We often hear that the stock market is gambling and it couldn’t be further from the truth.

In simple terms, and before I dig deeper, the stock market is a regulated, publicly open second-hand market for company shares. It’s like craig’s list or Facebook marketplace but extremely regulated.

What new investors see when they start investing is a roller-coaster stock chart for the price of a share, but what’s going on behind the scenes is pricing. Just like an auction, or the bargaining you do on Facebook Marketplace.

However, it’s essential to understand what shares are and how they are traded on the public stock market as it pertains to a business. The stock market allows any investor to buy shares of publicly traded companies. Profiting from the company is a factor of their financials and the potential business growth! The financials are facts, whereas the business growth is an estimated guess by anyone and everyone.

Let that sink in and read on as you capture the risk-reward factors of deploying your hard-earned cash.

The Evolution of a Business

A business really start from an idea but then it goes through different changes on paper. While the business itself doesn’t really change, the legal structure will change and evolve.

Apple and Microsoft both started in a garage, and it’s the case for many ideas. Slack was an internal tool developed to help a company make a video game as an example.

What does this have to do with the stock market? Everything, because the stock market is a funding mechanism to scale a business. That’s all it is.

Sole Proprietorship

This is where the ideas often start. You can get going fast and avoid the cost of incorporation until you figure out what your business really is. It’s best for those going solo in the beginning.

At this point, the ideas are being worked on and operationalized. You are figuring it all out and trying to go from sweat equity to actually getting paid.

Often times, you have a day-job and moonlight on your business.

Incorporation – Share Creation

The next step is to incorporate. It brings structure to the company as a separate entity, and it also offers several benefits that are important when going into a business.

The process requires you to issue shares in your name, or all the partners’ names, based on the desired ratio and identify all the officers involved in the business. This is the birth of the company shares – the exact same shares that could be found on the stock market one day. Incorporation of a company is where shares are formally issued and assigned to owners with a value. The process is federally and provincially regulated to register all the information.

That’s the real deal – a real corporation is then born, but it’s all private – it’s not trading on the stock market yet. The shares and the minutes are with a lawyer.

The profits are all amongs the shareholders. If you pay a dividend, all the shareholders receive the dividend.

Growth With Investors – Private Partners

Think of Dragon’s Den here. You have a business with a good product, and you want to grow and scale. You need funding. The bank is only willing to lend you a certain amount, so now you are looking for investors.

At this point, you will discuss with a lawyer on the share structure (voting or not) and issue more shares to allow an investor to join in. That investor expects a return, and that’s really what you see in Dragon’s Den; it’s quick math to understand the return on investment. There are more diligent and rigorous analyses done after the show to validate numbers, but it’s about a return on investment. The Dragons essentially do a valuation and then assess the potential growth for a return on investment. The valuation is simple and fact-based on the financials, but the growth potential is an assessment based on their skills.

- Invest X amount of capital

- Expected growth at Y percentage

- Capital recovery is in W years

- Additional years are P (the profit)

We’ll get back to skills later on but it’s important because no one can predict growth. It’s all based on assumption and experience.

At this stage of the business, the Dragons are making a private investment. It is still done through the form of shares assigned to the investors, or through various contracts. However, you will see them always talk about ownership of a percentage of the company.

TIP: Watch several Dragon’s Den episodes to capture what’s happening with the valuation and growth expectations.

The IPO – Initial Public Offering

At some point, you can only go so far with investors and financial institutions. There is a risk that they aren’t willing to take and there is often an opportunity to scale with bigger opportunities for investors (an IPO). You can think of this as crowd-sourcing funding with big money players.

Before the IPO

1. Decision to Go Public

The company decides to raise capital, increase visibility, and offer liquidity to early investors. The stock market creates liquidity. Otherwise, it’s all between the early investors and owners. Following the decision to go public, the company will leverage an investment banks (underwriters) to guide the process.

2. Due Diligence, Filing, & Regulatory Processes

The company prepares a detailed prospectus (with financials, risks, plans) and submits it to regulators (e.g., SEDAR+ in Canada, SEC in the U.S.). This includes a valuation estimate and how many shares will be offered.

The selected investment banks agree to sell the shares, usually by buying them from the company at a set price (that’s the funding part) and then reselling them to institutional clients. A price range is marketed through a “roadshow” to generate demand from big investors (mutual funds, pensions, etc.).

It’s a big money process with little exposure to the little DIY investors.

3. Pricing the IPO

Just before launch, the final IPO price is set based on demand and generate excitement. Shares are allocated to institutional investors and some retail brokers (accessible to the little DIY investors).

After the IPO (Public Trading Begins)

1. IPO Day – Shares Start Trading

On IPO day, the ticker symbol is live and begin trading on an exchange (like TSX or NYSE). The opening price is often different from the IPO price due to public demand.

The stock may spike or drop on day one. The first day or week is very speculative. This reflects market enthusiasm or caution. The price now moves based on supply and demand, news, earnings, etc.

2. Post-IPO Lockup Period

Insiders (like founders, employees) are often restricted from selling for 90–180 days. After the lockup expires, more shares may flood the market, sometimes causing price drops.

Suffice to say, there are potential uncertainties over 6 months. There can be a lot of marketing and hype at play when the company starts trading but then it normalize itself as investors learn more about the company.

3. Ongoing Reporting

The company must now file quarterly and annual reports, disclose executive compensation, and meet governance standards. Analysts begin to issue public ratings and price targets.

Differences of Private and Public Shares

This summary table highlights all the important concepts between private and public shares.

| Private Company Shares | Public Company Shares | |

|---|---|---|

| Ownership | Owned by a small group of individuals—founders, family, private investors, venture capital firms, or employees. | Owned by potentially thousands or millions of public shareholders via the stock market. |

| Availability | Not traded on a public exchange; transfers are restricted and often require approval from existing shareholders or the board. | Freely traded on a public stock exchange (e.g., TSX, NYSE, NASDAQ) without needing approval from the company. |

| Liquidity | Low—finding a buyer can be difficult and time-consuming. | High—shares can be bought or sold quickly on the exchange at market price. |

| Valuation | Determined through private negotiations, funding rounds, or internal agreements; no public market price. | Determined by the stock market in real time, based on supply and demand. |

| Disclosure Requirements | Limited—financial statements are usually private and disclosed only to shareholders or regulators as required. | Extensive—must regularly disclose detailed financials, operations, risks, and governance (e.g., quarterly and annual reports). |

| Regulation | Less regulated, but still subject to corporate law and securities rules for private offerings. | Heavily regulated by securities commissions and stock exchange rules. |

| Raising Capital | Usually through private placements, venture capital, or loans; limited pool of investors. | Can raise large amounts by issuing new shares to the public. |

| Share Classes | Often customized with different rights (voting, dividends, liquidation preferences) for founders, investors, and employees. | Usually standardized common shares, though preferred shares may also be issued. |

| Share Price Transparency | Not publicly visible; updated only when transactions occur. | Price is public, updated continuously during trading hours. |

| Exit Strategy for Shareholders | Typically through a sale of the company, buyback, or IPO. | Simply sell shares on the stock exchange. |

Taking a Company Private

The opposite also happens.

Take WestJet as an example. It was a publicly traded company, and then it was purchased by an asset management firm and made private under the firm.

This usually happens when an investor (a large one) sees value in a company, but the market doesn’t see it. It’s sometimes easier to make the changes you want by bringing it private.

What the Stock Market Represents

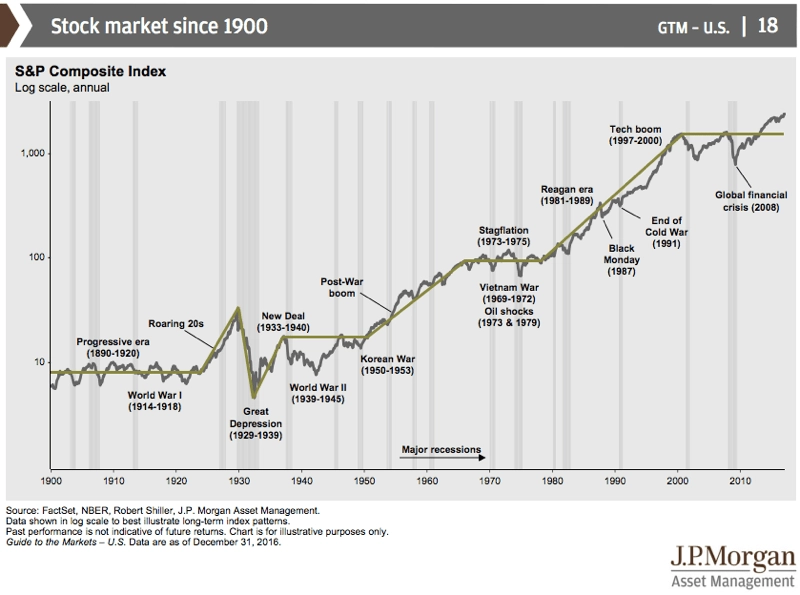

As you can see, it’s quite the journey to reach the stock market and it represents the growth of a company.

Growth is the game; growing sales, growing revenue, growing profits, and growing the stock price.

While it has drops and challenges in the short term, the stock market in the long term goes up, just like inflation. If you hold an index, you ride the index, and if you hold individual stocks, you rely on the quality of the one business you invest in.

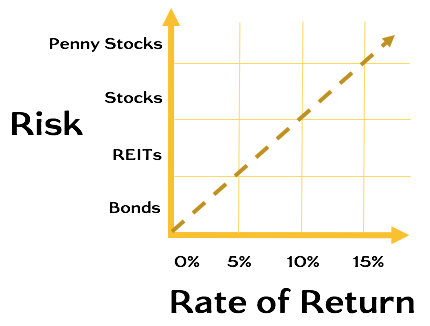

Return on Investment – The risk vs reward concept

The risk-reward of a GIC (Guaranteed Income Certificate) is zero risk and little reward. You don’t even keep up with inflation. If all your money is in GICs, you essentially lose purchasing power over the years – that translates to filling the gas tank less and less for the same dollar.

While the risk is zero, and you can sleep at night, it creates a different challenge – you lose to inflation. When your salary doesn’t grow with inflation, you feel you are falling behind in paying your bills. It’s the same concept as your investments and in retirement.

Investors are looking for various risk-reward investments that allow them to sleep at night, and yet put their money to work.

The stock market on average, depending on the market or index, will offer 8% to 10% return annually. The stock market risk is the fluctuation and timing but over time, it normalizes. That’s why it’s not a good place to invest for 1 year or even 3 years. Short term investing should be done differently for risk exposure.