Understandably, many investors would be interested in a monthly income investment during this everlasting low-interest rate environment, but the investments or products are not without their pitfalls. You need to choose wisely and understand how the income is generated.

The low-interest rate is a challenge for retirees who grew up with higher interest and bond rates. The payout on their investment was juicy in the 80s, and now it’s not, and the income is still needed. There was a time when a fixed income portfolio would suffice, but that is not the case anymore.

Fixed income is used to balance risk rather than provide the necessary spending income that it used to provide. I know that I have seen my parents switch towards equity from juicy fixed-income investments. Government and municipal bonds were great, and now preferred shares are the replacement for some investors. Even those who have changed their payout and equities provide better returns, but with it comes the risk.

You can invest in separate investment options or buy products such as mutual funds or ETFs built to provide monthly income. But have you ever walked into a bank and seen the offer of $600 per month for $100,000 in investment? That’s how they advertise their products.

Other strategies are employed, and different mixes of assets are put together and offered through many different products such as BMO Monthly Income Fund or ETF.

Receive Monthly Income

Let’s be clear: generating retirement income is not complicated when you know the available strategies. However, choosing the best option at the right time is not always easy.

Those seeking monthly pay from investments usually chase higher-yield products, which can be risky.

Bonds

Buying and holding bond coupons alone doesn’t usually lead to monthly income. Bond payments are often every three months or semi-annually. Buying bonds is also a different process than buying blue chip stocks. If you are not used to it, you may be more interested in a Bond mutual fund or ETF, which can be set up to pay monthly income.

Take, for example, the iShares 1-5 Year Laddered Government Bond Index ETF (TSE:CLF) which currently provide a 3.17% distribution yield. You may be tempted by the yield based on the current interest rates, but look at the price history. Who said fixed income was less risky than a stock? Interest rates have a major impact on bond rates, and since coupons are sold for a fixed time, you end up needing to either wait with the fixed rate or sell on the secondary market, which is then based on offer and demand.

Another important point to look at is that the yield is expected to go down. Look at the high yield coupons and their expiry dates, they are all expiring in the short term horizon so it only means that the yield will go down over time unless interest rates go up. Not that simple anymore to get consistent monthly income. You might be better to learn how to buy bonds on your own.

In a tax-free account (TFSA, RRSP, or RESP), all yields are equal (aside from the foreign withholding tax), but they are not the same in a taxable account.

See dividends vs. distribution for more details on the tax implications. If you need to hold non-qualified dividends in a taxable account, the yield comparison needs to consider your taxes for a fair comparison. Taxes become a big consideration in retirement as withdrawal triggers various taxes and if you are setup properly, you can earn income tax-free with dividends.

Dividends

While most companies pay a quarterly dividend, some equities pay monthly dividends. The Dividend Snapshot Screener tracks around 20 monthly dividend-paying stocks excluding REITs.

It usually means that cash flow is relatively consistent and possibly represents subscription or recurring revenue. You cannot promise a monthly dividend without knowing you have the cash coming in monthly; otherwise, where would the financial accountability be? Investors would simply not buy those investments.

Distribution

Distribution is where it gets interesting as anything that is not considered a qualified dividend as per Canadian regulations is a distribution with the perspective of a mutual fund or dividend ETF. When a fund has bonds that pay what is the equivalent of interest, the fund cannot call that dividend, it uses the term distribution to bundle all the money it gives back to shareholders.

Covered Calls

Covered calls are an advanced income generating strategy. It’s another way to earn an income from your holdings on top of a possible dividend. It’s like double dipping. I won’t go into details are as it’s an options trading strategy that limits your upside while protecting your downside.

Return of Capital

This is an interesting one. You generate income by getting your money back. It’s like a withdrawal of your initial capital rather than a capital gain. When this happens, the adjusted cost base (ACB) needs to be adjusted. It’s often used with mutual funds and ETFs to maintain the promised distribution.

Capital Gains

This refers to take your profits which can be used to pay the distribution in a mutual fund or ETF. In some cases, there are regular purchase and disposition of holdings which triggers capital gains (or losses).

Monthly Income Funds & ETFs

Banks are in the business of making money, so they jumped at the opportunity to offer monthly income funds or ETFs as outlined below. Not all of them are created equal, yet they have the same purpose and are being bought by many investors.

Let’s have a look at the popular Monthly Income Funds and Monthly Income ETFs and what makes them what they are. One interesting point is that distribution yield is not widely advertised on the bank’s website or even the Globe & Mail investor section.

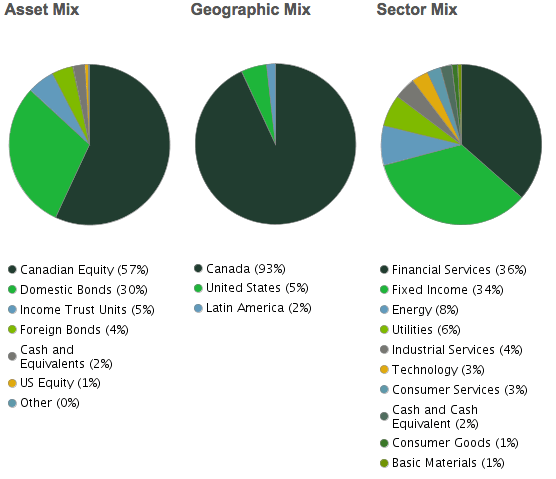

What is important to understand is that all the monthly income generation method mentioned above are used in the products outlined below. Most of them own very similar content as you can see and yet they have varied distribution yield.

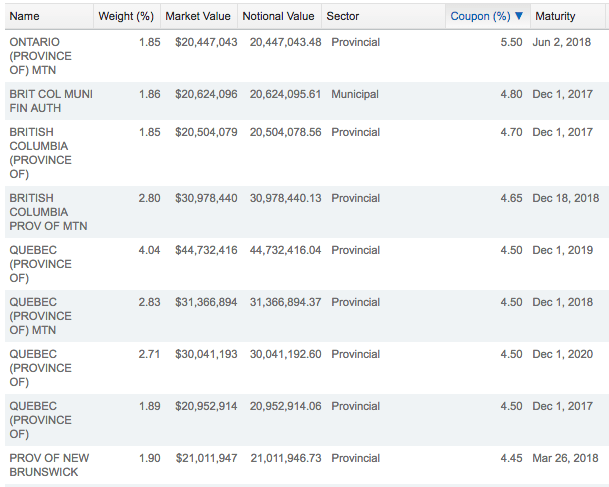

The mutual funds tend to balance bonds and equity to deliver their results

BMO Monthly Income Fund

BMO Monthly Income Fund (fund details) is the most expensive monthly income fund outlined here with a 1.57% MER.

- Monthly Distribution: $0.024

- Annual Distribution: $0.5878

- Annual Distribution Yield: 7.94%

CIBC Monthly Income Fund

CIBC Monthly Income Fund (fund details) has an MER of 1.47% with a very different set of holdings than the BMO Monthly Income Fund.

- Monthly Distribution: $0.06

- Annual Distribution: $0.72

- Annual Distribution Yield: 5.95%

RBC Monthly Income Fund

RBC Monthly Income Fund (fund details) has an MER of 1.20%. It tracks the bond index along with the TSX capped composite.

- Monthly Distribution: $0.0425

- Annual Distribution: $0.51

- Annual Distribution Yield: 3.62%

Scotia Diversified Monthly Income Fund

Scotia Diversified Monthly Income Fund (fund details) has an MER of 1.46%.

- Monthly Distribution: $0.03

- Annual Distribution: $0.5695

- Annual Distribution Yield: 5.13%

TD Monthly Income Fund

TD Monthly Income Fund (fund details) has an MER of 1.47%. This fund has the lowest yield of all and one of the lowest exposure to bonds

- Monthly Distribution: $0.0299

- Annual Distribution: $0.4115

- Annual Distribution Yield: 2.03%

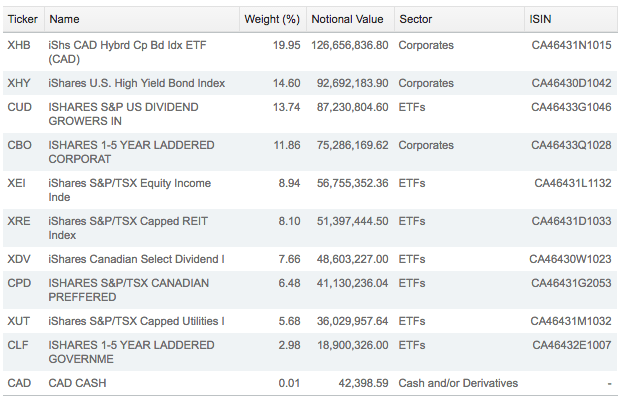

iShares Diversified Monthly Income ETF

iShares Diversified Monthly Income ETF (ETF details) provides monthly income with an MER of 0.56%. As it happens, the ETF is a super ETF in that it’s built from many ETFs. This ETF appears much more appealing than the other mutual funds from a cost perspective.

- Monthly Distribution: $0.05

- Annual Distribution: $0.60

- Annual Distribution Yield: 5.29%

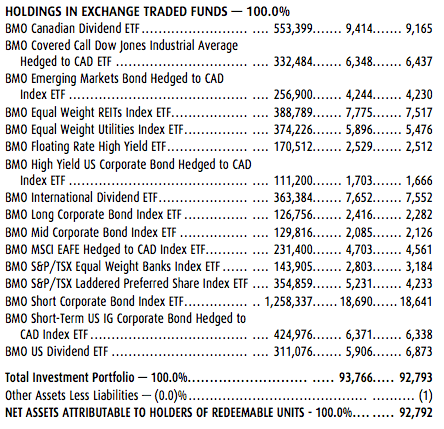

BMO Monthly Income ETF

BMO Monthly Income ETF (TSE:ZMI) (ETF Detail) has an MER of 0.55% beating the BMO Monthly Income Fun MER by 1%. Why buy the mutual fund? If you have a discount broker that offers free ETF transactions, you have no fees.

- Monthly Distribution: $0.056

- Annual Distribution: $0.672

- Annual Distribution Yield: 4.23%

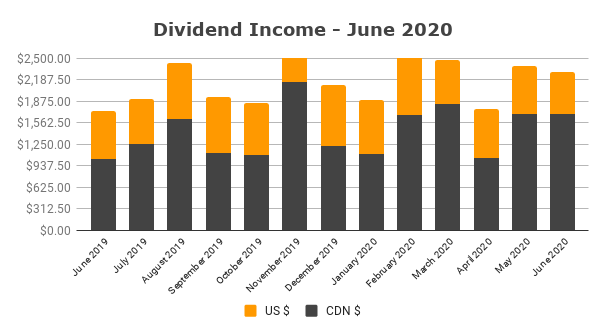

Monthly Dividend Stocks

There are monthly dividend stocks, but don’t hesitate to build a portfolio that can pay you regular quarterly income. When spread, it does still provide a decent monthly income, see my dividend income reports.

Monthly Income Considerations

As you can see, all of the products offer similar holdings with varying ratios yet, the MER varies along with the yield. It can get confusing when you look at the yield to understand how it’s generated since the return of capital or covered calls come into play, and it’s not easily quantifiable.

Use your judgement and don’t be too greedy on the yield. Asset managers are generally rewarded based on short term performance rather than long term. If the yield is higher than what highest dividend paying stock, than you can be sure there is return of capital or covered calls used. Simplicity went out the window.

One big question to ask yourself is if you just want the income or if you want growth in the product, or both. As you saw in the bonds graph above, interest rates have a major impact on both fixed-income and dividend stocks. The higher the interest rate, the more fixed income will be purchased and vice versa. Investors will seek security with high-interest rates when available. Establish your goals for your monthly income investment and review them regularly.

When in doubt, compare it to a Canadian Bank stock :)