July marks the first month that I have officially identified my stocks for a retirement income portfolio. I have shared what the basic of my retirement portfolio will be with the following model retirement portfolio.

I have also shared my magic retirement number ($1,777,777). It’s the number I want to reach to start a new chapter and quit work or transition to part-time.

In trying to show how I transition from a dividend growth portfolio to a dividend income portfolio, I have put together the following grid and I admit, this grid would have been great to have years ago. Dividend yield and dividend growth are two numbers companies subscribed to as per their policies which allows us to map them in a grid.

This is what a dividend growth portfolio looks like. 48% of the portfolio, before making changes, was in high dividend growth stocks and 42% was in medium dividend growth. REITs are low growth and I have none.

| wdt_ID | Dividend | No Growth | < 6% Growth | > 6% Growth | > 10% Growth |

|---|---|---|---|---|---|

| 2 | None | 6.90 | 0.00 | 0.62 | 0.00 |

| 3 | Yield < 2% | 5.49 | 0.00 | 13.19 | 47.54 |

| 4 | Yield > 2% | 0.00 | 0.00 | 11.71 | 4.64 |

| 5 | Yield > 4% | 0.00 | 0.00 | 6.26 | 0.00 |

| 7 | Yield > 6% | 2.53 | 0.00 | 1.12 | 0.00 |

In the dividend income portfolio phase, I still need dividend growth to keep up with inflation. The dividend income has to grow alongside or faster than inflation and that still comes from dividend growth.

Stock Trades

Since I officially have a retirement timeline, my strategy now is to primarily buy dividend income stocks.

In July, I did the following transactions:

- I dropped BDX.

- I added Verizon.

- I took some profits with Master Card and Costco

- I bought more National Bankworking towards a full position.

- I bought more Telus working towards a full position.

- I bought more Emera completing a full position.

A full position for my portfolio is when the stock reaches 5% of my portfolio weight. If it goes above 5.5%, I will consider taking profits.

I consult the Dividend Snapshot Screeners before making any transactions. I review the data and key metrics that relate to my investment goals. Dividend Growth plays a significant part in all my transactions and I can review the 3, 5 and 10 year growth alongside the revenue.

You cannot find those data points for free outside of building it from earning reports. At some point, DIY investors will need to realize that access to data is critical and you will need to spend a bit of money to save yourself time. Don’t be at a disadvantage, outperform the market with access to data.

Dividend Income

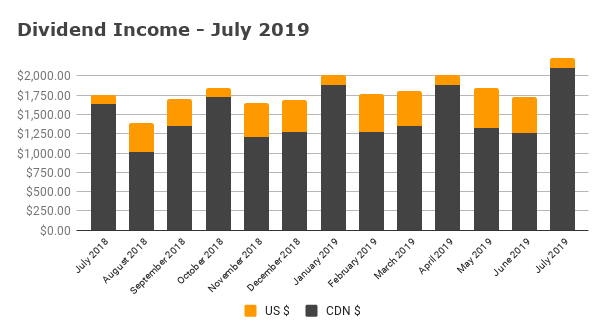

My July 2019 dividend income is $1,732. My portfolio will undergo a shift in the types of assets over the next 5 years. For the last 5 plus years, I was focused on high dividend growth stocks with a chowder score about 12% or more if it made sense. I am now adding holdings with a higher dividend yield. The dividend income should grow faster as I transition to higher yield while slowing down the portfolio growth.

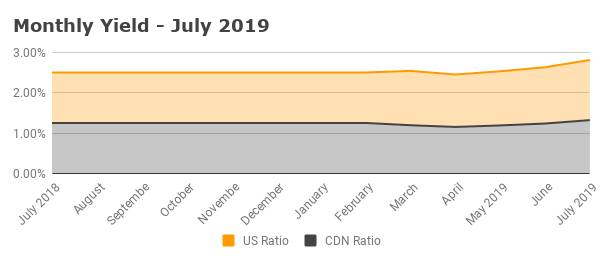

I am going to start showing what the dividend market yield of my portfolio looks like as I transition to a dividend income retirement portfolio.