After the refresh of Google Finance, I am in need of a Google Finance Alternative. The update is a disappointment from a DIY investor’s perspective.

Losing the portfolio was not a big deal, but the new layout, new graphing and removal of some key data is a major letdown.

Google Finance was set as my homepage and the first thing I looked at in the morning with a coffee, now I am in need of a replacement that can provide me the necessary information to get a quick glance at the market, news and easy to read graphs.

I was surprised to see how many tools were used outside of what discount brokers provide. In fact, it turns out that not many DIY investors use their discount broker exclusively to look at data.

In the search for a Google Finance replacement for my quick market and portfolio overview during my morning coffee, I decided to test drive some of the sites I was suggested. None of it replaces tracking my portfolio dividend and performance, though; these tools are to keep a pulse on the markets.

Mobile Stock Portfolio Tools

I must admit that my mobile is the first device I use to look at the markets. Being on the West Coast, everything is open when I roll out of bed.

As such, my mobile is the first tool I use to look at the markets and my holdings.

I have tried the following apps on my iPhone, but I settled on Yahoo Finance as my go-to. The contenders were investing.com, Apple Stocks, Seeking Alpha, Bloomberg, MarketWatch, and TradingView.

I settled on Yahoo Finance due to how it was allowing me to see my watchlist. Apple Stocks was not far behind.

I pretty much just watch my portfolio plus a few others I am watching closely. Nothing very complicated. I really like the alert option from Yahoo Finance and the new 52-week high notification.

Caveat – I cannot speak to options on Android.

Desktop Stock Portfolio Tools

I reviewed a number of stock charting & news tools used by many readers and decided to rate them according to the following set of criteria.

Below is the list of tools that will be reviewed. I created an account and looked up Royal Bank and created a watchlist or portfolio where possible to understand the process and information on hand.

I did receive a few more options when I polled my readers and at first glance, the tools either required an account or were not providing a portfolio style portal and decided against evaluating them.

Stock Charting Tools Criteria

- Quote: Is the basic and fundamental stock information such as 52-week ratio, market capitalization, and dividend yield to name a few.

- News: Does it provide news at a glance regarding the stock or list of stocks?

- Charting: Can I compare multiple stocks within the same chart? Can I have arbitrary timelines?

- Usability: Is the navigation simple or cluttered with advertisements?

- Portfolio: Any portfolio tracking capabilities? or a simple watchlist? A bonus is to have the ability to group a set of stocks together.

- Mobile: This is a bonus, really, but a consideration nowadays.

- Cost: Is it free? Is the free version enough?

My goal, before anyone gets upset at my ranking, was to find a replacement to Google Finance where I could quickly see what’s up with the market and the stocks in my portfolio.

I had the stock I held in a list and could see the news pertaining to the list and I could see a clear up or down trend. I did not have to navigate away from the main page or select multiple tabs. I had it all set up in one page and it was clean and I searched for a similar setup.

As you read through, feel free to adjust the ranking based on what you are looking for. Those are my rankings according to my needs but it should give you a headstart in finding what works for you. The ratings below have the following meaning.

- – Good

- – Passable

- – Needs Improvement

- – Free

- – Paid Option

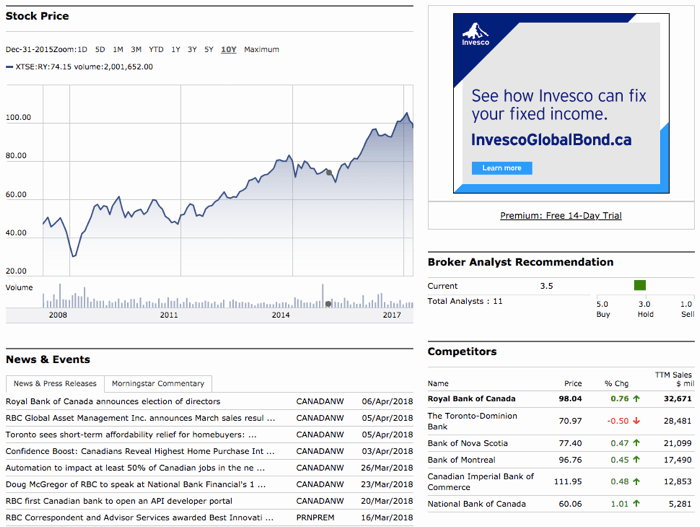

and the competitors all showed up as options. I tested it with Enbridge and the same happened with 6 pipeline competitors.

Usability – As mentioned in the intro, the US design is easier to navigate but that’s not to say the Canadian design is not. The Canadian design has tabs to navigate between the data set and the page is well organized with separators to group the data together.

Portfolio – The portfolio management is not easy to use. The interface is definitely not keeping up with Web 2.0. It works but there are more steps needed than necessary.

Mobile – No mobile app found.

Cost – The free plan compares to all the other providers but you are reminded through the site about the premium subscription to unlock added features.

Stockhouse.com

My first experience was a disappointment as a Canadian looking to pull up Royal Bank of Canada. The ticker format is not intuitive and it creates a frustrating experience to find the stock you want.

If you are familiar with MorningStar, you will notice similarities in the data and feeds since it’s powered by Morningstar.

Quote – It has excellent data. Possibly too much for the untrained investor. I really like how the sector and industry are up front. I believe it’s a very important data point when investing to understand the actual business.

News – It’s the same disappointment as Morningstar. Sorry, but I want to see more news outside of what the companies have to say.

Charting – It’s exactly the same as Morningstar. The colors are different but the same overall.

Usability – Aside from the inconsistencies around the ticker name, the usability is consistent with web 1.0 design. It does not resize or adjust the layout based on the window size and has many menus to navigate.

Portfolio – There is support for both a watchlist and portfolio tracking. The portfolio has a nice feature where you can compare it to an index and it also tracks dividend. I have my doubt that the dividend works properly since it’s usually manually tracked but if you wanted to track your portfolio with dividend growth and performance tracking against an index, you can try it.

Mobile – No mobile app found.

Cost – Free with the option for a paid service

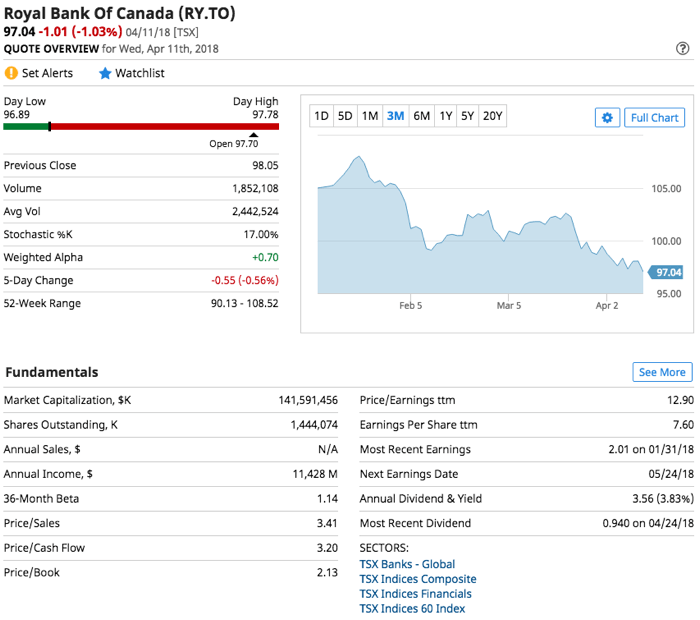

TMX Money

TMX Money is the DIY investor service out of the company that runs the Toronto Stock Exchange. I did not find it good enough for my needs in the past but if you are a Canadian investor with a Canadian portfolio, it may work well for you.

Quote – All the basic data points are present and easy to view.

News – News provided are from the standard financial news aggregator. No search engine news surfaced.

Charting – You can compare to indexes and stocks which is a minimum requirement for me and you get the picture but the interface and visual is stuck in time. Too many steps to refresh and update the chart.

Usability – The interface is functional but can be clunky when compared with other Web 2.0 interfaces. Creating a portfolio is not as intuitive as other competitors.

Portfolio – Portfolio management is present with too many steps to manage it and it’s tucked away on its own away from your overall account and no news shown against your portfolio.

Mobile – No mobile app found although there exists a TMX Money Dividend app.

Cost – Free with a paid option for real-time data.

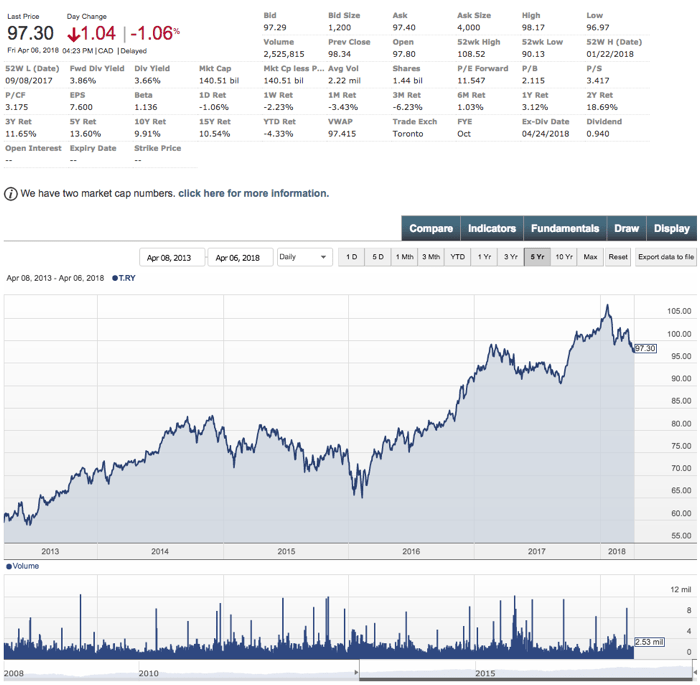

barchart

A pleasant option for looking up stock information but mostly geared towards technical traders.

Quote – The standard data points are present with a neat price alert feature. It’s the easiest alert setup I have seen so far.

News – News provided are from the standard financial news aggregator. No search engine news surfaced.

Charting – The visual is pretty consistent with the competition and good overall with many options but unfortunately, I could not see how to add other stocks to compare. That’s a feature I like to see to understand comparative growth over time.

Usability – The site, menus, and charts are easy to use.

Portfolio – Portfolio support is present but I found it confusing as the price for a transaction needed an entry and exit price. A little confusing with little explanation as to how the data was going to be used.

Mobile – No mobile app found.

Cost – Free with the option for a paid service

MarketBeat

A lot of data is available and some of it unique. I don’t find it particularly well laid out for what I am looking for but it’s possibly a good research tool if you are interested in analyst ratings or insider trading.

Quote – A simple set of data points is present on the first tab. I find that most other options show the dividend and the yield to avoid having the investor hunt for it. Often times, it’s the annual dividend with the dividend yield in brackets. The missing P/E Ratio as seen in the image below doesn’t speak to a good data source or update from the system. All other competitors have the P/E displayed. Again, a good representation is the P/E Ratio with EPS in brackets if you want to save space.

News – The news headline section breaks down the different source of information allowing investors to filter by sources if desired. The layout of MSN Money is still better for a bird’s eye view and scanning the page but it has more sources than the standard aggregators with a nice filtering touch.

Charting – Charting is provided by Trading View so it’s powerful. At this point, why not just use Trading View if that’s what you want.

Usability – The layout and data presentation doesn’t work for me. The chart tab is at the end and not even included in the primary tab or view.

Portfolio – No portfolio or watchlist support from my purview of the interface. While there are paid features, it seems to open access to research information and timely notifications.

Mobile – An app is present.

Cost – Free with the option for a paid service

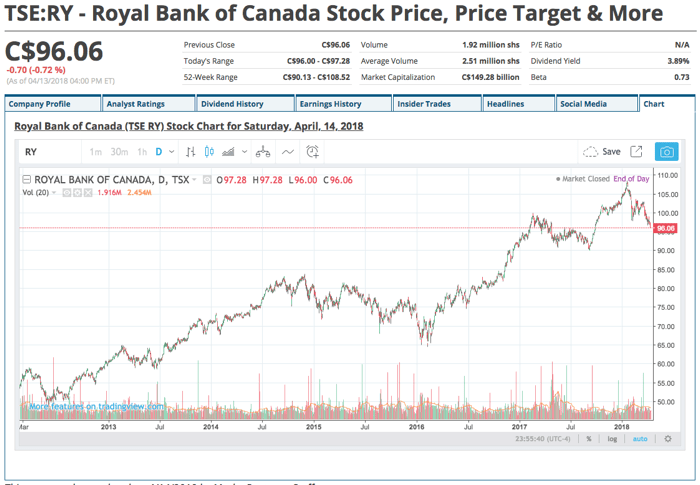

Trading View

Trading View has a lot to offer but it falls short for me. It’s trying to be in the social or crowdsourcing of investing idea similar to Seeking Alpha and it promotes ideas over the news. On the flip side, you are not overwhelmed with advertisement and the UI is appealing and it comes with a mobile app.

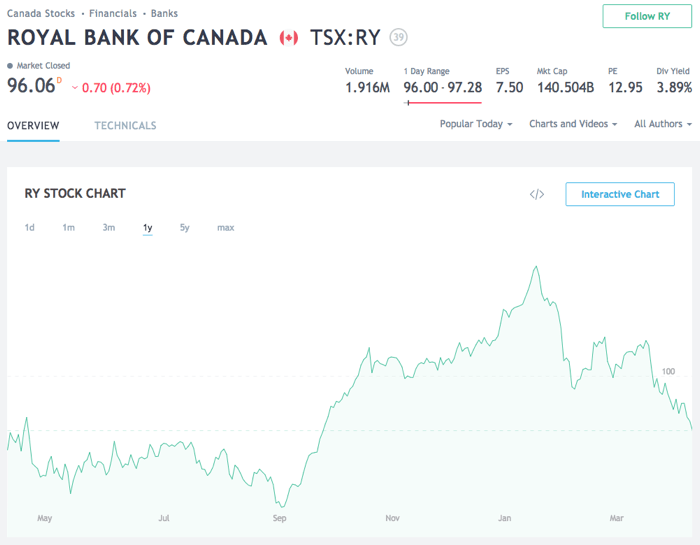

Quote – The cursory data view has limited information at your fingertips and the option available isn’t ‘fundamentals’ but ‘technicals’. That should be your clue here that Trading View is technical platform first.

News – There is a news section tucked away and in the case of Royal Bank of Canada, it only pulled data from Yahoo Finance. All you know is that Yahoo Finance picked up the news and you don’t know the actual source.

Charting – The chart is powerful. It’s one of the best in class. In fact, it’s so powerful, it can be scary to figure out how to use it. I would prefer fewer bells and whistle with a condensed menu for non-technical investors.

Usability – Due to the technical investing approach, the terms used in menus and layouts of the menus are not easy to follow. It takes time to find what otherwise should be at your fingertips. The sidebar watchlist is what I would want as my primary interface.

Portfolio – No portfolio, just a watchlist which is enough for me and it allows you to group them.

Mobile – A mobile app exists and works well.

Cost – Free with the option for a paid service