Investors need to realize that there are differences between eligible and ineligible dividends when it comes to the Canadian tax code. It’s part of a comprehensive tax strategy.

This becomes apparent come tax time. Knowing the details will help you make better investment decisions when deciding how to allocate your investments and which investment account to use.

For example, investments such as REITs require thoughtful considerations when selecting an investment account. While a return of capital is the most tax-efficient distribution, your ability to manage the accounting will come into play.

Difference Between Dividend & Distribution

Let’s explore the characteristics of these two types of dividend payments. Normal stocks tend to pay dividends, whereas REITs and income trusts tend to pay a distribution. You can see the usage of the different words from their communication and website.

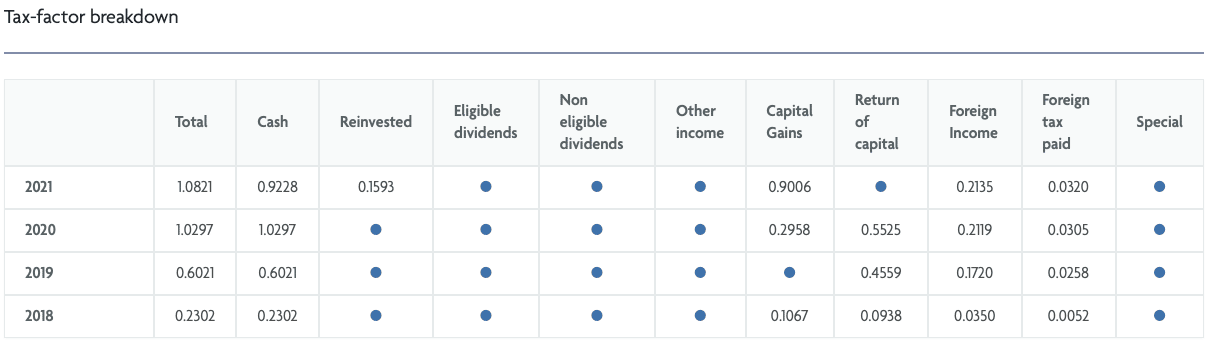

Below is a breakdown of an ETF’s tax composition. As you can see, there is a lot to consider when you invest in a taxable account.

TIP: Be ready to track your ACB. You’ll have to get set up with a spreadsheet and track the price adjustments. The labour can be worth it financially :)

What Is An Eligible Dividend

1) Dividends from Common Shares. Most regular dividend payments from Canadian corporations are eligible. This includes the monthly, quarterly or annual dividends paid out by most Canadian corporations.

2) Dividends from Preferred Shares. Most preferred shares dividends are eligible as well.

3) Dividends from US Corporations in RRSP/RRIF account. The dividends paid by US companies in an RRSP account are tax-exempt from both Canadian and US governments as part of a tax treaty between the two countries. For income taxes, we can consider them eligible.

Please note that MLPs are not US corporations; they are Master Limited Partnerships, and their structure differs from that of a corporation. As such, other tax implications are to be considered (see point 6 in Ineligible Distributions).

What Is An Ineligible Dividend

1) Dividends from Non-Canadian Corporations. If a dividend is paid by a non-Canadian company, it is not eligible for the preferred dividend tax rate.

There will be a tax withheld at source when you hold a US company and you will need to claim it back for a taxable account. You, unfortunately, have no way to claim it back if held in an RRSP or TFSA account (point 3 above is the exception).

See the tax table below to understand all the nuances of holding US companies as investments. With respect to the Canadian tax code, non-Canadian dividends are not eligible dividends when it comes to applying the preferred tax rate in a taxable account.

What Is Not a Dividend or a Distribution

This type of distribution is taxed at your normal income tax rate. So in general, the taxes on these ineligible distributions are higher. Here’s a list of some investments that may potentially pay out ineligible distributions:

1) Non-Canadian Dividends. Dividends from foreign companies are ineligible for the dividend tax credit. Not all tax-sheltered accounts can be used to avoid paying taxes on foreign dividends. Dividends from American corporations should only be held in an RRSP account to avoid paying taxes on the dividends.

2) Real Estate Investment Trusts (REITs). These unique assets provide investors with a way to diversify their portfolios by investing in real estate. Many investors use REITs to complement their stock and fixed-income assets.

Dividend investors like them as well…one of the main benefits is the regular income. REITs differ from other investments because they pay income from the rent revenue they generate. But distributions from REITs can be ineligible. It depends on how the entire distribution is broken down.

You must look at what the company includes in their distribution. In some cases, you receive a return of capital, which affects the ACB of your stock. This is why you often hear the rule that you should hold REITs in a registered account such as a TFSA or RRSP (Traditional or a Roth IRA for Americans) to avoid the burden of accounting for income tax purposes. REIT taxation should be understood before you add REITs to a non-registered account.

3) Income Trust. They do not always offer eligible dividends. They can sometimes have a return of capital along with dividends. Just like REITs, make sure you know if you are receiving a return of capital, as it will adjust your capital gains at the time of disposition. You need to reduce your purchase cost which could increase your capital gains.

4) Bonds. Bonds do not pay dividends. They pay interest, and the payments are considered as such, which falls under the marginal tax rate calculation for income. This can include bond ETFs and bond mutual funds.

5) Mutual Funds or ETFs. These products now have a mixture of dividends and distribution. In many cases, you cannot declare the entire amount as eligible dividends since it may have interest, a return of capital, capital gains, or covered calls premiums. Many dividend ETFs or monthly income funds such as BMO Monthly Income Funds will fit this category.

6) US MLP. The distribution is not subject to any preferential tax treatment. It will be taxed at the marginal tax rate and treated as income when in a taxable account. Foreign tax withholding applies, which impacts the yield on the investment.

Tax Efficient Summary

Be careful; the US withholding tax exemption, part of the Canada-U.S. tax treaty, does not apply to tax-free savings accounts (TFSAs) or registered education savings plans (RESP). Also, with TFSAs and RESPs, you cannot claim a foreign tax credit for the tax withheld.

Keeping track of all the differences between eligible and ineligible dividends might seem like a hassle. Generally, ensure you know what taxes will be applied to select the proper investment account.

Use the table below to reference which accounts to hold your investments. It can save you money and simplify your accounting.

Dividend & Distribution Tax Summary

| Non-Registered | TFSA | RRSP | RESP | Examples | |

| Canadian Dividends | Preferred Canadian Dividend Tax Rate | No Taxes | No Taxes | No Taxes | TSE:RY |

| Canadian Distributions (REITs, Income Trusts) | Normal income and Capital Gains taxes can apply | No Taxes | No Taxes | No Taxes | TSE:REI.UN |

| US Dividends | 15% Withheld – Foreign Tax Credit can be claimed. The income tax rate applies. | 15% Withheld – No Foreign Tax Credit | No Taxes | 15% Withheld – No Foreign Tax Credit | NYSE:JNJ |

| US Distributions (MLPs) | 39.6% Withheld – Foreign Tax Credit can be claimed. Income tax rate applies. | 39.6% Withheld – No Foreign Tax Credit | 39.6% Withheld – No Foreign Tax Credit | 39.6% Withheld – No Foreign Tax Credit | NYSE:MMP |

MLP Taxation details can also be found in the Globe & Mail.

If the distribution is in taxable accounts, your brokerage firm will provide year-end statements that break down the cash and dividend payments. Bring the statements to your accountant when you do your taxes.

As you can see from the table, taxes are complicated when it comes to generating income from companies, REITs, Income Trusts, or MLPs. Tracking all the information becomes critical, and you need a process to track your transactions and income.