Numbers can be manipulated to tell the story you want to tell. It’s done repeatedly, so you need to do your homework. Always double-check the numbers and source of data.

When discussing investments with readers, all the conversations should be grounded by facts and data, but I usually get the following questions.

- Is Beat the TSX a good strategy I can follow? It seems to beat the TSX index …

- My portfolio is not keeping up with the index this year. Should I change my approach? Why are you looking at a one-year window?

- The dividend snowball approach with high-yield stocks increases my yield on cost over time, where I can reach a high yield on cost after many years.

The History of Investment Benchmarking

It’s probably a bit far-reaching to call this the history of benchmarking, but read on to capture its essence.

As Canadians, we often hold the same dividend stocks, including the banks. It’s our bias to invest locally. But why do we choose the TSX as a benchmark? There is no reason to choose that as a benchmark except that the financial industry has established that model. Analysts, investment news, educators, and the industry use it repeatedly. It’s like a series of subliminal messages.

Realistically, investment firms need a benchmark for their products and employees. Employees build mutual funds or ETFs and must understand and compare their performance. When a product beats the comparative index, it’s a way to market it, and it’s also a way for the fund manager to be rewarded with healthy bonuses. That’s the employer, consumer, and employee relationship concerning comparing performance.

How else would you reward a fund manager with promotions or bonuses? The lack of churn in a fund? The growth in invested capital? But then, is the manager focused on bonds evaluated against the manager focused on technology? An agreed-upon benchmark helps level the playing field within a firm across managers.

Now, translate that into an advisor-investor relationship. The same software company’s model applies, and unless you request a different type of benchmark, the usual benchmark will be used.

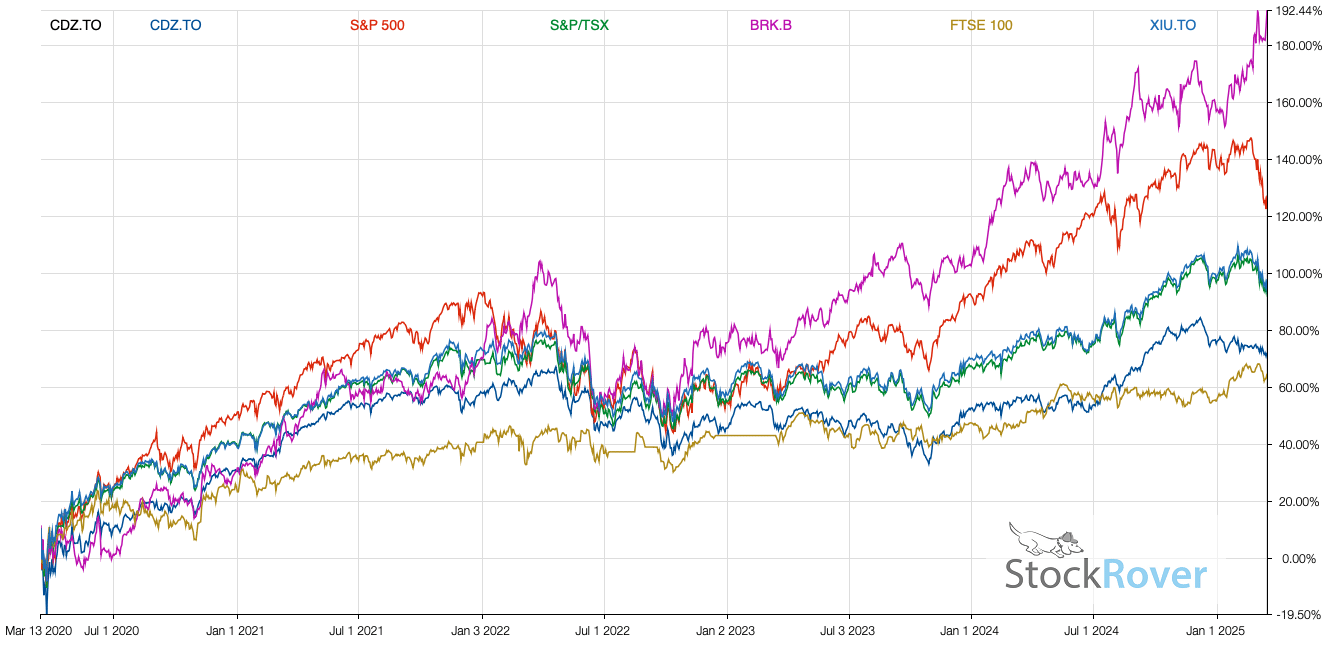

The wrong benchmark leads to potentially lousy investment decisions. Regardless of my investments, during the accumulation years, my benchmark is the S&P 500 index.

Choosing a Benchmark – You Have Options

Remember I said you can make the numbers tell the story you want? Self-evaluation is often not easy if we aren’t critical about our choices.

Your benchmark selection can be whatever you want it to be! You can benchmark against Berkshire Hathaway, an index, or my portfolio, but that would be hard since it’s not set up to be tracked over time.

As mentioned, I used the S&P 500 to benchmark my investments. I chose that benchmark because it represents my alternative investment approach, but I will admit that I would find it hard to put 100% of my portfolio be into one index, even though my kids are doing just that. I would eventually choose two ETFs in order to balance between the two on a quarterly basis.

Choosing a benchmark is up to you, not up to the industry. You need to compare it to something you would be comfortable with as an alternative option.

The point is that I don’t compare my portfolio to get a bonus or promote an ETF; I compare my portfolio to make effective decisions for my future. My future is based on having the largest investment nest egg possible, be it from capital appreciation, dividends, interest, or options. If I can have $4M instead of $3M, why not? If I can reach $2M by 55 and retire, why not?

It’s about building the most significant nest egg during the accumulation years. Whether you earn 2% or 5% in dividends, the more you have, the faster you reach your goals. When it’s time to live from your portfolio, you can choose the approach you want: dividend income from dividend stocks, 4% withdrawals from ETFs, or a blend of options.

Comparing Your Portfolio – The Time Horizon

How you want to compare your investment matters for the decisions you make from the comparison.

There is a saying to not try to keep up with the Joneses which is about feeling confident in yourself and where you are but often times, many of us don’t know where we are and we are looking for a way to establish where we are. Am I earning enough for my age? Am I saving enough for my age? You’ll always end up with less or more than someone else but investment performance isn’t about the Joneses, it’s about where you end up and how long you must work to achieve your retirement.

Here is a TFSA table that shows growth over decades. You want to have an annual compound growth or return (CAGR) at 10% for your money to work for you. The table below assumes you deposit your money on January 1st of every year so use the numbers as an approximation.

The rate of return should be since inception, not the last 12 months. It’s really dangerous to do annual comparison to markets. I really don’t suggest you break down your performance per year and compare to the benchmark of your choice per year.

The time horizon should be at least 5 years. Until you reach 5 years, it’s all based on where you started and it usually lacks a downturn economic event. It makes a big difference how you perform through that event and compare past that.

When you start, and until you have five years under your belt, you have to be patient and lean on your investment thesis for buying the investments you hold.

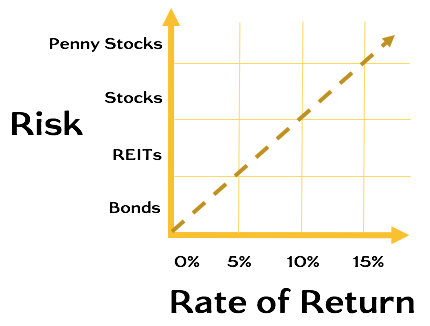

What About Risk?

We all build a portfolio according to our risk profile, but the compass to achieve financial independence is the same. It doesn’t change any of the math to forecast when you reach that number.

Sure, your portfolio might be behind because you decided to have bonds too early in life, or you decided to have REITs because you feel good seeing the income, but you still have an annual rate of return to forecast your retirement, and that’s where you can decide what to do.

Risk management is a personal choice; it allows you to sleep at night, but it needs to be intentional, and you want to know the impact it has on your working years until you reach retirement.