Not only is dividend investing a way to live from your income, but you can earn the first $50K in dividends tax-free! It’s not easy to achieve, though.

Once you reach your retirement number, retirement income is more about tax management than portfolio income. It’s all about managing the withdrawal per account to achieve optimal tax savings.

Which Account Is Important?

Remember that you are incentivized to put money in your RRSP for the tax deduction, but what do you do with the tax deduction? Invest it back in your RRSP or TFSA. If not, you have pretty much negatively impacted the purpose of your RRSP unless you can guarantee you will earn less once you withdraw from it.

Why go over the RRSP and TFSA when the goal is to earn $50K in dividends tax-free? Simply put, to earn $50K in dividends tax-free, you need to generate $50K in dividends from your non-registered account. Think about it, how much should the account have to generate that much?

With a 5% yield, to be generous, you need $1,000,000 in your non-registered account to earn $50,000 in dividends. Since most people will find it hard to reach that number across all accounts, let alone in a non-registered account, it’s a pretty high bar to achieve, but it’s possible.

So, should you focus on your non-registered account? Well, no is the short answer. You want to make sure you contribute to your TFSA no matter what!

Between the TFSA and the RRSP, the TFSA wins, in my opinion.

TFSA To The Rescue

It’s not all gloom. Investing in your non-registered account or TFSA is all done with after-tax dollars.

Instead of having $1,000,000 in only one account, let’s have $200,000 in your TFSA and $800,000 in your non-registered account with a yield of 5%. You can get $10,000 from your TFSA and $40,000 from your non-registered account.

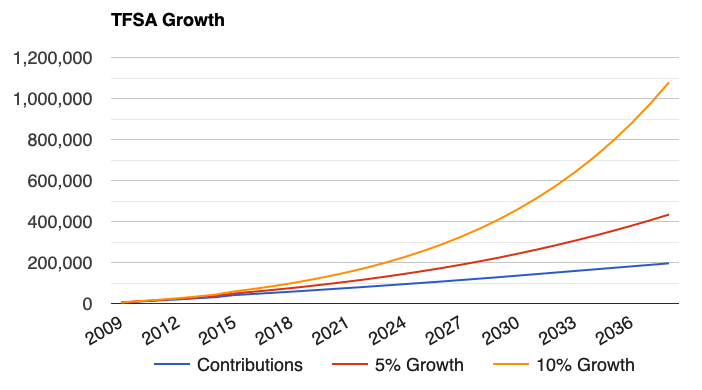

You should easily increase your TFSA to $200,000 in 20 years. I almost reached that amount in 12 years. The bigger your TFSA, the smaller your non-registered account has to be for tax-efficient income.

Why $50K Tax-Free?

It’s pretty simple. Dividend income identified as eligible dividends has a preferential tax treatment. It’s more efficient than capital gains until you reach a certain income, and then it swaps.

Being tax efficient is another way to increase your passive income.

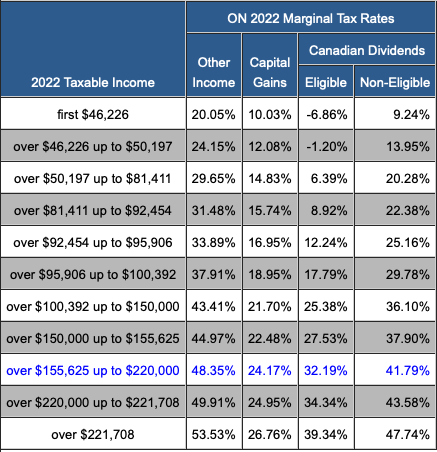

Capital gains and eligible dividends are more favourable for your taxes than employment income. Here is how it plays out for Ontario and British Columbia on the tax front.

As you can see, no taxes are paid up to $50,000 on eligible dividends earned in a non-registered account, but it’s not easy to get there. If you want to see a table for your province, you can access it here on Tax Tips.

The trick now that the TFSA exists is to balance the TFSA and the non-registered account.