With many fixed-income investors looking at dividend investing to bridge their income gap, many focus on dividend yield rather than dividend growth investing. It can be a mistake that will cost them dearly.

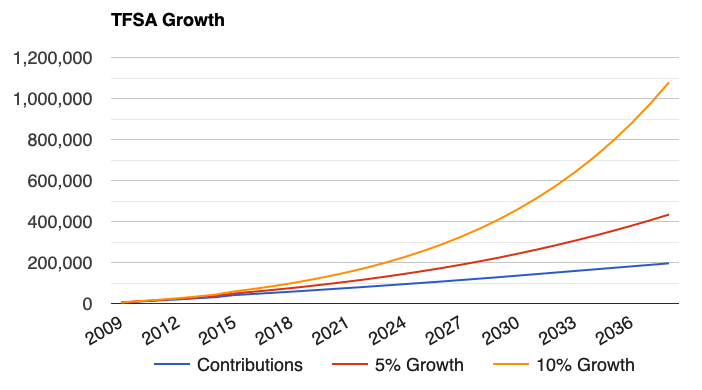

Don’t overlook the importance of investing in solid dividend growth stocks. My annual rate of return (ROR) since 2009 has been over 12%, beating the meager 6% return of the Canadian Index.

It means I can double by money in 5 years whereas you need 12 years with the Canadian index. It’s a big difference in working years to reach your retirement number.

There are two distinct investing phases (Accumulation & Retirement Income). The accumulation phase is where you build and grow your wealth; the retirement Income phase is where you live from your income and portfolio.

I have a tool that can help organize your portfolio below to see the relationship between your holdings and dividend yield and dividend growth.

Each phase requires a different strategy. While dividend investing can be done in many different ways, dividend growth investing is a powerful approach worth using in during the accumulation phase.

While focusing on the dividend yield may satisfy the need for receiving regular income, it may come with the sacrifice of long-term stock growth and prevent your retirement portfolio from reaching the size you need.

Dividend Yield is looking at returns today while Dividend Growth is looking at future growth.

Tribulations of a Dividend Growth Investor

As a dividend investor, you will explore a few ideas during your investing journey.

One of them is going to be to buy a dividend stocks before the ex-dividend date only to sell after and repeat just to cash in on more dividends. That usually doesn’t last long … It’s a lot of work for little payoff.

You will go through the idea of just buying high-yield stocks, REITS, or specialized funds only to find out that the yield is great but the capital isn’t going anywhere.

Another one is to try the Dogs of the TSX and get the highest yield within the largest market cap stocks on the TSX.

Once you do enough investing in the Canadian market, you will soon realize that there are many more dividend growth stocks in the US that offer better opportunities. You will have to make the decision to exchange your Canadian dollars for USD and get over the exchange rate.

Dividend Growth Investing Concept

The concept is pretty simple, but to start with, as an investor, you will need to realize that you may be eliminating high-yield stocks. If you look at my portfolio, I have a limited amount of high-yield stocks.

| wdt_ID | Dividend | No Growth | < 6% Growth | > 6% Growth | > 10% Growth |

|---|---|---|---|---|---|

| 2 | None | 6.90 | 0.00 | 0.62 | 0.00 |

| 3 | Yield < 2% | 5.49 | 0.00 | 13.19 | 47.54 |

| 4 | Yield > 2% | 0.00 | 0.00 | 11.71 | 4.64 |

| 5 | Yield > 4% | 0.00 | 0.00 | 6.26 | 0.00 |

| 7 | Yield > 6% | 2.53 | 0.00 | 1.12 | 0.00 |

Putting that limitation aside, the primary data point to look at is dividend growth. You want to ensure the dividend stock you are interested in grows its dividend regularly and at a good dividend growth rate. That’s what makes dividend growth investing safe.

Utility stocks do not usually exhibit a high dividend growth rate since their business growth tends to be regulated and slower. Just having increased dividends for over 25 years does not mean you have good growth, either. It means you can rely on it for income.

Assuming the company maintains its dividend payout ratio within its guidelines, what we see is both dividend growth and stock appreciation when the corporation is able to grow its bottom line.

One way to visualize it is by comparing the EPS and the dividend paid. When both increase together, the stock shows significant strength in growing its bottom line, and the stock will also appreciate. As an investor, you win on two fronts:

- Dividend Growth (Accelerate your compound growth if you DRIP )

- Stock Appreciation

Have a look at Canadian National Railway as an example.

The payout ratio stays within the range, implying the dividend is not growing faster than the earnings. The yield is also relatively stable, which implies the stock price is growing along with the dividend growth.

With increasing earnings, the price also grows and somewhat exhibits the same pattern as the EPS, which leads to a relatively consistent dividend yield.

In the case of CNR, the dividend yield is usually below 2%, but CNR has a really good dividend growth rate.

- 3-year dividend growth: 12.75%

- 5-year dividend growth: 16.54%

- 10-year dividend growth: 15.59%

Selecting Dividend Growth Stocks

Step 1 – Annual Dividend Growth

Make sure the company has increased its dividend annually for a number of years. The Canadian Dividend Aristocrats have a 5-year minimum, while the US Dividend Aristocrats have a 25-year minimum.

I like ten years as a minimum, as it usually means it has gone through at least one economic recession. You can see the Canadian Dividend Achievers for that list.

As a first step, you can start with one of those lists or just filter from any lists you can access.

Step 2 – Compounded Annual Dividend Growth Rate

Even if you have increased your dividend every year, the growth rate of the dividend increases might not match what you want. A 1 cent increase will allow the company to be included in the dividend aristocrats list, but it doesn’t offer a significant growth rate.

Choose the dividend growth rate you want to target. I am targeting 10% but I am ok with over 7%.

This data point might be harder to get from free services. You should also decide how far back you want to look to establish the growth rate.

Again, I like ten years and then I look at 3 and 5 years to see if there is consistency. The Dividend Snapshot Screener provides 3, 5 and 10-year CAGR dividend growth rates.

When both steps are combined, you are left with a strong list of dividend investing options. There are currently 20+ Canadian dividend stocks matching the criteria of 10 years of consecutive dividend increases with a 10-year average of 10% or more.

Many of the stocks are blue-chip dividend stocks as well. The end result of holding many of the stocks matching those criteria is a predictable dividend stock portfolio.

How To Leverage Dividend Growth Investing

Investors often see a strategy with one lens, but there are multiple ways to view dividend growth investing.

As you can see from the table below, just like the yield, dividend growth is also broken down into categories.

| wdt_ID | Dividend | No Growth | < 6% Growth | > 6% Growth | > 10% Growth |

|---|---|---|---|---|---|

| 2 | None | 6.90 | 0.00 | 0.62 | 0.00 |

| 3 | Yield < 2% | 5.49 | 0.00 | 13.19 | 47.54 |

| 4 | Yield > 2% | 0.00 | 0.00 | 11.71 | 4.64 |

| 5 | Yield > 4% | 0.00 | 0.00 | 6.26 | 0.00 |

| 7 | Yield > 6% | 2.53 | 0.00 | 1.12 | 0.00 |

- Over 10%: Aggressive dividend growth; those are stocks with a focus on growth.

- Over 6%: Moderate dividend growth, usually from blue-chip stocks with a dominant control in their areas.

- Under 6%: Slow dividend growth, those stocks can struggle to keep up with inflation. They tend to be coasting … They often advertise higher yield too.

It’s not one category or another; it’s about understanding them and building your portfolio accordingly.

For example, Canadian banks are in the ‘Over 6%’ category and can be a great foundation for your portfolio, but where do you go from there?

Your portfolio needs to achieve one of those, or both, if possible:

- Grow your portfolio. Build the largest nest egg you can to achieve financial independence

- Grow your income. You need to keep up with inflation in retirement; otherwise, your purchasing power will decrease over time.

I try to avoid the last category if I can unless it’s strategic.

DRIP Is Not Dividend Growth

DRIP allows your investments to compound, and you should DRIP whenever possible. While the DRIP shares give you more dividends, that’s not dividend growth.

You either DRIP within the same stocks or just re-invest the proceeds into another dividend-paying stock, but the latter is usually expensive as you incur a trading expense.

You Want DRIP + Dividend Growth

When it comes to compounding and total returns, you want to DRIP your dividends and a good dividend growth to buy more shares with a DRIP.

When you compound, your returns will show the results, and you can reach your retirement number much faster. With good compounding, you can save years of hard labour.

Sanity Check Your Dividend Stocks

We often talk about how high yield stocks can be risky, the same can be said about low dividend growth stocks.

Those companies are not risky from a lost perspective, they are detrimental to your long term investing strategy regardless of where you are in your journey.

REITs, in my opinion, often fall in the bad spot for risky yield and low dividend growth, yet, many DIY investors flock towards REITs because of the real estate assets …