As I approach my 40’s soon, I come with wisdom from an almost 20 year experience in making ‘real money’. When I was in my 20’s I had no idea what I was doing when investing my money.

- I had some of my money in high MER mutual funds with Investor’s Group.

- I bought flow through shares and other risky investments and saw my $5000 investment go to zero in the name of alluring tax deductions.

- I chased dividend income and not dividend growth.

- I concentrated too much of my portfolio in the TSX.

You get the idea. Here are 5 pieces of money tips I would tell my younger self.

Buy Less Stuff

It’s much easier to buy stuff than get rid of it, especially if you are seeking to get rid of it by selling it on Facebook Marketplace or Craigslist or even Poshmark. Even though I don’t consider myself an accumulator of ‘stuff’ I still bought a lot of stuff.

Downsizing and moving a few times have helped to reduce the amount of stuff that I owned but not without the painful realization that I had wasted so much money on stuff that didn’t really ‘spark joy’ for me.

When we are on our deathbed, we don’t look back on our life and think about the stuff we bought as we take our last breaths.

Right? This money tip is about keeping more of your hard earned cash.

You Should Have Probably Traveled More

This money tip isn’t so much about having more money in your pocket but about diligently spending it.

One thing I don’t regret was spending $10,000 on 1 month trips exploring the world. Sure, 10 years later, the $10,000 I spent traveling to Tibet, Nepal, and Bhutan on a 5 week trip would be worth almost $20,0000 with a CAGR of 7%.

But did I even invest in the right things at age 25 to get a CAGR of 7% for 10 years?

I don’t think I was.

Even now, when I see large rhododendrons while walking around the city, I think fondly about the time, 13 years ago when I hiked the Annapurna circuit in the middle of the Himalayas. I think how amazing it was to see Mount Everest, the highest mountain in the world, while in Tibet. I smile when I think about the Land of the Thunder Dragon and the amazing hospitality of the Bhutanese, where they measure Gross National Happiness.

The ROI (return on investment) of my $10,000 on that trip has been paying dividends in the form of fond memories even 13 years later.

I trust that it will continue paying me ‘dividend memories’ for years to come.

Go Straight to Hybrid or Index Investing

As I briefly alluded to earlier, I bought the “next hot stock” while listening to Jim Cramer when I was younger (yes I admit it). I day traded. I bought penny stocks. I bought flow-through shares. I bought mutual funds with Investor’s Group. I signed up with my mom’s “advisor” to invest my money.

I set up stop losses in 2008 when my quality blue chip stocks like $JNJ $V $BCE went down 20% and unfortunately sold them.

I lost a lot of money and I wasn’t even trying to beat the market.

Now, I know that index investing through exchange-traded funds is the way to go. To appease my appeal towards cash flow, I invest in dividend-paying companies too.

This hybrid investing approach where I put 50% of my portfolio in ETFs and passive investing and 50% of my portfolio in dividend growth stocks or dividend-paying companies works for me.

Why try to beat the market when the S&P500 mean annual return including dividends for the past 25 years has been 11.4%?

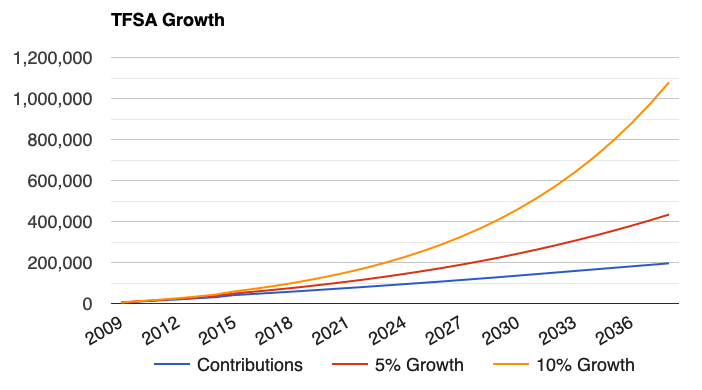

Imagine if all that money I lost from not knowing what I was doing was instead put to work through the passive investing approach at age 22?

This step-by-step guide on how to invest your TFSA will guide you to earn passive income in Canada.

This money tip is about making your money work when you sleep. Pure and simple. You’ll feel more financially secure.

Concentrate Your Portfolio

Even when I became enlightened as a hybrid investor, I still had a lot of individual Canadian dividend-paying companies that were small holdings in my portfolio.

Sure, it might be exciting to get dividend payments so frequently when you have over 100 dividend-paying companies paying you, but even if you’re up 50% on an investment, it won’t matter in the grand scheme of your $500,000 investment portfolio when that investment was just $5000. An unrealized capital gain of $2500 is just 0.5%.

On the other hand, if you had a $25,000 investment in the same company and there is a 50% unrealized capital gain that is $12,500 a 2.5% increase in your portfolio. The number of stocks in your portfolio has an impact.

I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches—representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.

Warren Buffett

James Clear writes about Mr. Buffett’s 20-slot lesson more eloquently here.

There will be winners and losers in your investment portfolio if you have a portion of it that you actively manage, make those winners count for something.

Another smart money tip on having your money work for you.

Buy And Hold

They say it is the time in the market not timing the market that builds great wealth.

Investors tend to buy when others are buying and sell when others are selling too, even if this means most people are buying at the market’s peak and selling at the market’s trough levels.

CNBC gives a sobering market timing statistic shared by the Bank of America to drive the point home.

If you think about the S&P500 since the 1930’s, if you missed the S&P500’s 10 best days in each decade, the total return you would get since 1930 would only be 28%. If you held through the S&P500’s high points and low points, your return would be a whopping 17,715%.

The relationship between our emotions and our investing approach cannot be understated.

We are our own worst enemy for our investment portfolio.

In the stock market, there are those who use it as a slot machine in hopes of quickly getting rich in Canada, but we need to ignore the noise and remind ourselves it is where you can invest in and own portions of excellent businesses.

Are there money tips you would share with your younger self?

If you could go back would you change anything with regards to your money management?

Great tips! I guess we all had our share of mistakes and I’m glad I had mine so I can pass what I’ve learned to my kids .

Thank you for this great article and awsome blog!