When following my progress make sure you clearly understand the goals of the accounts and the purpose of the investments.

Corp Account Guidelines

A reminder on the account guidelines:

- Preserve capital by not taking unnecessary risks while not expecting growth, per se.

- Earn income from the investment with a yield above 5% from dividends or distributions.

- Keeping up with inflation is not necessary as it’s not a retirement account.

- No re-investment of income. It will either be used to pay taxes, or withdrawn from the corporation as dividends to myself.

- Focus on Canadian currency.

The money invested is simply a way to put the cash to work. Banks don't pay interest, and a high-savings account doesn't pay either.

Investing In FHI

What I like about FHI is the healthcare coverage. Healthcare tends to be an area government invests in to ensure stability. As you can imagine, there can always be a health crisis around the corner …

As per my other investments in this account, FHI is also a covered call ETF. As a dividend investor, I take my dividend investing approach to the next level with covered calls.

It’s a strategy I would do on my own but I don’t find it easy to trade covered calls. As such, I am looking at covered call ETFs.

These are the holdings in the ETF. All large cap stocks or bigger that many would hold individually. The ETF, while used for income, also does well in appreciation which is an added bonus over the 6.50% yield.

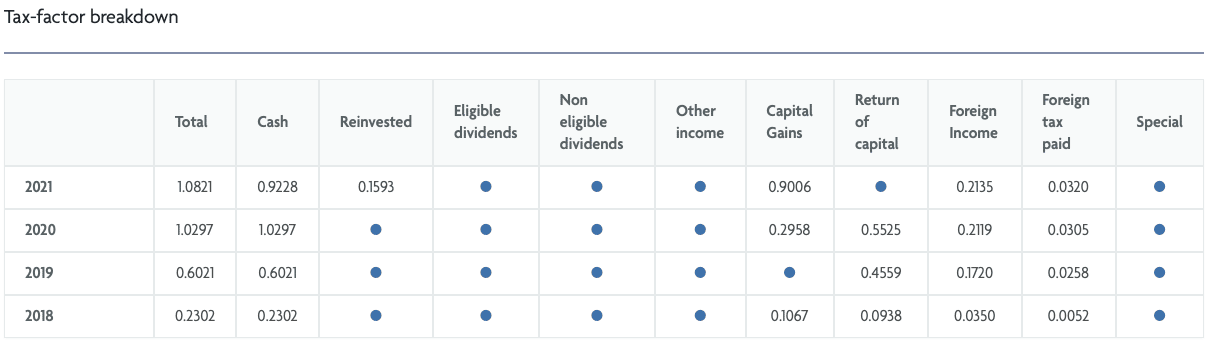

Tax Efficiency

It’s not as effective on the tax front but it’s not bad either. It’s mostly capital gains which is actually the most efficient.

Investing In HDIV

This is an ETF that goes to the next level with covered call ETFs as the underlying holdings. Say you were to buy all the underlying ETFs individually but then borrowed some money to invest more.

In a way, you let someone else manage the risk that you could normally take. If you are not willing to borrow to invest, skip it. I, on the other hand, did borrow to invest and can borrow to invest. Borrowing to invest is how you use leverage to get ahead. In fact, any successful real estate investors will tell you that as they always use the equity in a property to buy another one to generate cash flow.

Here are the top points of the ETF goals, and it pays over 9%.

- Attractive monthly income

- Sector diversification broadly similar to S&P/TSX 60 with higher yield

- Increased growth potential vs individual covered call ETFs

- Higher yielding alternative vs broad-based index ETFs and individual covered call strategies

While I am not necessarily keen on gold and energy stocks in general, I focus on the bigger picture here which is the income.

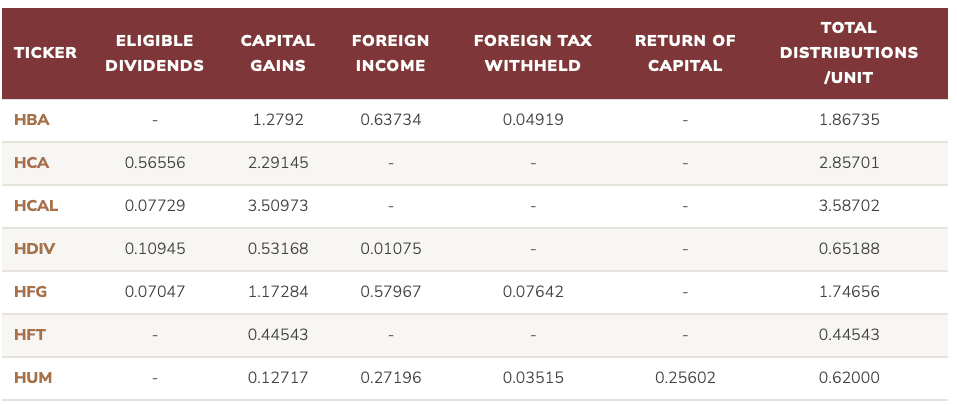

Tax Efficiency

Some exposure to foreign income, otherwise it’s primarily capital gains.

Next Steps

No additional ETFs to add in the plan unless something comes up … The interesting part now is that the portfolio leads to a generous 7.68% yield with what I consider minimal downside and with some potential appreciation down the line.

Since all distributions are reinvested, compounding is at work.

Remember, this money is in a corporation and it’s not about investing in hail maries but to generate income above what the banks can pay. Even if I can get a GIC at 5% today, there is no compouding with GICs …

GICs is when you cannot handle a downside like putting cash aside for a down payment or some other large payment but that’s one of the primary reason why many investors are shifting their money around since banks are starting to pay now.

The extra 2.68% compounded is a big deal mathematically and should not be ignored.