Canadian REIT ETFs provide attractive investment attributes of real estate investment as it invests in several property-owning real estate companies in one go.

It reduces the risk for an investor betting on just one property of his own. REIT ETFs also grant an excellent diversification option to investors.

While investing directly in real estate might sound lucrative, it involves a lot of research and is both time and capital intensive. Moreover, a bad choice could lead to all that hard-earned money going down the drain.

A REIT ETF can help you manage your portfolio risk while you put the majority or your portfolio in a performing ETF.

What Is a REIT ETF?

A REIT ETF, offers a low-cost way to invest in the real estate asset class. Not only that, ETFs are highly liquid in nature and trade as normal stocks on the stock exchange.

There are a couple of REIT ETFs to be aware of:

- REIT ETFs that invest directly in real-estate companies

- REIT ETFs that invest in other REIT ETFs

The Best REIT ETFs

The selection of REIT ETFs is a lot smaller than bond ETFs which should make it easier to find the best REIT ETF.

In fact, it’s going to be pretty easy to find the best as there aren’t many options. I have outlined the six candidates below.

| ETF Provider | wdt_ID | Ticker | NAV | MER | Yield | Frequency |

|---|---|---|---|---|---|---|

| BMO | 1 | ZRE | 0.811 | 0.61 | 4.18 | Monthly |

| Vanguard | 2 | VRE | 0.287 | 0.39 | 3.16 | Monthly |

| BlackRock | 3 | XRE | 1.410 | 0.61 | 2.31 | Monthly |

| BlackRock | 6 | CGR | 0.264 | 0.71 | 2.40 | Quarterly |

| CI | 8 | RIT | 0.791 | 0.90 | 4.24 | Monthly |

| Purpose Investing | 9 | PHR | 0.420 | 0.78 | 3.81 | Monthly |

To pick the best REIT ETF, it really depends on what you are looking for. Are you looking for growth? for income? or for both growth and income?

We need to look at historical performance to see how the ETF has performed. I like to blend the yield and the return since inception as long as it has been around for more than five years.

| ETF Provider | wdt_ID | Ticker | ROR Last 5 Years | ROR Since Inception | Inception |

|---|---|---|---|---|---|

| BMO | 1 | ZRE | 12.92 | 10.99 | 19/05/2010 |

| Vanguard | 2 | VRE | 10.06 | 8.36 | 02/11/2012 |

| BlackRock | 3 | XRE | 10.32 | 10.08 | 17/10/2002 |

| BlackRock | 6 | CGR | 7.14 | 7.23 | 26/08/2008 |

| CI | 8 | RIT | 11.52 | 10.91 | 15/11/2004 |

| Purpose Investing | 9 | PHR | 9.00 | 7.76 | 29/04/2014 |

The best 2 REIT ETFs are ZRE and RIT. I favor ZRE as it has a larger NAV and lower fees but they differ in what they hold.

ZRE – BMO Equal Weight REITs Index ETF

The BMO Equal Weight REITs Index ETF has been designed to replicate, to the extent possible, the performance of the Solactive Equal Weight Canada REIT Index

It’s 100% exposed to Canadian real estate and holds 23 REITs total.

RIT – CI Canadian REIT ETF

The Fund’s investment objective is to seek long-term total returns consisting of regular income and long-term capital appreciation from an actively managed portfolio comprised primarily of securities of Canadian real estate investment trusts, real estate operating corporations and entities involved in real estate related services. Up to 30% of the Fund’s assets may be invested in foreign securities.

While ZRE is 100% exposed to Canadian REITs, RIT is different and include real estate companies such as .

Why Invest in REIT ETFs

Investors invest in REIT not only to gain from a diversified portfolio but also because of their lucrative distribution as REITs are required to pay out at least 90% of their income as distribution (difference between distribution and dividends).

Some REITs are focused while others are diversified (by asset class, investment objective or geographies). Since REITs are tied to a particular property class, a Canadian REIT ETF can offer a balanced investment option to investors.

Many real estate investors, therefore, prefer to invest through an exchange-traded fund for their low cost, convenience, and diversification instead of trying to make sense of individual REITs.

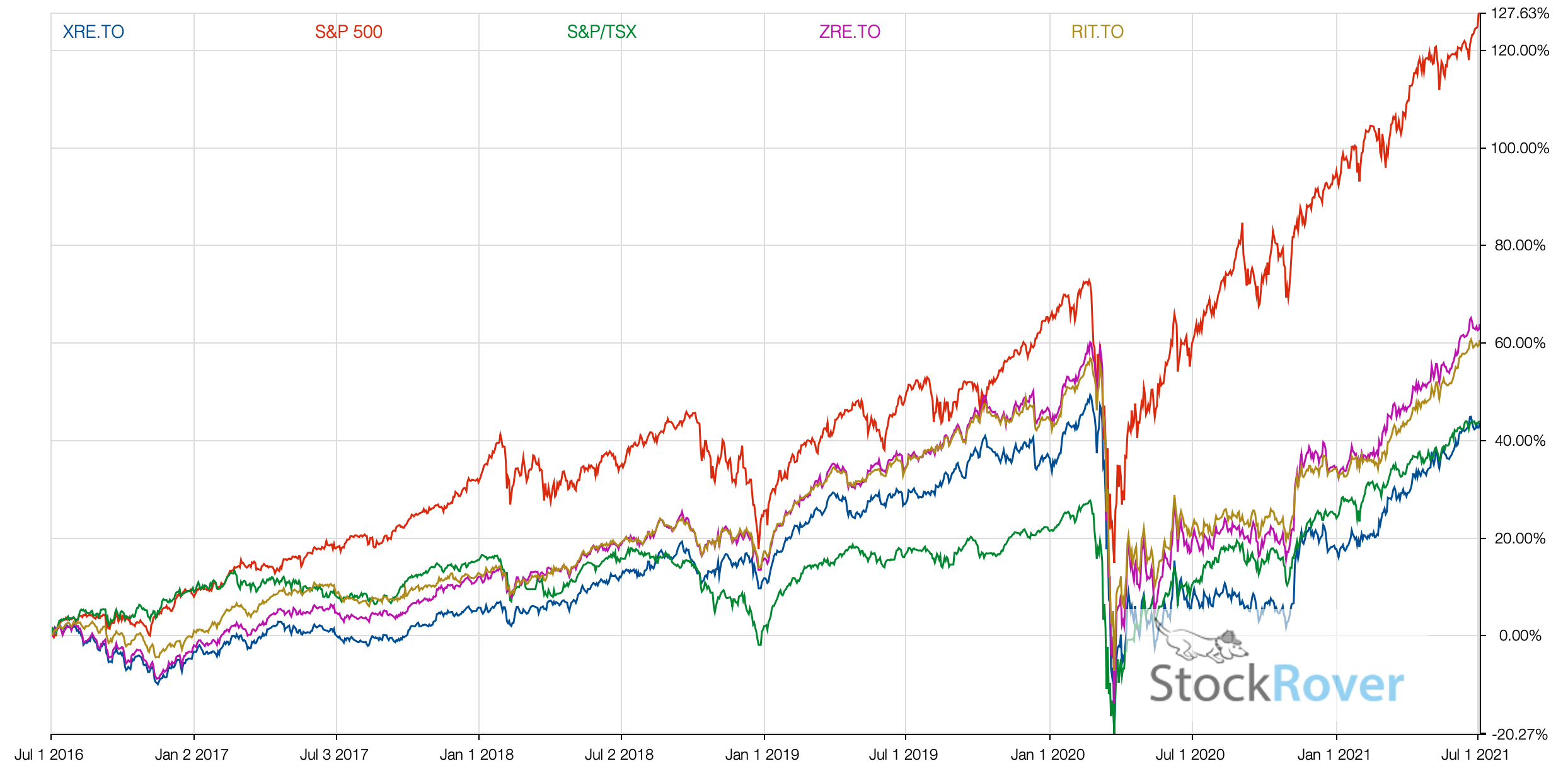

However, if you are looking for growth, you are missing out. The performance for the top 2 REITs by return shines compared with the TSX but falters compared with the S&P500. If you want good returns, stick to the S&P 500 index with an index ETF like VFV ETF.

If you are looking for retirement income, there are better options such as the FIE ETF (iShares Canadian Financial Monthly Income ETF) which sports a better yield and a decent return.

Which REIT ETF Is Good For Your Portfolio

An investment through an ETF grants investors the ownership in dozens of REITs through a single investment and that too at a reasonable price.

Once an investor decides to invest through ETFs, he needs to find out the characteristics that make a good REIT ETF for him/her.

For example, whether you need an equity REIT or mortgage REIT or a combination of both. Few other things that investors can pay heed to are the expense ratio, returns, and assets under management of an ETF.

Investors should try and strike a balance between higher return and lower expense ratio.

Don’t fee pressure to have exposure to REITs. You don’t have to expose your portfolio to all sectors. REITs in Canada have limited growth unless they consolidate. At some point, I elected to not hold any REITs in my portfolio.

How To Buy REIT ETFs

To buy a REIT ETF, you need a discount broker as ETFs trade like stocks on a stock exchange for ETFs. You specify the number of shares you want to buy from the selected ETF and whether you want to pay the market price or you enter the price you want to pay.

I usually put a limit order using the market price just to avoid any blip from a trading algorithm.

As it happens, there are many discount brokers that offer access to free ETFs and you should use a discount broker with free ETFs if you can. Questrade is one of those discount brokers with free ETFs.