You don’t want to think about taxes just when you have to do them. Once tax season is upon us, you usually have few options to optimize your taxes. At that point, it’s just about doing your taxes on time. This investment tax guide should help plan ahead to keep more money in your pocket.

While regular income tax from an employer pay is pretty simple to do, you need to do more when you have investments. It’s one thing to follow the steps from a tax software such as Turbo Tax; having all your documents in order is another.

For example, if you earn less than $50 in dividends from a company, the company doesn’t have to send you a T5 form but you are still responsible for declaring your income.

While Turbo Tax and other software make entering numbers easy, you still need to do quite a bit of preparation before you can do so with your investments.

I find that I sometimes have to do three passes on my income tax, and I am pretty organized with my tax receipts. Everything is digital in Dropbox per year.

Unfortunately, not everything is included in receipts. Non-registered investments require the most work, along with an employer’s company stock plan, known as ESPP (Employee Stock Purchase Plan).

Here are some income tax planning steps for building an efficient investment portfolio. There are many more steps for others such as business owners or self-employed but I want to focus on the investing part.

Income Tax Planning

Let’s be clear that we sometimes focus on the RRSP deadline but your income tax deadline is April 30.

If you owe money, you want to wait :) To know if you owe money, you need to do your taxes, and you don’t want to wait until the last minute either, as you may be scrambling for documents.

Step 1 – Gather all your forms

You will probably receive your T4 sometime in February. The date limit is March 1; otherwise, your company can be penalized. Along the way during the first few months, you will be receiving your T5 forms and RRSP contribution summary.

If you contributed late in February, chances are you won’t receive your statement until sometime in March. Also, just double check you did not over contribute in your RRSP account.

Your T5 will show the amount to be taxed from your dividends received during the year.

TIP: All my documents are digitized and go into a folder that is backed up.

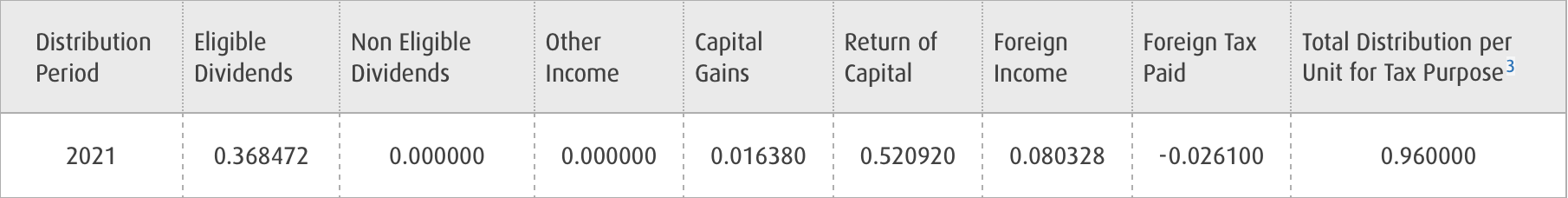

Step 1.1 – REIT Taxes

REITs are a little special. You will get a T3 form that you can use, but it’s more complicated than that when you have a return of capital. Make sure you understand the tax slip from your REIT investment.

TIP: Manage your return of capital properly. It’s also tax-efficient.

Step 2 – Capital Gains & Losses

Figure out your capital gain or loss for each stock, ETF and mutual funds you sold in the year. Make a spreadsheet and itemize all the trades.

If you receive ESPP from your employer, you need to take those into account and use the proper purchase price for the capital gain (i.e., not the discounted price). You would not believe how many employees overpay in taxes regarding ESPP.

Oftentimes, the employee gets a discount on the share price but that discount is taxed at the employee’s marginal tax rate and taken from the pay cheque and reported on the T4. The transaction for capital gains must come from the market price at the time of purchase.

TIP: Understanding Income Tax on ESPP

If you sold an investment in December to take a capital loss, you cannot include the loss in your income tax report if you re-purchased the shares within 30 days.

In the eye of the government, it’s as if you were still holding it and never sold it. Make sure you plan your capital loss usage in November. That’s six months before you have to file your income tax report. As you can see, planning can save you some money.

TIP: Make sure you have all the transactions to show the capital gains in the spreadsheet. I have a sheet for each year. Check out the capital gains guide.

Step 3 – Borrowing To Invest

If you have borrowed money to invest, you want to be able to clearly show the interest amount you have been paying on the loan.

Your last statement from the bank should do the trick, as it probably shows a cumulative interest paid to them for the year.

TIP: Make a digital copy of that statement. I am all paperless now.

Step 4 – Currency Profits Have To Be Declared

Income (or loss) from currency exchange needs to be reported. If you made a currency exchange, you need to declare that. For example, any Norbert’s Gambit with DLR needs to be tracked.

I use the Bank of Canada to calculate the exchange rate. For each transaction in US currency executed outside a tax-free account, I always convert the trading fees and proceeds in Canadian dollars using the exchange rate to properly calculate the currency benefit or loss.

The Bank of Canada tracks the last 10 years of daily exchange rates so it easily covers the 7 years of record you must keep.

Step 5 – Distributions or Return of Capital tracking

You need to have good tracking for non-qualified dividends (see distribution vs dividends) outside of a registered account.

Make sure you understand your investments as a dividend ETF or a mutual fund like BMO Monthly Income Fund do not only pay qualified dividends.

Efficient Tax Planning

Early on, being efficient with your taxes to reduce the amount you pay isn’t a priority but later on, being efficient with your investment can save you in taxes.

Being efficient is about really understanding your investments and using the appropriate account to be efficient.

TIP: Another key point to be aware of is the US dividend withholding tax of 15% applied to any accounts except for the RRSP.

Be Ready For An Auditor

The tips are intended to get your documents organized. It’s fine to have the numbers and enter them in the software, but your income tax report can be reviewed at the request of the government, and you have to keep the last seven years.

If you have everything printed and in an envelope, you are golden. I have moved to paperless and digitized all the documents now. The auditor just needs to go through that, otherwise, you need to prove everything again.