Investing is easy once you know what stocks to look for, but making sense of everything thrown at you from everywhere is not so easy! It’s overwhelming and then stressful as you want to avoid making mistakes with these investing tips.

Beware! Many of my learnings go against what the financial industry tells you to do. Isn’t that counter-intuitive? It’s like you have to unlearn to learn again but stick with me for a moment.

Since you are here to make changes for the better. Have an open mind and get ready to learn and improve your portfolio.

The Most Critical Investing Tips

You need to know the investing framework that is available to you. It can feel overwhelming with so many new acronyms, but you must try to learn. The investing framework we all have consists of the investment accounts available to us.

TFSA: Tax-Free Savings Account

You can read all the nitty gritty details on the TFSA, but in simple terms, you can invest your money tax-free, but you have an annual limit on how much money you can contribute. Otherwise, the rich would not pay taxes …

You can easily have $1M in your TFSA if you are diligent about your investment selection and you contribute annually. Below is my TFSA account on December 2023 after investing the maximum ($88,000) TFSA contributions up to 2023.

TIP: This is the first account you should open and start with. There is no downside to it at all. Just get started.

RRSP: Registered Retirement Savings Plan

The RRSP is the older sibling to the TFSA and is worthy of use, but you generally want to do it after the TFSA when your income is in the low tax bracket. The benefits of the RRSP are greater, with a higher income. The tax break is the name of the game, and you MUST reinvest the tax refund to maximize your RRSP.

TIP: The tax refund is where the magic happens to really maximize your RRSP investments. Make sure you don’t use it to go to Vegas!

RESP: Registered Education Savings Plan

The RESP is approximately a 20-year investment plan, and then it’s decumulation. It’s your first stab at figuring out the 50-year version of accumulation and decumulation for retirement. Use index investing and contribute regularly.

The timing is much more critical when the time to withdraw money comes around, as a market crash can hinder the funds available, and not investing in the market can hinder growth. Challenging, isn’t it?

TIP: The RESP has unique properties to be aware of. Withdrawing money properly can be complicated.

FHSA: First-Time Home Savings Account

The FHSA is strategic account. It’s not for retirement and is similar to the RESP. You invest for a while, and then you have to withdraw. It has a limited timeline. Use index investing and contribute regularly.

TIP: It’s relatively new, and strategies around its use are just materializing. Nevertheless, if you don’t have a home, you have to consider it.

Understand Your Investing Timeline

It seems simple, but most investors will make the mistake of building a portfolio as if they are retired when they are young. Unless your strategy is index investing, you have two phases of investing: when you work and when you are retired.

Your Must-Have Investment Compass

This is not what most people will think about, but it will make sense once you think about it.

- Can you imagine driving a car without a fuel gauge?

- Can you imagine a pilot flying an aircraft without instruments?

Investors need their form of instruments, too. We need short-term and long-term data with multiple portfolio views to make decisions.

This is an area where nearly all trading platforms will fail you. If you think you have what you need from your broker, you are probably wrong and missing out.

What is most important to all investors is to have a view across all your accounts in one place, along with your annual rate of return since inception for your portfolio and your individual accounts. This is my rate of return, and it tells me when I can reach my goals along a timeline.

| Accounts | ROR | Yield |

|---|---|---|

| Computershare | 12.52 | 5.62 |

| Portfolio | 13.30 | 2.10 |

| RBC | 9.64 | 14.83 |

| RBC-S | 12.94 | 4.69 |

| RRSP | 17.13 | 0.71 |

| RRSP-S | 13.60 | 0.90 |

| TFSA | 12.75 | 0.71 |

| TFSA-S | 15.16 | 2.30 |

| TSX | 7.51 | 0.00 |

Unfortunately, data points always used and discussed in the media are the last 12 months, which is interesting from a news perspective. Still, it’s pretty ineffective for portfolio management. You should not decide based on your performance over the last 12 months.

Create your own portfolio view with Google Sheets. This is the most critical step. We all want to buy our first stock, but you want to get set up to manage your portfolio from the beginning.

Why is this important? Too many investors invest for several years, are unsatisfied, and don’t know what to do. Is my portfolio too diversified? Do I have too many stocks? Which is a good holding and which is not? A portfolio tracker provides you with all the answers!

TIP: You will be tempted to use yield on cost, but you must avoid it. It doesn’t help building a growing portfolio.

Know Your Portfolio Performance

Profit is not the same as annual return. Profit is just a value at a point in time and doesn’t offer anything towards projecting into the future.

If I say I made 300%, what does that mean? It means you triple your investment, but what does it tell you? It doesn’t say much more, unfortunately. You don’t know if it’s in one day or 20 years.

The profit or return on investment (ROI) lacks the time component. To truly compare your investments and assess your performance, you want to track an annual rate of return since the beginning.

You can easily get the rate of return for your individual stocks, accounts, and portfolio.

Understand your rate of return and how to calculate it. If you know your rate of return is 10%, for example, you can double your money in 7 years. It’s how you estimate when you can reach your goals.

TIP: What is a good portfolio return? The annual rate of return should be your benchmark. It’s the only compass you need.

Income vs Total Returns

As a dividend investor, you need to understand there is an inverse relationship between passive income and total returns.

Simply put, the higher the yield, the lower the total return over time. I started using the Chowder Score to find good long-term investments. It provides a blend of income and growth combined as a score depending on your needs.

Most dividend investors start with the income angle. Still, that strategy is better for retirement, whereas dividend growth with a total return angle is better during accumulation.

Don’t settle for one way to invest all your life. Approach it this way: dividend growth during your accumulation years and income investing in retirement. It’s a simple portfolio switch.

Compare my dividend income growth with my portfolio growth. In 4 years, my portfolio has doubled and my dividend income has not. While it grows, it’s not at the same pace as my investments.

TIP: My yield is around 2%, and while I could increase it, I don’t need the income now. It’s better to have a larger portfolio during the accumulation phase.

Avoid Country Bias

As a Canadian, we tend to start with the Canadian markets, but the big economy is the US economy.

Luckily, you don’t need US dollars to profit from the US economy. All you need is to invest in the best S&P 500 ETF. That is not an income play for retirement, though.

Let’s be clear: it’s not a dividend stock, and it’s not a dividend investment. It’s a total return investment that has historically done much better than the TSX. Many S&P 500 ETFs trade on the TSX in Canadian dollars.

TIP: Canada is a small economy; US stocks can supercharge your portfolio. You can even receive USD dividends from Canadian stocks.

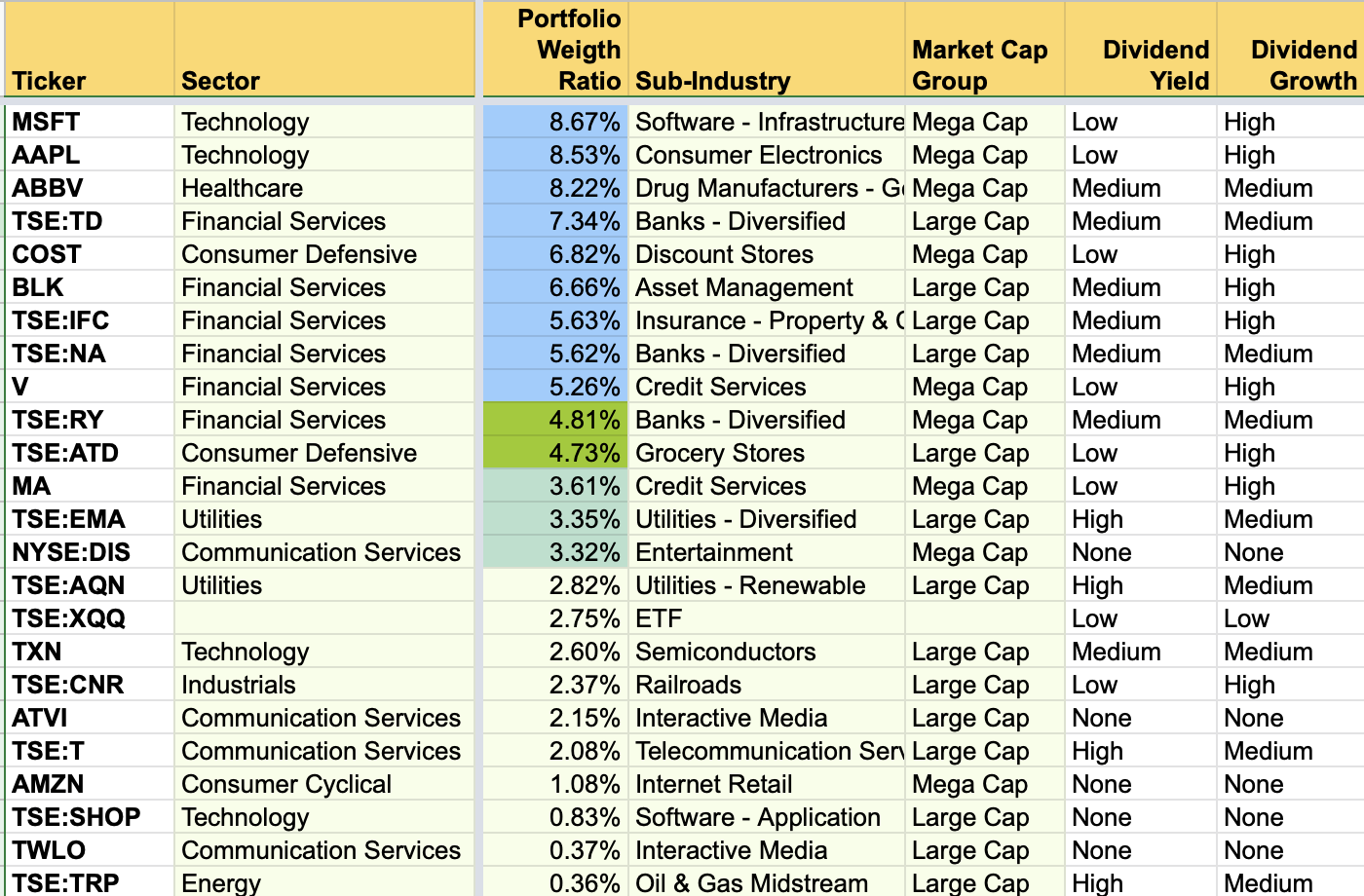

Categorize Your Holdings

The basic starting point is knowing the sector and industry, but that’s basic. All it tells you is your exposure to an industry, and the risk is relative to your understanding of it.

As with most investors, I started with the above but also evolved into tracking a matrix of dividend yield vs dividend growth. The table helps you view your exposure to the type of holdings you have.

| wdt_ID | Dividend | No Growth | < 6% Growth | > 6% Growth | > 10% Growth |

|---|---|---|---|---|---|

| 2 | None | 6.90 | 0.00 | 0.62 | 0.00 |

| 3 | Yield < 2% | 5.49 | 0.00 | 13.19 | 47.54 |

| 4 | Yield > 2% | 0.00 | 0.00 | 11.71 | 4.64 |

| 5 | Yield > 4% | 0.00 | 0.00 | 6.26 | 0.00 |

| 7 | Yield > 6% | 2.53 | 0.00 | 1.12 | 0.00 |

Another category I like to consider is defensive vs offensive holdings. Don’t mix it with the sector concept, but rather focus on the purpose the holding has in your portfolio.

If you follow my dividend income reports, you will notice a lot of analysis on the structure of my holdings. My defensive stocks are not usually the best-performing stocks, but they provide stability and a foundation for my portfolio. Think of the Canadian banks, for example.

Another simple categorization is by market capitalization. For the longest time, I did it mentally, but there is an official categorization of the market cap and the risk that comes with it.

In the end, you need to track your sector & industry allocation, your market cap categories, your dividend yield and your dividend growth. That’s when you see the full picture.

Understand What Risk Means

Risk comes from the fear of losing your money. Since equity investment fluctuates, when it drops, your portfolio value drops and many investors panic even if it’s just on paper (i.e. you have not sold, so it’s not a realized loss).

The flip side is to invest in GICs or leaving it in the bank for 1% return. You do not keep up with inflation here. Your savings lose purchasing power every year. In fact, with the rule of 72, it will take you 72 years to double your money with a 1% interest rate.

You need to overcome your risk fear to put your money to work. It’s that simple. Some people do it by buying properties and renting them, for example, and others do it with the stock market.

TIPS: REITs are not as safe as you think. Yes, real-estate is good, but REITs are companies managing real-estate, make sure you understand what REITs are.

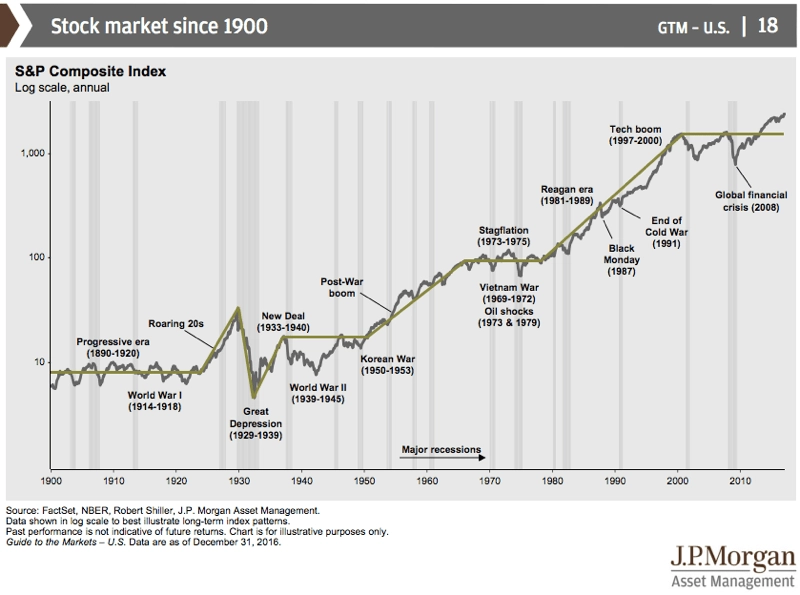

The stock market recovers over time and it’s not a zero sum game, check out the trend below.

What this all means is that when the market drops, you should find a way to add money because the market is on sale as opposed to selling.

If you are retired and have a proper portfolio strategy, you should have cash, or cash equivalent, on hand for short-term fluctuations. You don’t want to be forced to sell during a crash.

Another risk comes from the size of a company. Smaller companies have more growth potential but also more risks. If you look at my portfolio, I only have large-cap and mega-cap stocks for the most part. It significantly reduces the risk.

| wdt_ID | Market Cap Tier | Value Range |

|---|---|---|

| 1 | Mega Cap | > $200B |

| 2 | Large Cap | $10B - $200B |

| 3 | Mid Cap | $2B - $10B |

| 4 | Small Cap | $300M - $2B |

| 5 | Micro Cap | $50M - $300M |

| 7 | Nano Cap | < $50M |

Dividend Growth Is Important

Regardless of the dividend investing approach you follow, you need to consider dividend growth.

If you focus on total returns, you tend to want high dividend growth for many consecutive years.

If you focus on retirement income, you need dividend growth to beat inflation. Aim for at least 5%.

A REIT that pays a 6% yield might seem good, but after years of paying 6%, you are falling behind on the income front. Inflation is ruining your future income from this REIT.

Be fearful of investments that do not increase the dividend or distribution. You must know that and know why you hold it in your portfolio. Your portfolio income has to beat inflation if not all individual holdings.

TIP: DRIP, DRIP, & DRIP. You need to put the dividend back to work ASAP.

Why Hold So Many Stocks?

I see portfolios with 40 or 50 Canadian stocks … It’s pretty much the TSX 60 bought at different times.

For example, do you need to hold all the big banks? Just pick 2 or 3 and ride them. How many insurance companies do you need? How about the number of Brookfield stocks?

If you want to take some calculated bets, it’s perfectly fine. At least pick a percentage of your portfolio for your strategic bets.

TIP: Monitor your allocation and have a plan to rebalance. Taking a profit can be good, but I do not do that anymore.

Now, statistically speaking, 50 stocks mean a 2% allocation per holding, and chances are you have sub-par holdings, bringing down the overall performance of your portfolio.

Get a clear picture of your portfolio. Go back and categorize them with all the data points mentioned above.

Keeping so many stocks is like building an index; the only control you have as a dividend investor when building your own index is the income. This can only work in retirement; otherwise, you leave a lot of money on the table when growing your portfolio.

The problem with too many stocks is that you have to keep track of that many stocks. It feels like you lack conviction in your decision. You also have the problem of choosing what to do with new money, such as adding to an existing stock or a new holding.

The number of stocks in your portfolio is your choice, and you need to feel good about it to sleep at night but know what you give up from an optimal perspective. There is no right or wrong way to invest as long as the decisions are conscious!

Holding Your Employer Stocks

Nowadays, many investors have stocks from their employer when they work for a publicly-traded company. Stock options used to be the norm, but over the years, restricted stock units (RSU) and employee stock purchase plan (ESPP) have become the norm.

All these stocks received for free or at a discount becomes part of your portfolio and can often be very large compared to the rest of your portfolio. Make sure you see it all as one overall portfolio.

TIPS: Have a plan for when to sell your ESPP.

Taking It To Another Level

At some point, you will be comfortable, and the money-making machine will be at work. If you built confidence in your investing method, your investment growth should be somewhat predictable within ranges, at which point you can then calculate profitability with borrowed money.

Don’t overextend yourself. When things go well, we tend to be greedy, but remember that it’s borrowed money, so make sure you can pay it back safely.

TIPS: Borrowing money to invest is a tool based on math, not gambling. Make sure you understand the math before investing with borrowed money.