Every year comes the RRSP season. Advertisements will be sent your way until we reach the RRSP deadline, and I wanted to discuss how to maximize your RRSP. Financial institutions will want you to invest with them or even offer you an RRSP loan, but before you pull the trigger and take action, have a plan to effectively maximize your RRSP.

There are two concepts to maximize your RRSP, and the math is very simple.

- How you use your tax credit (RRSP or TFSA)

- The tax-free growth with the best dividend stocks.

Let’s review those two critical advantages to clearly understand how to maximize your RRSP contributions.

RRSP Tax Credit

The RRSP tax credit is simple: All your RRSP contributions (up to your maximum) provide you with a tax credit at the end of the tax year. Here are examples of two different incomes and what it means to maximize your RRSP.

| Examples | With RRSP | Without RRSP | With RRSP | Without RRSP |

|---|---|---|---|---|

| Income | $60,000.00 | $60,000.00 | $120,000.00 | $120,000.00 |

| RRSP | $5,000.00 | $0.00 | $10,000.00 | $0.00 |

| Taxable Income | $55,000.00 | $60,000.00 | $110,000.00 | $120,000.00 |

| Taxes (BC) | $10,359.00 | $11,844.00 | $29,294.00 | $33,364.00 |

| Disposable Income | $44,641.00 | $48,156.00 | $80,706.00 | $86,636.00 |

| Paid Taxes | $11,844.00 | $11,844.00 | $33,364.00 | $33,364.00 |

| Tax Refund | $1,485.00 | $0.00 | $4,070.00 | $0.00 |

You’ll notice that for the same amount, the higher the tax bracket, the higher the tax credit. This is one reason why you may want to reserve your contributions for when you are in a higher tax bracket. The TFSA can help with that since you can invest in a TFSA until you want to maximize your RRSP contribution.

The scenarios above outline that you get a tax break when you contribute to your RRSP, but what they don’t show is what you do with the tax break, and this is where you can truly maximize your RRSP. If you usually see your tax break as a gift, I would strongly suggest you reconsider because the tax man intends to collect it later on when you withdraw funds from your RRSP.

Although it can be used to pay for your car insurance, home insurance or your trip to a sunny destination, it’s much better to re-invest it. The age-old dilemma is whether you invest it (TFSA anyone?) or pay your mortgage. Both options can offer the power of compound growth. My take is if you are early in your mortgage and pay down your mortgage for a little while, it will have a significant impact over time.

Otherwise, it’s your choice; one has a guaranteed rate, and the other has a potential investment return rate. In either case, you will benefit significantly compared to paying for insurance or other spending.

Tax Refund Scenarios

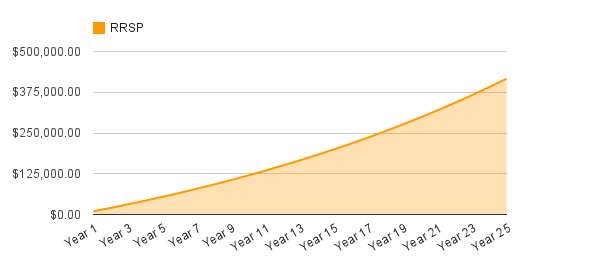

RRSP Growth @ 4% for 25 years

I used the $120K example from the scenario above as it can be representative of a family income. As you can see, it takes hard work and a lot of savings to reach 1 million dollars. This example represents just the RRSP contribution and assumes you spend the tax refund.

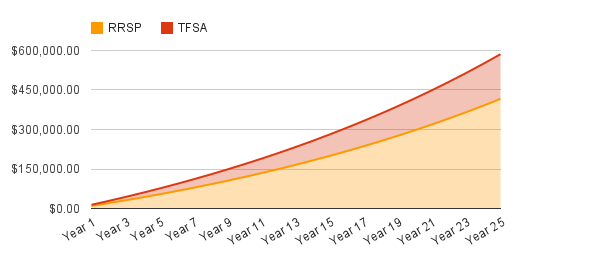

RRSP Tax Refund invested in a TFSA

It’s the same scenario as above but with the $4,070 tax refund invested in your TFSA. Little by little, your TFSA will grow. After 25 years, you would have $169,498 in your TFSA. Not too bad, if I may say.

The growth is also simulated with a 4% annual compound growth, which is probably conservative if you invest in equities. A good dividend growth investing strategy should help you grow it faster due to the 10% annual growth in your dividends, and you’d expect a company that can do that to also increase in value.

RRSP Tax Refund invested in your Mortgage

Here, we apply the tax refund to your mortgage with a 3.5% rate (it might not be realistic for 25 years, but for immediate comparison, it works). We use the same $4,070, and you can see that you shave six years off your amortization for a total savings in payments of $18,864.

For the last six years, you should invest the tax refund to kick-start your savings, and you could reach $26,996 at 4% annual growth. If you can maintain your lifestyle once your mortgage is paid and you invest the same payments for the next six years with your tax refunds, you will have $144,161. That’s still $25,000 short, but it’s possible with a strict budget and willpower.

The Mortgage + Tax Refund pays a total of $108,779 in interest, whereas the default mortgage will pay $149,343. It’s an excellent savings on the mortgage, but after 25 years, what do you have to show? No extra investment and no extra equity … Is that where you want to be?

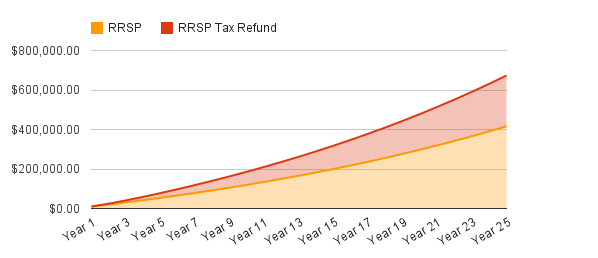

RRSP Tax Refund invested back in your RRSP

With your tax refund invested back in your RRSP, the total assets land at $673,387.11 – no small change. The tax refund re-invested allows the contributor to increase the tax refund, which increases the amount invested in total. The RRSP value is the same as all the other scenario but the re-invested tax refund ends up higher than a TFSA in this scenario at $256,928.03 compared with $169,498.85. That’s almost $100,000 greater.

If you compare investing your tax refund in your TFSA with accelerating your mortgage, you will notice that after 25 years, in both scenarios, your mortgage will be paid with a possible clear winner, depending on your ability to continue saving.

- With 25 years of TFSA contribution, your portfolio will have grown by an extra $169,498

- With extra mortgage payments, your portfolio will have an extra $26, 996 (not taking into account the ~$1,500 per month possible investment from the mortgage payments)

- With extra mortgage payments and extra monthly payments in savings, your portfolio would have an extra $144,161

- With extra mortgage payments and extra half-monthly payment in savings, your portfolio would have an extra $85,875

- With 25 years of RRSP re-invested tax refund, your portfolio will have grown by $256,928.03

It’s really interesting when you sit down and look at the numbers. It’s mind-boggling how clear it can make it. I expected it to have a larger impact on the mortgage but due to the structure of mortgage interest (front-loaded), the added payments later in the term don’t make the same dent, so you reach a point of no return other than the satisfaction of being done.

RRSP Tax-Free Growth

Tax-free growth implies that your money can grow tax-free, but organizing your investments to maximize the benefit is essential. If you want to compare investments from a tax perspective, a buy and hold strategy of an equity may be better outside of an RRSP than inside since all you have to do is pay capital gains when you sell.

The only additional benefit of an RRSP is the tax refund, but it’s only a benefit if you invest it to make more money. Otherwise, you will mainly be focused on paying taxes on your RRSP withdrawal in your golden years.

Spousal Contributions to Maximize Your RRSP

For families, I am introducing another way to maximize your RRSP. ALWAYS have the higher-income spouse make the contribution when you can since the higher-income spouse will receive the tax break. The tax refund can be quite nice. All you have to do is open a Spousal RRSP and contribute to it just like you would do for yours. Let’s look at a scenario.

- Wife makes $90,000 with a marginal tax rate of 38.29%

- Husband makes $70,000 with a marginal tax rate of 29.70%

As you can see, there is almost a 10% tax difference. Assuming they each put $5,000, the individual tax refund is:

- $1,897 for the wife

- $1,485 for the husband

- A total of $3,382

Now if we let the wife take a $10,000 RRSP contribution, her tax refund would be of $3,522. That’s an increase of $140 dollars. If you start increasing the RRSP contributions, the tax refund will also increase, especially if you change tax bracket.

Final Thought to Maximize Your RRSP

Work towards investing in both your TFSA and RRSP if you can. If not, choose a strategy that works for you and work on saving more to do both when you can.