The landscape of investing has changed dramatically over the past few decades. Not only has access improved, but the variety and structure of investment products have evolved as well. Take exchange-traded funds (ETFs), for example—while mutual funds have been around for much longer, ETFs offer a similar purpose with a more modern and flexible structure.

Below is a look at how investing in Canada has changed over time—not just in terms of investment products, but also in how Canadians can access the markets.

A Brief Timeline of Canadian Investing Innovation

- 1993 – ETFs are introduced, creating a new, low-cost way to invest. The concept of index investing gained traction in the early 2000s with the rise of the “Couch Potato” strategy.

- 2010 – Online brokers drop their transaction fees from $29.95 to $9.95. I remember paying $30 per trade at Scotia iTRADE (formerly ScotiaMcLeod) before the banks were forced to lower fees due to new competitors entering the market.

- 2014 – Wealthsimple launches, targeting younger investors and mobile-first users underserved by traditional banks.

- 2021 – National Bank becomes the first major Canadian bank to eliminate trading commissions, responding to pressure from newer online brokers.

- 2021 – Canadian Depositary Receipts (CDRs) are introduced, giving Canadians access to US stocks in Canadian dollars. Their popularity has grown significantly since 2023.

- 2025 – Questrade eliminates trading commissions (with minor ECN fees still applying).

- Now – Both Questrade and Wealthsimple offer fractional shares, allowing investors to dollar-cost average more effectively, without needing to buy full shares.

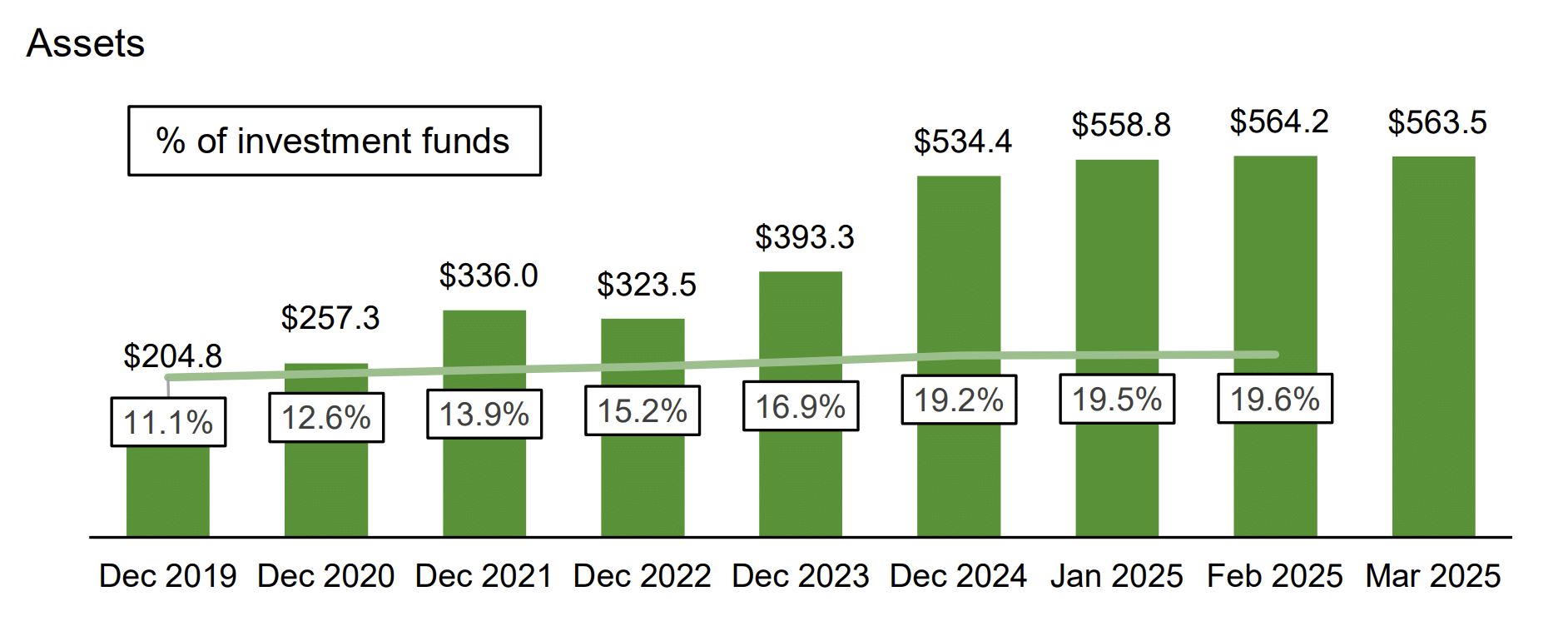

While many of these innovations have been available for years, it takes time for mass adoption. Today, commission-free trades, ETFs, and fractional shares are becoming standard expectations. Just look at the ETF growth in Canada over the past five years (values in billions):

Why Invest in US Stocks?

Adding US stocks to your portfolio can significantly enhance your returns and diversification. With similar economic structures and cultural overlap, investing south of the border doesn’t feel foreign to most Canadians.

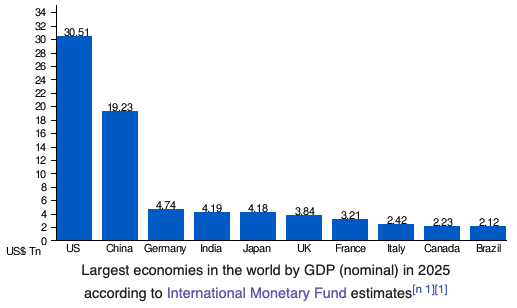

Here’s a comparison of global economies (2025 data via Wikipedia). The difference in scale between Canada and the US is staggering.

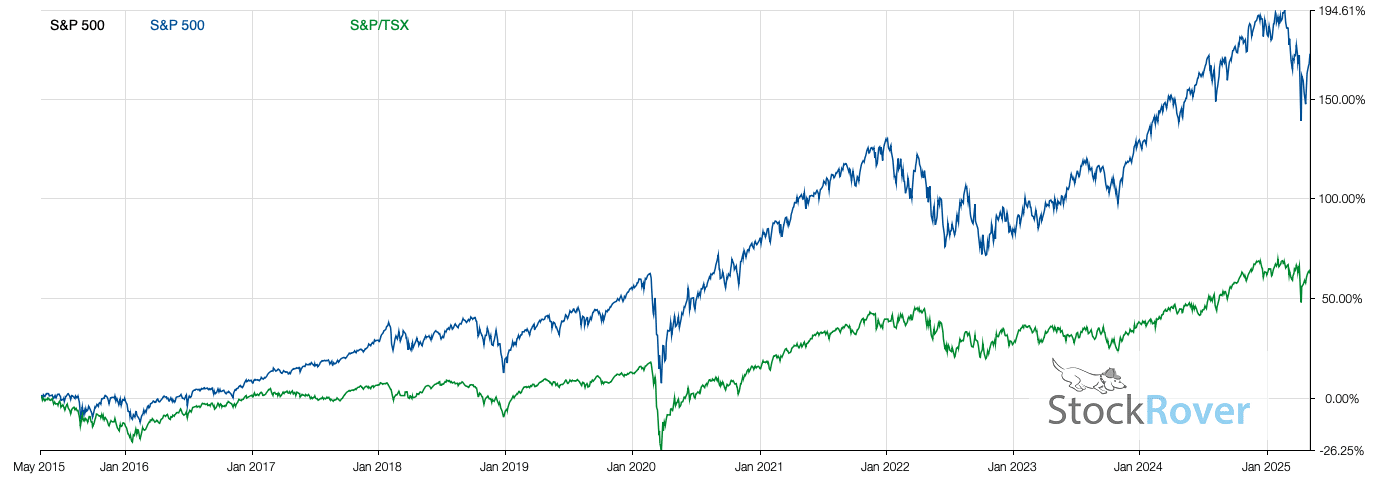

Should you ignore the US stock market? Not if you care about long-term performance. Over the past decade, the S&P 500 has far outpaced the TSX—except during oil booms when Canada briefly shines. Aside from maple syrup (ha ha), the global economy doesn’t lean heavily on Canada.

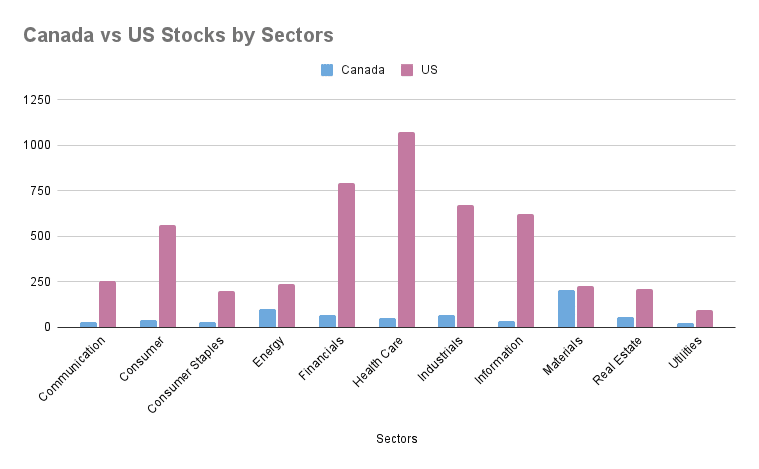

Exposure to US stocks gives you access to industries Canada lacks—such as tech and healthcare. The TSX has only one mega-cap stock compared to dozens in the US. In fact, over 5,000 companies trade on major US exchanges versus about 700 on the TSX.

Sadly, statistically speaking, most Canadian, and retirees especially, will hold many of the stocks in the retirement portfolio sample covering the Canadian market due to the lack of variety.

3 Ways To Buy US Stocks

Let’s look at three main ways you can add US stocks to your portfolio—each with its own pros and cons.

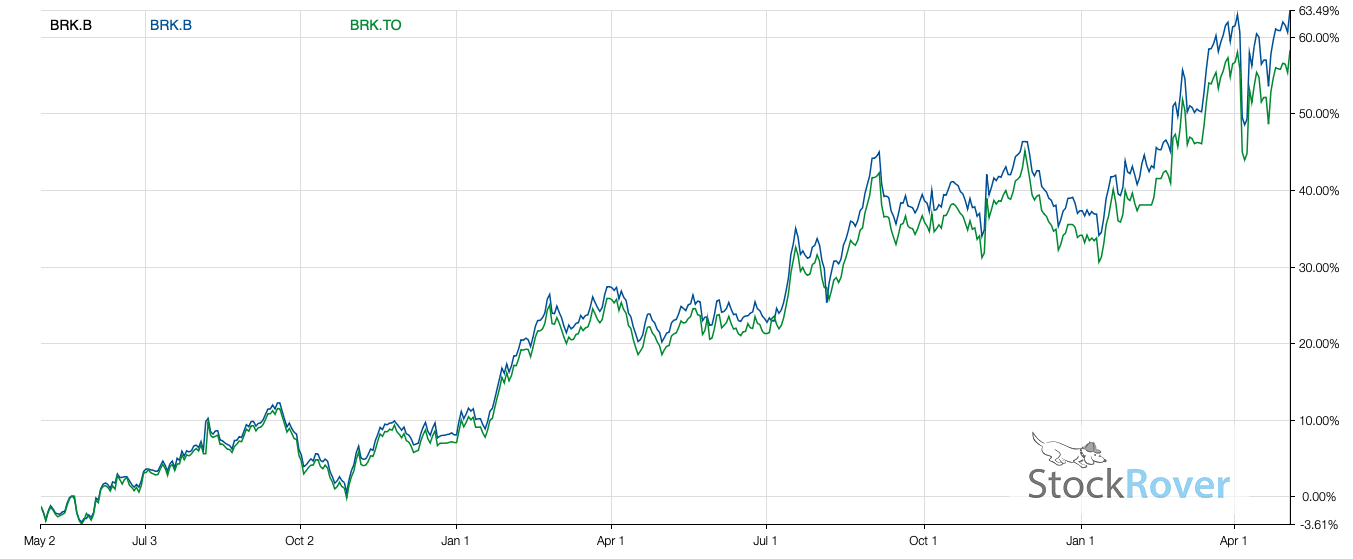

1. The Traditional Way: Buying US Stocks Directly

There are a few requirements to meet before you can hold your US stocks

- A US-dollar trading account (some brokers provide this automatically; others may not).

- To fund your US account with USD, you can:

- Deposit directly from a USD bank account

- Convert CAD to USD via the broker’s currency exchange

- Use Norbert’s Gambit to get a better exchange rate

Once you’re set up, you can purchase US stocks directly. Just remember: holding US stocks means you’re exposed to currency fluctuations, which can significantly impact your returns over time.

2. The New Way: Canadian Depositary Receipts (CDRs)

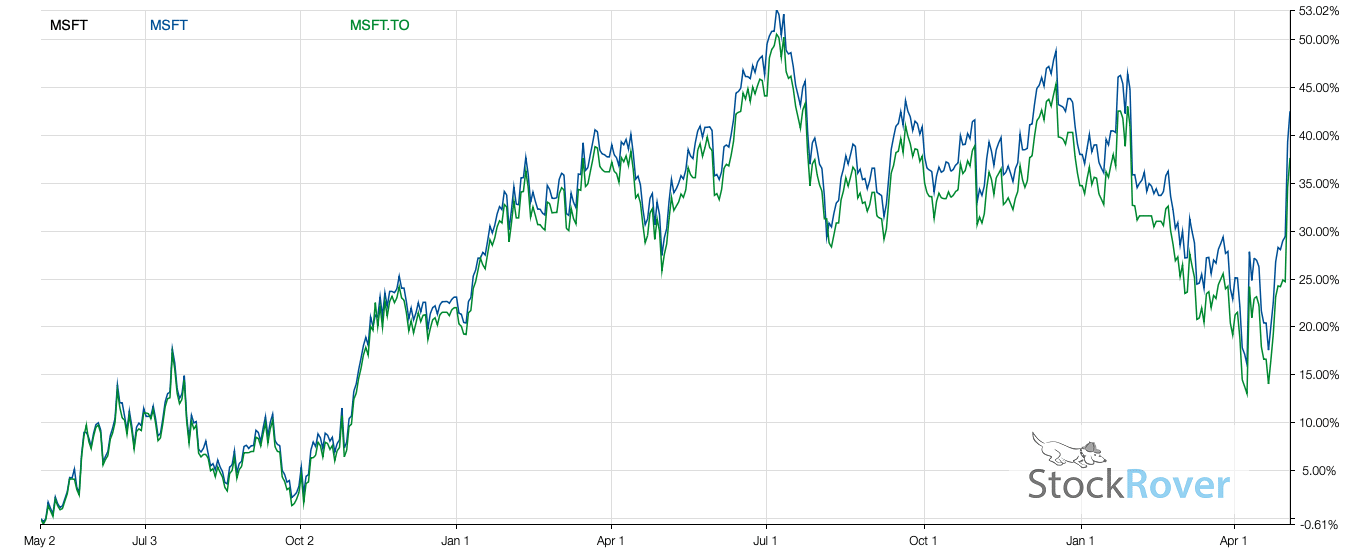

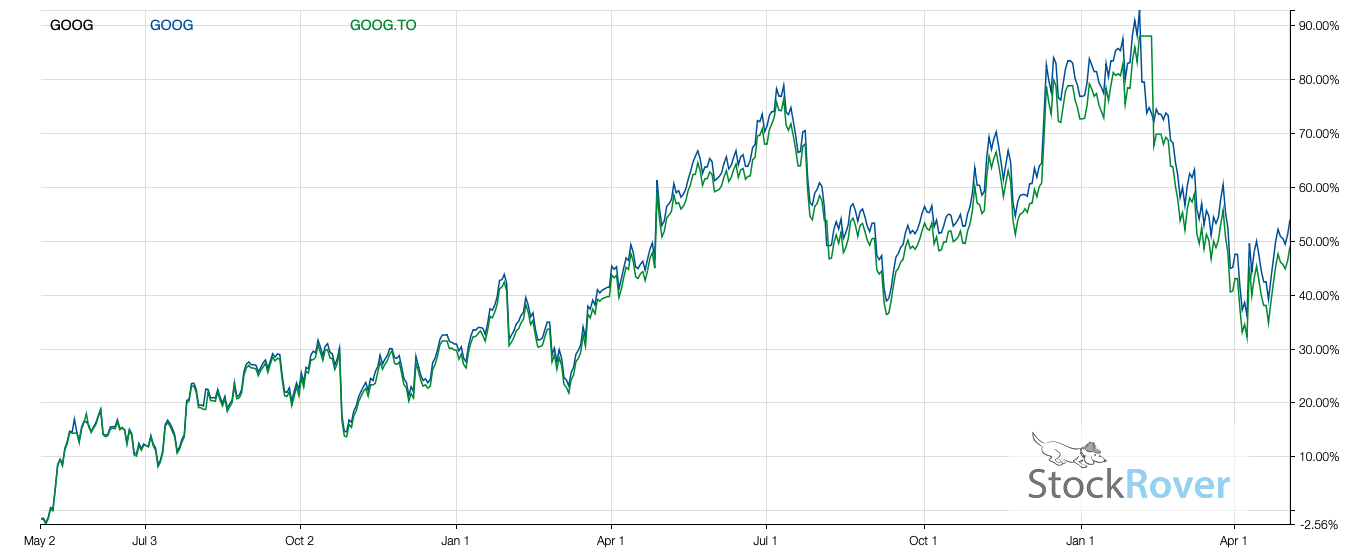

Launched in 2021, CDRs let Canadians buy US stocks using Canadian dollars. These securities are hedged to reduce currency risk and trade like any Canadian stock. Currently, only a selection of major US companies is available as CDRs.

While CDRs offer convenience and hedge currency impact, there’s a small performance gap due to the structure of currency hedging. Still, they’re ideal for investors who want simplicity and less currency exposure.

Depending on where you are in your financial journey, the currency fluctuation is a variable you may not want to deal with. Note that currency trading is a whole different ball game and it can fluctuate pretty quickly.

3. The Proxy Way: ETFs and Mutual Funds

ETFs and mutual funds provide another route to access US markets, offering diversified baskets of US stocks. While you don’t own individual companies directly, the sheer variety of funds now available lets you tailor your exposure by sector, strategy, or risk level.

The challenge? Too much choice. It’s important to do your homework and pick funds that align with your goals.

Final Thoughts

In just the last decade, Canadian investors have gained easier, cheaper, and more flexible ways to grow their wealth. From ETFs and commission-free trading to fractional shares and CDRs, the investment landscape has never been more accessible.

Adding US exposure—whether through direct holdings, CDRs, or ETFs—is a smart move for diversification and long-term growth. Just be mindful of the method you choose and how it fits into your broader financial strategy.

No more excuses. Put your money to work now.