For Canadians, there are only two options to invest in the railway oligopoly, and they are either Canadian Pacific or Canadian National Railway. They not only cover Canada from coast to coast but also part of the US.

To this day, railway transportation is still one of the most cost-effective ways to move goods across North America. It is a business worth investing in, and the question is which one should you buy. Don’t forget that the railway stocks also competes with the trucking transportation stocks.

Railway Stocks Overview

While both are good companies, you are looking for which one will perform better in the next five to ten years. Both are often seen at the top of the best Canadian dividend stock.

Don’t try to think 30 years; no company builds a 30-year plan. It’s all under 3 and 5 years, which means they can help you understand the business expectations over the coming years but not the coming decades.

Canadian National Railway

tse:cnr | Industrials | Railroads- Grade: A

- Market Cap: 90.44B (Large Cap)

- P/E: 20.18

- Dividend Yield: 2.46%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 5/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Canadian Pacific Railway

tse:cp | Industrials | Railroads- Grade: C

- Market Cap: 102.30B (Large Cap)

- P/E: 26.69

- Dividend Yield: 0.83%

- Dividend Aristocrat: NO

- Dividend Growth Fit: 3/10

- Dividend Income Fit: 3/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

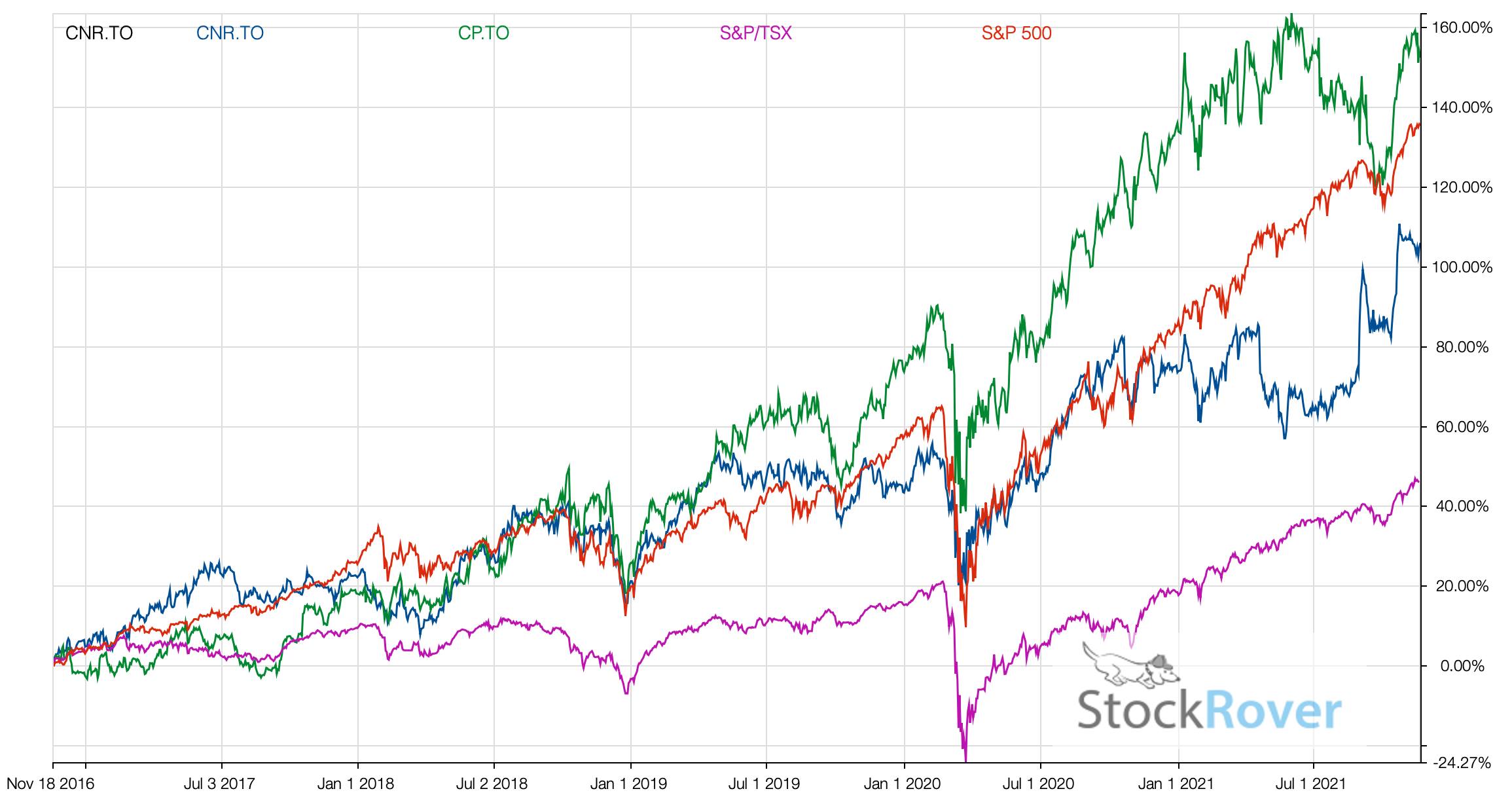

CNR vs CP – Which is the better buy today?

Both companies are solid now after being managed by Hunter Harrison (RIP). Canadian Pacific Railway was behind for a while, but the management team has taken control back.

If you prefer stability, I would suggest Canadian National Railway as they have been more consistent, and that’s why it scores higher due to consistency over ten years.

On the other hand, CP has a lower P/E and a lower dividend payout ratio, giving it higher potential growth. Overall, CNR covers more ground across North America through its railway, but CP is present in all the major stations in Canada.

Both have dividend growth in the double digits so you may chose the highest yield of the two stocks for a new position but then you probably want to add enough to DRIP if you have many years ahead of you. If you are approaching retirement and living on the income, the highest yield is probably good enough.

TIP: Reading about companies is one approach to research, but another is to use the best screener to look at all the data you need to make your purchase decision