The recent earning season is not showing an end to the current challenging economic situation. It’s further from that as I believe we are just right in the middle of it.

Don’t be mistaken, big tech companies had plenty of warnings of challenging times ahead. Many slowed down hiring and cancelled projects. The recent earning miss is now going further as the economy is now showing greater challenges.

Interestingly enough, I have not really seen dividend cuts or dividend reductions from companies yet. It’s a bit odd as the news seem to be highlighting a doom economy … but I don’t believe it’s dire if there aren’t dividend cuts …

For those relatively new to a down market, this is where you make your money. As such, there is nothing wrong with selling at a lost to get better future returns. I did just so last month …

For those comparing, my portfolio is bouncing up and down sideways but you should know I have added over $100,000 of new money this year in my taxable account.

Here are my rate of returns.

| Accounts | ROR | Yield |

|---|---|---|

| Computershare | 12.52 | 5.62 |

| Portfolio | 13.30 | 2.10 |

| RBC | 9.64 | 14.83 |

| RBC-S | 12.94 | 4.69 |

| RRSP | 17.13 | 0.71 |

| RRSP-S | 13.60 | 0.90 |

| TFSA | 12.75 | 0.71 |

| TFSA-S | 15.16 | 2.30 |

| TSX | 7.51 | 0.00 |

The TSX above is the simulated index investing strategy based on XIC ETF.

Stock Trades

My cash is all deployed now.

I have essentially taken two full positions in the last month.

Income Account Trades

The focus of this account is to have a yield above 4% with moderate dividend growth.

- Fortis had two transactions in October for a near full position. I was not sure if I would add to Fortis with my second transaction but I decided to do so even though Emera got beaten down.

Since it’s all in Canadian dollars and invested in Canadian Blue-Chip stocks, I also need to diversify within industry (i.e. the competitors) as the picking is slim … I don’t invest in energy or basic materials or REITs stocks so that leaves the usual Canadian holdings; financials, utilities, and telecoms.

Why I don’t hold BCE? I am not a big fan of the sports business venture they have and the television and radio broadcasts – have you seen what your kids watch? or listen to?. They operate like a bond with a stable income and asmall dividend growth, and would rather some stock growth potential.

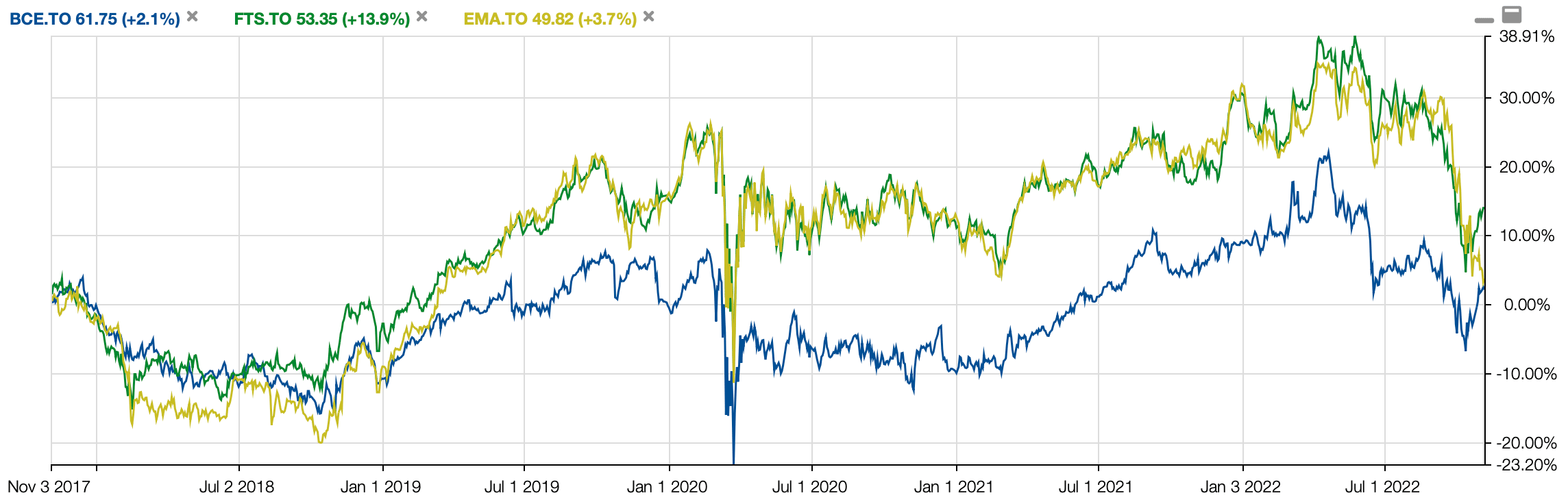

Look at the stock price performance. BCE has no growth in 5 years.

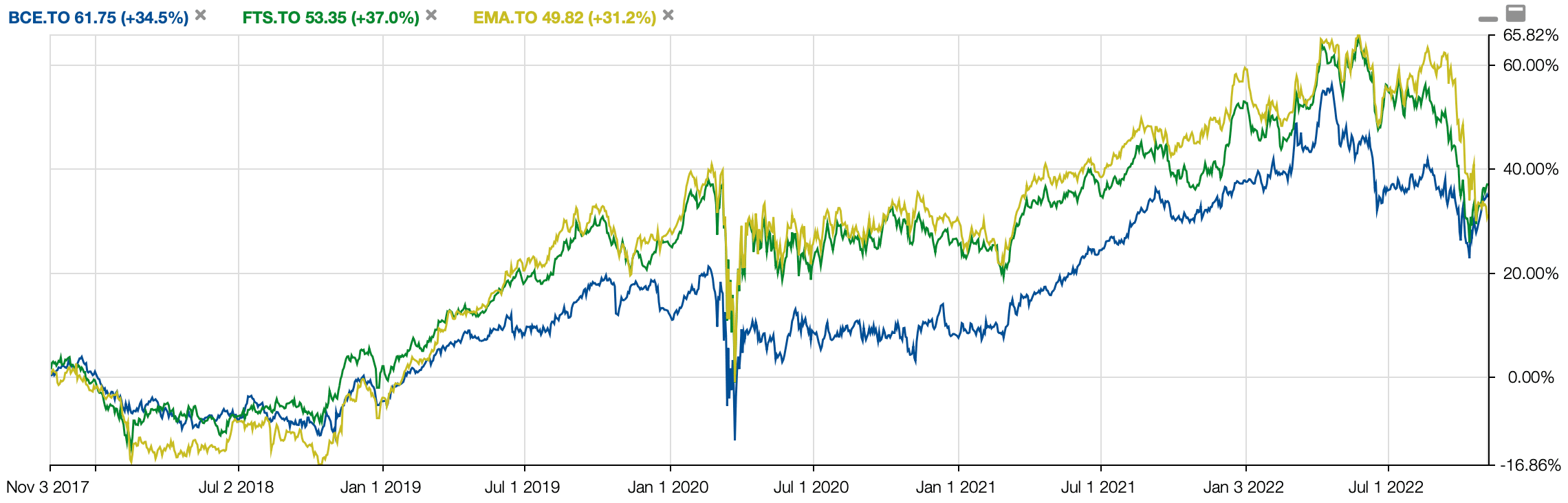

Now with dividends re-invested in the same stock, BCE saves face a little. This is what I mean by a bond stock.

However, as you can see, utilities generally have done better.

Dividend Growth Account Trades

These accounts are more focus on total returns while leveraging dividend growth investing as a strategy.

- I took a full position in Google after selling some Visa in my TFSA and selling Disney in my wife’s RRSP.

This transaction isn’t really a dividend investment but like I mentioned earlier, these markets are ripe with oppotunities. I am not thinking about the next quarter or winning the next two quarters, I am thinking about 5 years from now.

Portfolio Management

While I do track my sector allocation, the industry exposure is what I look at. For more on sector diversification, read my thinking on it here.

It should be telling what my exposure to the Canadian market is, and it’s invested in 12 stocks. Yes, 12 Canadian dividend stocks make up my portfolio, and a lot of it in the financial sector.

Dividend Income

My October 2022 dividend income is $1,558.

Don’t spend time balancing your monthly income. It should not matter as you should have a year or two in cash as a safety net. Plan your retirement safely as not having cash on hand can have a major impact on your retirement.