Rebalancing a portfolio is a very powerful concept. It allows the investor to systemically sell high and buy low.

Index investors do that regularly and there are no reasons why a dividend investor cannot do the same and it doesn’t have to cost much in fees either. Make sure you have a good discount broker with low fee ETFs such as Questrade.

Success in investing comes from having a process you believe in.

Portfolio Rebalancing Process

Step 1 – Setting Targets

To rebalance, you need to start with a set of targets for your dividend portfolio. Setting sector targets work best. Considering I personally have over 30 stocks, I could not imagine setting a target for each of my stocks.

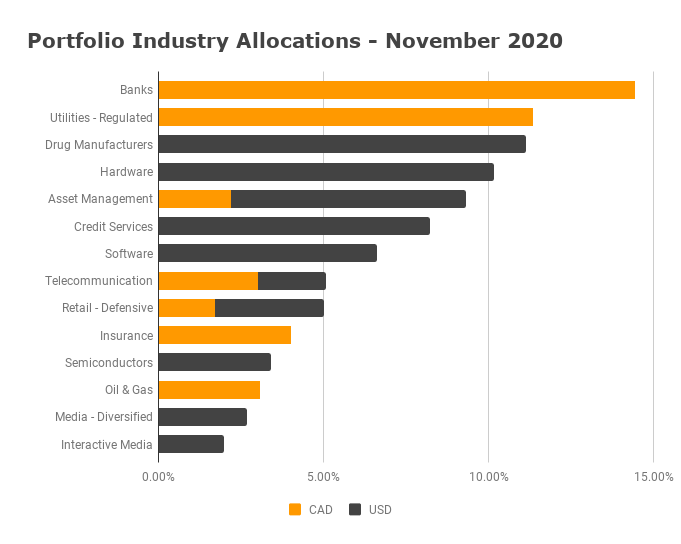

It’s a lot more manageable to set targets by industry or sector since you can group stocks within either. While I started with sector, I am now using industry to track my diversification.

It’s more representative of the business. For example, both a life insurance company and a bank are in the financial sector but are in different industry and will be impacted differently by economic events.

You may decide to have only 1 per sector and that works too. Over time, any investor will start diversifying within a sector just to minimize exposure. The same applies to industries.

Here is a hypothetical set of targets for your reference. There is 10 sectors at the moment and it may change over time at which point you would adjust the sector targets.

- 15% – Financial

- 15% – Utilities

- 15% – Telecommunication

- 10% – Energy

- 10% – Healthcare

- 10% – Real Estate

- 10% – Consumer Goods

- 5% – Technology

- 5% – Transportation

- 5% – Bonds

Choose what you are comfortable with and you can adjust as you learn more about yourself and investing. For example, I have no basic materials, no REITs and no bonds.

Sectors have become a little muddied recently as many technology companies are no more part of the technology sector but part of the industry they serve. Facebook, for example, is in the communication services sector and the same goes for Disney.

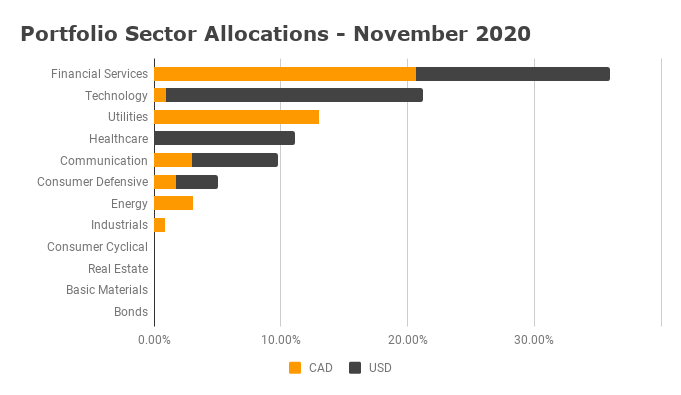

Where do you stand? The graph shows my current diversification. At the time of writing. I am heavy in financials and I have always known it.

The reason is that I started building my portfolio with many financials and I only diversified by adding new money as I feel very confident in the Canadian banks. The Canadian Banks are like my bonds.

Interestingly enough, you do not need to have your different accounts balanced, it’s the overall portfolio that you want to have follow your balancing strategy. Your TFSA could be focused on growth since you probably contribute annually.

The accounts used to borrow to invest should be excluded. That’s a strategy on its own.

Step 2 – Set Key Rebalancing Trigger

The simplest trigger is once a year. If you are investing in stocks, chances are you look at your portfolio a little more often than once a year and I would recommend to do it at least once per quarter.

The fees for selling and buying should not be too costly on your portfolio and 3 months is a decent amount of time for a market to move. If you are going to pick a rebalancing date, I would recommend you pick May or October as they have represented the annual highs and lows as referred to by the expression “Sell in May and Go Away“.

Another trigger is to set a percentage variation for each sector to decide on rebalancing. For example, if your target is 10% for the transportation sector, you could decide to rebalance with a 3% variation up or down. If your sector reaches 13% or 7%, you would look at selling or buying.

The challenging part is that it doesn’t mean just one other sector moved. You could have 6 sectors all moving slightly and you don’t want to rebalance them just yet… You would have the option to sell for cash or to inject more cash if you did not have any as part of your allocation.

Step 3 – Decide How To Rebalance

You don’t always have to sell in order to rebalance, sometimes you just have to add some funds. This is the best approach during the accumulation years.

It’s a matter of planning how you want to rebalance. You don’t want to sell 10 stocks worth $100 and pay $10 in commission, it just doesn’t make sense. When it’s time to rebalance, you might not actually be able to do it efficiently and you just need to plan it.

Step 4 – Rebalance Within a Sector

It’s also important to have a look within an industry to see if anything should be adjusted. For example, you could own the 6 major Canadian banks for your financial sector and depend on when you purchased your stocks, you might want to rebalance between them.

If I look at my portfolio, TD Bank and National Bank are doing better than the other banks. At some point, I could take a profit and add to another bank. It usually means you invest in a higher yield bank too if one is lagging behind the others.

I don’t tend to do anything until a stock is consistently 20% above my purchase price. At that point, I will evaluate if it’s time to take a profit for the benefit of another investment.

Final Thought on Rebalancing a Stock Portfolio

Rebalancing is a powerful concept that takes the emotions away from investing and let you reflect on the ups and downs of your holdings.

I find that investing is very much about the process and your diligence to stick to a plan as opposed to finding the next gold mine.

One lesson I have learned is to not sell your winners to add to your losers. Not all holdings are equal. Try to rebalance between your winners and consider just selling your losers.

It goes back to knowing why you invest in a company, do a portfolio stress-test to bring clarity to your portfolio.