So far, my dividend growth investing strategy has prevented my portfolio from dividend cuts except for The Walt Disney Company. Considering there are so many Canadian companies that cut their dividends, it should be an important learning around dividend investing.

World news, employment news and market news are all polarizing. The markets continue to make new highs in this V shape recovery but will we see a W shape at some point? That depends on the sector, industry or companies. This makes it even more critical that you understand the companies you are investing in.

Be careful about using the term I am investing for the long term, I am fine. A flat performance for 5 years is money not at work. You invest to make your money work for you so make sure you invest it in a company that will make it work. If all you get is a 5% dividend yield, make sure you know that. I stopped investing in REITs because all I was getting was the unit distribution and I switched to focus on dividend growth so I could get the yield (however low) plus the stock growth.

To date, my annual rate of return is 12.98% – thanks to dividend growth stocks!

As you read through, you will noticed detailed graphs built from all the data I track to monitor and manage my portfolio. Just like an airplane pilot needs its instruments to navigate in the air, I need my investment data to manage my portfolio. Don't manage your portfolio blindly hoping for results, you'll be sorry later.

Stock Trades

I am sitting on some cash (3%) waiting for an opportunity to buy but the V-shape recovery of many of my US holdings happened too fast. It’s fair to say that the Canadian and US markets are not recovering at the same pace.

I added shares to the following holdings:

- Royal Bank

- TD Bank

- Telus

- Master Card

As I outlined in a recent newsletter, I did take a position in what I call Millionaire Maker Stocks. Those Millionaire Makers are technology stocks for online shopping, connecting customers and working from home. The unknowns and shift in technology usage is an opportunity to profit with a tiny position. Yes, they don’t pay a dividend but only a tiny portion of my portfolio is assigned – namely 2.76%. I expect it to grow higher as they go up in value.

I bought some shares of Shopify and Twilio. Yup, bought it on the way up and both are already up 40%. You can’t look at these stocks the same way you look at a bank. It’s all about the potential.

Portfolio Management

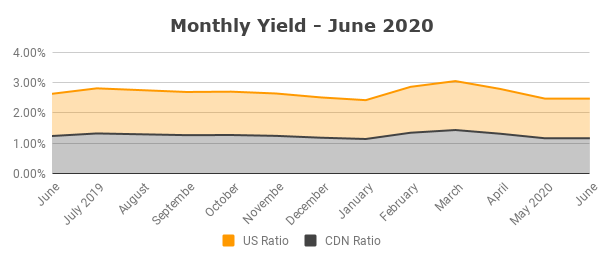

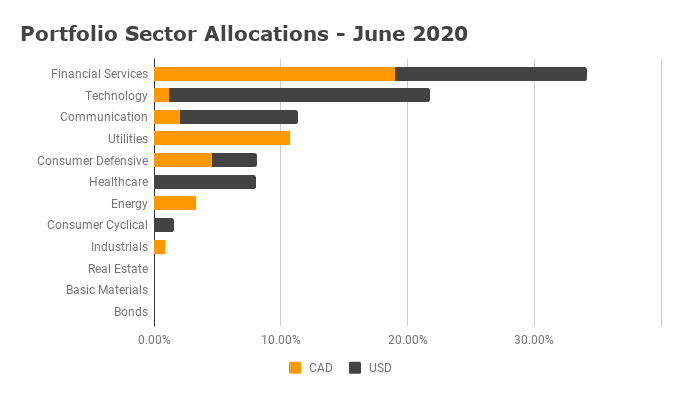

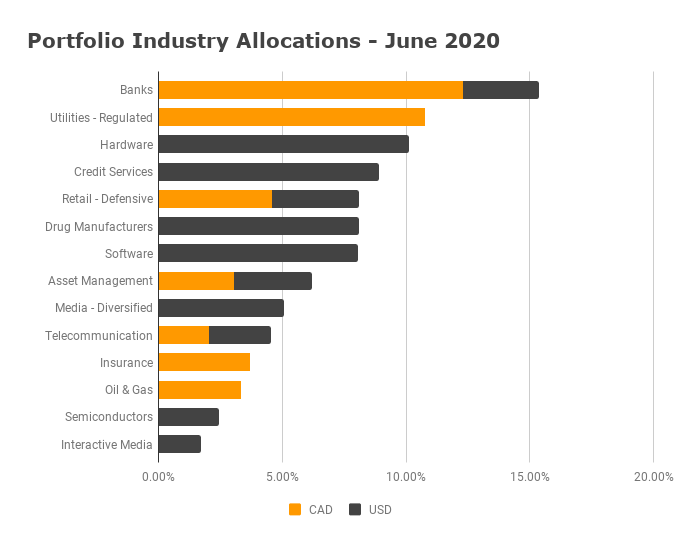

The ratios below have been pretty consistent. you can see where Canadian stocks or US stocks are favoured in my portfolio. Even with my financial ratio at a third of my portfolio, I am not impacted by the economy it would seem.

Dividend Income

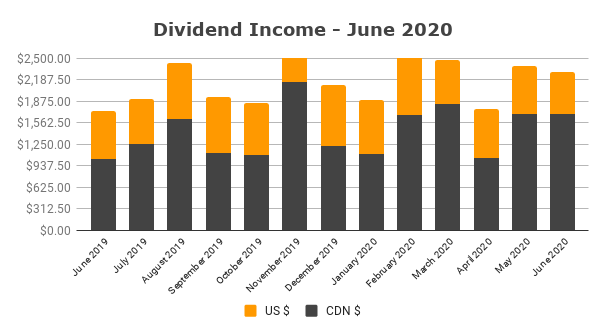

My June dividend income is at $2,306. Nothing special to report this month. Many of my holdings have over $20K and I can DRIP shares with many of my holdings which puts compound growth at work. The new shares increase my dividend and the future dividend growth will also increase it.