As you approach retirement, one question looms large: How do I ensure I don’t outlive my money?

In a landscape of ever-increasing lifespans, and the Die With Zero mindset, the annuity—a financial product that promises guaranteed income—has re-entered the conversation.

While annuities were once seen as dull, conservative investments for the ultra-cautious retiree, they’re experiencing a bit of a renaissance. With interest rates rising and retirement planning becoming more complex, more Canadian retirees are asking, “Is an annuity right for me?”

Let’s dive into the world of annuities in Canada—how they work, who they’re for, and whether the pros outweigh the cons.

What is an Annuity?

At its core, an annuity is a contract between you and an insurance company. You give the insurer a lump sum of money (typically from your RRSP, RRIF, or other non-registered funds), and in return, the insurer agrees to pay you a steady stream of income for a set period—or even for life.

Annuities are meant to convert your savings into predictable, regular income, much like a pension.

It’s a fixed income product and not a growth investment. Another way to look at it; it’s an insurance against outliving your money!

Types of Annuities in Canada

- Life Annuity: Pays income for life. Can be single or joint. Optional guaranteed payout periods.

- Term Certain Annuity: Pays income for a set number of years. If you die early, payments go to your beneficiaries.

- Impaired or Enhanced Life Annuity: Offers higher income if you have a medical condition that shortens your life expectancy.

- Index-Linked Annuity: Payments increase with inflation. Great for long-term protection but lower initial payments.

How Do Annuities Work?

Suppose you’re 65 and retiring with $300,000 in your RRSP. You purchase a life annuity. Based on current rates, the insurer might offer you roughly $1,750/month for life. The exact amount depends on your age, gender, health, interest rates, and chosen options (e.g., inflation protection, joint life).

You are essentially exchanging a lump sum for peace of mind—knowing that you’ll never run out of income, even if you live to 100.

The way to think about it is as follows; if you were to withdraw $21K (12 months x $1,750), your $300K would last just over 14 years but the annuity gives you the assurance that if you live longer than 14 years, you keep on getting the payment.

It’s not about return on investment here, it’s about your beating your life expectancy.

Why Should You Consider Annuities

As fewer Canadians have defined benefit pensions, annuities have become a valuable tool to replicate that dependable income stream. It’s a safety net.

Pros of Annuities

✅ Guaranteed Income for Life: You’ll never outlive your money.

✅ Simple and Worry-Free: No need to manage investments or react to market volatility.

✅ Market Risk Protection: Stable income regardless of what the markets do.

✅ Tax Efficiency: Prescribed annuities offer partial tax advantages for non-registered funds.

✅ Customizable: Choose inflation protection, joint life, and more.

Cons of Annuities

❌ Irreversible Decision: Once purchased, your money is locked in.

❌ Inflation Risk: Fixed payments lose value over time if not indexed.

❌ Limited Growth: You give up the upside of investing.

❌ Poor Value If You Die Early: Without guarantees, your estate may receive nothing.

❌ Complexity: Misunderstanding options can reduce value.

Who Should Consider an Annuity?

- Retirees without a defined benefit pension

- People in good health and expecting a long life

- Those who prefer simplicity and certainty

- Anyone worried about outliving their savings

- Those wanting to maximize their retirement money (Think Die With Zero)

Who Might Avoid Annuities?

- Those in poor health or with shorter life expectancy

- DIY investors seeking flexibility and growth

- Those already receiving guaranteed income from other sources

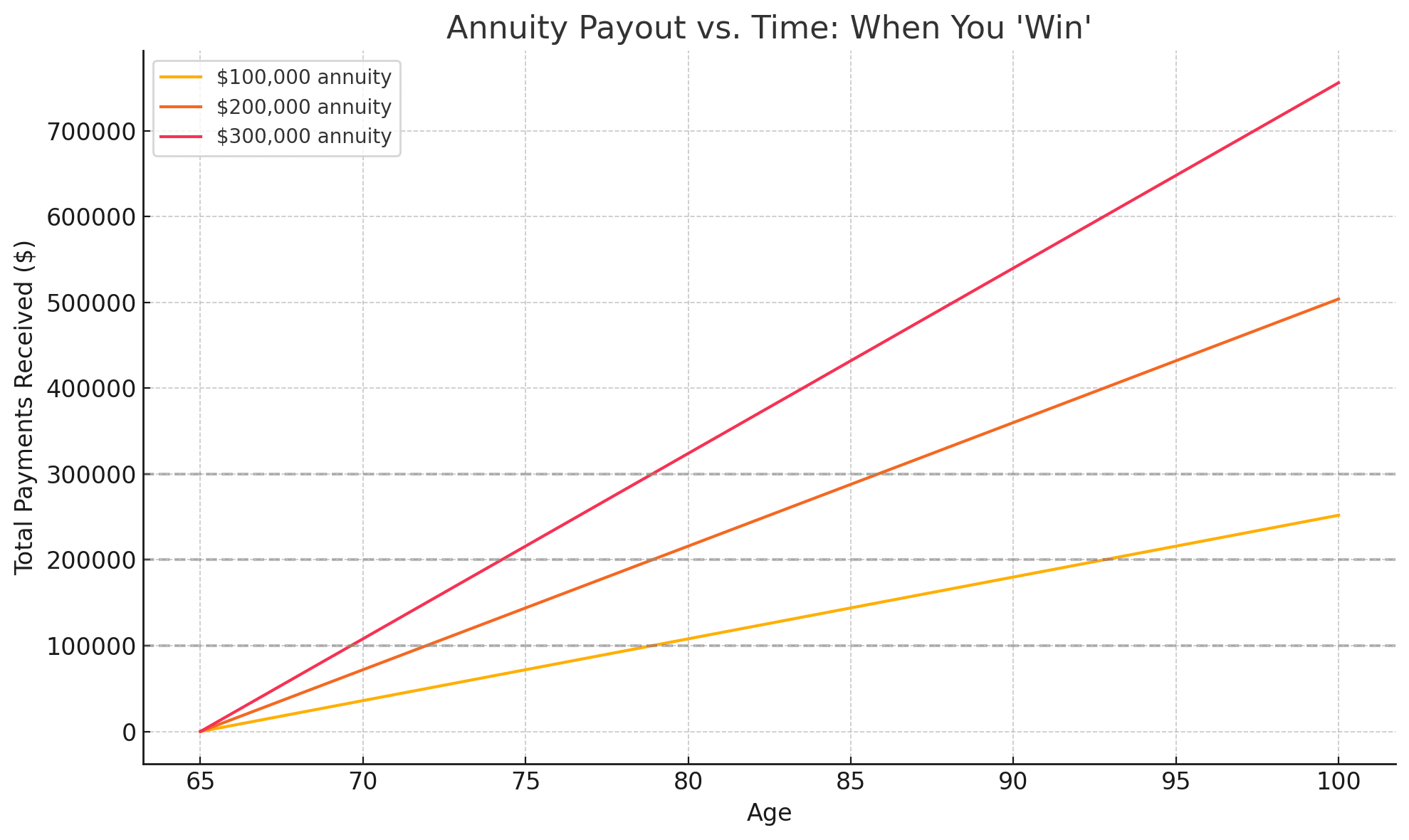

What Can You Expect From a $100K, $200K, or $300K Annuity?

| Lump Sum | Approx. Monthly Income | Approx. Annual Income |

|---|---|---|

| $100,000 | $600 | $7,200 |

| $200,000 | $1,200 | $14,400 |

| $300,000 | $1,800 | $21,600 |

📌 These are rough estimates. Actual payments will vary depending on insurer, interest rates, and selected options.

When Do You “Win” With an Annuity?

The break-even point—the age when your cumulative annuity payments equal your original investment—is typically around age 80.

Here’s a simplified way to visualize when you win with an annuity but you have to look at it as a fixed income and not a stock market investment. It’s like using annuity with a retirement bucket strategy where the fixed income is the annuity.

Beyond that age, you’re ahead financially—your annuity keeps paying regardless of how long you live.

When Should You Buy One?

The “sweet spot” is often between ages 70 and 75 for the best balance of payout and planning simplicity. Some retirees “ladder” purchases—buying smaller annuities over several years to diversify interest rate risk.

You want to consider an annuity for the pension replacement that provide a baseline foundation and consistency. Your other investments can do the rest of the heavy lifting to keep up with inflation.

💡 As your stock market risks declines towards an older age, your cash wedge (or bucket strategy) becomes increasingly important and that’s where the annuity along with the CPP and OAS can provide a baseline of safety.

Alternatives to Annuities

- GICs: Low risk, guaranteed return, but no longevity protection

- Dividend ETFs: Higher income potential, market risk exposure

- Cash Wedge: Liquidity + market exposure in layers

Final Thoughts

Annuities aren’t for everyone, but for the right person, they can be a powerful tool for financial security and peace of mind. Use annuities to:

- Cover basic expenses

- Supplement CPP, OAS, and investment income

- Simplify income as you age

- Insure against longevity risk

Consider annuitizing a portion (20–30%) of your savings to lock in guaranteed income—then keep the rest flexible. Speak to a fee-only financial advisor to find the right balance.

In a world full of uncertainty, guaranteed income is one of the most underrated financial assets you can buy.