The Tax-Free Savings Account, or TFSA, is a special type of investment account that provides tax benefits for Canadians. The main tax benefit of this type of account is that investment income earned in a TFSA is not taxed upon withdrawal.

It was introduced in 2009 and is very similar to the United States Roth IRA or UK Individual Savings Account.

How The TFSA Works

The premise of the TFSA is that it is an investment option for Canadian residents who want to invest and grow their money tax-free.

The TFSA is designed to be a flexible investment account that allows the account owner to withdraw money from the account at any time and not pay taxes.

The account’s premise is that you use after-tax income, so when you deposit money into it, you can also withdraw it tax-free.

The benefit is that you avoid taxes on capital gain, interest, and dividends on money saved or invested in the account.

Benefits of the TFSA

As mentioned, the biggest benefit of the TFSA is that your assets can grow tax-free inside the account, unleashing the power of compound growth.

Inside the TFSA account, you can hold all of the same investments you could under the RRSP, including publicly traded stocks, bonds, mutual funds, and real estate investment trusts (REITs).

Because of the account’s tax-free benefit, you can invest in a stock, watch it grow, earn dividends, and then withdraw any earnings at any time and not pay taxes on the capital gains. This represents significant potential savings for investors.

With its introduction, the TFSA has become a strong competitor to the RRSP in terms of tax-free growth. Both are great vehicles, and you need to understand their usage for the long and short term.

The Rules of the TFSA

The biggest rule of the TFSA is the amount you can contribute each year. See how much money you can generate over time.

It’s worth noting that the TFSA has a carry-over aspect to it, which means that you can roll over any unused contribution to the following year.

However, even though you can withdraw anytime you would like, you still cannot contribute more than the TFSA contribution limit plus the previous carryover in the current year. There is not “reinvestment” option during the same year, you have to wait until the next calendar year.

To start using a TFSA account, you must be at least 18. From that point on, your contribution room starts accumulating, unlike an RRSP, which requires you to earn income before you can leverage the account. For more details on opening a TFSA account, see the Canadian Revenu Agency website.

How it Compares to Other Investment Accounts

The TFSA is different from most other investment accounts because of the tax savings that it provides to investors and it is essentially the opposite of the RRSP account from a tax perspective.

In the RRSP, you get a tax deduction for contributions, essentially making the contributions pre-tax money, but at that the same time, you have to pay taxes on withdrawals.

The gamble is whether you believe taxes will be higher now or in the future. If you think you will pay higher taxes now, the RRSP makes sense because of the current tax savings you receive. If you think taxes will be higher in the future, using the after-tax money now and not paying on withdrawals makes sense for the TFSA.

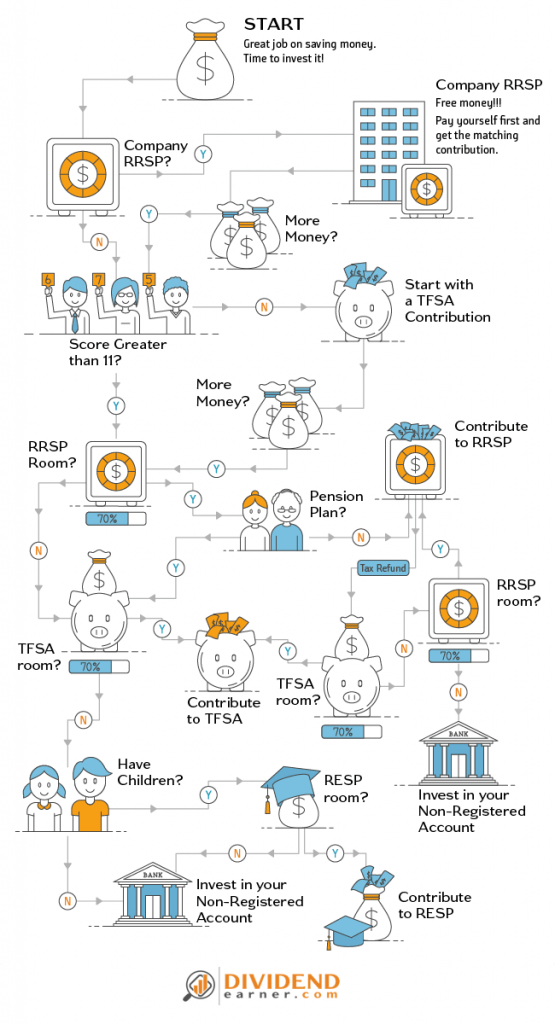

The choice of which account to use becomes a regular topic of discussion as it hinges on predicting your future. The dilemma around TFSA or RRSP first is there for everyone.