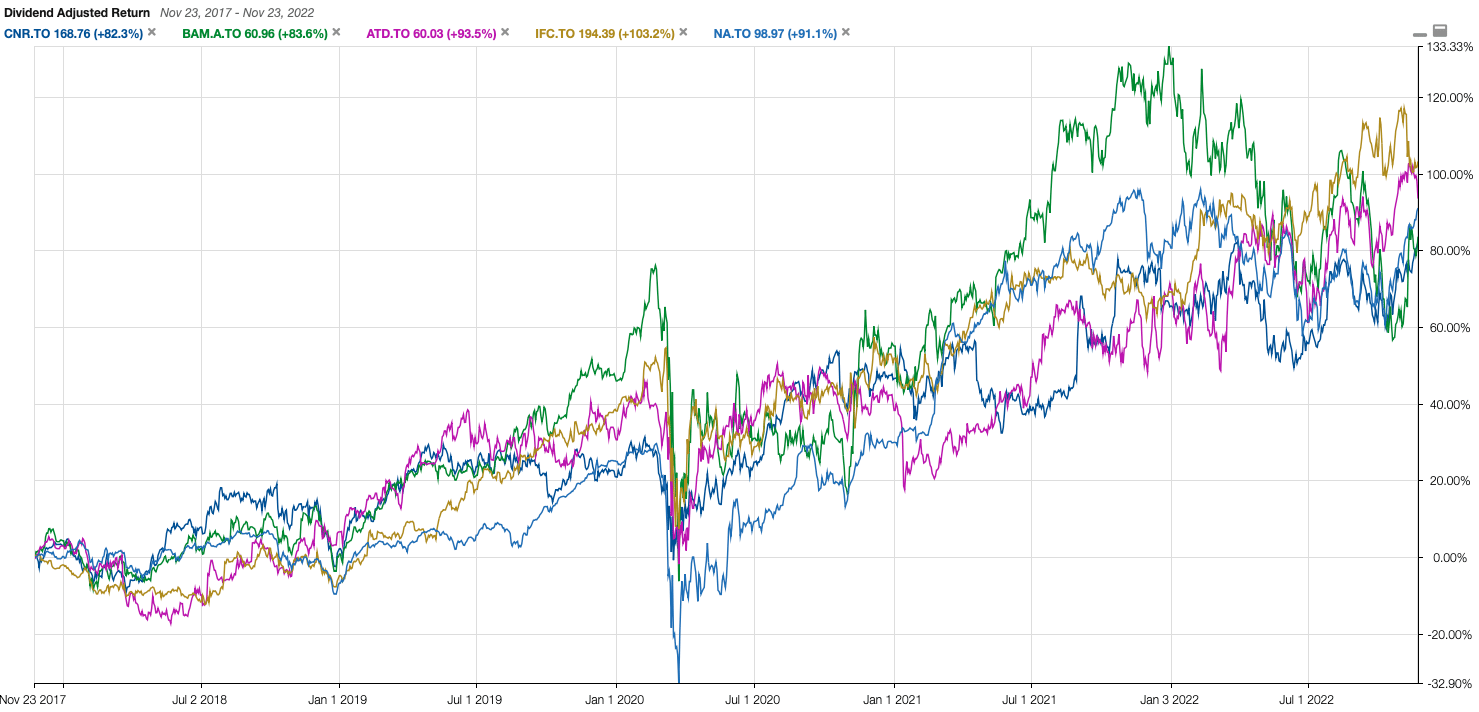

Best 5 Canadian Large Cap Stocks

This group includes most of the TSX blue-chip stocks, which tend to be oligopoly. These Canadian stocks are more stable but generally have moderate growth.

Of the five picks below, only one has a good dividend yield for a dividend-focused investor. The other picks are focused on dividend growth. None have a dividend yield above 4%, but they have excellent dividend growth.

Not a place for energy dividend stocks here sadly. There are better options to start with.

Canadian National Railway

tse:cnr | Industrials | Railroads- Grade: A

- Market Cap: 87.88B (Large Cap)

- P/E: 19.61

- Dividend Yield: 2.53%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 5/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Brookfield Asset Management

tse:bam | Financial Services | Asset Management- Grade: C

- Market Cap: 120.49B (Large Cap)

- P/E: 38.92

- Dividend Yield: 2.79%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 5/10

- Dividend Income Fit: 4/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Alimentation Couche-Tard

tse:atd | Consumer Defensive | Grocery Stores- Grade: A

- Market Cap: 66.39B (Large Cap)

- P/E: 18.65

- Dividend Yield: 1.11%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 9/10

- Dividend Income Fit: 3/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Intact Financial

tse:ifc | Financial Services | Insurance - Property & Casualty- Grade: C

- Market Cap: 54.46B (Large Cap)

- P/E: 24.68

- Dividend Yield: 1.74%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 5/10

- Dividend Income Fit: 3/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

National Bank

tse:na | Financial Services | Banks - Diversified- Grade: B

- Market Cap: 52.99B (Large Cap)

- P/E: 12.91

- Dividend Yield: 3.49%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 5/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Best 4 Canadian Mid-Cap Stocks

This market cap segment is where you find up-and-coming future large-cap stocks. Alimentation Couche-Tard, and Intact Financial were once part of this group.

Capital Power Corporation

tse:cpx | Utilities | Utilities - Independent Power Producers- Grade: A

- Market Cap: 8.72B (Mid Cap)

- P/E: 12.17

- Dividend Yield: 4.63%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 7/10

- Dividend Income Fit: 7/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Equitable Group

tse:eqb | Financial Services | Mortgage Finance- Grade: B

- Market Cap: 3.59B (Mid Cap)

- P/E: 9.60

- Dividend Yield: 2.26%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 4/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

FirstService Corp

tse:fsv | Real Estate | Real Estate Services- Grade: D

- Market Cap: 10.79B (Large Cap)

- P/E: 59.81

- Dividend Yield: 0.58%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 3/10

- Dividend Income Fit: 1/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Stantec

tse:stn | Industrials | Engineering & Construction- Grade: B

- Market Cap: 16.49B (Large Cap)

- P/E: 42.78

- Dividend Yield: 0.62%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 7/10

- Dividend Income Fit: 3/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Best 5 Canadian Small Cap Stocks

This group of stocks is interesting as this is where most of the REITs are. Yet, I am not a fan of REITs as you may have read.

Let’s be clear about this category: these are small-cap stocks and, therefore, have more risks than large-cap stocks. I cannot say that the risk vs reward is worth it with this group of stocks.

- Calian Group Ltd

- WELL Health Technologies Corp

- Canaccord Genuity Group

Best 5 Canadian Micro Cap Stocks

This group of companies is either targeted for acquisition or growing by expanding.

However, this is also a risky investment group. It should represent a small part of your portfolio. When the risk is discussed, equity is often highlighted as the highest risk, but you should now see the difference between a large-cap stock and a micro-cap stock.

33% of the stocks in this group have no 5-year return yet, while another 33% have a negative return over the last five years. That leaves only another 33% with a positive return to select from.

While I was hoping to see candidates I would consider, I could not settle on any stock with any degree of confidence.

Best Canadian Nano Cap Stocks

We are going to skip this market cap group as, technically, this is now entering the high speculation area of investing.

That’s a much different investment strategy.

Best Dividend Stocks by Accounts

Now we make this more complex a little to figure out the best stock to hold in various accounts. The best RRSP investments aren’t always what we think they should be. Again, you need to focus on accumulation and decumulation.

The best TFSA investments are similar. The only big difference is to consider the US withholding tax from US dividend stocks. Otherwise, you can hold the same stocks.

Investing in high-yield stocks isn’t about finding the best stocks; it’s a risky approach in general. You become an active investor at that point since you have to pay attention.

My Portfolio By Market Cap

I have built a portfolio that delivers around 12% annualized returns (a.k.a. Annual ROR) and have made my fair share of mistakes.

My leanings have been to keep it simple. Canada doesn’t have a lot of great options in the end. Canada has a TSX 60 while the US has the S&P 500 for example. The numbers just show you how many great companies you can find.