Are the high-yield Covered Call ETFs too good to be true?

That’s probably the first question that comes to mind if you have been investing for a while. There is no way you can sustain a yield this high for a sustainable time period. In fact, many remember what just happened to BCE and earlier Algonquin Power & Utilities Corp.

How Income From Covered Calls Works

Before dismissing the product, take some time to understand how Covered Call ETFs work. In my opinion, it’s not a passive income vehicle; I consider it active income investing. Here is how it works from a simple example.

- Fund buys a large amount of shares of Tesla

- Fund borrows 50% of the fund Net Assset Value and buys more Tesla (leveraged investing)

- Fund writes covered calls on the Tesla stocks using their skills (something I found too difficult to do personally)

- Fund earns money on covered calls premiums, or has capital gains/losses

- Fund pays investors with premiums (seen as ROC on the tax statement) and capital gains (seen as Capital Gains on the tax statement)

- Fund price is tied to the Tesla stock

As a note, when examining various max yield ETFs, the rockier the underlying stock, the higher the yield. It’s simple: there are more opportunities to have higher premiums. Stable stocks, such as Berkshire Hathaway, typically won’t have very high premiums. Even Microsoft is more stable with a lower yield.

Avoid Relying On Max Yield ETFs for Retirement Income

I want to start with the caution. Retirement is about safety and consistency. It’s not where you take risks, and these active income investments are risky.

Sadly, many retirees lack large enough portfolios to adopt a boring dividend investing approach, where the yield covers their expenses, and start looking for higher yield. That’s when the REITs enter the portfolio, or investing becomes a search for high yield stocks.

The mindset is set on dividends when it could be approached differently. Chasing high yields isn’t the approach you should chase, rethinking your retirement and portfolio is what you should do. It’s possible you have enough money and you should use a 4% withdrawal rate.

Put Your Max Yield ETFs To Work!

Investing in Max Yield ETFs isn’t about chasing high yields or creating a retirement income. It’s about adding a source of funds for investing.

Let’s go back to my early investing days… I started with $40,000 in my RRSP account, and the TFSA account didn’t exist at the time. Having a budget and finding ways to save money to invest was how it started.

| Early 2000’s | 2020 |

|---|---|

| $30 per trade followed by $10 per trade | Free trades |

| No CDRs (Hard to access the US market) | CDRs (increasing regularly) |

| Very little ETFs (Mutual funds where very popular) | Many new ETF products |

Investing a small amount of money was not possible. To keep your trading fee under 1%, you needed to invest $1,000 at a time. It could take a few months to reach that. That’s a lot of time for a stock to surge and miss an entry point.

I understand that we often focus on buying low, and selling high, or the performance of a holdings but building wealth is about putting your money to work.

- Budget, save, and invest

- Increase your income and don’t increase your lifestyle to invest more

- Create a side gig to earn an extra income (maybe tax-free)

- Create a company and invest the income (either in the business, or in the stock market)

This is where Covered Call ETFs come in for my portfolio. When I started the corporate account, I went in with the idea to have a high yield portfolio but the performance was a disaster. Even with the re-invested distribution, it never performed the way my main portfolio performs.

Money is money. I don’t evaluate my portfolio based on the income, I evaluate it based on my net worth growth.

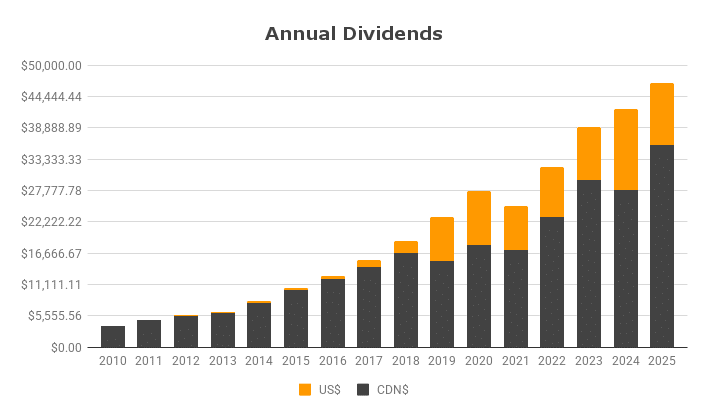

Income

Not an exponential curve

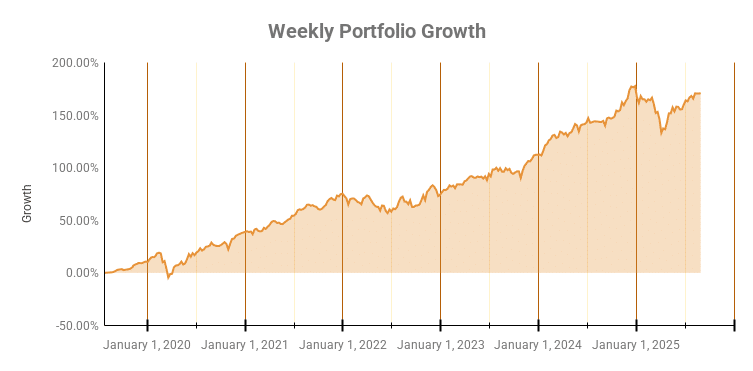

Growth

Nearly 200% within 5 years

I use the Max Yield ETFs as a funding source for my investments. I do not reinvest the distribution; instead, I use it to augment my excellent growth investments. If the Max Yield ETF drops below my purchase price, I might buy more, which is intentional but not automated.

My current personal portfolio exposure to Max Yield ETFs is 2.54%. It’s quite low, and as you can see, it generates around $2,000 per month to reinvest into other stocks.

While my employment income invest in the company RRSP plan to take advantage of the RRSP matching contribution, the Max Yield ETF allows me to DCA into many positions within my accounts.

I started with my taxable account, and I have since added HHIS (safer as it holds all the Max Yields) in my TFSA.

I do not expect to make money from those Max Yield ETFs. If, for some reason, the ETF grows as it did with YTSL, I will take a profit and possibly re-enter it later. It’s a very active approach. I watch the ticker on my phone with Yahoo Finance, and I get trading alerts for all-time highs.