Where and how to start a beginner portfolio is a question all investors ask at one point in their investing journey. I was there once and I needed to figure it out on my own with the help of a couple of books (The Investment Zoo and The Lazy Investor).

I have also made mistakes and learned some invaluable lessons the hard way in some cases. The earlier you start and make the mistakes, the easier it is to recover with time on your side.

Building a Dividend Growth portfolio is easy with the proper tools, but where do you start after you understand why dividend investing works? Not everyone has to make the same mistakes.

As you start investing, there are two major phases of investing where you grow your portfolio and one where you withdraw. Don’t expect your starting portfolio to be the same as your portfolio in retirement during your financial freedom days.

Building a New Dividend Stock Portfolio

When investing, you should keep it simple and stick to your country. As you start growing your beginner portfolio, you will need to consider growing your portfolio strategically through economies and sector exposure.

For example, Canadians need to consider the US market while Americans can stick to the US market. It’s simply based on the size of economies and variety of stocks offered. The difference between the Canadian stock market and US stock market is big.

The starting model portfolio is pretty simple. It assumes that you don’t have a lot of money and that there is no reason to go all in on one stock or to pay a lot in transaction fees.

While investors focus on getting started and investing in their first stock or ETF, it is necessary to cover some additional topics. You could also keep it simple with a simple ETF portfolio.

- Deposit Strategy

- Investment Accounts

- Beginner Portfolio

- Risk Tolerance & Emotions

- Income Taxes

Deposit Strategy

For the first $50K, consider the following guidelines. At this stage, you are defining and refining your investing strategy – it’s the learning phase. Take it slow and invest once per month or per quarter.

Find a discount broker with free ETFs and low transaction fees. I personally try to keep my stock trade costs to 1% maximum – I invest $1,000 for a $9.95 transaction fee.

If you have all of the $50K ready, spread your purchases to avoid seeing your beginner portfolio go down and not being able to average down. There is nothing like seeing your money go down right after you buy and waiting for months to see it come back.

Avoid the situation by breaking it down in 10% per month or 25% per quarter for example. If you are building up, pick your minimum monthly investment amount and automate it. You can deposit $250 per month and buy once every 4 months.

In this beginner portfolio building stage, it’s not the time to become paralyzed by analysis. The intention is to leverage dollar-cost averaging. The markets move up and down and you can’t predict the movement. Just accept it and be ready to capitalize when it’s time.

Leverage The Investment Accounts

Depending on your situation, you will have access to different accounts. You may ask yourself whether you should start with your a Non-Registered account (ie taxable), a TFSA or a RRSP.

One important concept of RRSP is the tax refund, and it sometimes takes time to realize that the tax refund is not a travel bank but your retirement money. An RRSP allows you to defer taxes, whereas a TFSA is completely tax-free.

The difference is important and will play a huge role in your retirement and how you withdraw money as RRSP withdrawals are income for the purpose of income taxes, and a TFSA withdrawal doesn’t add to your income.

Both accounts play an important role in your beginner portfolio and have different tax advantages and contribution limits (see your TFSA contribution limits).

Beginner Stock Portfolio Example

The initial beginner portfolio starts with 50% in an index and 50% in dividend stocks.

Why the index? You don’t have enough experience to make the best investment choices initially. The index will provide safety while you learn the ropes of dividend growth investing.

It’s also easier to invest in an index ETF when you don’t have much money to invest. Finally, with both strategies in play, you will learn which of the two is really appropriate for you and the amount of time you want to put towards your portfolio and selecting a stock

| wdt_ID | Investment | Ratio | CAD Tickers | US Tickers | Reason |

|---|---|---|---|---|---|

| 1 | Dividend Growth Stocks | 50% | RY, TD, BCE, T, FTS, EMA, CNR | JNJ, PG, KMB, V, MA, T, VZ, DIS | Large cap blue chip stocks with oligopoly. Brands you know and see everyday |

| 2 | Index ETF | 50% | VFV, VCN, XIU, XDV | VTI, VOO | Tracks a full market or a subset of the top companies |

Did you expect some fancy model? Boring works. Also, there is no energy as it’s too volatile to start with and no REITs as I see them as income only investments.

Here is what a solid beginner portfolio can look like and the steps to build it. For each step, you have to figure out your incremental steps. ETFs can be purchased without transaction fees but the stock trades will have a transaction fee. You can buy the stocks in $1,000 increments.

- Buy $5,000 of VFV

- Buy $5,000 of Royal Bank (The largest Canadian Bank)

- Buy $5,000 of VFV for a total of $10,000

- Buy $5,000 of Telus (The best Canadian telecom)

- Buy $5,000 of VFV for a total of $15,000

- Buy $5,000 of Fortis (The largest regulated utility)

- Buy $5,000 of VFV for a total of $20,000

- Buy $5,000 of TD Bank (The second largest Canadian Bank)

- Buy $5,000 of VFV for a total of $25,000

- Buy $5,000 of Canadian National Railway

All the companies are leaders and hold a dominant position in their business. Once you reach the $50,000 mark, you have to decide if you keep the index, go all-in on an index strategy or do dividend growth stocks. You will also have to start thinking about US exposure if all you choose are Canadian stocks. In the example above, you start with the S&P500 through VFV.

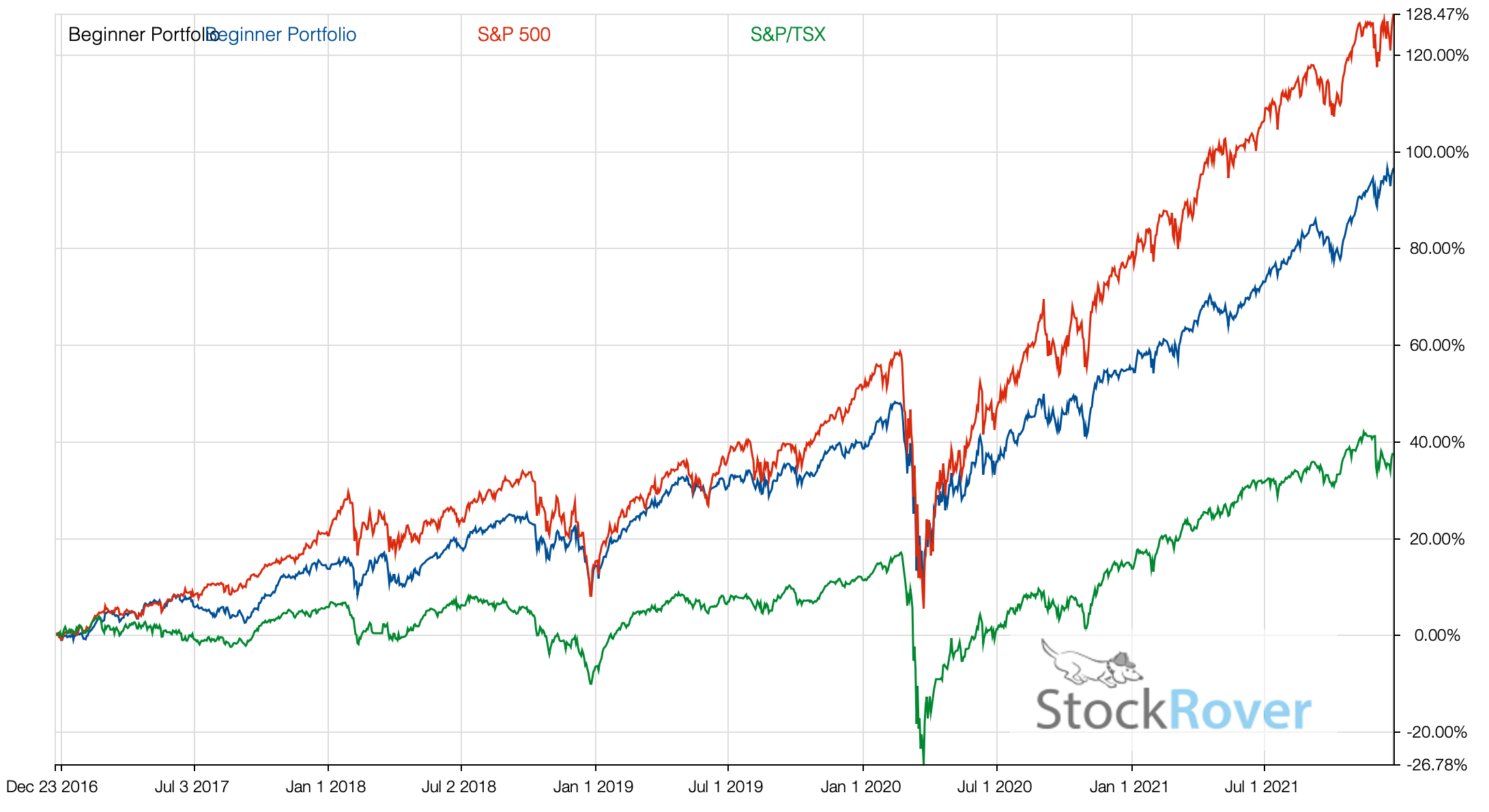

Below is the performance of the beginner portfolio since 2016 as a reference to see what a foundation can do.

With dividend stocks comes the need to choose a stock to buy or sell as well as identify how many stocks you will own and how much per stock you will have. Be careful not to build your own index.

It’s imperative that you track your portfolio performance to understand your rate of return. I was disappointed with the basic performance metrics from the discount brokers and built a portfolio and dividend tracker to have confidence in the numbers.

What should you expect in terms of performance? Well, the first year can be a roller coaster with up and downs. There can always be short term noise in the markets but after 2 or 3 years, the growth starts to normalize.

A Word On Risk Tolerance & Emotions

What about risks? What is your risk tolerance? Generally speaking, the financial industry ranks the risk tolerance for investors as follows:

- Conservative – 70% bond target

- Cautious – 50% bond target

- Balanced – 30% bond target

- Assertive – 15% bond target

- Aggressive – 0% bond target

One way the financial industry is managing risk is by increasing bonds for a less aggressive portfolio.

Whatever your risk tolerance, starting with an index will allow you to truly understand what you are capable of as long as you track the performance of your investments and compare.

Using an index is still investing in equity and from a risk tolerance perspective, you are fully expose to equities but you take away the potential stock selection mistakes where you pick a stock for the wrong reasons and lose money.

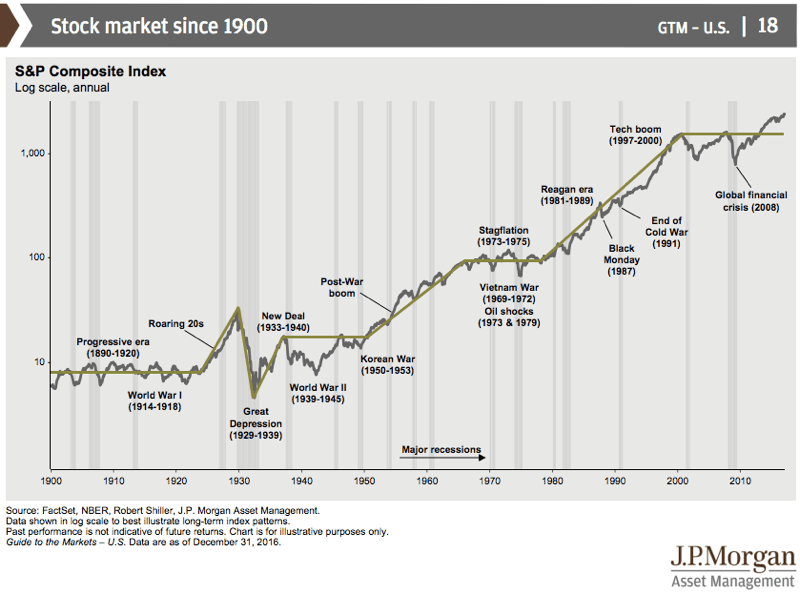

While they are both equities, the index follows the stock market pattern, which tends to go up when you pull back over a long period of time.

Income Tax Considerations

The account selection previously covered may be enough to get started with the basics of investment income taxes, but there are fundamentals you need to know about the impact of income taxes on your investments. The choice of investments per account will become critical to keeping more of your money.

There are five main buckets where income taxes apply to investments:

- Capital Gains – The tax investors pay on profits outside a registered account.

- Tax on Income – Interest from cash or investments (distribution) or payments from bonds fall into this category

- Dividend Tax – The preferential rate applied to eligible dividends

- Return of Capital – Income trusts and REITs do that, and it creates a significant effort on the accounting front

- Foreign Dividend – The tax rate on foreign dividends.

While you may be keen on high-yield REITs, taxes on REITs can be complicated in a non-registered account.