Finding the best RRSP investment for your needs doesn’t have to be a challenge. A RRSP, or Registered Retirement Savings Plan, is an account designed by the government of Canada to help you save and invest for retirement.

It is unique in providing two tax-efficient ways to save and invest.

Everything you earn in the account grows tax-free. The growth from transaction to transaction will not be taxed until withdrawal. That means you have more money at work

Your contributions are also tax-deductible, which means you can put the money back in the RRSP to have extra money at work to build wealth.

Also, take a moment to see if your employer has a matching contribution plan, as it can significantly accelerate the growth.

Also, note that there are contribution limits and other rules when it comes to withdrawal if you are not familiar with the details as well as deposit such as RRSP over-contribution. The Canada Revenue Agency has all the rules and details.

Supercharge your RRSP Investments

An RRSP account can hold various investment products. Depending on your timeline and risk appetite, there are various options. Seniors, for example, don’t invest the same way as young adults.

A 60-year-old senior would consider a safe withdrawal or income strategy to complement the CCP and OAS payments. Conversely, a younger millennial with a 30-plus-year investment horizon can opt for a more aggressive strategy.

Savings accounts don’t pay, and GIC doesn’t either. You are behind inflation, so it doesn’t help you at all. Bonds have also dropped significantly, and many have seen capital decline.

The question you want to answer is which stocks you should settle for. Do you go for the usual telecom stocks for income or go with the banks for income and growth? Fear not; help is here to pick the best stocks in Canada for retirement.

Index Investing for the Hands-Off Investors

If you want to keep it simple and not stress over individual stock fluctuation, index investing is the way to go.

Index ETFs are the best option, and there are many options from various companies. The two major companies are Vanguard and iShare from BlackRock.

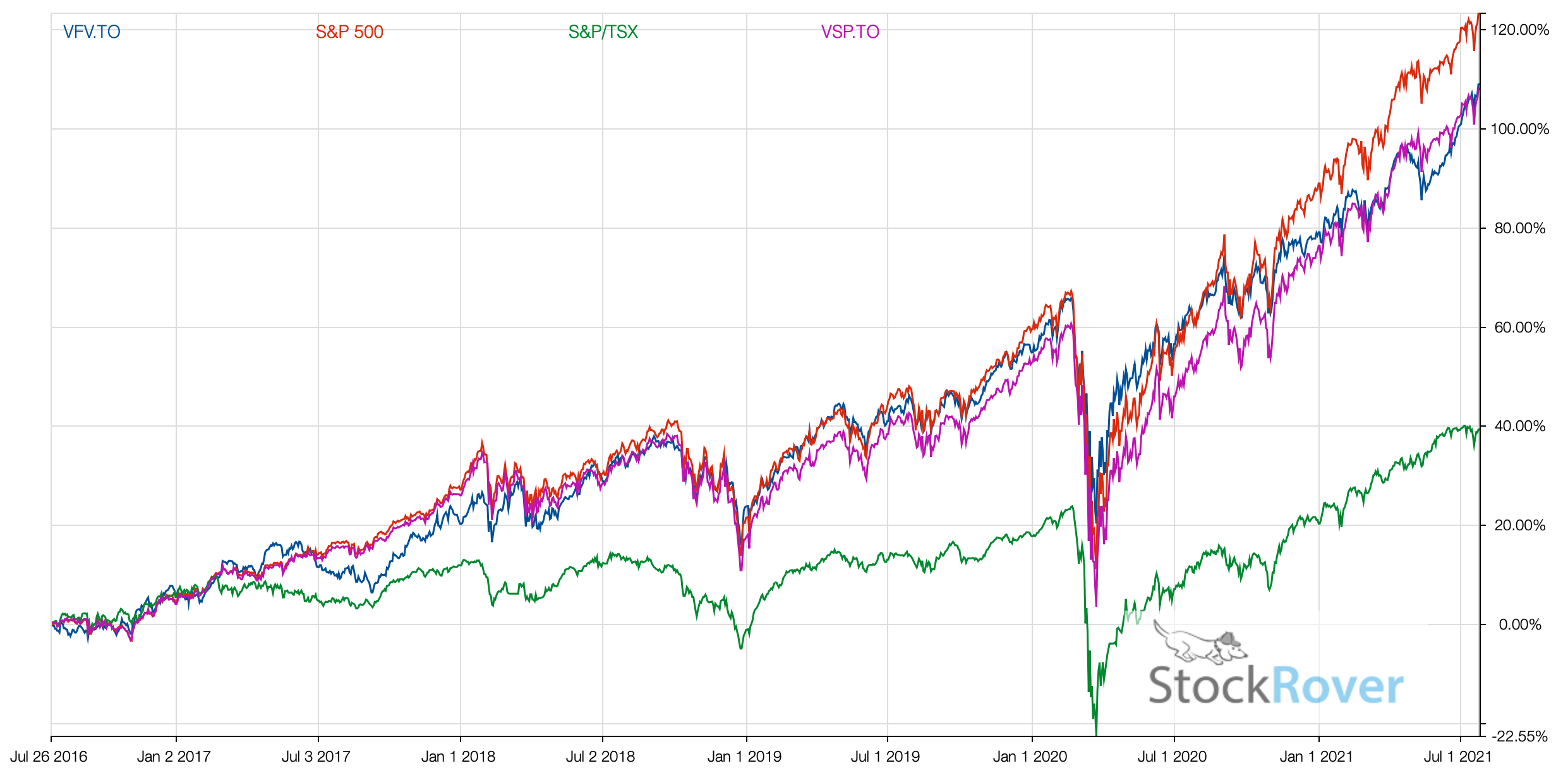

What you get is a market average return. For Canadians, please buy the US S&P500 index or the total stock market index. Our Canadian economy is small and not very diversified. With the Vanguard VFV ETF, you can easily have an annual rate of return of 12% over many years.

Some discount brokers offer free ETF transactions, too. With Questrade, for example, you get to buy ETFs for free, and you have a sell transaction fee only.

Individual Stock Investing

Even retirees have stocks these days. For capital preservation and a decent income, retirees tend to have bank stocks, utility stocks, and telecom stocks. These 3 industries are core to the economy and are primarily defensive investments. It means you invest to avoid the worst instead of investing for profits.

You must capture the difference between investing when you can add more money during the accumulation years and investing when you live from the income of your portfolio.

While you have one portfolio, I believe it needs to be constructed differently.

Income Investments In Retirement

Being retired usually means there is no income coming in to add to the pile of money.

Safety and predictability become more important for investors. Unfortunately, the high-interest bank account doesn’t pay and neither do bonds really.

Since the retirees will already have some of the Canadian banks, telecoms, or utilities, they tend to flock to REITs next in an attempt to have stability with real estate and income from rent.

I am not a big fan of REITs as the safety of the asset is not reflected in the stock price. Instead, I prefer the covered call strategy on bank stocks for example. Doing covered calls is not easy, as such I focus on the best covered call ETFs.

FHI – CI Health Care Giant Cover Call ETF

The ETF holds the top healthcare stocks from the US which have usually less volatility than other sectors and many pay a decent yield to add to the income from the options premium.

The ETF holds the top 20 healthcare stocks that you will all recognize and are an integral part of the North American healthcare system. They are primarily the mega-cap stocks from a market capitalization.

ZWB – BMO Covered Call Canadian Banks ETF

This is your safe play if you are very risk averse but your income drops by 30% …

It’s pretty simple, the ETF holds the major banks and writes covered calls. This is what many DIY investors would do on their own.

Dividend Stocks For The Long Term

For wealth building during the accumulation years, you want stocks with growth potential and that usually means a low dividend yield or none at all if you think of Shopify or Lightspeed POS. The below stocks will fall under the best dividend growth stocks you can find in Canada.

SHOP and LSPD are what I call millionaire makers. You invest a small amount and let it ride. Valuation is usually high due to growth and you can’t compare numbers with a bank for example.

Here are 3 Canadian RRSP investments you can invest in for growth.

Alimentation Couche-Tard

tse:atd | Consumer Defensive | Grocery Stores- Grade: A

- Market Cap: 65.54B (Large Cap)

- P/E: 18.32

- Dividend Yield: 1.13%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 9/10

- Dividend Income Fit: 3/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Canadian National Railway

tse:cnr | Industrials | Railroads- Grade: A

- Market Cap: 90.44B (Large Cap)

- P/E: 20.18

- Dividend Yield: 2.46%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 5/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Intact Financial

tse:ifc | Financial Services | Insurance - Property & Casualty- Grade: C

- Market Cap: 55.63B (Large Cap)

- P/E: 25.22

- Dividend Yield: 1.71%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 5/10

- Dividend Income Fit: 3/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only