Investing is important, if not critical, to make your money work for you. You work hard for your money and your money should work hard for you.

As it happens, the bank is certainly not breaking a sweat paying you to keep your money in their vault. The onus is on you to put your money to work.

Investing is how you take charge of your financial security. It allows you to grow your wealth but also generates an additional income stream if needed ahead of retirement.

Various investments such as stocks, ETFs, bonds, or real estate will provide either growth or income but in some cases both. While you can receive income from the government through the Canada Pension Plan (CPP) or the Old Age Security (OAS) Pension, it’s not enough to take care of retirement and you probably don’t want a plan that relies on that.

Not investing, or not doing it properly, can mean a longer working life. When taking investing seriously, the returns generated from your investments can provide financial stability in the future. It can be challenging but with a clear investment strategy, you can easily achieve financial freedom.

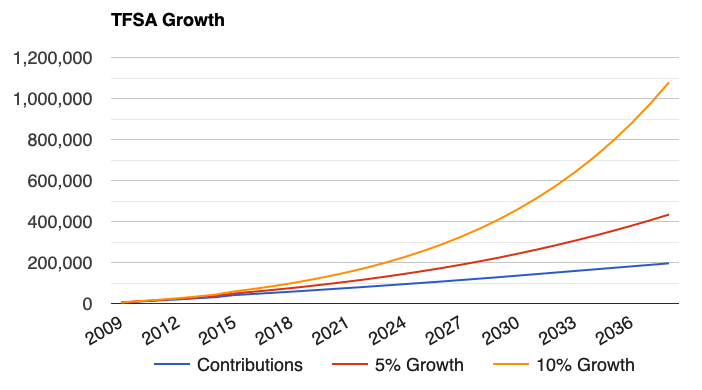

Here is what different investment returns in your TFSA mean after 40 years. The debate over RRSP or TFSA first is ongoing but based on your situation.

Your quality of life is at risk here! Keep on reading to take control.

As you can see from the graph, the first million takes the longest, after that it goes much faster due to compounding. That’s why you often hear that the first million is the hardest.

The growth is based on the maximum contributions allowable since 2009 with all future contributions post 2019 at $6,000 for simplicity. See the TFSA Contribution Limits for the details on annual contribution amounts. The TFSA alone can generate massive wealth in 40 years.

The returns that you expect from your investment will depend primarily upon your investment objectives, the amount that you invest and the timeline that you are looking at.

There is a popular English proverb “You reap what you sow.” – it is essential that you sow so that you can reap the benefits in the future.

You eventually have to face up to the consequences of your actions (or lack of). The same goes for Investing. Investment is required to meet the important milestones in your life, be it sending your kid to college or building your retirement fund. When it comes to investments, it is always better to start early.

What is investing?

Investing can mean different things to different people. While for some people, investing means putting in money to achieve profit, for others, it can also mean investing time or effort for some future benefit, such as investing in oneself’s skills or health.

In this context, we will define investing as “putting money into a financial product, shares, property, or a commercial venture with the expectation of achieving a profit”.

Investing means committing capital or funds to different types of assets with the expectation that you will generate a gain or profit in the future from these investments.

Savings vs Investing

Investing is also sometimes mixed up with saving (interest rate only) and speculation (penny stocks or options trading). An investment is generally different from savings as an investment is a more active way of deploying your wealth while saving is generally understood as storing a part of your income without worrying about where you are deploying your surplus funds.

Investing vs Speculating

Investing is also different from speculation as speculation is generally considered as targeting high returns from your investments within a short period. Speculation, such as trading penny stocks, may be considered as a form of a very high-risk investment within a short time horizon.

Investments are generally long-term and take care of the risks such that the returns are commensurate with the undertaken risk.

When trying to build wealth or outperform an index, you need the right tools to find your winning investment. As a DIY investor, my winning tool is Stock Rover. It allows me to build the most powerful dividend stock screeners. Stock Rover is powerful! It's like having a supercar in your hands, take the time to learn the tool.

Top 5 Reasons

1. Higher Investment Returns

Investing funds in an asset involves a tradeoff as the investor foregoes the utility of using the funds for his investment in the present for some higher utility in the future.

- Stock investment can lead to returns in two ways – one could be through dividends while the other could be from capital gains.

- Investing in a bond can benefit the investor in the form of regular payouts or coupons which are given during predetermined periods.

- Investing in real estate can also benefit an investor through rental income and capital gains.

See the performance of my portfolio investment in equities.

| Accounts | ROR | Yield |

|---|---|---|

| Computershare | 6.86 | 6.70 |

| Portfolio | 12.30 | 1.67 |

| RBC | 8.20 | 4.23 |

| RBC-S | 10.49 | 0.14 |

| RRSP | 17.12 | 0.91 |

| RRSP-S | 11.09 | 0.85 |

| TFSA | 12.56 | 0.82 |

| TFSA-S | 16.22 | 1.30 |

| TSX | 6.04 | 0.00 |

2. Retirement Plan or FIRE

The majority of people invest for retirement purposes. As most people rely on their salary income for meeting their needs, it becomes difficult to sustain their lifestyles after retirement when one does not have a job.

This means that everyone needs to invest a part of his income during working years to ensure a nest egg during his retirement years. While the government and companies used to give a defined benefit pension plan for employees earlier, now one has to mostly rely on defined contribution plans.

A lot of young people also want to retire early so they need to invest a larger portion of their income in order to meet their goals. The “FIRE” movement has become a major movement amongst millennials. “Financial Independence, Retire Early (FIRE)” is a goal that many are striving for these days.

Saving a major proportion of income from a young age (as high as 70% of your income) can allow one to retire at the age of 40-45 years, instead of the 60-65 years. The FIRE movement advocates a frugal lifestyle both at the time of investing as well as during early retirement.

See how dividend income can grow when left to DRIP with good dividend growth.

3. Tax Efficiency

Investing can also help in saving taxes as there are accounts such as the RRSP, TFSA, 401k, Roth IRA and others where the taxes on your investments is lower or non-existent.

As governments reduce their responsibility towards funding their citizens’ retirement years, they have created these types of accounts so that citizens can contribute and fund their own retirement.

4. Beat Inflation

Investing is also important to beat inflation. If you don’t invest your money but just leave it in your checking or savings account, the money will decline in purchasing power as inflation eats away at its value.

While reported inflation is quite low nowadays, actual inflation is quite high as education and healthcare expenses are increasing much faster than reported inflation. Canadian banks are not even paying 2% on savings deposits, which means that if you do not invest, your money will lose value over time.

This 2% return may not be sustained for long as other foreign central banks have cut close to 0% or even lower. This means that you could face a day when your bank deposits earn 0% return or even negative returns sometime in the future when inflation is taken into account.

To insure yourself against such a situation, it might make sense to start investing in a mix of assets which can beat inflation.

5. Reach Your Financial Goals

Investing is one of the critical ways in achieving the financial goals for oneself. As an individual grows through life, there are new financial requirements that come up.

It usually starts with buying a house. Even if one funds a house through a loan, there is the requirement of a substantial down payment. By investing through a mix of assets, an individual can build up the corpus required for the down payment.

Another major investment goal can be the college education of children. With the steep college tuition required these days, a parent can start investing for college tuition even when the children are still very young. Besides these financial goals, retirement is always an omnipresent financial goal for people during their working lives.

Downside of Investing

While investing has many advantages, there are some disadvantages to investing as well.

1. Losses

There is no such thing as a total risk-free investment and there is always the risk of a loss of your investment. Even government securities which are considered as the safest type of investment are not totally risk-free. Governments can default on their debt and there are numerous instances of such defaults in modern history.

2. Requires Investing Knowledge

Investing requires specialized knowledge of finance and different types of asset classes. Experience is also very important in investing, as an investor who has seen a number of economic cycles can, in general, navigate different types of situations better than a novice investor.

Since most individuals do not have training in finance, they may require the help of a financial advisor. Choosing the right financial advisor is a difficult task due to the potential conflict of interest on how they are paid. One of the primary reasons many DIY investors move away from mutual funds.

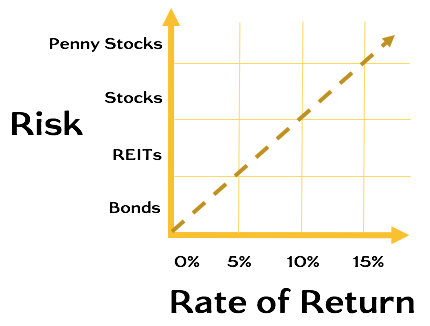

Types of Investment Assets

Investing is very closely related to risk which is an indicator of the return that you would expect from investing in a specific asset. Generally, the higher the risk of an asset, the higher the return that is expected by an investor. For example, the risk from investing in a stock is generally higher than that of a bond so the return expectation is also higher from stock than a bond.

There is a wide spectrum of investment assets each of which has a different risk profile. Some of the common types of assets are – stocks, commodities, fixed income, gold, real estate, art, derivatives and alternative investments such as venture and private equity capital.

Types of Investing Styles

There are also different types of investing styles, also known as investment strategies, besides the different types of investment. The main ones are outlined below in order of knowledge / effort. The investing style approach you choose will depend on your interest in the topic and the amount of time you are willing to invest in.

None are better than the other for generating returns. It’s up to your skills and lady luck since no one can predict the future.

Index Investing

This strategy is based on John C. Bogle’s investing approach, in which instead of focusing on beating the index and paying high fees, you would mimic the index at very low fees.

There is huge momentum nowadays with index investing. It allows any investor to put their money to work with little knowledge and still get good returns. However, it is also argued that over a really long period of time, no investors can continuously beat the index. Why try to beat the index if professionals can’t do it is their conclusion.

ETFs are currently the best method for index investing, and the best Canadian ETFs are often the simplest.

Dividend Investing

This approach focuses on dividend stocks with the goal to earn an income and / or use the dividend growth as a method to find high-quality growth stocks. A dividend income stock will usually have a higher dividend yield whereas a dividend growth stock will have a lower dividend yield.

Retirees often seek high-yield stocks to fund their retirement to avoid depleting their portfolio. This method provides a method to avoid running out of money and have more control over it.

Value Investing

This approach is probably closer to Warren Buffett’s investing method where he looks for strong companies with an economic moat that is undervalued. Identifying an undervalued stock can be very difficult but also profitable when you can spot them.

Valuation is not a simple technique, and there are books on how to do it, along with theories from scholars. This approach requires patience.

Technical Trading

This approach looks at trends in stock price movement and volume. The patterns are mostly based on how general investors approach investing, which leads to recognizable patterns.