I finally finished looking into what my retirement portfolio should look like to increase my dividend income while not sacrificing dividend growth for inflation. The basic of my retirement portfolio is shared as a model retirement portfolio.

I have also shared my magic retirement number. It’s the number I want to reach to start a new chapter and quit work or transition to part-time.

Stock Trades

June was a consolidation month. Based on where I have money and what the opportunities are, I usually buy the best from my short list. With that said, it’s not always the best approach to DRIP shares since the dividend might not be enough to buy 1 share.

In June, I did the following:

- I consolidated some investments to support DRIP with TD Bank, Royal Bank and Emera.

- I took some Visa profits and bough AT&T

- I added to National Bank and increased my position.

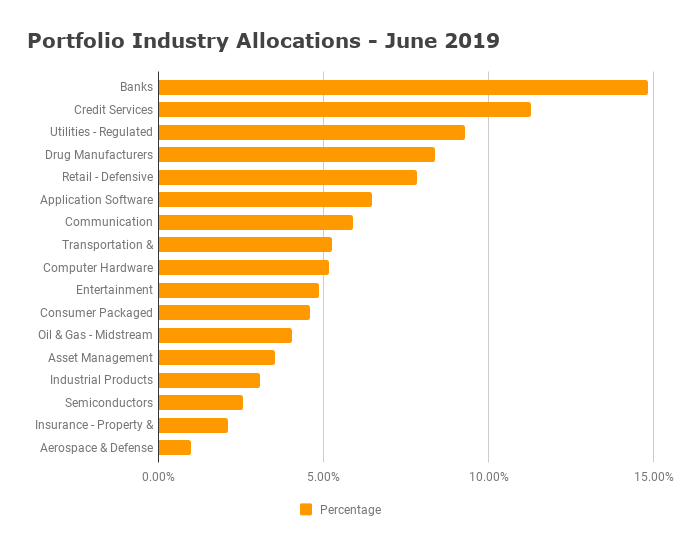

A full position for my portfolio is when the stock reaches 5% of my portfolio weight. If it goes above 5.5%, I will consider taking profits as I did with TD Bank.

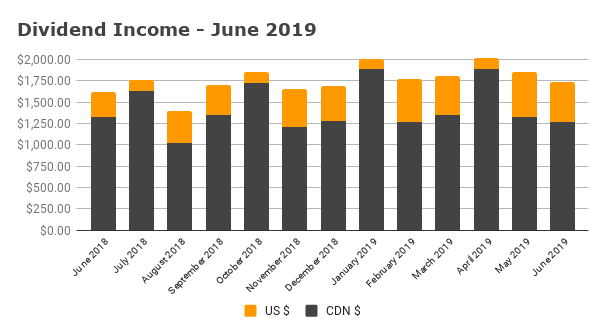

Dividend Income

My June 2019 dividend income is $1,732. My portfolio will undergo a shift in the types of assets over the next 5 years. For the last 5 years, I was focused on high dividend growth stocks with a chowder score about 12% or more if it made sense. Those holdings would usually have a lower yield but a significant growth in both the dividend and the stock.

My strategy will now shift towards higher yield stocks and a lower dividend growth. A stock with a 4% dividend yield and a 4% dividend growth will work well. That would lead to a chowder score of 8%. Fee free to look at my holdings, I update the list monthly.