Recently, split shares have been a big topic. The yield is excessively attractive for many, but what’s the downside? What risk do you take with split-share corporations?

Read on and understand split shares as they often surface as a topic of conversation with retirees regarding retirement investing for income.

What Are Split Shares Funds?

Split-share funds are a special type of investment in which a Class A share and a Preferred Share are placed in place, trading separately under a specific investment strategy against a specific stock or group of stocks, such as banks, utilities, or pipelines.

The Class A share is often called the capital share and provides a higher distribution (not a dividend as wrongly advertised). It does so by using leverage and covered calls, where the risk comes in. More on this later.

On the flip side, the preferred shares operate similarly to preferred shares in the fixed-income space.

Distributions within a split-share fund will happen first with the preferred shares, followed by the capital shares, but capital shares will only have a distribution if the Unit NAV (Net Asset Value) is over a certain threshold.

The Unit NAV is the combination of the NAV for the preferred shares and the capital shares. If the Unit NAV is below the threshold, no distribution is made.

The risk of not being paid distribution is based on the stock market performance. Since leverage and covered calls are performance magnifiers, if the market does well, you do well, but if it doesn’t, you could be faced with a lower NAV and, therefore, not receive a distribution.

These funds are often called split-share corporations or split-share funds. They also have an end date, but historically speaking, it has generally been renewed for most of the offerings.

Quadravest and Brompton are some asset management firms offering many split-share corps.

Putting Split-Shares Corp Into Context

Let’s examine all the investment options available to see where split-share corporations fit in the investing world.

Here is a table outlining the types of investments that are generally available to investors. I am excluding fiat and cryptocurrencies and interest and GICs to keep the table simple.

The intention is to show the relative risk as you invest based on what it holds. The first row represents the standard investments we know, which represent how companies generally access funds.

A stock, or an IPO, is a way for a company to access funds to grow, and then the money flows on the secondary market. It’s the same deal with bonds, by the way.

| Fixed Income | Equities | |||

| Standard Investments | Bonds | Preffered Shares | Stocks | Income Trusts |

| Advanced Strategies | Options | |||

| Pooled Funds | Mutual Funds, Exchange-Traded Funds | |||

| Closed End Funds | ||||

| Split Shares | ||||

Options are additional trading strategies leveraging the underlying securities with the intention of magnifying profits, but they can also magnify your losses.

Anything that uses options is then applying a magnifier but usually on the income and not on the value of the stocks as it has no effect on the stock price of the underlying assets.

Split shares have to pay the dividend on the preferred shares and the distribution on the capital shares. Even if the underlying assets generate dividends, the preferred shares will be first in line, and the distribution of capital shares will come from options, not dividends.

Characteristics Of Split Shares

Here is your cheat sheet for split shares.

- Split-share funds are designed to provide income. They are not about stock appreciation, so if you plan to compare BAM with a split-share, you aren’t comparing apples to apples.

- Split shares pay a distribution rather than simply a dividend. They’re like REITs, and you need to understand where to hold them for tax efficiency. Each split-share fund should be able to describe its distribution type.

- Distribution can be missed during poor market conditions due to the minimum Unit NAV expected. If you need the income month to month, you won’t get paid during the hardest time. Many skipped their distribution in 2008, 2020, and 2022.

- Not indexed to inflation. Most distributions are flat month-to-month and year-to-year. You lose purchasing power, and in retirement, you can’t count on DRIP to compound the growth.

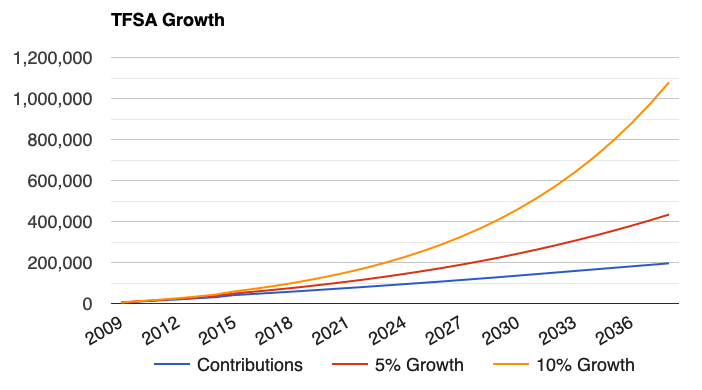

If you DRIP, you can compound pretty fast. Here is what a 10% compounded return can do. You need to understand your appetite for risks, as you can get an annual rate of return of 11%- 13% with the banks over a 10-year period.

Polarizing Views on Split-Shares

Over the past few months, a few readers have brought up split-share funds as a topic. It’s enticing since they provide a high income. Often, it is over 10%, which is impossible to get with normal stocks. They are quickly considered by retirees wanting to supplement their Canada Pension Plan to enjoy a better retirement.

Interestingly enough, Mike from Dividend Stocks Rock shared his opinion in a recent newsletter, and he is not a fan. Mike is personally focused on total returns through dividend growth stock selection.

After a quick Google search, Pat McKeough from TSI is also not a fan and does not recommend Class A shares (or capital shares) to his clients.

Conversely, a YouTuber focused on passive income for FIRE (Financial Independence Retire Early) is very bullish on those. He is very bullish on everything covered calls. Be careful, the reported yield is based on yield on cost which is a flawed metric.

I would not build a portfolio strategy on split shares. I would ensure everything I need is covered outside of split-shares and then see if I could allocate 2% or so to a split-share corp as an income multiplier.

I currently hold non-paying dividend stocks to get higher returns, and I could flip them to hold split shares when I need the income, for example. I would only do this once I live from my portfolio’s income, never during the accumulation years.

I currently favour the simpler strategy of Covered Call ETFs. Lower yield but simpler and less risky overall.

What’s your view?

How You Can Buy Split-Shares

Investors seeking to add split shares to their portfolio must be set up to buy stocks on the stock market with an online trading platform.

While they are unique in how they operate from a corporation perspective, the shares are traded like any other stock in Canada. Choosing the right trading platform can help you keep your costs low and choose your discount broker wisely.

List Of Canadian Split-Shares

Here is the list of Canadian split-shares. I won’t outline the NAV or yield here as they’re complicated. The yield drops to zero if the conditions aren’t met, and it’s based on the Unit NAV, which is not widely available outside the company’s prospectus on the split-share funds.

| Provider | Fund | Ticker |

|---|---|---|

| Brompton | Brompton Split Banc Corp. | SBC |

| Brompton | Life & Banc Split Corp. | LBS |

| Brompton | Brompton Lifeco Split Corps. | LCS |

| Brompton | Global Dividend Growth Split Corp. | GDV |

| Brompton | Dividend Growth Split Corp. | DGS |

| Brompton | Sustainable Power & Infrastructure Split Corp. | PWI |

| Brompton | Brompton Oil Split Corp. | OSP |

| Quadravest | Financial 15 | FTN |

| Quadravest | North American Financial 15 Split Corp. | FFN |

| Quadravest | US Financial 15 Split Corp. | FTU |

| Quadravest | Dividend 15 Split Corp. | DFN |

| Quadravest | Dividend 15 Split Corp. II | DF |

| Quadravest | Dividend Select 15 | DS |

| Quadravest | Canadian Life Companies Split Corp. | LFE |

| Quadravest | Canadian Bank Corp. | BK |

| Quadravest | Prime Dividend Corp. | PDV |

| Quadravest | M-Split Corp. | XMF.A |

| Quadravest | Commerce Split Corp. | YCM |

| Quadravest | TDb Split Corp. | XTD |

| Middlefield Funds | E Split Corp. | ENS |

| Middlefield Funds | Real Estate Split Corp. | RS |

| Mulvihill | Premium Income Corporation | PIC.A |

| Mulvihill | S Split Corp. | SBN |

| Mulvihill | World Financial Split Corp. | WFS |

| Mulvihill | Top 10 Split Trust | TXT.UN |

| Harvest | Big Pharma Split Corp. | PRM |

I can see using Split shares as a “sleeve” to increase yield in a portfolio …but no more than 8-10% of portfolio value . Buying split shares is timing too . The best time to buy them is in a market correction . Buying them at top of a market can hurt in the long run . My test is always ” how did they do in 2008 and March of 2000 ? ” Happy investing crew !

Thanks James. Indeed and one would have to be patient between 2008 and 2020 …

Are you buying them these days? I saw half of Brompton split-shares are not paying distribution next month.

I’m a fan of ENS, I like the steady income, and with the DRIP I can compound monthly. Using portfolio visualizer over 2, 3, and 4 year periods ENS has out-performed. They are one of the rare-split funds in that they only hold ENB. They are also rare in that they have increased the distribution since inception (only once, but it’s possible they will again).

I own some ENB too for balance on growth / income.

I agree with everything else – these are not really for accumulation years but they can juice your income in retirement. I do worry about not keeping pace with inflation but I’m also in the “go-go, slow-go, no-go” camp, so I’m okay with working things such that they don’t necessarily keep a 1:1 pace with inflation.

Thanks James for taking the time to share your approach.

Which account do you hold it in?

I hold preferred units of LFE and DF for bond like portfolio ballast. They have done the job as intended, being down less than half what bond funds are showing lately and returning 3 or 4 times as much income as short term bonds or my HISA.

Thanks for the comment Rich.

Indeed the preferred shares appear to be stable. My parents have held the DF preferred shares for a long time now.

I owned a number of split corps over the years. I learned to just buy the preferreds. The capital shares may look attractive at times, but can be risky. For example PIC.A that was $20 in 1998 went down to close to $2.00 in 2008. Long term Total Return dismal. PIC.PR.A on the other hand maintained a price of about $15 long term (except for the Covid dip), paid a dividend and had reasonable Total Return.

The only splits I presently own, are the Partners Value (BAM) split preferreds that have a fixed maturity date. More like bonds.

Some judge the splits by their holdings. How could holding all 5 banks be risky? But really, we should be more concerned about the companies that run the split corporations. Is there risk there?

Thanks Graham for sharing your experience.

Passive Income Investing has posted more comprehensive videos on Split Funds. Would you update the link to Passive Income Investing on Youtube to this one?

https://youtu.be/x6bs3u2bM5s

Thanks Erica for sharing an update.

I actually like the original one a lot with respect to the explanation it does. You have both now :)

Awesome! Thanks 😊

I have been burned, but learned my lesson, a couple of times with split shares. I started buying and selling to buy others without looking at the distribution history and price charts. Now I know to stick with the common shares that either almost always pay out, or if they do drop below the NAV line, they rebound quickly. My two favourites are DFN and SBC. GDV is new, but I also have that for some global “diversification”.

Thanks Kyle,

So you got burned but your are still at it :)

Care to share why you did not move away completely and how it fits into your overall portfolio?

Sure. I started with FTN after looking into split shares. I can’t say that I understood them, but if they were paying out that kind of money, I wouldn’t mind some of it coming my way. I blame my lack of knowledge and investigation for the bad move to another poorly paying split share. Since then, I take the beneficial history of the global economic crisis and the pandemic to check on a fund’s strength and distribution history through tough times.

I remain wary of the split shares’ volatility (and other higher paying ETFs like ZWU keep me from buying the preferred part of the split share) but I enjoy the high distributions in my TFSAs and RRSPs for my wife and I. They now provide about a third of my dividends/distributions. But when I retire, I plan to move most of my money out of the split shares to more stable stocks and ETFs.

Thanks for sharing your experience Kyle.

I looks like you are investing in Split Shares during the accumulation for growth. That’s an interesting approach.

Is that because you can “see” and calculate the compound growth? As opposed to invest in a dividend growth stocks like CNR or ATD.

Much appreciated!

Yes, I would have preferred to start investing like you, TAWCAN and other DIYers did with dividend growth stocks, but I was a little “late to the game” when I started the DIY journey in 2014 at the age of 46. We had tried investing the Canadian way in the late 90’s with bank mutual funds (burned then by the dot-com bubble bursting) and continued to sink in a monthly amount (a la the Wealthy Barber) until 2008. That failed miserably (the bank even gave us a letter of apology). After sitting on the sidelines watching the stock market recover after 2009, and letting our small savings grow in an insurance growth fund we moved to, I educated myself in DIY investing (MoneySense had a good article on successful Canadian DIY investors) and spoke to others who were fairly successful. I started small with a TD TFSA and was eventually able to take my wife’s spousal RRSP money out of the fund, penalty free, in 2014. I fell prey to the greedy days of the Canadian oil boom and lost a fair bit in 2016 when the oil market fell, but other than that, I have been investing fairly well and have moved a lot towards the income funds, REITS, split shares, and covered call ETFs. Time has been the important factor, as I need to build a nest egg of stable income soon. Time is also the main factor for staying away from the slow growth of more blue chip companies. I wouldn’t advise anyone to follow my path, as it seems a little unsettling to only invest in ETF’s and funds that have companies in their holdings, rather than investing in the companies themselves, but the income stream has been steadily improving and I am very close to my annual dividend goal and looking at retiring from my job next year. I’m looking at using this income stream now to start investing in more solid options without the level of risk I am currently taking.

Thanks for sharing your story and glad to see that you have been able to recover and achieve retirement soon.

I am heavily invested in split share funds during the accumulation phase. Similar reason to Kyle. I started late. The monthly distributions I recieve, added to my deposits into my investing accounts have allowed me to invest more money sooner. Split share funds are great if you understand how to use them and they are not all the same. I use ENS, GDV and RS as long term safe and reliable payers. I consider these low risk. I buy and hold. And hold significant dollars in them.

Then I use medium risk ones like bk, lbs, dfn, ftn as yield multipliers. May not hold forever and I do not hold as much money in them.

Lastly there are high risk DF, FFN, DGS. These I hold small percentages in, I only buy them when they are not paying out distributions or after overnight offerings. I then sell portions of my holdings when they start paying, to capitalize on significant price gains. As well as crazy high yield on cost.

It’s a good system but you need to really understand the cycles.

Thanks for your comment Tyler. Looks like you figured something out for yourself but it seems to be a fair amount of work. Do you conclude it’s worth it? What’s the total return on your portfolio according to your broker? Are you over 10% annual rate of return?

Also, yield on cost is meaningless … Use market yield instead. I makes people feel good but doesn’t provide any useful portfolio insight. I went over it on this post: https://dividendearner.com/should-i-use-yield-on-cost/

Historically, GDV/SBC have a perfect record, not missing a single dividend payment, even during the pandemic. Even the split corps with 13-16% yields are still really good if they just miss 2-4 payments per year (adjusted on an annual basis it still works out to 10%). I prefer split corps over covered call investments but there is inherent risk since the NAV operates independent of their actual stock price. Then there’s overnight offerings which throws a monkey wrench into the timing…