The TFSA account is by far the most important account in your portfolio! Don’t ignore it and put it to work as soon as you can.

The choice of investing in your TFSA or RRSP first is still a debated question, but what isn’t up for debate is your contribution amount per year and how much you accumulate in the contribution room.

The TFSA contribution limit starts accumulating once you turn 18, unlike RRSP, where you need to have income declared to accumulate contribution room. It’s the perfect vehicle to create a passive income machine with dividend investing.

How much you can contribute is based on your accumulated limit and how much you have contributed. Your TFSA contribution room is pretty easy to calculate – check out the amazing calculator below with mind-blowing math.

Note this: the TFSA account is the best way to start investing. Students should start here and build a six-figure portfolio faster than they can imagine with a simple ETF model portfolio.

2024 TFSA Contribution Limit

The TFSA contribution room for 2024 is $7,000 for a total contribution of $95,000 since inception.

Here are the TFSA limits by year since the introduction of the account in 2009, with a total TFSA room since inception at $95,000. Here is the CRA source with all the limits they track.

| wdt_ID | Year | Yearly Limit | Cumulative | Comment |

|---|---|---|---|---|

| 1 | 2009 | 5,000 | 5,000 | |

| 2 | 2010 | 5,000 | 10,000 | |

| 3 | 2011 | 5,000 | 15,000 | |

| 4 | 2012 | 5,000 | 20,000 | |

| 5 | 2013 | 5,500 | 25,500 | |

| 6 | 2014 | 5,500 | 31,000 | |

| 7 | 2015 | 10,000 | 41,000 | |

| 8 | 2016 | 5,500 | 46,500 | |

| 9 | 2017 | 5,500 | 52,000 | |

| 10 | 2018 | 5,500 | 57,500 | |

| 11 | 2019 | 6,000 | 63,500 | |

| 12 | 2020 | 6,000 | 69,500 | |

| 13 | 2021 | 6,000 | 75,500 | |

| 14 | 2022 | 6,000 | 81,500 | |

| 15 | 2023 | 6,500 | 88,000 | |

| 16 | 2024 | 7,000 | 95,000 | |

| 17 | 2025 | 7,000 | 102,000 | Estimate |

| 18 | 2026 | 7,000 | 109,000 | Estimate |

| 19 | 2027 | 7,000 | 116,000 | Estimate |

| 20 | 2028 | 7,000 | 123,000 | Estimate |

| 21 | 2029 | 7,500 | 130,500 | Estimate |

| 22 | 2030 | 7,500 | 138,000 | Estimate |

All of the profits made within a TFSA are completely tax-free, including the withdrawals. This is a game-changer for retirement. Imagine never paying taxes in retirement. Wouldn’t it be amazing? … and yet it’s possible with a diligent investment.

Future contribution limits are indexed to inflation rounded to the nearest $500. You can always review the details at the Canada Revenue Agency (CRA), but to see how profitable a TFSA can be, continue reading.

TFSA Contribution Calculator

It’s pretty simple to calculate your contribution using the table above. The formula is the total for the current year minus your contribution to date minus the total for the year before you turn 18.

For example, if you turned 18 after 2011, the formula would have the following parameters:

- The total for 2024 is $95,000

- Contribution to date, say $10,000

- Total before turning 18 is $10,000

We are left with the following math: $95,000 – $10,000 – $10,000 = $75,000

Now that you can easily calculate your potential and actual TFSA contribution room. I suggest you try to maximize your TFSA contribution each year.

A dividend growth investing approach will easily beat inflation and provide solid returns toward a tax-free retirement.

Accessing Your Contribution Details

If file a tax return, you should have an account with the Canada Revenue Agency. You can always check the status of your contribution room under your account. Financial institutions are required to report the contributions, but they do it leisurely.

You need to create an account. It’s pretty helpful to have the account, and you can manage your direct deposit for your tax return.

TFSA Withdrawal Rules

You can withdraw tax-free at any time but cannot contribute that money until the new year. If you were to contribute the maximum over the first few months of the year and then withdraw it in August, you can only add it back come January 1st of the following year.

TFSA Over-Contribution Penalty

If you happen to overcontribute, the extra contribution will be subject to a 1% penalty per month. I recently handled an RRSP over-contribution, and it’s more paperwork than you want.

If you realize you have over-contributed, quickly withdraw the amount and start filling out the forms. Get ahead of it to avoid surprises.

TFSA Growth Opportunity

Having the account is step one in building wealth, the next step is putting your money at work. When you do, and you start early, time can do wonders when partnered with compound growth.

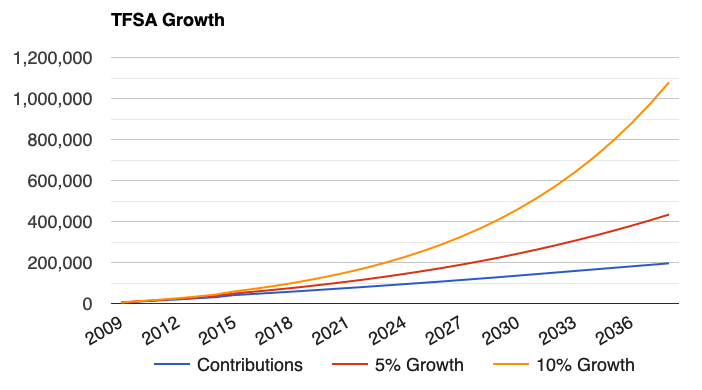

Below is a graph and table showing the potential growth. Choosing between investing in your RRSP or TFSA first is an excellent problem to have, and the perfect solution is based on your situation. Investing in an RRSP requires diligence in handling the tax refund to reap the benefits.

The better you do in your TFSA, the less your OAS clawbacks will impact you and the more you can retain from your CPP payments in retirement.

How you decide to grow this tax-free account can have a major impact later in life, and that’s why it’s an investing account and not an emergency account. Investing is important, if not critical.

Before you think the 10% growth in the table below is impossible, my TFSA market value is outlined below, and keeping up with the 10% and doing better.

Check out my stock portfolio to see what I hold. Dividend investing is truly passive income.

It’s true what they say: “The first million is the hardest!”.

TFSA Investing Strategy

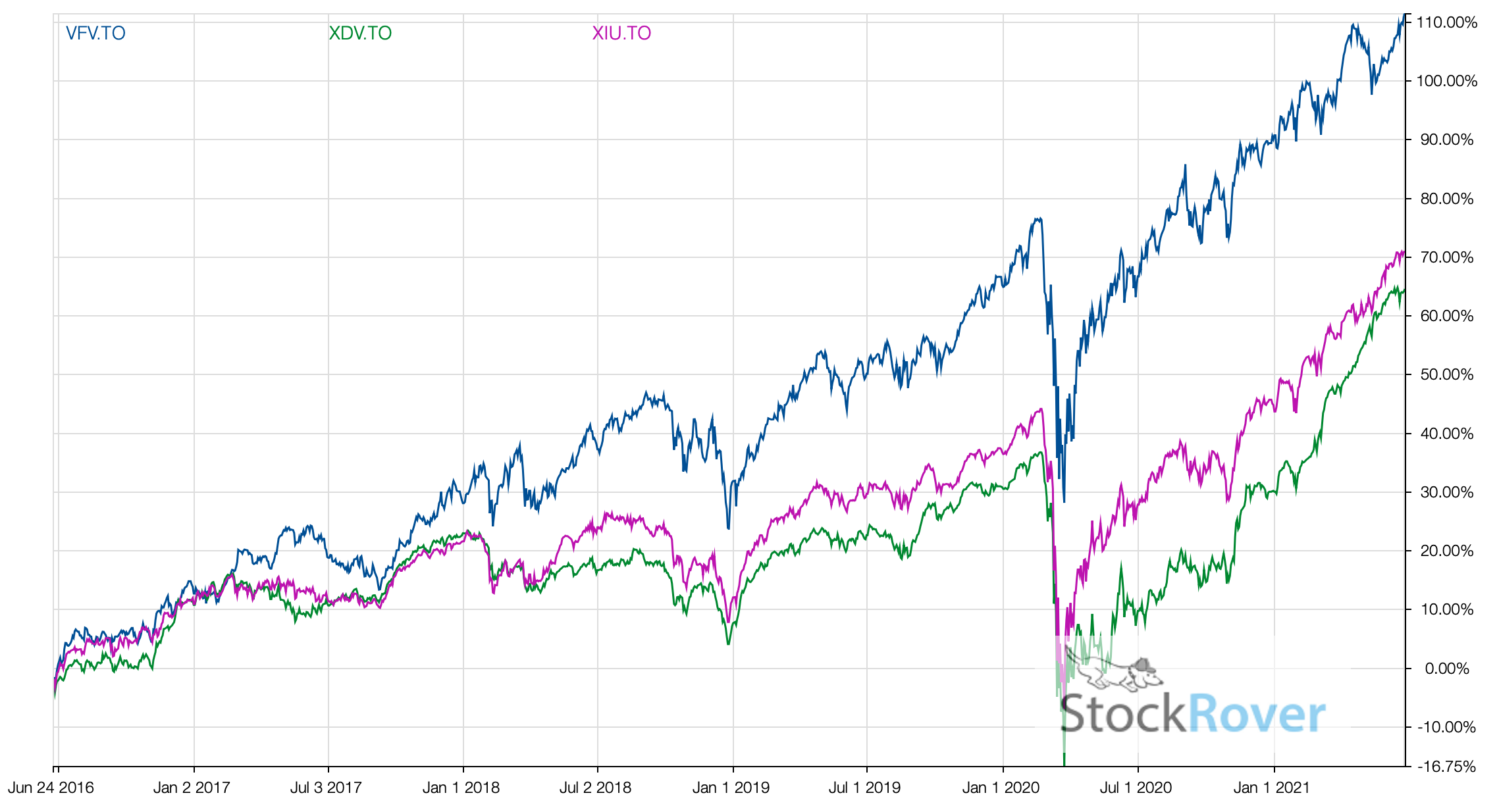

Before you delay investing by learning about all the various strategies, start with the simplest one: buy the S&P500 index. The index covers the top 500 companies in the US — all international conglomerates.

VFV is an ETF purchased in Canadian dollars tracking the S&P500 index. It’s my go-to benchmark.

When trying to build wealth or outperform an index, you need the right tools to find your winning investment. As a DIY investor, my winning tool is Stock Rover. It allows me to build the most powerful dividend stock screeners. Stock Rover is powerful! It's like having a supercar in your hands, take the time to learn the tool.