Recently, split shares have been a big topic. The yield is excessively attractive for many, but what’s the downside? What risk do you take with split-share corporations?

Read on and understand split shares as they often surface as a topic of conversation with retirees regarding retirement investing for income.

What Are Split Shares Funds?

Split-share funds are a special type of investment in which a Class A share and a Preferred Share are placed in place, trading separately under a specific investment strategy against a specific stock or group of stocks, such as banks, utilities, or pipelines.

The Class A share is often called the capital share and provides a higher distribution (not a dividend as wrongly advertised). It does so by using leverage and covered calls, where the risk comes in. More on this later.

On the flip side, the preferred shares operate similarly to preferred shares in the fixed-income space.

Distributions within a split-share fund will happen first with the preferred shares, followed by the capital shares, but capital shares will only have a distribution if the Unit NAV (Net Asset Value) is over a certain threshold.

The Unit NAV is the combination of the NAV for the preferred shares and the capital shares. If the Unit NAV is below the threshold, no distribution is made.

The risk of not being paid distribution is based on the stock market performance. Since leverage and covered calls are performance magnifiers, if the market does well, you do well, but if it doesn’t, you could be faced with a lower NAV and, therefore, not receive a distribution.

These funds are often called split-share corporations or split-share funds. They also have an end date, but historically speaking, it has generally been renewed for most of the offerings.

Quadravest and Brompton are some asset management firms offering many split-share corps.

Putting Split-Shares Corp Into Context

Let’s examine all the investment options available to see where split-share corporations fit in the investing world.

Here is a table outlining the types of investments that are generally available to investors. I am excluding fiat and cryptocurrencies and interest and GICs to keep the table simple.

The intention is to show the relative risk as you invest based on what it holds. The first row represents the standard investments we know, which represent how companies generally access funds.

A stock, or an IPO, is a way for a company to access funds to grow, and then the money flows on the secondary market. It’s the same deal with bonds, by the way.

| Fixed Income | Equities | |||

| Standard Investments | Bonds | Preffered Shares | Stocks | Income Trusts |

| Advanced Strategies | Options | |||

| Pooled Funds | Mutual Funds, Exchange-Traded Funds | |||

| Closed End Funds | ||||

| Split Shares | ||||

Options are additional trading strategies leveraging the underlying securities with the intention of magnifying profits, but they can also magnify your losses.

Anything that uses options is then applying a magnifier but usually on the income and not on the value of the stocks as it has no effect on the stock price of the underlying assets.

Split shares have to pay the dividend on the preferred shares and the distribution on the capital shares. Even if the underlying assets generate dividends, the preferred shares will be first in line, and the distribution of capital shares will come from options, not dividends.

Characteristics Of Split Shares

Here is your cheat sheet for split shares.

- Split-share funds are designed to provide income. They are not about stock appreciation, so if you plan to compare BAM with a split-share, you aren’t comparing apples to apples.

- Split shares pay a distribution rather than simply a dividend. They’re like REITs, and you need to understand where to hold them for tax efficiency. Each split-share fund should be able to describe its distribution type.

- Distribution can be missed during poor market conditions due to the minimum Unit NAV expected. If you need the income month to month, you won’t get paid during the hardest time. Many skipped their distribution in 2008, 2020, and 2022.

- Not indexed to inflation. Most distributions are flat month-to-month and year-to-year. You lose purchasing power, and in retirement, you can’t count on DRIP to compound the growth.

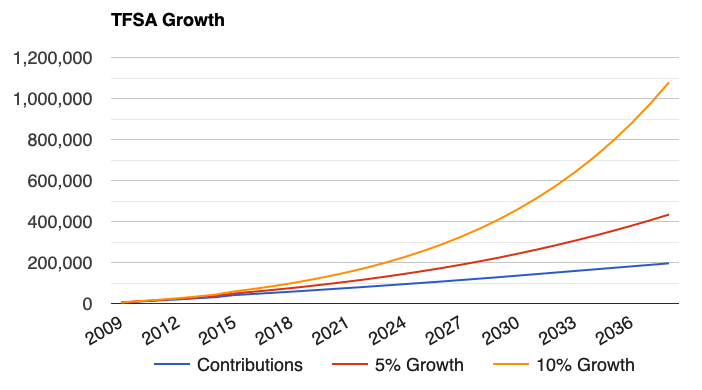

If you DRIP, you can compound pretty fast. Here is what a 10% compounded return can do. You need to understand your appetite for risks, as you can get an annual rate of return of 11%- 13% with the banks over a 10-year period.

Polarizing Views on Split-Shares

Over the past few months, a few readers have brought up split-share funds as a topic. It’s enticing since they provide a high income. Often, it is over 10%, which is impossible to get with normal stocks. They are quickly considered by retirees wanting to supplement their Canada Pension Plan to enjoy a better retirement.

Interestingly enough, Mike from Dividend Stocks Rock shared his opinion in a recent newsletter, and he is not a fan. Mike is personally focused on total returns through dividend growth stock selection.

After a quick Google search, Pat McKeough from TSI is also not a fan and does not recommend Class A shares (or capital shares) to his clients.

Conversely, a YouTuber focused on passive income for FIRE (Financial Independence Retire Early) is very bullish on those. He is very bullish on everything covered calls. Be careful, the reported yield is based on yield on cost which is a flawed metric.

I would not build a portfolio strategy on split shares. I would ensure everything I need is covered outside of split-shares and then see if I could allocate 2% or so to a split-share corp as an income multiplier.

I currently hold non-paying dividend stocks to get higher returns, and I could flip them to hold split shares when I need the income, for example. I would only do this once I live from my portfolio’s income, never during the accumulation years.

I currently favour the simpler strategy of Covered Call ETFs. Lower yield but simpler and less risky overall.

What’s your view?

How You Can Buy Split-Shares

Investors seeking to add split shares to their portfolio must be set up to buy stocks on the stock market with an online trading platform.

While they are unique in how they operate from a corporation perspective, the shares are traded like any other stock in Canada. Choosing the right trading platform can help you keep your costs low and choose your discount broker wisely.

List Of Canadian Split-Shares

Here is the list of Canadian split-shares. I won’t outline the NAV or yield here as they’re complicated. The yield drops to zero if the conditions aren’t met, and it’s based on the Unit NAV, which is not widely available outside the company’s prospectus on the split-share funds.

| Provider | Fund | Ticker |

|---|---|---|

| Brompton | Brompton Split Banc Corp. | SBC |

| Brompton | Life & Banc Split Corp. | LBS |

| Brompton | Brompton Lifeco Split Corps. | LCS |

| Brompton | Global Dividend Growth Split Corp. | GDV |

| Brompton | Dividend Growth Split Corp. | DGS |

| Brompton | Sustainable Power & Infrastructure Split Corp. | PWI |

| Brompton | Brompton Oil Split Corp. | OSP |

| Quadravest | Financial 15 | FTN |

| Quadravest | North American Financial 15 Split Corp. | FFN |

| Quadravest | US Financial 15 Split Corp. | FTU |

| Quadravest | Dividend 15 Split Corp. | DFN |

| Quadravest | Dividend 15 Split Corp. II | DF |

| Quadravest | Dividend Select 15 | DS |

| Quadravest | Canadian Life Companies Split Corp. | LFE |

| Quadravest | Canadian Bank Corp. | BK |

| Quadravest | Prime Dividend Corp. | PDV |

| Quadravest | M-Split Corp. | XMF.A |

| Quadravest | Commerce Split Corp. | YCM |

| Quadravest | TDb Split Corp. | XTD |

| Middlefield Funds | E Split Corp. | ENS |

| Middlefield Funds | Real Estate Split Corp. | RS |

| Mulvihill | Premium Income Corporation | PIC.A |

| Mulvihill | S Split Corp. | SBN |

| Mulvihill | World Financial Split Corp. | WFS |

| Mulvihill | Top 10 Split Trust | TXT.UN |

| Harvest | Big Pharma Split Corp. | PRM |