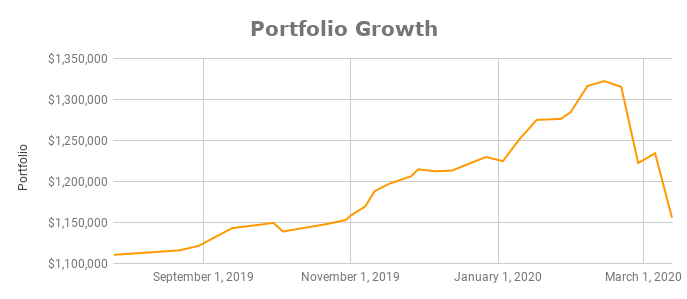

Markets have dropped a number of times now but we need to understand that the markets were also peaking a little. The growth seen in the past 6 months could not continue on that trajectory. When markets are over-valued, a catalyst is sometimes needed to bring it back to norms. We got that but much more with the coronavirus and the oil price war. We went from over-valued, to normal valuation, to bear markets now that many stocks hit new 52-week lows.

With the market frenzy, my portfolio is back to October numbers. I just lost the insane increase we saw these past 5 months (see below). I have not sold any stocks and I have not bought any yet. I feel the markets just got closer to normal valuations and we are starting to see some bargains pop up. I just started tracking historical as I have money across multiple accounts and it’s nice to see the historical view.

As a reminder, just when you think stability in the markets comes around, world events happen and shift the pendulum. The reality is, there isn’t any stability ever. Stability can last 2 or 3 months but that’s just about it when it comes to world events and you should not focus on playing those events for a long-term portfolio. Yes, there can be money to be made if you do short-term trading but a long-term dividend growth investing strategy will succeed regardless of those events.

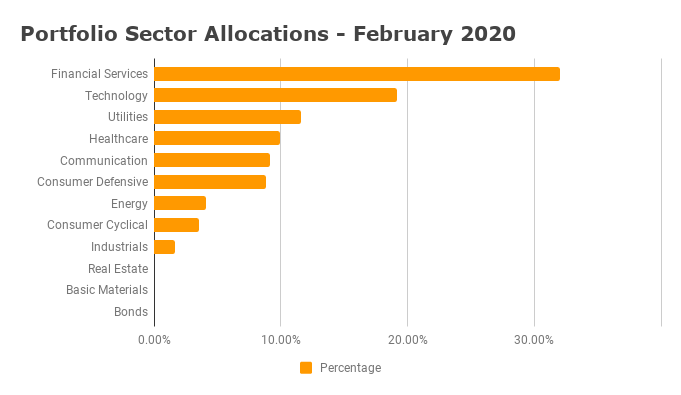

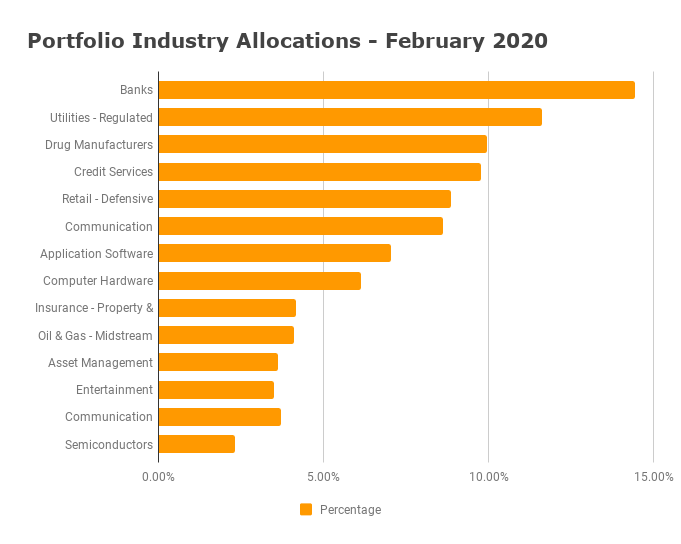

As you read through, you will noticed detailed graphs built from all the data I track to monitor and manage my portfolio. Just like an airplane pilot needs its instruments to navigate in the air, I need my investment data to manage my portfolio. Don't manage your portfolio blindly hoping for results, you'll be sorry later.

. Unfortunately, same DRIP cost as December 2019.I have some cash waiting in my RRSP account and will probably make a trade in the coming weeks.

Portfolio Management

I think the drop in prices is an opportunity to buy solid-income stocks these days. As they enter oversold territory, it means you can get the yield and the appreciation when they bounce back. There is a small window of opportunity with income stocks and I am not talking about the insane high-yield oil stocks here, I am talking about the banks as an example. I am staying away from oil stocks for the record, I do not like the oil environment in Canada and the competition around the world.

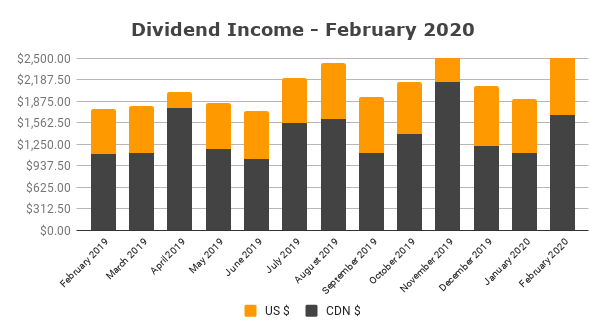

Dividend Income

My February 2020 dividend income is a high $2,662 – it’s a new high. My monthly dividend income is not balanced and that’s not a problem. Balancing monthly income should not be a goal as you should have a cash waterfall approach where the dividend income (if used for retirement) should fill next year’s income or the following year to be safe.