Canadian Bond ETFs are popular and it’s important to understand why.

While you may not need or want bonds in your portfolio today, one day you will consider it and it’s important to understand what is available and what will fit in your strategy. Bonds are for safety, so be careful when chasing a safe investment with high income, that is a conundrum.

What Are Bonds?

Bonds represent a fixed-income vehicle for investors. It’s a promise from an entity (corporate, government, municipal, …) to pay you interest for a certain time of time for a certain amount of money.

In short, it’s a loan with fixed parameters. As it happens, there is also a secondary market for bonds when it trades and is usually priced according to interest rates.

With that said, bonds don’t lose money when you keep them to maturity. The dilemma investors have to assess is if their money is better with a GIC or a bond.

What Is A Bond ETF?

A bond ETF is an equity investment (the ETF) that focuses on investing in bonds as the underlying investment. The ETF could also invest in other bond ETFs.

Take the Vanguard Global Aggregate Bond Index ETF (VGAB ETF), it invests in 2 Bond ETFs (VBU ETF and VBG ETF). In turn, being that VBU is a CAD-Hedged fund for currency, it directly invests in BND. That’s 3 layers of ETFs before you actually invest in bonds.

ETFs trade like stocks on the stock market. Investors bid on the ETF at a specific price and that’s what drives the price of the ETF during the day. Read this to understand the pricing of an ETF as opposed to the NAV (Net Asset Value).

During the trading day, there can be a variation in price vs NAV. Here is another explanation on how the price of an ETF and NAV can be adjusted to avoid a divergence between the ETF price and the NAV.

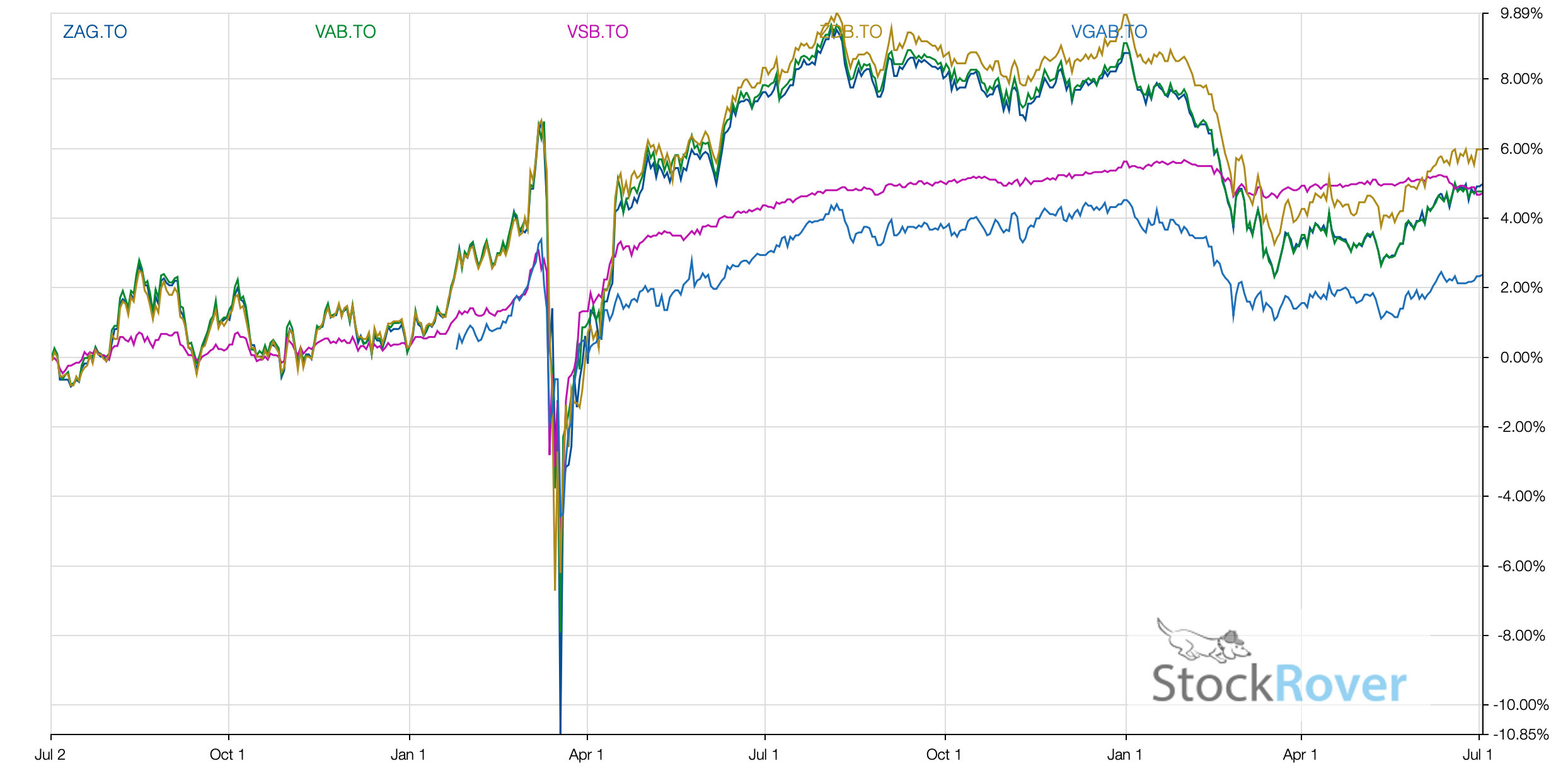

Investors can end up making an ETF overvalued or undervalued temporarily during trading hours as you are at the mercy of the market pricing. During the Covid-19 pandemic, most bond ETFs were negatively impacted even as bond ETFs were seen as safe havens.

Going back to what a bond is, bond ETFs are not as safe as the actual bonds for your capital. It’s easier to access bond ETFs and have a fixed-income representation but the value is still bouncing around as per the secondary bond market.

The Best Canadian Bond ETFs

Instead of making it simple to select a bond ETF, we now have many options to choose from … Too many options can confuse what bond ETF to buy. Let me simplify the selection for you.

The principle, as an investor, when looking for fixed-income representation, is to have the least fluctuation. It’s not about building wealth but protecting it.

- The return should be equal to the income received. Growth is not important with bonds.

- Have the least amount of fees.

- Invest directly in the bond coupons as much as possible.

- Invest in Canadian bonds only and avoid any currency impact.

The table has been sorted by returns since its inception. As pointed out, we want the least amount of variance over time so we want a low performance which is counter-intuitive.

Based on the data identified, the best Bond ETF is the one with a near 3% return since inception and an appropriate yield based on the holdings.

My pick is VGV – Vanguard Canadian Government Bond Index ETF.

- It focuses on high-quality bonds from the government.

- Has little fluctuations in performance.

- Pays a decent yield compared to GICs and interest rates.

- Only downside is the trade volume as it is relatively small with a lower trade volume than others.

The iShares CBO ETF and iShares CLF ETF are close second and third.

Mark from My Own Advisor picks VAB – Canadian Aggregate Bond Index ETF, which is also a good choice and has higher trading volume and higher net assets, if that’s important.

What’s the pattern? Those are the least-performing Bond ETFs.

| wdt_ID | Ticker | ETF Name | # Bonds | MER | Yield | Return |

|---|---|---|---|---|---|---|

| 7 | ||||||

| 14 | VLB | Vanguard Canadian Long-Term Bond Index ETF | 336 | 0.17 | 3.08 | 5.23 |

| 15 | VGV | Vanguard Canadian Government Bond Index ETF | 371 | 0.20 | 2.40 | 3.13 |

| 16 | VCB | Vanguard Canadian Corporate Bond Index ETF | 659 | 0.19 | 2.76 | 3.63 |

| 17 | VAB | Vanguard Canadian Aggregate Bond Index ETF | 1,075 | 0.09 | 2.58 | 3.26 |

| 18 | XBB | iShares Core Canadian Universe Bond Index ETF | 1,404 | 0.10 | 2.62 | 4.94 |

| 19 | XSB | iShares Core Canadian Short Term Bond Index ETF | 488 | 0.10 | 2.13 | 3.83 |

| 20 | XCB | iShares Core Canadian Corporate Bond Index ETF | 956 | 0.44 | 3.08 | 4.43 |

| 21 | XGB | iShares Core Canadian Government Bond Index ETF | 387 | 0.39 | 2.21 | 3.78 |

| 22 | XQB | iShares High Quality Canadian Bond Index ETF | 448 | 0.13 | 2.39 | 3.30 |

| 23 | XLB | iShares Core Canadian Long Term Bond Index ETF | 526 | 0.20 | 3.15 | 5.61 |

| 24 | CLF | iShares 1-5 Year Laddered Government Bond Index ETF | 62 | 0.17 | 2.06 | 2.57 |

| 25 | CBO | iShares 1-5 Year Laddered Corporate Bond Index ETF | 283 | 0.28 | 2.59 | 3.17 |

Why Not Choose The Best Performing Bond ETF?

Simply put, bonds are a fixed-income investment with no fluctuation in value. Yes, there is a secondary market, but the purpose of a bond is to earn interest, just like a GIC, but with different guarantees.

When you buy a bond ETF, you swap the interest for distribution, and the guaranteed value at maturity is gone. It’s the same as investing in real estate vs. REITs. Both have real estate as underlying assets, but the generated income changes.

As such, the best-performing ETF is also the riskiest, and that is not what an investor should be focused on when investing in bond ETFs since you are looking for stability.

Interest rates will also have an impact on the following:

- REIT ETFs will be impacted as they are for income

- Bond ETFs will be impacted as they are for safety and need to keep up with interest

- Bonds on the secondary market will be impacted the same way as bond ETFs

- Bonds held to maturity will not be impacted.

The reason for the secondary market and the adjustment in value is if interest rates rise faster than what the bonds can pay, the investor has to decide on losing value on the bond and recovering it with higher interest rate investments.

If you still think that returns are essential with bonds, then it means you believe in the strategy to predict interest rate movement and where governments will go with their interest rates. Interest rate prediction is complicated and not a strategy I want to learn.

Last but not least, if you want performance, a Bond ETF is the last place to look …

How Bonds Fit In Your Portfolio

Why do you invest in bonds? It’s not to get rich.

You buy bonds for 1 of 2 reasons.

#1 Reason To Hold Bonds

You want to balance risk, which means you want to minimize the swing in your portfolio when stocks move negatively. Just know that the more bonds you hold, the safer you feel but the less your portfolio grows.

The financial industry tries to have a rule around matching your bond holding with your age, but that’s too much, in my opinion, you do what you need to sleep at night.

Generally speaking, when investing for retirement, you don’t want bonds until you approach your 50s. Otherwise that’s a lot of lost growth. You might want to diversify with other Canadian dividend ETFs.

Another alternative to bonds as a Canadian is to invest in a financial blue-chip ETF for higher dividends and returns.

#2 Reason To Hold Bonds

Assuming you are approaching retirement, you want a cash equivalent as part of your withdrawal strategy. This strategy is like a retirement bucket list, from stocks to bonds to cash.

For example, you might want 5% of your portfolio in bonds while you have two years of cash. It gives you a safe cushion to withdraw from your portfolio when the market drops. It means you avoid selling stocks at the wrong time.

Just know that real bond coupons or GICs will never fluctuate in value, whereas an ETF will. So you need to look for a ladder ETF for the bucket strategy.

How To Buy Bond ETFs

It’s much easier to buy bond ETFs than bonds separately, which is why they are so popular.

To buy a bond ETF is very easy, it’s just like buying stocks, you need a discount broker as ETFs trade like stocks on a stock exchange for ETFs. You specify the number of shares you want to buy from the selected ETF and whether you want to pay the market price or enter the price you want to pay.

I usually put a limit order using the market price just to avoid any blip from the trading algorithm.

As it happens, there are many discount brokers that offer access to free ETFs, and you should use a discount broker with free ETFs if you can. Questrade is one of those discount brokers that offers free ETFs.