At which point do we consider this situation the new normal? Interestingly, it has not impacted by stock selection strategy as I am focused on tollbooth stocks.

As you read through, you will noticed detailed graphs built from all the data I track to monitor and manage my portfolio. Just like an airplane pilot needs its instruments to navigate in the air, I need my investment data to manage my portfolio. Don't manage your portfolio blindly hoping for results, you'll be sorry later.

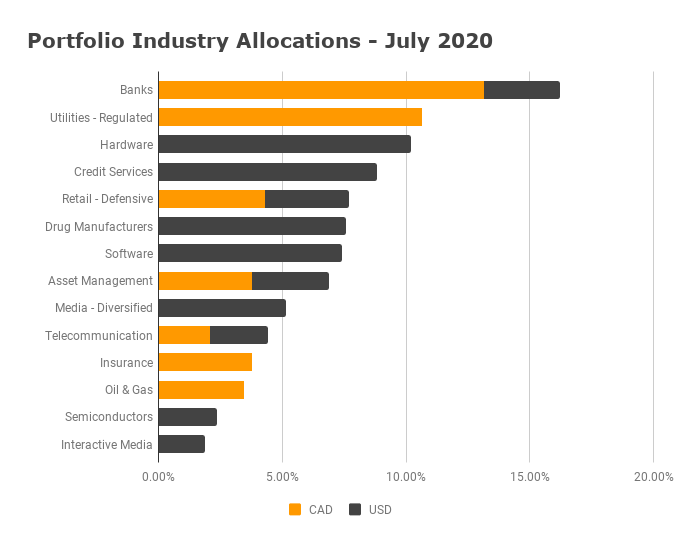

I find Canadian banks currently offer some good value based on the yield and future growth potential. Since I primarily invest in my non-registered account, I tend to focus on investments that are simple for taxes and to set up the account for retirement income.

One stock on my buy list is Johnson & Johnson. I am watching it and the sector.

Portfolio Management

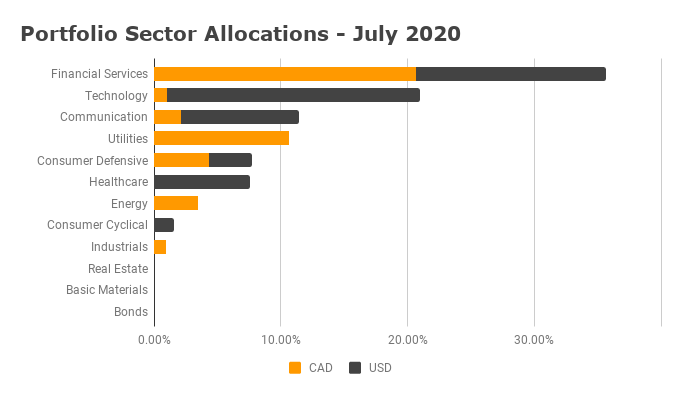

Sector allocation used to be how I set ratios but I realized it doesn’t work. Concentrations are not equal and technology is shifting the landscape. So much so that many companies had industry adjustments. For example, Disney, Netflix, Facebook and Google are all part of the communication services sector now. On the flip side, all the payment technology companies are still in the financial sector but are just technology tollbooths to payments.

As such, I focus on the industries now to get a view of my exposure.

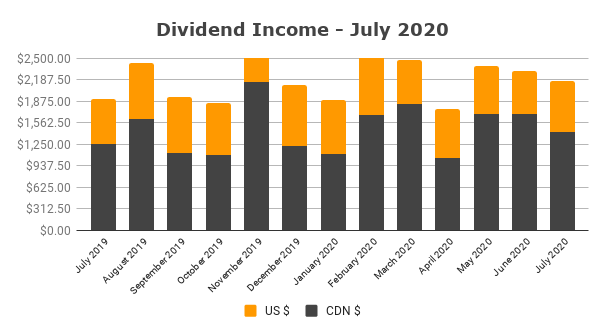

Dividend Income

My July dividend income is at $2,172. My dependable dividend income keeps on coming.

Nothing special to report this month. The monthly income is generated from 16 holdings. All of my holdings are set to DRIP shares if possible. I don’t like to just let it accumulate as it takes time to accumulate enough to make the transaction fee worth it and then unless adding to each holding, you end up selecting one stock with shares worth $20 or $400.

The other thing is the timing. With synthetic DRIP, it happens right away and at RBC I can get a discount with Canadian stocks if one exists. If I wait, I may have lost a chance on the DRIP