How rocky are the next 6 months going to be? These markets are a dream come true for technical traders and short-term investors as they simply play on the momentum and fear of the news. For long-term investors, what does it mean?

It’s tricky. From one earning to the next, it’s a waiting game to see if the numbers the company reports are in line with expectations. It’s not easy because a lot of it can be based on consumer and corporation spending. Are there business segments where spending is constant? If so, are you late and paying a premium to get in?

It’s not easy to make sense of it all and then FOMO kicks in … “Fear Of Missing Out”. Emotions need to be controlled to avoid making mistakes and subsequently losing money. Remember that long-term investing is for returns over a long period, obsessing over needing to buy at the bottom doesn’t help. What is important is if you are going to get the return you expect from the company’s business over time. In short, how impacted is the business with the current economic situation?

Stock Trades

One thing all investors need to know when placing a trade is that the second after you place it, it’s a 50/50 change for the price to go up or down. You need to learn not to sweat the pennies and and small movements.

I sold my entire position in Verizon. I opted to keep AT&T. Nothing wrong with Verizon, I just wanted some cash to deploy elsewhere and AT&T DRIPs better as a boring income play. I took a position in Nike as one of the leading brand poised to continue winning digitally. When you cannot touch and feel, customers go back to what they know and trust. I missed my chance with Lululemon here even if it doesn’t pay a dividend.

I added more to Microsoft. A winner I expect to see more. They have more growth in the cloud space to grow income and they will play in the work-from-home space as well.

I added to Royal Bank, the bank I consider #1 to hold. It still has not recovered. It may also come back down again once we hear more about employment over the next 6 months after government support goes away.

Portfolio Management

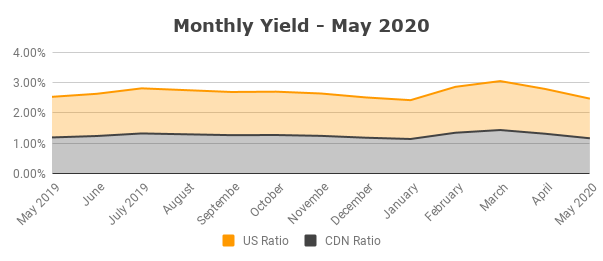

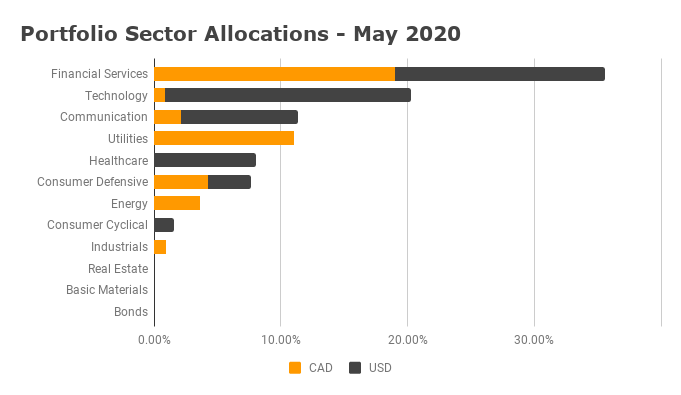

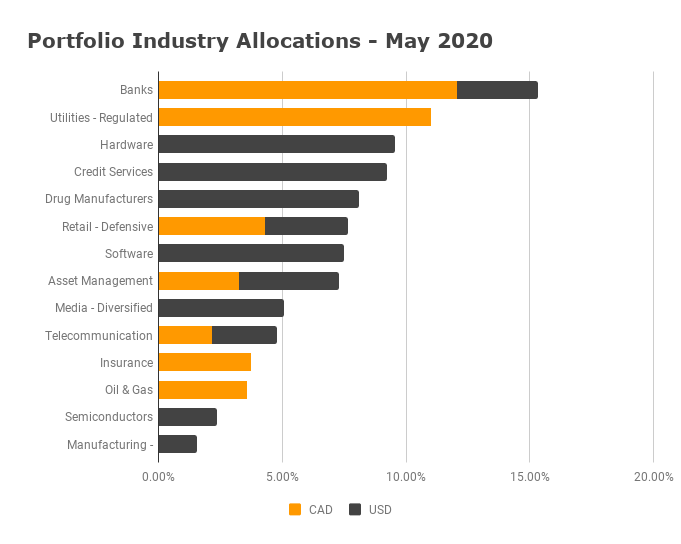

The ratios below have been pretty consistent. you can see where Canadian stocks or US stocks are favoured.

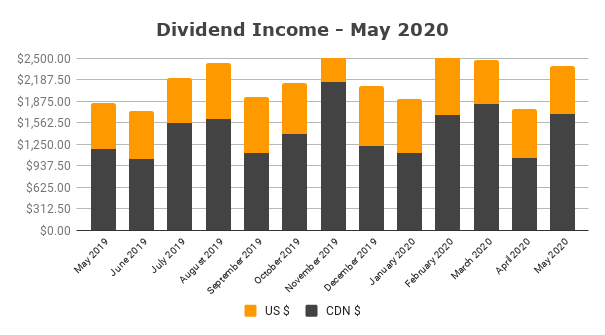

Dividend Income

The dividend income is spread across 5 accounts between my wife and I so even though it looks like a nice total, it doesn’t quite pay the bills when you take into consideration taxes. With that said, I earned $2,395 this past May 2020. All the dividend is re-invested for compound growth.

Only one of my holdings, The Walt Disney Company, has suspended their dividends and I intend to keep it. Otherwise, my picks have not been impacted at all. Surprised? You should not be as I don’t have energy producers and I don’t chase the yield. There is a pattern to the Canadian companies that cut their dividend.