At this point in my investing journey, and while I am a dividend growth investor, the dividend income I receive is not important.

What is important is the total value of my portfolio as I know, at any point in time, I can sell all my holdings and buy dividend stocks with a yield of 4%. Today my yield is 2.14% and I could essentially double it in a day’s work.

Why do I share this? It’s to share that I am intentional in what matters to my portfolio.

When I started, the yield drove a lot of my decisions. At this point, the annual rate of return of my portfolio and investment drive my investment decisions while using dividend growth as a way to find the stocks that fit my portfolio.

Be intentional and aware.

Stock Trades

I sold all my BlackRock in my RRSP. It’s a fine company, and better than many Canadian alternatives but I am optimizing the return by doubling down on existing holdings.

I bought more shares of Apple and Costco right away and I am sitting on some cash now to see what opportunities arise.

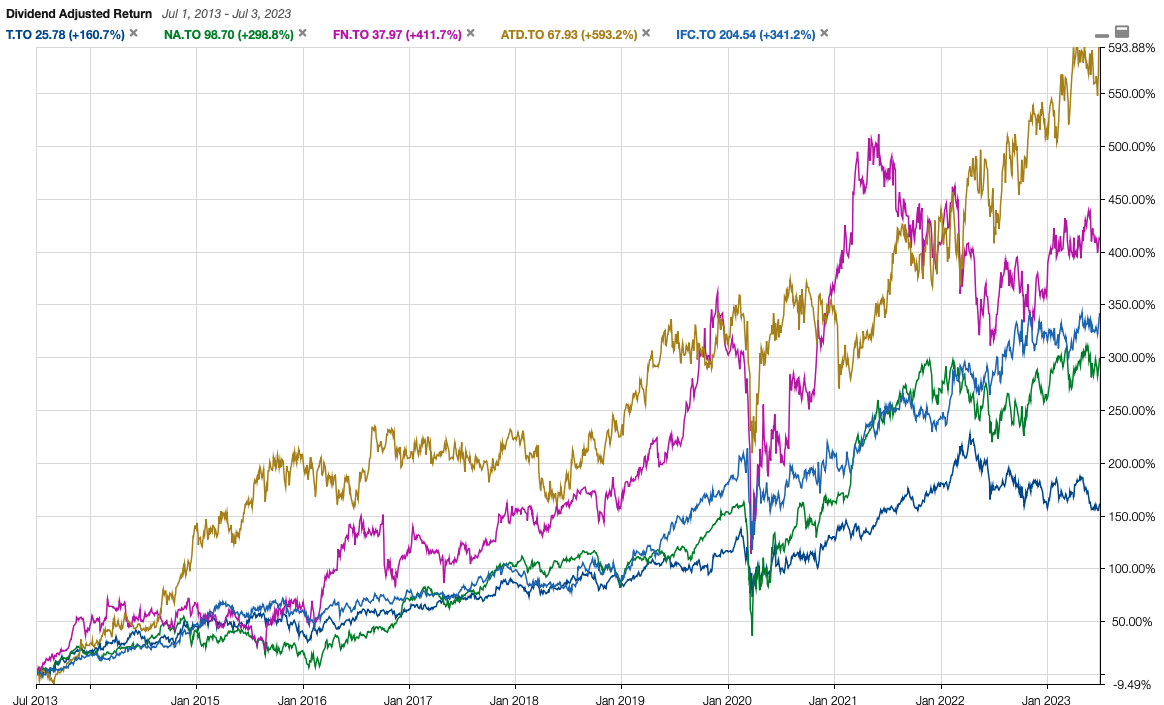

In my wife’s RRSP, I have sold all our Telus shares. While it’s probably a good point to add the company for income (read income), it’s just not performing to my needs, and it has not for many years. It did great over a decade ago, and for now, I see it as an income stock only.

Don’t be fooled. Yes, it pays a good yield and has dividend growth, but the total return doesn’t keep up with other dividend-growth stocks. It’s not hard to find a better investment.

I exchanged the money for USD by selling them as US shares.

I still have a fair bit of money to invest now from those sales. I am just going through my options.

- Add to existing holdings

- Find a new holding

I like my holdings but I also have nearly 10% in some of them. It’s not a big deal but if I don’t have to increase my exposure by finding another great stock, then why not add a new holding for diversification …

Portfolio Management

Diversification is not really a concern these days for me. Even cyclical stocks aren’t something I focus on either. Today’s books don’t cover the economy we are in.

- Globalization changed access to goods but it also created a supply chain issue. No books talk about this.

- The Cold War is now a chip & AI war where restrictions and domestication of services are changing.

I am not trying to predict anything, but the political landscape isn’t what it was. Downside protection isn’t what it used to be.

I don’t think it’s about diversifying across sectors as you probably need to assess the impact of the company against geo-political changes. Think of the production of EV car batteries, we are highly dependent on China. Any tit-for-tat on a political landscape can have a major impact.

Apple working on having production of computer chips in the U.S. is another example.

Dividend Income

My June 2023 dividend income is $2,114.

Here is what my dividend income has been and how I forecast future dividend income. 20.86% is the average dividend growth since 2010.

The dividend growth includes both new money, DRIP shares, and the dividend growth by the companies.

If you want high income, check out the corp account. This retirement account has a yield of 2.17%.

| 2010 | $3,785.87 | ||

| 2011 | $4,742.99 | $957.12 | 25.28% |

| 2012 | $5,650.70 | $907.71 | 19.14% |

| 2013 | $6,270.04 | $619.33 | 10.96% |

| 2014 | $8,108.62 | $1,838.59 | 29.32% |

| 2015 | $10,415.40 | $2,306.78 | 28.45% |

| 2016 | $12,460.67 | $2,045.27 | 19.64% |

| 2017 | $15,475.60 | $3,014.93 | 24.20% |

| 2018 | $18,757.22 | $3,281.62 | 21.21% |

| 2019 | $23,305.32 | $4,548.10 | 24.25% |

| 2020 | $28,285.82 | $4,980.50 | 21.37% |

| 2021 | $26,034.41 | -$2,251.41 | -7.96% |

| 2022 | $32,763.15 | $6,728.74 | 25.85% |

| 2023 | $39,596.62 | $6,833.47 | 20.86% |

| 2024 | $48,458.62 | $8,862.00 | 20.86% |

| 2025 | $59,304.00 | $10,845.38 | 20.86% |

| 2026 | $72,576.65 | $13,272.65 | 20.86% |

| 2027 | $88,819.81 | $16,243.16 | 20.86% |

| 2028 | $108,698.31 | $19,878.50 | 20.86% |