Happy new year to everyone.

202 has definitely been challenging mentally as normal day-to-day habits were upended along with the challenges from being separated from friends and families. Moreover, some families have had hardship due to health impact. I sympathize with you all and I wish you a much better year ahead. Stay strong.

On the economic front, while all signs were pointing towards a recession prior to the pandemic, the arrival of the virus has certainly been a catalyst for many changes in the investing world.

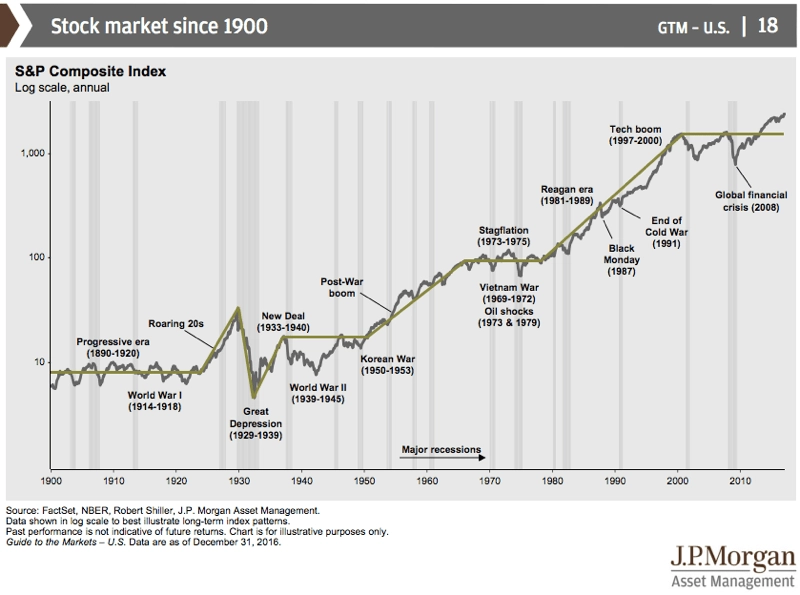

I want to remind investors that while a pandemic is a one in a life time event, stock market crashes or pull backs are more prevalent. In fact, recessions are cyclical and that’s why we classify sectors as cyclical and defensive due to their behaviours during recessions and market pullbacks.

See below for all the stock market pullbacks since 2009. You need to be ready for one at any point without sacrificing growth and that’s why you need to know why you own a stock and do a portfolio stress-test.

With the funds I had, I purchased the following stocks which was mostly adding to existing holdings.

- Canadian National Railway

- Intact Financial

- Apple

- Microsoft

- Visa

- The Walt Disney Company

- ISHARES NASDAQ 100 INDEX ETF CAD HEDGED

- Twilio

- Amazon

My 5% of millionaire makers is set now. I also drop all Enbridge from my RRSP account. It broke even after 10 years including DRIP shares and I don’t need the income at the moment.

I also dropped all of my Cisco as a failed 5G investment.

Overall, the impact is a lower expected annual dividend for 2021 today but I expect the dividend growth and new capital will bring me back up.

Portfolio Management

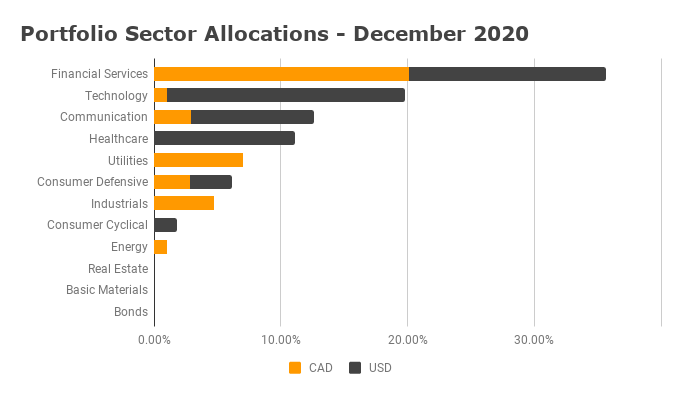

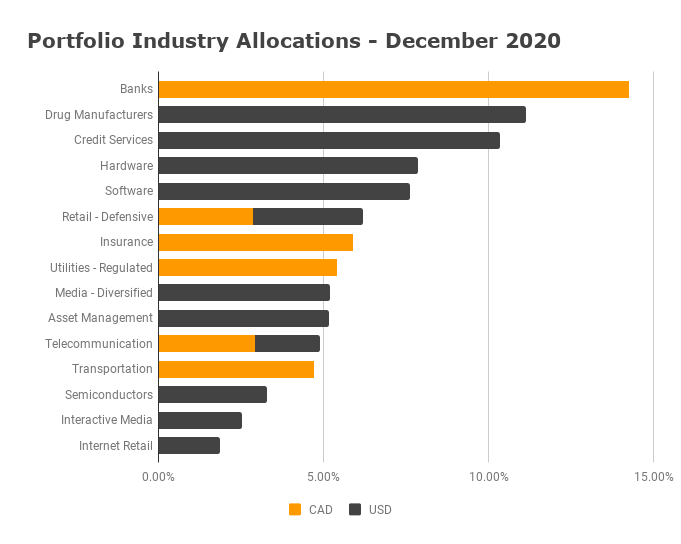

This is how my holdings are spread across the dividend yield and dividend growth now. To date, almost 55% of my holdings are in USD. The Canadian market has limited options that can easily be complemented with ETFs.

| wdt_ID | Dividend | No Growth | < 6% Growth | > 6% Growth | > 10% Growth |

|---|---|---|---|---|---|

| 2 | None | 6.90 | 0.00 | 0.62 | 0.00 |

| 3 | Yield < 2% | 5.49 | 0.00 | 13.19 | 47.54 |

| 4 | Yield > 2% | 0.00 | 0.00 | 11.71 | 4.64 |

| 5 | Yield > 4% | 0.00 | 0.00 | 6.26 | 0.00 |

| 7 | Yield > 6% | 2.53 | 0.00 | 1.12 | 0.00 |

Disney is the outlier and increasing my no dividend holdings. It used to pay a dividend semi-annually and it is suspended now. Since I have almost 5% in DIS, it bumps the no dividend grouping.

I don’t expect Disney to pay a dividend until the parks are fully open and back to normal whenever that is.

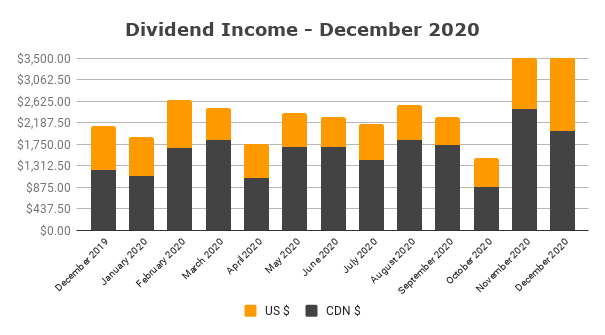

Dividend Income

My December 2020 dividend income was the benefit of a nice special dividend from Costco. The total amount is $3,534 with a $700 special dividend.

The annual dividend income is $29,059 which is a 22.29% increase over the previous year including all the dividend paid from new capital.