For students or new grads alike, if you have a bit of money aside, leaving it in the bank is not helping you build wealth. It’s safe, but since you are young, you have the biggest investing advantage ever on your side!

Whether you have worked 80 hours a week over the summer or inherited some money to kick-start life, leaving your money idle in the bank is not helping you.

Whenever you have a little money stashed aside, you want to put your money to work. One aspect of the wealthy is that they have multiple sources of income above their primary job. One of them is that they invest their diligently saved money in a dividend growth portfolio. They put their money to work!

You want to focus on a wealth generating portfolio and not a retirement portfolio for income. Both aim to build financial freedom but they apply to different times in your life as shown below.

Time In The Markets Is Critical

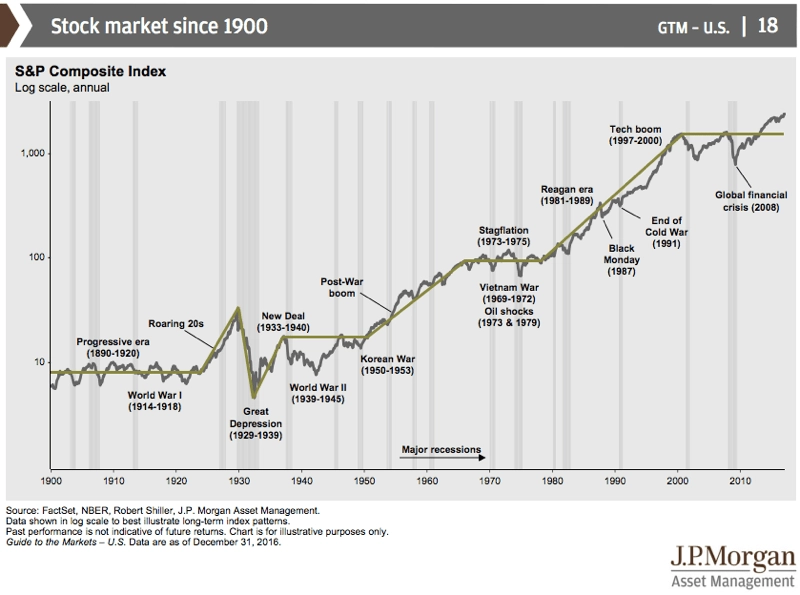

You have time on your side. Stock markets, like inflation, goes up over time. Have you ever seen salaries go down or the price of a Big Mac? Check out the Big Mac Index for some economic insights.

Time in the markets beats timing the markets.

– Famous saying

Safe investing is about looking at the long-term horizon, and it means looking at the forest (i.e. the big picture) and not the trees (i.e. the short-term blips).

Now that we have established time as a critical factor in investing, the next critical aspect is rate or return.

What You Learn: With a simple and safe investing strategy like index investing where you hold a basket of stocks from a stock market index, time will lift your portfolio in the long run. The Big Mac index is a good social topic too …

The Rule Of 72

This is an easy rule, and once you learn it, you will never forget it. It’s critical you capture it as it pertains to actually making money.

Time is usually the variable we don’t know… but as a student, you have a lot of time and what you don’t yet have is your rate of return.

However, while you have a lot of time, you don’t want to take forever to grow your money. We’ll go through the bank interest example and then the stock market example.

The formula for the Rule of 72 is pretty simple and is the following.

Years to double = 72 / Annual Rate of Return

1% Interest With The Bank

Assume you have $1,000 at 1% with the bank, your money grows with the following formula yearly and takes approximately 70 years to double.

- Year 1: $1,000 * 1.01 = $1,010

- … (skipping decades)

- Year 70: $1,986 * 1.01 = $2,006

If you divide 72 by the annual rate of return of 1% (annual interest of 1% in this case), you get 72 and that’s the number of years needed to double your money. You could be dead by the time your money doubles so even if you have time on your side, 1% is just not good enough!

While you could invest in a GIC with 2%, it will still take 36 years to double your money. Still not good enough.

What You Learn: You don’t make money with the banks. Don’t let the bank teller sell you any investments.

Double Faster With Stock Market Returns

Once you get started with investing, you can get your annual rate of return from your broker. However, since you are getting started, we need to go with the historical SP500 and TSX60 annual rate of return (or ROR for short).

To do that, we check the equivalent ETFs tracking stock market indexes which are Vanguard S&P 500 Index ETF (VFV) and iShares S&P/TSX 60 Index ETF (XIU ETF). There are many more but those are the prominent ones in the US and Canada.

Both ETFs trade in Canadian dollars but cover different stock markets.

- VFV has an annual return of 15.33% and covers the US S&P 500.

- XIU has an annual return of 7.08% and covers the Canadian TSX60.

Those numbers are going to fluctuate but you can see it’s much higher than 1%. As a note, ETFs are Exchange-Traded Funds and are relatively new to the investing world compared with mutual funds and stocks.

If you take the VFV numbers, you double your money in 5 years and if you take XIU, you double your money in 10 years. Both are pretty good compared with what the bank can offer.

Say we target 10% and split the difference. For some simple math, if you take 72 and dividend by 10%, you get 7.2 years to double your money.

- Year 1: $1,000 * 1.10 = $1,100

- Year 2: $1,100 * 1.10 = $1,210

- Year 3: $1,210 * 1.10 = $1,331

- Year 4: $1,331 * 1.10 = $1,464

- Year 5: $1,464 * 1.10 = $1,610

- Year 6: $1,610 * 1.10 = $1,771

- Year 7: $1,771 * 1.10 = $1,948

- Year 8: $1,331 * 1.10 = $2,143

Obviously, the numbers would not move linearly like the above but it would have peaks and valleys over a 7-year period.

What You Learn: Today, the only meaningful way to put your money to work is with the stock market.

Avoid Fees At All Costs!

Since you are a student or new grad, and every penny counts, do what you can to avoid paying fees. Unlike 15 years ago, there are many ways to invest in the stock market now and a few online brokers offer no trading fees on ETFs and no minimum account requirement.

My recommended trading platform is Questrade. My kids are using it.

With Questrade, you can buy ETFs at no cost and you don’t need to have a minimum account size. It’s just perfect.

When you can only invest $100 here and there, not having to pay a fee means you can invest 100% of your money.

What You Learn: Be aware of fees. As a student, you often get a free pass on fees only to learn that once school is over, the banks will charge you. Put all of your money at work.

Avoid Taxes With Your TFSA!

Death and taxes are a certainty in life. As it happens, there are three accounts available for students to invest. At some point, you will have more money to invest and you will need to know about taxes on all accounts to properly invest. The TFSA is also the place to start with a beginner ETF portfolio.

- Non-Registered or Taxable Account. This is a normal investing account where you pay taxes.

- TFSA, or Tax-Free Savings Account. This is a tax-free account. You never pay taxes in this account. You accumulate contribution room that is tax-free.

- RRSP, or Registered Retirement Savings Plan. This is a retirement account. As you work, you accumulate contribution room that is tax-deferred.

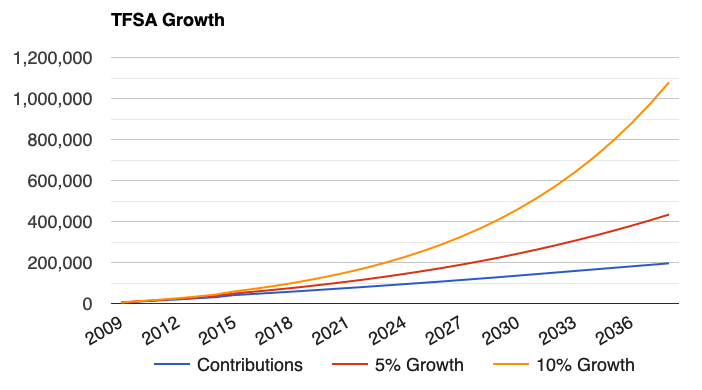

Don’t let the names confuse you. You can use all of the accounts for retirement. Focus on filling your TFSA every single year, and reach the 1 million dollar TFSA.

If you contribute the maximum to your TFSA annually and invest wisely, you can reach a million dollars! It would take about 30 years. Another seven years, and you can have two million dollars.

What You Learn: Fill out your TFSA first – always your TFSA. If you have extra money, you can add to your RRSP but make sure you can add to your TFSA the following year.

Leverage Dollar Cost Averaging

The concept of dollar-cost-averaging is to buy the same holdings at different prices as the markets move up and down. Over time, the cost of your holdings is an average of all your purchases.

It allows you to take advantage of the low times and the normal times to offset the high times. Dividend portfolios can do really well with DCA and the re-invested dividends.

The idea is to make regular purchase like once a month. You can deposit money in your Questrade TFSA account every pay day but you make a purchase once per month for example.

What You Learn: Take advantage of all prices by buying regularly throughout the market’s ups and downs.

The 7-Step Game Plan

Here is the step-by-step game plan.

- Create a TFSA account with Questrade.

- Deposit an initial amount like $500 to fund the account. You should be able to do an Interac e-transfer.

- Setup a deposit amount that you can do regularly (leverage dollar cost averaging).

- Buy whole share(s) of VFV when you can. It could be 1 or 2 at a time.

- Maximize your TFSA annual contribution (see the maximum annual contribution here).

- Repeat until you have $100,000 in the account. Then you can review and assess your investing strategy from here. You can stay the course too.

- Keep track of your portfolio. Make a note of your annual rate of return from your broker.