The Piotroski Score, or Piotroski F-Score, is a score between 0 and 9 that helps in finding out the best financially strong stocks, with 9 being the best and 0 being the worst.

It measures a company’s financial strength based on the three most important criteria: profitability, leverage, and operating efficiency.

What is the Piotroski Score?

The Piotroski score was named after Chicago Accounting Professor Joseph Piotroski. He used this metric on high book-to-market firms. According to him, this score could enhance returns when applied together with other ‘value investing’ strategies.

Companies with a Piotroski score of 9 check all nine criteria used to determine the strength of a firm’s financial position. It is a great tool for evaluating value stocks.

Piotroski Score or the F-score checks the financial strength of a company before investing. It addresses important concerns like if the company has made profits and is able to able to generate sufficient cash flow during the current year, its quality of earnings, management’s ability to make a profit by employing total assets, how much of assets are financed by debt, its ability to pay back short-term liabilities with its short term assets, growth without capital dilution, etc.

The Piotroski Score Calculation

- If the company has a positive return on assets / net income in the current year – 1 point

- If operating cash flow is positive in the current year – 1 point

- If operating cash flow is more than Net Income – 1 point

- If return on assets (ROA) > ROA previous year – 1 point

- If leverage or long term debt / total assets in the current year is lesser than the previous year – 1 point

- If the current ratio (current assets / current liabilities) in the current year is lesser than the previous year – 1 point

- If there is no increase in the number of outstanding shares – 1 point

- If gross margin > gross margin from the previous year – 1 point

- If asset turnover ratio > asset turnover ratio from the previous year – 1 point

For every criterion that a company meets, a point is awarded and companies getting a high score of 9 qualify as good value stocks. As you can see from the list above, this score is based on fundamental metrics and are sourced from the latest available financial statements.

Metrics based on profitability are net income, return on assets, operating cash flow in the current year, and cash flow from operations being greater than net income.

Metrics based on leverage include lower long-term debt (YoY), higher current ratio, and lack of dilution ie. no new shares issued in the last year.

Metrics based on operating efficiency are higher gross margin and asset turnover ratio compared to the previous year.

How to Use the Piotroski Score

In simple terms, the higher the score the better:

- A score between 1 and 4 is a bad score

- Between 5-6 is acceptable

- And between 7-9 is great.

An analysis of trends for the Piotroski Score will show prospective investment candidates if there are signs of better profit, cash flow, decrease in debt, improving margins, or vice-versa if profits/ margins have dropped and debt has increased.

Applicability of Piotroski Score

As mentioned earlier, Piotroski Score was devised by Joseph Piotroski to identify better-value stocks. He helped investors differentiate between cheap stocks based on their financial strengths/ weaknesses.

Though value investing is a great strategy, investors need to be careful to pick only financially strong companies and Piotroski Score helps in this direction.

Piotroski Score is applicable for both non-U.S. and emerging markets across various firm sizes. Thus it helps a great deal in solving the problem of investing in deep-value stocks in emerging markets which have become an important destinations for investment in recent times.

Limtations of Piotroski Score

Piotroski Score does not apply to Capex-heavy companies where huge debt is required to run the business efficiently. Companies operating in financial and industrial sectors will be ruled out under this screening metric. Piotroski Score was originally used on companies having high book-to-market ratios.

Companies operating in different industries have different book-to-market bands which makes comparison impossible. Another limitation of the F-score is that it takes into account only the recent performance as it compares the latest numbers to those of the previous year.

Examples of the Piotroski F-Score

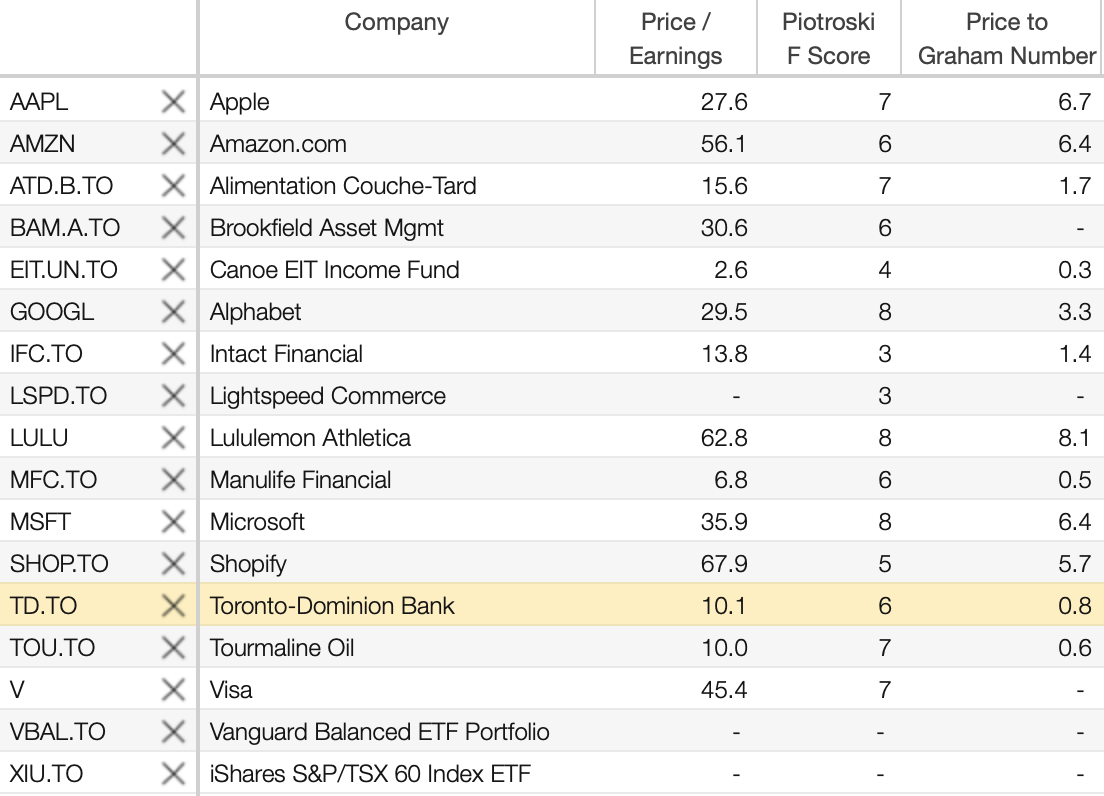

This is how you can filter on the Piotroski F-Score with Stock Rover and use along with the Graham Number if you want.

Where to get the Piotroski Score?

If you like the idea of using the Piotroski Score in your screening process, you will either need to calculate it yourself if you can have access to all the metrics and do that math. Otherwise, some screeners have it ready to use as shown above with Stock Rover.

It’s one thing to know how to calculate it and how to use it, it’s another to insert the number in your filtering and decision process. Save yourself time with a screener.

Should you use the Piotroski Score?

The Piotroski Score is a great tool to find out solid stocks with improving financials, improving margins and strong balance sheets.

However, the Piotroski Score should be used in conjunction with other metrics. Remember all cheap stocks are not necessarily ‘value stocks’ and the Piotroski Score is only one view into the company’s financial strength.

Though it is a useful tool for value investors it cannot be used alone to make investment decisions.

How Dividend Earner Uses The Price to Piotroski F-Score

As with all metrics, they change over time. I don’t use it as a sell indicator or a hold indicator but more so as a tiebreaker after I have narrowed down my search with my own Chowder Score.

Frequently Asked Questions

What is a good Piotroski Score?

A score between 7-9 is considered strong while 1-4 is weak and 5,6 is average.

How do I get my Piotroski Score?

Make a list of the nine valuation metrics as prescribed under Piotroski Score and keep assigning 1 point for each criterion a company meets. Add up the total score to arrive at Piotroski Score.

Or simply use a screener that provides you the data immediately for all stocks.

What are the different factors used in Piotroski Score?

Piotroski Score uses 9 different criteria to value a stock. These are based on:

i) Net income

ii) Return on assets

iii) Operating cash flow in the current year and

iv) Cash flow from operations being greater than net income.

v) Long-term debt

vi) Current ratio and

vii) Number of equity shares

viii) Gross margin

ix) Asset turnover ratio