The markets can have a mind of their own at times … The recent pullback is reminiscent of 2009 when many financial stocks were discounted.

Corp Account Guidelines

A reminder on the account guidelines:

- Preserve capital by not taking unnecessary risks while not expecting growth, per se.

- Earn income from the investment with a yield above 5% from dividends or distributions.

- Keeping up with inflation is not necessary as it’s not a retirement account.

- No re-investment of income. It will either be used to pay taxes, or withdrawn from the corporation as dividends to myself.

- Focus on Canadian currency.

The money invested is simply a way to put the cash to work. Banks don't pay interest, and a high-savings account doesn't pay either.

Screening Method

The method I used to screen GWO during my first trade is still valid.

I did, however, double-check for better options. Income trusts or ETFs were currently excluded in my filtering as I wanted to focus on a dividend stock due to the market drop.

The shortlist is the following with a yield close to 6%

- Great West Life

- Power Corporation

- Manulife

I had a look at the banks and only Scotia Bank had a yield near 5% and still not in the attractive territory unlike many of the life insurance stocks.

I opted to stick with Great West Life instead of its parent company or Manulife.

Interestingly, Great West Life was also highlighted as a top pick on BNN last week.

Tax Efficiency

At this point, I have 60% of my initial contribution in dividend stocks while 40% in an ETF which is more tax efficient for a similar yield.

The difference is that Great West Life will increase the dividend over time while the ETF will stay relatively fixed.

It’s a balance and not just a play on tax efficiency.

In a corporate account, capital gains are very efficient and many covered call ETFs pay a return of capital. You get money back without any taxes until you sell and trigger a capital gains.

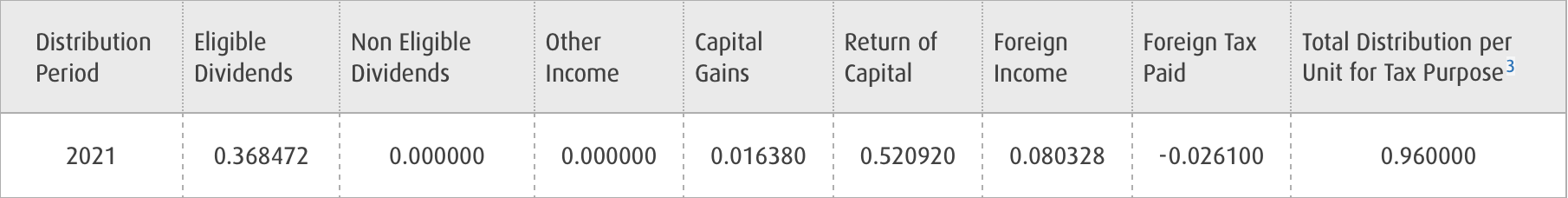

See the ratios below to understand the actual tax rate of the ETF distribution.

Note that I am still learning about corporate tax for investing … While I have a good handle on personal taxes, it’s my first year doing corporate taxes with an accounting firm. Hopefully, I am not making too many inefficient decisions.

Next Steps

The markets can always make me adjust my plans but my next contribution of $5,000 will be earmarked for an income trust or ETF.

how do the canadian banks compare to insurance and bce

The Canadian banks are still around 4%. Only BNS reached 5% recently but it has not crossed over the 5-year average yet.

BCE is usually in the 5% but I prefer insurance these days with increasing interest rates and their PE is really really low.

So many bargains in the market for the last couple of weeks and definitely lifeco are a safer bet if we’re looking for a decent yield.l

Thanks D.E. After comparing GWO to SLF and MFC two months ago, I elected to add GWO to our RRIF.

Nice. MFC is definitely getting up there too with the yield.