Utility companies play a significant role in our day-to-day life. They are the equivalent to the blood in our veins when it comes to our world’s infrastructure. Take the power down and not much works and we are in the dark ages. As a business, there is nothing more stable in our world than utilities.

As an investor, finding the appropriate utility stock for your portfolio can get confusing. It’s understandable as it could be confusing finding the one that fits your portfolio.

Should you pick the largest by market capitalization? Should you pick the highest yield utility? How about the one with the best consistent dividend growth? Utility stocks aren’t going to break records in total returns but they can still provide emotional safety. Fret not, below are the best utility stocks in Canada you should consider as a starting point.

Overall, utility stocks will provide a good dividend and if you can DRIP, you can compound your holdings at a good rate. Be aware that while utility stocks pay a good dividend, they are sensitive to interest rates.

They are a proxy for income for many investors. Utility stocks have a place in a portfolio and more so in a retirement portfolio when investing for income. See below for a list of dividend-paying utility stocks.

I caution investors about falling in love with utilities. While they provide a good dividend income and have seen good stock appreciation in recent years, they are not growth stocks. Just like telecoms, they are regulated and growth usually comes from acquisitions or from venturing into other businesses.

As an example, telecom companies started owning TV channels and created Crave TV. In the case of Telus, it ventured in the healthcare data services and Brookfield Infrastructure Partners started investing in data centers.

I did a survey with readers and the results are shared at the end of the post.

Top 3 Utility Dividend Stocks

My approach to valuing dividend stocks is heavily biased towards the Chowder Score which takes into account the consistency of the dividend increases and the dividend growth. Below are the top picks for a solid investment.

For the valuation of utility stocks, you must review the free cash flow (not displayed below) as it is better than looking at earnings. It would be nice if we could evaluate all businesses the same way but we cannot. REITs and income trusts are evaluated through funds from operations and some capital-intensive companies are better evaluated with free cash flow.

Utilities are interest-sensitive stocks, keep that in mind when building your portfolio.

Note that screening stocks for income requires unique dividend data. Not many screeners focus on dividend data and dividend strength. You should consider a screener such as Dividend Snapshot Screeners.

Fortis

tse:fts | Utilities | Utilities - Regulated Electric- Grade: B

- Market Cap: 26.52B (Large Cap)

- P/E: 17.46

- Dividend Yield: 4.37%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 7/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Emera

tse:ema | Utilities | Utilities - Regulated Electric- Grade: B

- Market Cap: 13.87B (Large Cap)

- P/E: 13.66

- Dividend Yield: 5.88%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 4/10

- Dividend Income Fit: 9/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Capital Power Corporation

tse:cpx | Utilities | Utilities - Independent Power Producers- Grade: A

- Market Cap: 5.05B (Mid Cap)

- P/E: 6.46

- Dividend Yield: 6.29%

- Dividend Aristocrat: YES

- Dividend Growth Fit: 6/10

- Dividend Income Fit: 10/10

- Chowder Score: Members Only

- Revenue Growth: Members Only

- Dividend Growth: Members Only

Reader Interest in Utility Stocks

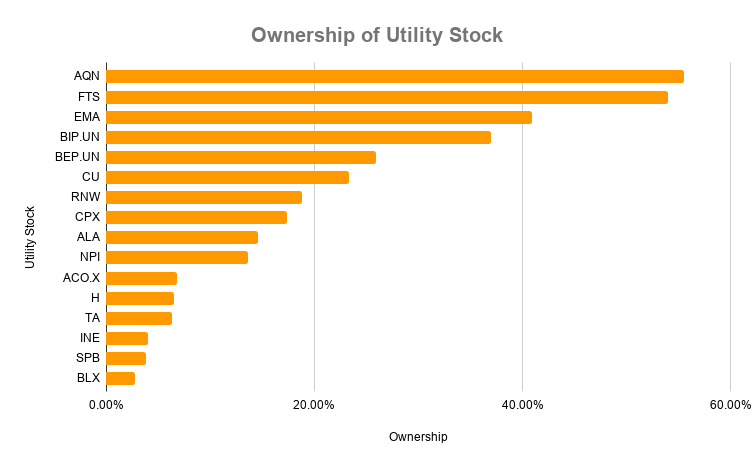

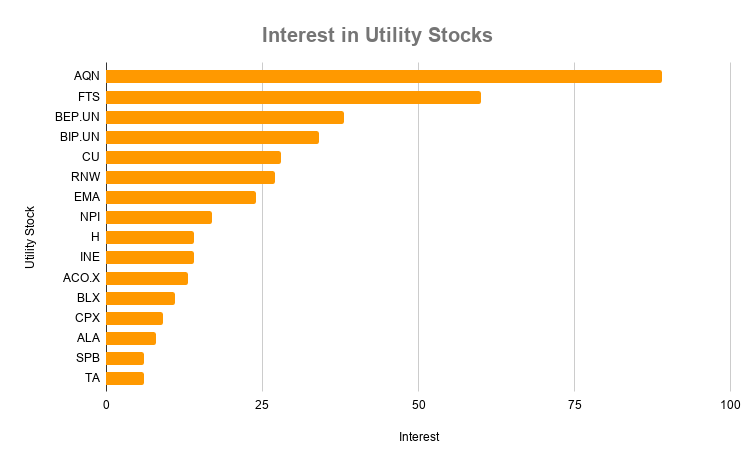

I surveyed my readers to see what the interest in utility stock generally is. See below for the results.

The following chart shows the ownership of each stock by the investors surveyed. As you can see, over 50% of investors have Fortis and Algonquin Power & Utilities Corp.

The following graph shows the stocks of most interest by investor surveys. It’s the next utility they are interested in.

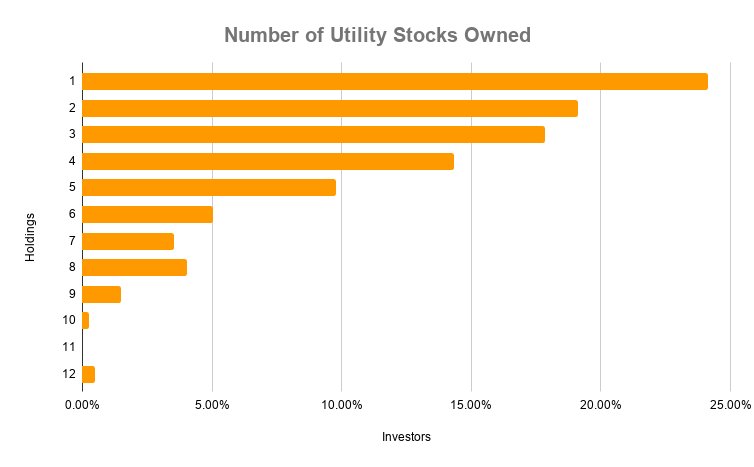

The following graph shows how many utility stocks investors generally hold in their portfolios.