When I executed a major currency swap in April, I had to shuffle quite a bit between CAD and USD inside both my TFSA and RRSP. As part of that transition, I made the decision to keep my TFSA fully in Canadian dollars going forward. Now that CDRs exist, that’s finally possible—but it also means I’m limited to the current list of available CDRs for that account.

That move gave me the opportunity to realign a few positions, and in the process, I added two new holdings: Berkshire Hathaway and JPMorgan Chase.

These decisions didn’t come from watching headlines—they came from doing the work. I’m constantly playing with screeners, adjusting filters, removing constraints, adding new ones… That’s how you discover hidden gems. A stock screener is an essential tool in my investing process.

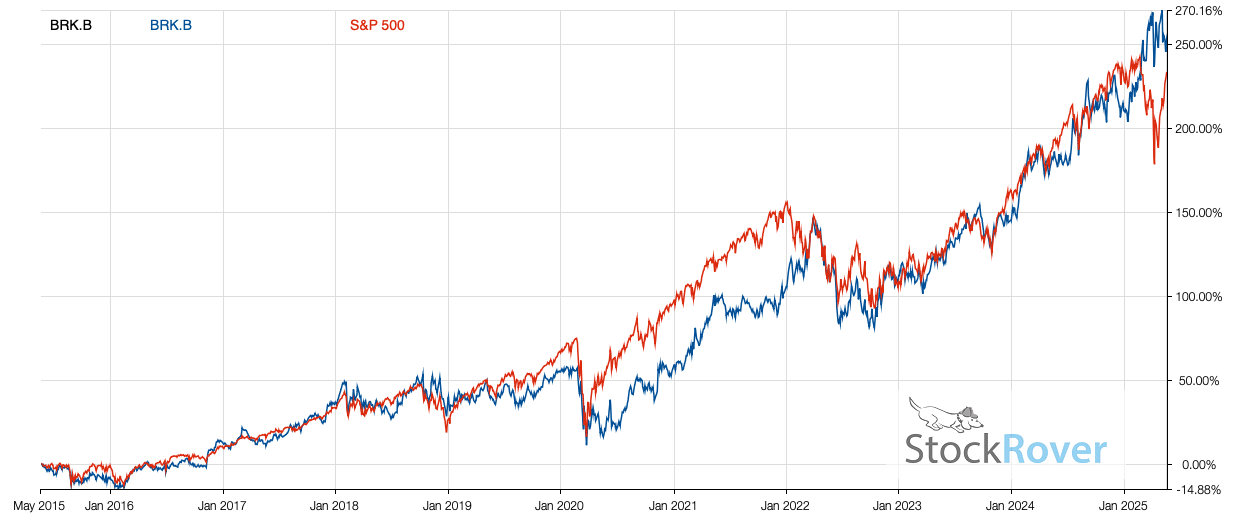

The Case For Berkshire Hathaway

I used to ignore Berkshire Hathaway because it doesn’t pay a dividend—and as you know, dividends are usually a big part of how I filter stocks. But just like I made space for Constellation Software (CSU) in the past, Berkshire finally earned a spot in my portfolio.

Here’s why:

- They grow through acquisitions—and they know how to integrate their acquisitions. Think CSU, ATD, WCN… Growth by acquisition is a proven growth vector that’s tough to beat.

- Their investment style is patient and opportunistic. They don’t chase hype. They wait, and they strike when there’s blood in the streets—something I believe we’ll see again as global tariffs ramp up.

- They’re sitting on a mountain of cash. And as Buffett famously said, cash is just potential waiting to be converted into assets that produce returns. He doesn’t believe in sitting on idle gold—he invests in businesses that generate income.

And perhaps most important of all:

Tariffs + Cash + a New CEO = Opportunity.

The new CEO doesn’t have to fix a broken system. He inherits a well-oiled machine and a proven playbook. This isn’t a sudden handoff—he’s been in the system, groomed for this, and the internal investment teams are still intact. The setup is ideal for making bold, calculated moves.

So Why Did I Wait So Long?

Honestly? Berkshire hasn’t crushed the S&P 500 over the last decade. Historically, it’s trailed or matched it. That’s why I focused on holdings that consistently outperform—names like COST, MSFT, AAPL, GOOG, and ABBV.

But just because it hasn’t outperformed doesn’t mean it won’t. The next chapter of Berkshire is starting now, and that’s why I’ve opened a starter position. I’ll monitor it, assess its place in my portfolio, and scale it if the thesis plays out.

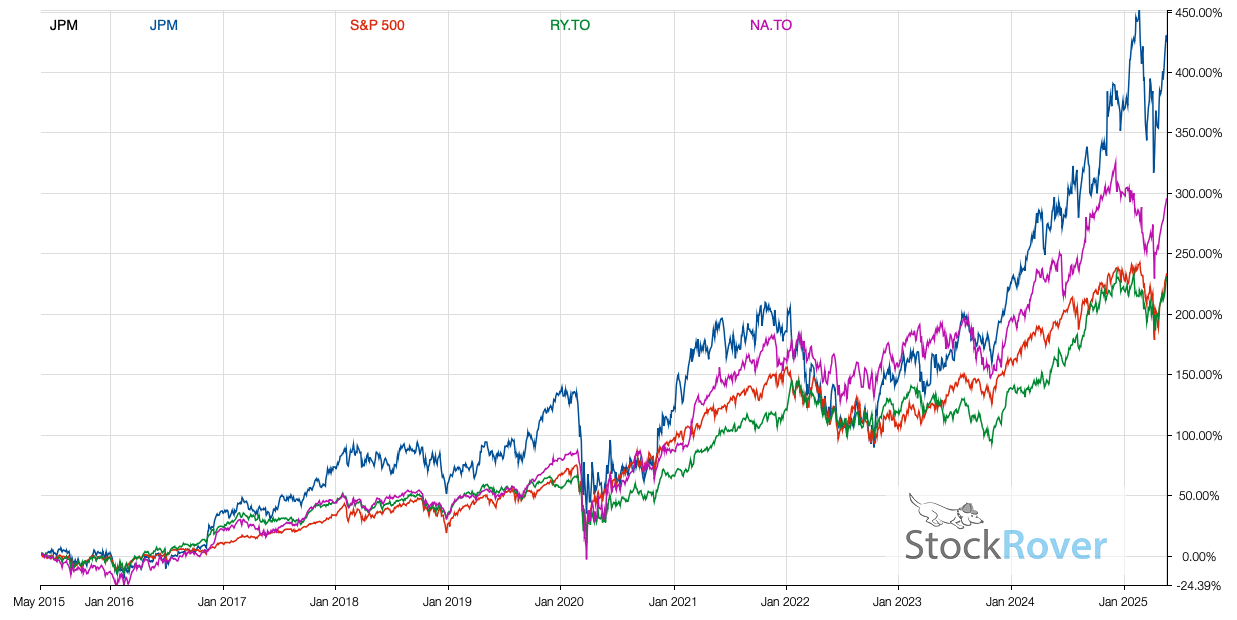

Adding a U.S. Bank

I already hold a solid basket of Canadian banks, but finance runs the world, and I’ve wanted U.S. bank exposure for a while. My recent currency swap created the perfect entry point, so I pulled the trigger on JPMorgan Chase.

Here’s what checked the boxes for me:

- Mega-cap dominance – They control large swaths of the market.

- Strong dividend growth – ~10% annually since the financial crisis.

- Valuation – With a P/E around 13, it’s reasonably priced.

- 5-year and 10-year CAGR – In line with my personal performance targets.

My benchmark is doubling my money every 5 years. That means I’m targeting at least 14% annual returns, dividends included. JPM fits that framework.

Final Thoughts

One last reminder: I never go all-in on a new position. I open with a small starter allocation—relative to my overall portfolio size—and let the story play out. Over time, I use new contributions or rebalancing opportunities to build the position if the thesis holds.

You’ll notice most of my holdings are U.S. mega-caps or Canadian large-cap stocks. That’s just part of my playbook. I stick to dominant, well-established companies with a clear moat—it helps me avoid unnecessary risk. These aren’t flashy bets; they’re reliable engines of growth that let me sleep well at night while still building serious wealth.