The biggest mistake I made when I started investing is thinking investing is the same at every age. At the time, I settled on dividend investing as I could see the dividends paid and extrapolate the dividend income over time. That thinking is pretty much what dividend income investing is and that was a mistake back then.

The strategy works when you need income but it’s not efficient when you need to grow your portfolio. You cannot have income and appreciation together. In the stock market, it’s an inverse relationship between the two.

With respect to investing strategy, there are 2 major investing life events if not 3. I called them:

- The startup phase (entrepreneurs willing to lose it all)

- The accumulation phase

- The retirement income phase

Back in 2008, I said goodbye to my financial advisor and mutual funds and settled for dividend income trying to build a monthly income only to realize 4 years later with more investing knowledge that the strategy was really for the retirement income phase.

I switched to dividend growth investing and my portfolio saw a significant value appreciation and the dividend started increasing faster too. With that said, it’s only generating 2.5% in yield as opposed to the 4% an income portfolio could be generating.

Unfortunately, when you start approaching the magic retirement number you set for yourself, the transition is not black and white. More on that in the portfolio management section.

As you read through, you will noticed detailed graphs built from all the data I track to monitor and manage my portfolio. Just like an airplane pilot needs its instruments to navigate in the air, I need my investment data to manage my portfolio. Don't manage your portfolio blindly hoping for results, you'll be sorry later.

Stock Trades

I tend to have Canadian and US dollars in various accounts from time to time and based on the account, I have certain rules I follow.

With the banks being lower recently, I added to TD Bank, and I initiated a position in Algonquin Power & Utilities Corp and Fortis. My holdings in Brookfield Infrastructure and Emera are pretty large and did not want to add to those.

To classify those holdings, they are core holdings with mid-growth and mid-income level expectations but they all border the high-income as I consider above 4% a high income.

In short, there is no perfect way to build a portfolio. You do your best based on the assumptions you make. I’d like to say I have hard rules but I don’t have except I find I have too many holdings.

Take Emera in my TFSA, it provides me with 11.85% annual ROR which is great when you think about it but it’s also the lowest performing stock in that account !!! My new $6,000 TFSA contribution is earmarked for XQQ (the Nasdaq100).

Portfolio Management

Transitioning from a dividend growth portfolio to a dividend income portfolio isn’t black and white either.

Let’s consider the 60/40 stocks and bonds ratio that has long been advocated. It doesn’t work in the low-interest-rate environment we are in. That’s why utilities are REITs are replacing bonds for many retirees. When you consider that, was it about safety or income? Well, it was always about both as in the end, nobody can afford to have dead money.

Why do I still have utilities, and banks in my portfolio? They are not dividend growth stocks in my book. Well, those stocks are like my bonds. It provides my portfolio with a stable foundation.

The ACCUMULATION PHASE is where you should make your money work for you and grow your nest egg as big as you can. It’s not about the dividend income!!!

The RETIREMENT PHASE is where you should live from your income and generating income is the goal. I chose to go for dividend income to avoid depleting my portfolio.

The challenge I have is the timing of my transition to income. I feel I started my transition a little too early now with stocks like AT&T and IBM.

My holdings between income and growth look as follows now.

| wdt_ID | Dividend | No Growth | < 6% Growth | > 6% Growth | > 10% Growth |

|---|---|---|---|---|---|

| 2 | None | 6.90 | 0.00 | 0.62 | 0.00 |

| 3 | Yield < 2% | 5.49 | 0.00 | 13.19 | 47.54 |

| 4 | Yield > 2% | 0.00 | 0.00 | 11.71 | 4.64 |

| 5 | Yield > 4% | 0.00 | 0.00 | 6.26 | 0.00 |

| 7 | Yield > 6% | 2.53 | 0.00 | 1.12 | 0.00 |

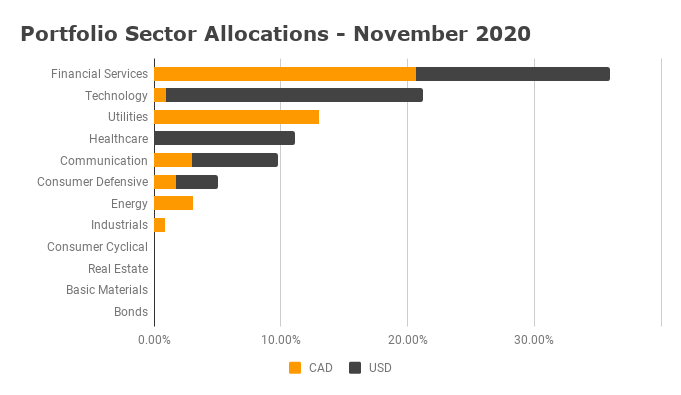

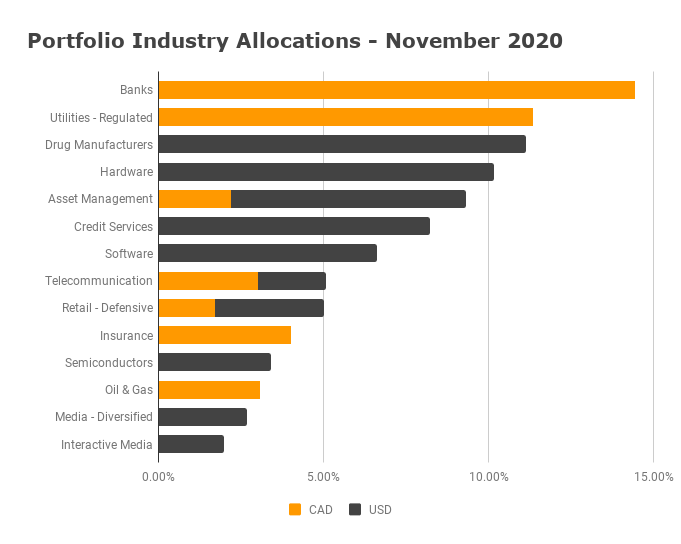

Here is how my sector and industry allocation shape up. My advice, focus on industry allocation, sectors are too wide.

Dividend Income

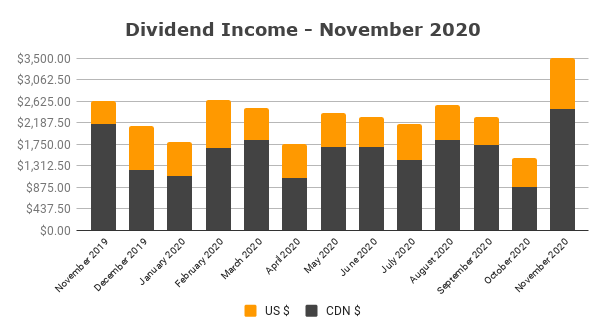

The tally for November is at $3,499 which includes income I would normally have had in October.

Here is the overall portfolio dividend income contribution by accounts:

| Accounts | Income % | Value % | Taxes |

|---|---|---|---|

| TFSA | 17.54% | 21.69% | No Taxes |

| RRSP | 30.98% | 53.23% | As Income |

| Taxable | 47.20% | 25.08% | Capital Gains, Dividends |