How do you invest for tax efficiency in your Canadian non-registered account?

This is a very important question for your retirement strategy. Sure you want to be efficient while you grow your portfolio but it becomes critical when you start withdrawing from the accounts.

What it comes down to is to have a clear understanding of the different taxes that can impact you. Below are the types of distribution you can receive from stocks, bonds, ETFs, and mutual funds. Learn about the taxes applied to each.

- Investment capital gains

- Eligible dividends

- Non-eligible dividends usually taxed like income

- Return of capital (ROC) from distribution

- Foreign dividends usually taxed like income

- US Foreign income is account-dependent

- Other income

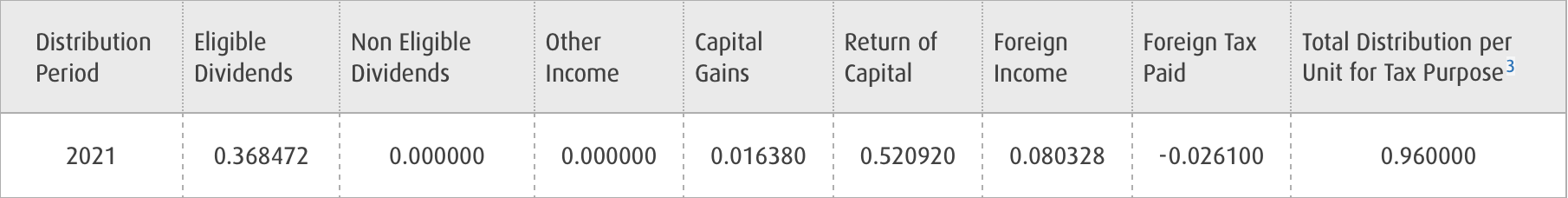

Here is an example of an ETF in a non-registered account that pays you from the fund. I bougth BMO ZWU Covered Call ETF in my corporate account for example.

In a TFSA or RRSP, we don’t tend to think much about taxes, but once you start building your non-registered account, it’s very important to understand taxes.

TIP: Winning the tax game means being on top of all your investments and accounts in one place. Most of us have multiple brokers for one reason or another, but the tax man looks at it together, and you should review your portfolio all in one place.

Non-Registered Account Tax Rates

Here is a simple example for someone earning $50,000 across various tax rates. The income assumes you only generate $50,000 from one of the income types.

In several provinces, you can earn $50K in dividends tax-free! The source of the data below is here.

| $50,000 Ordinary Income | $50,000 Capital Gains | $50,000 Eligible Dividends | |

| AB | 25.00% | 12.50% | 2.57% |

| BC | 22.70% | 11.35% | (5.96%) |

| MB | 27.75% | 13.88% | 6.53% |

| NB | 29.82% | 14.91% | 1.10% |

| NL | 29.50% | 14.75% | 11.29% |

| NS | 30.48% | 15.24% | 9.12% |

| NT | 23.60% | 11.80% | (4.03%) |

| NU | 22.00% | 11.00% | 2.03% |

| ON | 24.15% | 12.08% | (1.20%) |

| PE | 28.80% | 14.40% | 4.53% |

| QU | 32.53% | 16.26% | 11.43% |

| SK | 27.50% | 13.75% | 2.04% |

| YT | 21.40% | 10.70% | (7.78%) |

As your income grows, your tax rate will also increase since Canadian tax brackets have increasing rates. In all cases, capital gains and dividend income clearly beat ordinary income.

Check out the same table for $100,000 in income.

| $100,000 Ordinary Income | $100,000 Capital Gains | $100,000 Eligible Dividends | |

| AB | 30.50% | 15.25% | 10.16% |

| BC | 32.79% | 16.40% | 7.96% |

| MB | 37.90% | 18.95% | 20.53% |

| NB | 37.02% | 18.51% | 20.67% |

| NL | 36.30% | 18.15% | 20.67% |

| NS | 38.00% | 19.00% | 19.50% |

| NT | 32.70% | 16.35% | 8.53% |

| NU | 29.50% | 14.75% | 12.38% |

| ON | 37.91% | 18.95% | 17.79% |

| PE | 28.80% | 14.40% | 4.53% |

| QU | 32.53% | 16.26% | 11.43% |

| SK | 27.50% | 13.75% | 2.04% |

| YT | 21.40% | 10.70% | (7.78%) |

The Most Tax-Efficient Investment

Plainly put, during the accumulation years an investment with only capital gains is the most efficient as you don’t pay until you sell. You essentially defer your taxes to much much later.

It’s almost like an RRSP without the tax refund and with a better tax rate upon withdrawal since the RRSP will be treated like ordinary income while your taxable account will pay the capital gains tax rate.

Say you buy stocks in a handful of companies and hold them for 30 years before you sell, you won’t pay taxes until you sell.

With a dividend stock, you still get to grow your holding and pay capital gains later but you also pay taxes on your annual dividends.

The Most Tax-Efficient Withdrawal Strategy

Once you understand the tax rates, you need to make decisions on your withdrawal per account since you never really just earn capital gains or simply dividends. You will hopefully earn a mix of the three sources of income.

- Ordinary income from RRSP/RRIF/Pension

- Various taxable investments from your non-registered account

- Tax-free withdrawal from your TFSA

Here is my portfolio by account type ratios for both spouses.

| Accounts | Income % | Value % | Taxes |

|---|---|---|---|

| TFSA | 17.54% | 21.69% | No Taxes |

| RRSP | 30.98% | 53.23% | As Income |

| Taxable | 47.20% | 25.08% | Capital Gains, Dividends |

OAS and CPP will come into play at a certain age and will be treated as ordinary income once you take it.

As for the most efficient withdrawal strategy, there are none. It’s just about ensuring you make the best strategic decision to keep your income tax in the lowest bracket where possible.

Advanced Tax Strategy

There are some advanced tax strategies you can plan for early on, or consider at some point. For a couple, you want to try to balance the RRSP between the spousal through the use of a spousal RRSP.

At some point after your spouse, or common-law partner, is 65 years old, you can also plan for income splitting.

After-Tax Income

In the end, once you are retiring, it’s about your after-tax income and your tax bracket.

Based on my portfolio setup seen below, I will have to withdraw RRSP at some point in combination with my taxable dividends. Even if I just withdraw income from my RRSP portfolio, it will be taxed as ordinary income.

| Accounts | Income % | Value % | Taxes |

|---|---|---|---|

| TFSA | 17.54% | 21.69% | No Taxes |

| RRSP | 30.98% | 53.23% | As Income |

| Taxable | 47.20% | 25.08% | Capital Gains, Dividends |

Why Not Focus On Capital Gains Alone?

You certainly can approach your retirement with the 4% withdrawal strategy. Many investors do that.

However, you then need to plan your equity portfolio vs cash portion. Imagine retiring in 2020 when the market dropped … Do you have enough cash for 1 year? or 2 years?

If you think of doing capital gains only and then switch to dividends, you will have a tax bill to pay on the conversion at the time. The transition plan needs to be thought out to avoid a massive tax bill at one point.

This is an excellent post thank-you. I live in Ontario and always max out my TFSA and RRSP. I keep adding eligible dividend stocks to my non-registered account with a goal of getting to 50K in dividends a year. Possibly supplemented by say 10K a year in dividends from my TFSA. This would produce 60K a year or 5K a month of tax free income when I quit working. For me personally, that is more than enough. I will need to carefully consider drawdowns from my RRSP and LIRA accounts. I’m hoping government don’t change the favourable tax treatment of eligible dividends.

$50K from a non-registered account is an amazing goal! If you have a 5% yield, you will have $1M in that account.

Hi,

I think that your article is good, however it doesn’t put enough emphasis on “tax-efficient” stocks/ETFs held in non-registered accounts vs “tax inefficient” stocks/ETFs held in registered accounts such as a TFSA which is a strategy that can be very beneficial for retirees.

For example, many income specific ETFs have tax efficiency built right into them and as such, you want to hold them in a non-registered account. Such as the BMO covered call ETFs. Part of the income is generated by call options which is treated as “good” ROC which isn’t taxed in the short term. With a buy&hold strategy in retirement, taxes on this portion are therefore put off indefinitely. Once your ACB reaches zero, income is treated as capital gains. Obviously, you must consider that your estate will pay the brunt of the taxes you were spared. It’s a choice, but one that saves us thousands of dollars in taxes every year.

Cheers!

Indeed, ROC is the best immediate tax efficient investment but it needs to be planned for as a sell can trigger a full 100% capital gains.

Since not everyone is able to live from income alone and selling securities may happen. You need to be aware that ROC can reduce your cost to $0 per share. However, if it’s part of your estate planning where you never sell and the shares ride until death, then your estate will deal with the taxes ;)

Agreed, you need to plan your after-tax income strategy, but still, even if/when the ROC is taxed, it will be considered capital gains, which is still better than being taxed as dividends.

And you probably have at least 20-25 years before your ACB gets to zero, at which time, your ROC will be taxed as capital gains. To my knowledge, covered-call options are the most tax efficient form of income. Plus, you don’t have to worry about selling your CC ETFs which takes a lot of the stress out when in volatile markets. YMMV

Capital gains is lower only when the income for your situation is high based on the tables above. If you still have ordinary income, it will push the rates higher so it depends on the income you report. The table was compiled from a CIBC report on effective tax rate.

The province you reside and the income you have will play an impact on the tax rate but capital gains is not more favorable than dividends as a general statement. Even once you reach $100K in dividend, the tax on dividends is still better in some provinces.

Say you have a couple that can earn dividend up to $50K and then supplement with TFSA to the amount of $10K, the couple can earn $120K without any capital gains or ROC.

The gist of it all is that you need to have an idea of your income in the future and the source of your income when you reach/approach retirement.

The timing of this post is perfect as I have been looking into taxes in the non-registered account very recently.

If you wouldn’t mind answering the following – is the transaction fee only tax deductible in the non-registered account or eligible across all accounts? For capital gains, is the ACB for each stock supposed to include the transaction fee in the Google sheet for easy tracking at tax filing time? Do you have additional info that you can provide on doing this correctly?

Thanks

The fees all related to the taxable income. So it’s just your non-registered account.