The railway system is the backbone of transportation across North America, with an oligopoly of two major players in Canada, followed by the road network with trucks.

It’s doubtful new competitors will surface with a new railway, but road transportation is another story. From a business perspective, the railway companies control the flow of basic materials and other goods which often dictates where industrial companies will establish themselves to get easy access to their goods.

In other words, it’s a toll booth business for the North American economies. When the business is effectively managed, it can generate a profit in good and bad economies. There is some competition or extension of the business but these blue-chip stocks have not expended much outside their core competency. To better understand the effectiveness of the railway in North America, see how the competition stacks up and where it complements it for partnership.

The transportation industry has tremendous opportunities and, among them, some of the best-performing investments in Canada. Due to the large landscape to cover, railway is not only how imported goods move from coast to coast but also how oil is distributed when pipeline aren’t present. In Canada, oil companies rely heavily on the transportation industry.

Competitors to Railway

The bottom line is the challenge here. Airlines have to spend money on fuel and fuel prices are only going up. Energy-efficient airlines are not really on the short-term horizon. On the other hand, railway motor cars are evolving and cost can go down as well as having the ability to better predict shipment arrival.

Trucks just can’t compete on load alone. The number of drivers needed, along with the maintenance requirements, would not make this a cheap alternative. The trucking business booms when the railway business grows as you still need a truck to go from the train to the outbound cities.

Pipelines can take a bite out of the railway business but they are very expensive to build and require a lot of approvals. The environmental consideration is huge and the cross-country negotiations are even bigger. However, it is a definitive competitor as a new pipeline in one of the railway areas would drastically affect the amount of oil or natural gas cargo for that railway company.

No immediate competition since railroads don’t go on water and vice versa but I felt it prudent to surface it as a ship can arrive at ports where your selected railway company does not operate. Both actually can complement each other in moving goods between continents.

Best Railway Stocks

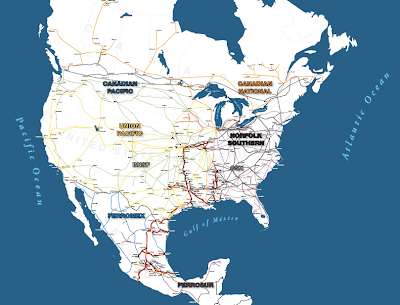

Before we look into the different railway companies, let’s have a look at the railway network. There exists only a handful of players on the West Coast where imports/exports are booming.

Canadian Railway Stocks

Canada only has two players in the railway business, and both trade on the US stock exchange. On a side topic, the railway history across the Rockies is very interesting. There is an old abandoned railway tunnel near the Vancouver area built to compete on the arrival to the West Coast. It was deemed too dangerous to keep, and it made for a very nice sightseeing trip.

| Ticker | Ticker | Company | Market Cap | P/E | Yield | Aristocrat | Graph | SectorID | IndustryID |

|---|---|---|---|---|---|---|---|---|---|

| CP | TSE:CP | Canadian Pacific Railway | 102.30 | 26.69 | 0.83 | NO | 1 | 9 | 78 |

| CNR | TSE:CNR | Canadian National Railway | 90.44 | 20.18 | 2.46 | YES | 1 | 9 | 78 |

Canadian National Railway

tse:cnr | Industrials | Railroads- Grade: A

- Market Cap: 90.44B (Large Cap)

- P/E: 20.18

- Dividend Yield: 2.46%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 5/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Canadian Pacific Railway

tse:cp | Industrials | Railroads- Grade: C

- Market Cap: 102.30B (Large Cap)

- P/E: 26.69

- Dividend Yield: 0.83%

- Dividend Aristocrat: NO

- Dividend Growth Fit: 3/10

- Dividend Income Fit: 3/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

U.S. Railway Stocks

From my research, there are four major players in the US, with one being Canadian Pacific merged with Kansas City. I am unfamiliar with all the US railway companies and their details. Still, I am positioning them based on their ability to profit from the self-sufficient oil-producing goals and their ability to deliver that oil to refineries. Interestingly, none of the US railways are part of the S&P500 dividend aristocrats.

| Ticker | Ticker | Company | Market Cap | P/E | Yield | Aristocrat | Graph | SectorID | IndustryID |

|---|---|---|---|---|---|---|---|---|---|

| UNP | NYSE:UNP | Union Pacific Corp. | 141.17 | 21.29 | 2.27 | NO | 1 | 9 | 78 |

| CSX | NASDAQ:CSX | CSX | 63.12 | 20.12 | 1.55 | NO | 1 | 9 | 78 |

| NSC | NYSE:NSC | Norfolk Southern | 59.18 | 17.93 | 2.06 | NO | 1 | 9 | 78 |

Final Thoughts

The first aspect of owning a railroad company is understanding where it operates and where its revenue is coming from to assess if it can benefit from economic changes. At the root, though, it’s one of the best methods of transportation and will continue to be so for many years.

It’s clear that in the past ten years, railway companies have grown tremendously. They are not cheap stocks to DRIP as you need a really large amount. CNR and CP are consistent dividend growers, and their yield is only low because of continuous stock appreciation.

Key points of research for me are:

- Railway Network – the west coast and central locations are very important for the coming years

- Efficiency – Are they operating effectively

- Growth Consistency – With a relatively low yield, there needs to be growth.