Ready to invest and put your money to work but you don’t know where to start and you are overwhelm with all there is to learn about investing?

It’s very understandable and there is no reason not to start investing while you learn all the details and nuances of investing. I know it’s a lot to process but it can be very simple to get started. My kids are doing it, and you can too.

One assumption to make before building the ETF portfolio is that you have 15 to 30 years to invest and let your money do the work for you. Start slow, and then think about evolving to include stocks in your portfolio.

Make sure to build a portfolio for the right moment of your life.

Risk Tolerance & Emotions

When you start and you have no prior investing experience, you encounter many various financial guidelines, all built around managing your emotions.

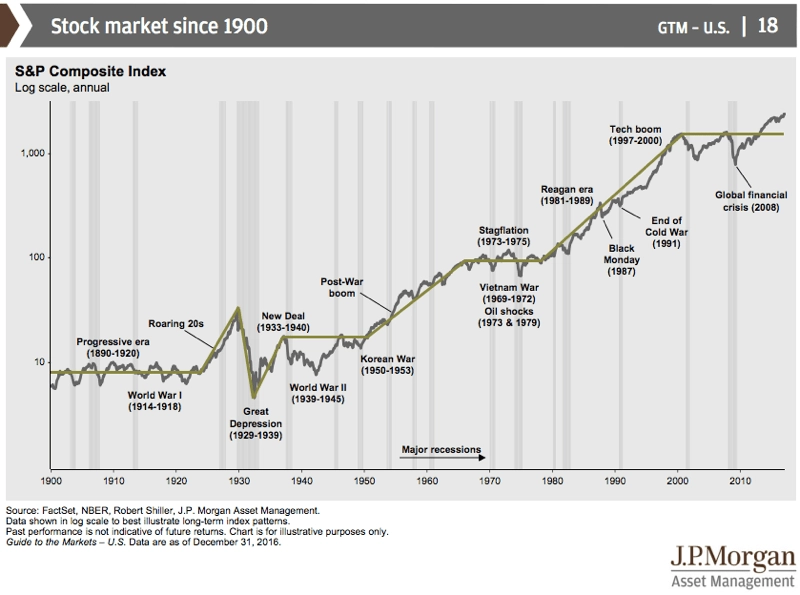

Investment risk is tied to your emotional response to a drop in value. How will you handle it? Sell everything when it’s down? That’s a bad move, and the chart below shows you how markets recover and make new highs.

As you can see, no need to panic. You need to be patient. Just don’t put yourself in a position where you need to sell during a downturn. That’s what emergency funds are for and the cash bucket strategy when you approach or are in retirement.

Building an ETF Portfolio

Throughout my experience as an investor, returns matter – make sure to track your rate of return. Why? Because it can offset lower contributions over time and/or reduce your work years.

As such, market returns across the world are not really appealling. Not to mention that as a Canadian, it’s easier to understand North America’s economies and business practices and I like to invest in what I can understand.

Now, you might be tempted to focus on the Canadian stock market, but I find it very limited. It’s predominantly financials and energy / basic materials. On the flip side, the US stock market has really good coverage of all sectors.

The first ETF to build a strong portfolio is an ETF that tracks the S&P500. You invest in the top 500 US companies operating around the world, and the companies do the globalization for you. My go-to ETF is the Vanguard S&P 500 Index ETF or VFV ETF.

Since its inception, VFV has returned 18.53%. It fluctuates, but over time, it’s a potential return. Imagine what your TFSA can grow to with such a rate of return, and that’s why VFV is in my portfolio as well.

Deposit Strategy

For the first $50K or $100K, consider the following guidelines. At this stage, you are defining and refining your investing strategy—it’s the learning phase. Take it slow and invest once per month or quarter. Once you reach the $100K, you can look into alternative strategies and blend your approach with a dividend portfolio, but there is no rush.

Find a discount broker with free ETFs and low transaction fees. I personally try to keep my stock trade costs to 1% maximum – I invest $1,000 for a $9.95 transaction fee. Questrade has free ETFs and no maintenance fees now.

If you have all of the $50K ready, spread your purchases over weeks to avoid seeing your beginner portfolio go down and not being able to average down. There is nothing like seeing your money go down right after you buy and waiting for months to see it come back.

If you are just starting to save, put $50 or $100 a week and buy the shares of VFV when you have enough cash to cover the price of a share or two. Over time, it will build up and grow.

In this beginner ETF portfolio-building stage, it’s not the time to become paralyzed by analysis. The intention is to leverage dollar-cost averaging. The markets move up and down, and you can’t predict the movement. Just accept it and be ready to capitalize when it’s time.

What I have noticed is that investors investing in index ETF either feel one ETF is not enough, they are itching to branch out or they buy one index that invests in the world, but when you break it down, that ETF invests in 6 different ETFs so you end up paying twice for MER (the one you own and the others – not always huge but know the MER).

Leverage The Investment Accounts

Depending on your situation, you will have access to different accounts. You may ask yourself if you should start with your TFSA or your RRSP.

One important concept of RRSP is the tax refund, and it sometimes takes time to realize that the tax refund is not a travel bank but your retirement money. An RRSP allows you to defer taxes, whereas a TFSA is completely tax-free.

The difference is important and will play a huge role in your retirement and how you withdraw money as RRSP withdrawals are income for the purpose of income taxes, and a TFSA withdrawal doesn’t add to your income.

Both accounts play an important role in your beginner portfolio and have different tax advantages and contribution limits (see your TFSA contribution limits).

Beginner ETF Portfolio Example

The initial beginner ETF portfolio starts with 100% in one index – the S&P 500. Let’s use VFV in this case, but ZSP also works.

Did you expect some fancy model? Boring works.

You must track your portfolio performance to understand your rate of return. I was disappointed with the basic performance metrics from the discount brokers and built a portfolio and dividend tracker to have confidence in the numbers.

What should you expect in terms of performance? Well, the first year can be a roller coaster with ups and downs. There can always be short-term noise in the markets, but after 2 or 3 years, the growth starts normalizing.

More on Risks

What about risks? What is your risk tolerance? Generally speaking, the financial industry ranks the risk tolerance for investors as follows:

- Conservative – 70% bond target

- Cautious – 50% bond target

- Balanced – 30% bond target

- Assertive – 15% bond target

- Aggressive – 0% bond target

One way the financial industry manages risk is by increasing bonds for a less aggressive portfolio.

With a risk tolerance questionnaire, what you will notice is that it covers emotional responses to portfolio losses (real or not), your growth expectation based on potential loss, as well as your confidence and understanding of the stock market.

Whatever your risk tolerance is, starting with one index ETF will allow you to truly understand what you are capable of as long as you track the performance of your investments and compare.

Using an index ETF is still investing in equity and from a risk tolerance perspective, you are fully expose to equities but you take away the potential stock selection mistakes where you pick a stock for the wrong reasons and lose money.