All-in-one ETFs provide a full portfolio strategy similar to robo-advisor. The all-in-one ETFs were created to simplify portfolio management for investors and as an answer to robo-advisors in a competitive market.

Is an all-in-one ETF portfolio right for you? Is it easy to use? Can it help you meet your goals? Read on to find out.

What Is An All-In-One ETF?

An all-in-one ETF is an ETF, or exchange-traded fund, that provides investors with a way to build a portfolio with just one ETF.

The one ETF means that the ETF you invest in will invest in a number of ETFs to build the portfolio.

The portfolio angle comes from the exposure the all-in-one ETF is investing in. For example, one all-in-one ETF will invest 20% in fixed income and 80% in equity to match your risk profile.

Based on the goals of the all-in-one ETF you choose, the ETF will rebalance between the holdings on a regular interval as outlined by the ETF.

Which Portfolio Composition Is Best?

This is probably the first question you will be faced with as most ETF providers will have 3 to 6 all-in-one ETFs to choose from to represent a portfolio risk. The concept is simple and efficient to manage your portfolio with ETFs.

In general, your risk will be related to how much equity vs fixed income you want to be exposed to. The rationale is that equity can have more ups and downs, and fixed income will have less. More on those two topics below.

The all-in-one ETF composition patterns will usually follow the following models. I shared my take on what portfolio is appropriate for your age – not necessarily what the financial industry will advocate though.

| Age Target | Fixed Income | Equity | |

| Equity | Under 40 | 0% | 100% |

| Growth | Under 50 | 20% | 80% |

| Balanced | Under 60 | 40% | 60% |

| Conservative | Over 60 | 60% | 40% |

| Income | Never | 80% | 20% |

I don’t like the rule that says to have a fixed income ratio that matches your age. You leave way too much money on the table. In reality, it’s not about your age, it’s about how far from retirement you are.

You can make the switch pretty easily with a couple of transactions and you want to do it 10 years before you retire to ensure you don’t retire in a down market.

However, the full retirement strategy is much more complex as you should also have cash on hand and fixed income is not that at all. Cash on hand isn’t a ratio either, it’s related to your cost of living.

A Word On Risk

Risk comes from the fear of losing your money. Since equity investment fluctuates, when it drops, your portfolio value drops and many investors panic even if it’s just on paper (ie you have not sold so it’s not a realized loss).

The flip side is to invest in GIC or leaving it in the bank for 1% return. You definitely do not keep up with inflation here. Your savings lose purchasing power every year. In fact, with the rule of 72, it will take you 72 years to double your money with a 1% interest rate.

You need to overcome your risk fear if you want to put your money at work. It’s that simple. Some people do it by buying properties and renting them for example and others do it with the stock market.

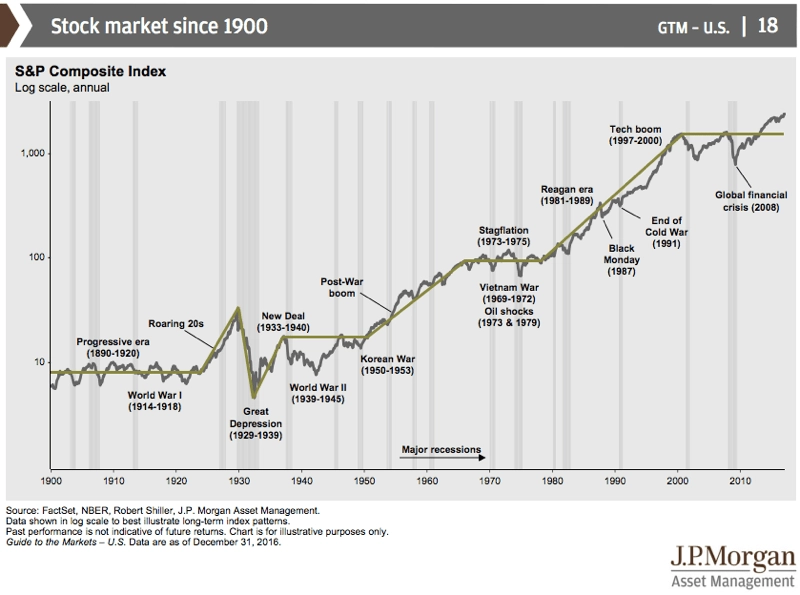

The stock market recovers over time and it’s not a zero sum game, check out the trend below.

Fixed Income ETFs vs Fixed Income Investments

One hard lesson for investors during the 2020 pandemic market crash was to learn that investments seen as safe also dropped in value. There was nowhere safe.

Bond ETFs dropped, as well as many other fixed-income ETFs.

If you understand a bond coupon and a GIC, you know that they are guaranteed. You get your money back plus the interest. While the value of a bond might fluctuate on a secondary market, if you keep it to maturity, you get your money.

The above is why fixed-income investments are safer.

However, an ETF on a stock exchange trades like an equity with offer and demand, so it is subject to market price fluctuations. Many ETFs invest in other ETFs, which in turn invest in other ETFs, causing a cascading effect on the price fluctuation.

All of this is to say that investing in fixed-income ETFs is not the same as investing in a GIC or a bond from a safety perspective.

All it does is make it easy for you, but you can still handle fixed-income investing on your own. You’ll find that it doesn’t really pay and you have to take on more risks to make it pay …

The Best All-In-One ETFs

Here is the full list of all-in-one portfolio ETFs to review. There are technically only 4 providers today offering portfolio ETFs and many have recent offerings.

As it happens, we cannot compare all the portfolio ETFs to each other as they are not built the same. We need to put them into five categories, as shown below.

Another point of caution is that these ETFs are relatively new from a time perspective. Three years of history during a pandemic doesn’t establish a pattern strong enough so be careful if you decide to put all your money into one.

| Age Target | Fixed Income | Equity | |

| Equity | Under 40 | 00% | 100% |

| Growth | Under 50 | 20% | 80% |

| Balanced | Under 60 | 40% | 60% |

| Conservative | Over 60 | 60% | 40% |

| Income | Never | 80% | 20% |

Best All-In-One Equity ETF

This is actually a battle of two ETFs; XEQT vs VEQT. Both are relatively recent having been created in 2019.

Both are pretty similar in terms of metrics but XEQT has the edge on most of them. While it’s the smaller ETF, the provider is BlackRock and one of the biggest ETF provider in North America.

Best All-In-One Growth ETF

This is actually a battle of four ETFs; XGRO vs VGRO vs ZGRO vs HGRO. Two new providers are in this ETF group with BMO and Horizons joining. They are small from a NAV perspective but should grow.

Considering we are now looking at 60% equity, we have to put the ROR in perspective.

That leaves us with the real contenders for the best all-in-0ne growth ETF with ZGRO and VGRO. The edge is for BMO ZGRO as all metrics are better except for the NAV which I believe will improve.

Best All-In-One Balanced ETF

Another battle of four ETFs; XBAL vs VBAL vs ZBAL vs HBAL. BMO and Horizons join the group again.

The best metric to use in light of these ETFs being newer is the yield. HBAL yield is too low and XBAL is too high for a balanced ETF. That leaves ZBAL and VBAL to consider. Either would be ok but I believe ZBAL has the edge. It has lower fees and the ROR since inception is higher.

Best All-In-One Conservative ETF

Another 4 ETFs battling for the best conservative ETF. Now we should expect some more income as the threshold shifted towards fixed income.

It’s also normal for the ROR to be around 8% or under since you are not capturing much of the stock market with this ratio.

One point worth mentioning is that the NAV for these ETFs is tiny. My thinking is that not many follow this path. However, I give the edge to XCNS for the yield and good ROR.

Best All-In-One Income ETF

The biggest concern I have with all these income ETFs is that the yield is not great for an income ETF. Some alternative income ETFs pay more.

So the question is if you want income or your want safety in bonds like investments. They aren’t the same.

When you get to this point, consistency and stability is probably what you want. As such, I opt for the BMO ZMI ETF.

Robo-Advisor vs All-In-One ETF

Robo-advisors gained popularity some years ago by providing investors with the ability to build a portfolio based on your profile and automatically rebalance it quarterly or annually.

Robo-advisors are also touted as being cost efficient but the same can now be said about low cost ETF index investing.

The only additional feature a robo-advisor offers over a DIY index investor is the portfolio assessment. However, it’s mostly just about testing your fear and increasing your fixed income – it’s not very sophisticated.

Why Invest in All-In-One ETFs?

For simplicity. There are no other reasons. The all-in-one ETFs hold 4 to 8 ETFs that you could easily do it on your own and select your personal ratio.

In fact, the 20, 40, 60, 80 and 100 ratios of equity vs fixed income is all arbitrary. If you do it on your own, you can choose 28 or 35 to match your own goals.

What stops many from holding just one is the desire to be exposed to industries. Some investors want to gain from the tech stocks in the Nasdaq 100 and others want a higher dividend from a bank ETF holding just the big banks or most of the financial stocks with a financial ETF.

How To Buy All-In-One ETFs

To buy a portfolio ETF, you need a discount broker as ETFs trade like stocks on a stock exchange for ETFs. You specify the number of shares you want to buy from the selected ETF and whether you want to pay the market price or you enter the price you want to pay.

As it happens, there are many trading platforms that offer access to free ETFs and you should use a discount broker with free ETFs if you can. Questrade is one of those discount brokers with free ETFs.

FAQ on All-In-One ETFs

Is My ETF Double-Dipping On Fees?

With an all-in-one portfolio ETF, you have an ETF that buys up to 8 different ETFs. It’s important to understand that the ETF providers are aware of the structure and they also ensure you do not pay more than one fee which is the one from the ETF you purchase.

In short, no there is no double dipping.

Here are the details from iShares and it’s disclosed on all their ETFs.

Management Fee: The annual fee payable by the fund and/or any underlying ETF(s) to BlackRock Canada and/or its affiliates for acting as trustee and/ or manager of the fund/ETF(s).

Management Expense Ratio (MER): As reported in the fund’s most recent Annual Management Report of Fund Performance. MER includes all management fees and GST/HST paid by the fund for the period, and includes any fees paid in respect of the fund’s holdings of other ETFs.

Is an all-in-one ETF a good investment?

The short answer is yes. Purely because it simplifies investing for most investors not interested to learn about investing and all the intricacies of risks.

You will get the market returns and overtime, most investors, even institutional investors, cannot beat it.

With that said, if you pick an income all-in-one ETF in your 20’s, you will not do well. You still need to focus on your equity exposure and take some risks.

How are ETFs taxed in Canada

It follows the same tax rules as ETFs and other equities.

You have to pay capital gains on the appreciation and you get a T3 for all the distribution reported by the ETF. It’s very similar to a REIT if you have experience with REITs.