Once the data on fees you pay is outlined and the long term impact of those fees is visible graphically, the decision to switch from mutual funds to low-cost index ETFs is easy!

The MER (Management Expense Ratios) is much higher than ETFs, or stocks, and that’s before you find out you may have fees for selling up to 7%!!! Say goodbye to high fees and start making your money work for YOU and not your financial advisor.

Fear not, I was once in your shoes and it’s pretty easy. I know that at this moment you may be angry or upset about the realization that your money was not working the way you expected it.

Now that you understand the high fees and the poor performance, you are ready for an alternative. As it happens, there are a couple of dividend investing strategies that you can use but more on that later.

First, let’s start by getting you out of the mutual funds world, and while you go through the process build your investment plan with key rules to stay focused.

Selling Your Mutual Funds

You finally figured out that mutual funds may not be for you and you are looking for what to do next. Once you see that the high mutual fund fees take away a lot of your profits, it’s game over for the mutual funds. I was there in 2008 and I woke up in my mid-thirties.

Follow the steps below to get out of your mutual funds and, more specifically, your mutual fund advisor. He profited from you; now it’s time to make him work for you.

- Don’t tell your advisor you are selling yet. Scheduling meetings for a review to execute the below actions.

- Make a list of all your accounts and what they hold. That’s the number of shares and the mutual fund code. Identify the cost of selling them too as there can be a fee for selling them before you hold them for seven years (unless that has changed).

- Once you are meeting with your advisor, start discussing moving your mutual funds with fees to no fees. There should be options. Make up a story, this is to avoid paying fees when you sell. Tell your advisor you want to pause and review. Find out if a bond mutual fund has fees and maybe use that.

- Find out which discount broker you want to go with. If you plan to invest in ETFs for indexes (more on that below), Questrade is good; otherwise, it’s up to you. I am with RBC Direct Investing (I bank there) and Questrade. I prefer RBC over Questrade.

- Once all is adjusted and transferred with no fees, you should be able to initiate a transfer for your discount broker. You simply have to fill out the forms and select to have the mutual funds sold and transfer the cash. At this point, you don’t even have to engage with your financial advisor if you don’t want to.

It will take some time and you will need to be patient. Remember, you are taking control of your financial future. It’s not worth fussing over the past with your mutual funds, it’s time to focus on making your money work for you.

Choosing An Investment Strategy

Now that you are moving away from mutual funds, you will need a strategy. This can get really complex fast, so while you go through the steps above, take your time reading.

Millionaire Teacher by Andrew Hallam is one such book you should read or The Lazy Investor by Derek Foster. You will get exposed to 2 of the easiest strategies to invest as outlined below. The basic concepts are pretty simple to understand but there are variations and nuances that.

Index Investing

This strategy is the simplest to establish and requires the least time and effort. From a return on investing perspective, you should expect to have stock market performance.

The S&P 500 is more performant than the TSX, and if you blend multiple markets, you will average across all of them. This is where it gets complicated. As Canadians, we tend to be biased towards Canada but in reality, it’s a small economy. I tend to favor the US market but that also means you are missing out on the emerging market.

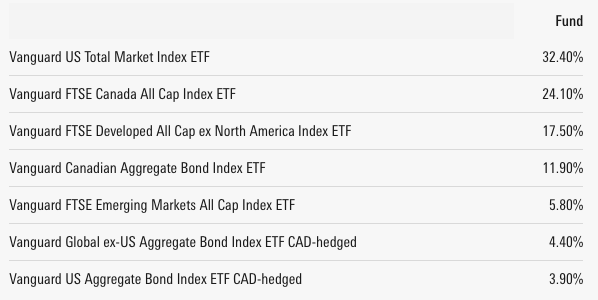

- What’s the best index composition? It’s for you to decide. VRGO ETF is an all-in-one ETF from Vanguard or you can pick a few index ETFs representing the Canadian market, the US market and the bonds market to keep it simple. VGRO, as seen below, simply purchases different indexes. If you like the ratios, you can do that or you can buy the ETFs separately.

- What should you expect in terms of performance? Depending on the ratio of bonds, you should expect between 6% and 10% just to be conservative.

- Most index ETFs provide a distribution (not a dividend) and you can DRIP it to buy more shares. It’s an auto-pilot method for compound growth.

- Another option if income is more where you are at are Canadian Dividend ETFs. They also offer low MER but a little higher than index ETFs.

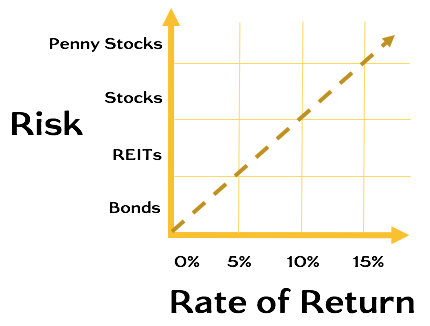

The bond ratio is a topic of its own. I do not have any bonds at my age, and I am comfortable with it. Bonds offset equity drops so it depends on your emotional capacity to handle seeing your portfolio swing up and down when the markets are tumultuous. Ignore the rules about age and so forth; those are also made-up rules by the financial industry. It’s really about your equity comfort level. The more bonds you have, the lower your return will be.

Rebalancing to match your ratios is a really good strategy that allows you to buy low and sell high. You sell the index that is up, and you buy the index that is low. I recommend you do it quarterly or semi-annually. Through my employer’s RRSP plan, I utilize the index strategy (that’s the only option) and it rebalances every quarter. I have had an annual rate of return of over 9% since I started back in 2009.

Dividend Investing

Dividend investing takes more time and effort. You can have better returns than index investing (or not) and you get to also build a portfolio that can generate income in retirement but you will have to research and monitor. It’s not hands-off like index investing. You will also need to start understanding the businesses you invest in.

With index investing, you don’t get to vote for the election of board members but with dividend investing, since you are a company owner, you get to vote if you want to. That means you are investing in a business with the expectation that the business will grow your investment. Some concepts to understand are:

- How the company makes money?

- Is the company profitable?

- Does the company have too much debt?

- Is the board and executives good at their job?

- Do they reward investors with dividends or share buybacks?

- Is profit organic or fuelled by acquisitions?

If your neighbour comes and asks you to invest in his venture, what question will you have? Let’s say he wants to enter the food truck business. To invest in his new venture, you will ask questions.

Same thing with the stock market. It’s exactly what the companies are doing by offering shares, they are simply raising money to expand and invest in new ventures to make more money.

This is where the homework will be and some of those questions can be answered by reviewing financial statements from the company. When we talk about dividend investing, it means that we filter out the entire listing by those who pay a dividend.

The idea is that those companies are more mature, are established and have enough profit to reward shareholders with a dividend.

As you can see, selling your mutual funds is easy. Your next step is a new journey based on your goals and desire to learn. You don’t have to chase performance. I like to know how fast I can double my money and you simply have to use the rule of 72. Take 72, divide it by the rate of return, and you get the number of yours it takes to double it. For simplicity, with a 10% rate of return, it will take 7.2 years to double your money.

If you have $100K, in 7 years, you have $200K, without adding new money. Check out the table below for your TFSA potential. I am tracking my total year after year to show.